Time to Taper? With Caution…Slow and Steady.

We all saw the news last Friday that the much anticipated Jackson Hole Central Bank Conference will now be a virtual event. We also found out that Fed Chairman Powell will be delivering his message virtually. We believe that he will be covering the robust economic recovery witnessed over the last 12 months, highlighting the (mild) headwind to the recovery from the Delta Variant, all while discussing potential policy amendments.

The market will be focusing on changes to the VERY accomodative policies that have been in place since March 2020 (i.e. QE, rates near 0%). While we don’t expect much change from the July FOMC meeting, we believe Chairman Powell will cautiously layout a plan for tapering asset purchases starting in the later part of 2021 (at the earliest) and (slowly) throughout 2022 (more likely).

Data As of 07/30/21

What is the Market Telling us?

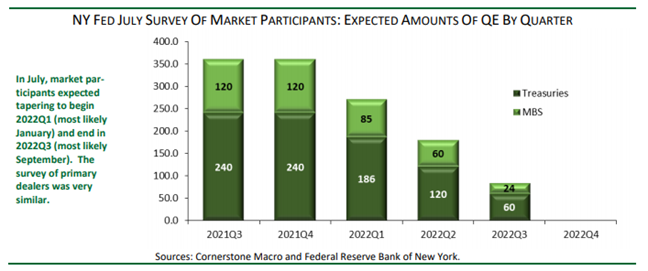

While we don’t have Tapering futures like we have Fed Fund futures, there is an alternative source: New York Fed’s survey of Primary Dealers and Market Participants. The most recent survey of primary dealers and market participants (from late July) suggest that both expect tapering to start early next year and to continue until September (shown above). The numbers above represent the survey participants expectations for Fed Asset Purchases expected by quarter over the next 6 quarters (To reconcile my chart above, the Fed is currently buying 80m UST/ month so * 3 months = 240m & 40m MBS/ month* 3 months = 120m).

Interestingly, one of the most hawkish FOMC members—Dallas Fed President Kaplan, who recently advocated for an earlier and faster tapering, sounded more cautious last Friday (8/20/21) and said he would be open to reconsidering his view should the Delta variant slow the recovery. We have to believe that other previously enthusiastic taperers could be in the same camp now. Since it will take time to assess the effect that the Delta variant will have on the economy, we think a scenario where the onset of tapering shifting to 2022 is perfectly plausible.

Aptus Take

We expect the Fed to be overly communicative and VERY slow (using Delta/ job market as an excuse) to wait until 2022 to taper asset purchases while also tapering at a MUCH slower pace than perceived by investors. Remember, back in June the market perceived the change in the Fed’s infamous Dot Plot as overly hawkish, severely impacting the mid- to long-term economic recovery. This led to a falling 10 yr Treasury and underperformance from the cyclical, value, reopening-exposed equities.

We’d like to provide a “Good, Bad and Ugly” commentary covering the tapering and how the markets could react to each as we approach a possible event.

Good Taper

The Fed begins tapering in December and at $5 billion or $10 billion/month, essentially leaving QE ongoing for most (or all) of 2022. Likely Market Reaction: Risk on. Multiples likely hold firm or expand. A weaker USD and strong performance from cyclicals and commodities as well as growth (negative real rates supportive of heightened valuations). Yields would likely rise but limited as the Fed is still buying a significant amount of the Treasury supply. This scenario would be major headwind for fixed income. Welcome “Goldilocks”.

Bad Taper

The Fed begins tapering in December at a rate of $15 billion/month and ends QE in mid 2022. This outcome isn’t really “bad” because it’s already mostly priced into markets, but with COVID cases elevated and some rising concerns about growth, the market would be more sensitive to the Fed following this procedure, especially if the Delta variant persists through the fall. Likely Market Reaction: Status Quo. Minus a possible knee jerk reaction lower and we’d expect markets to stabilize given elevated Fed communication which likely eases fears of another 2013 Taper Tantrum. Defensive sectors and Large Cap Growth (Mega Caps) likely outperform small caps/cyclicals and interest rates are range bound (call it a 1.25% – 1.50% 10 year Treasury). We believe some function of this environment is what the market is currently pricing in.

Ugly Taper

The Fed begins tapering QE in December at a rate of $30 billion/month (or more than $15 billion), ending QE before June 2022. This would be a shock to markets and substantially increase stagflation concerns, because the Fed aggressively tapering QE with the uptick in COVID cases would clearly signal that the Fed is nervous about inflation regardless of the loss of growth. Likely Market Reaction: Pain. Reflation sectors would lead the way down (cyclicals/ energy). Mega- cap tech and ultra defensive sectors likely the winners. The dollar strengthens and yields rise (bad for bonds).

What about a “No Taper”?

While maybe benefical to equities in the short term, we believe the medium/long term risks of sustainably higher inflation would create much bigger risks to stocks than the Delta variant. Too high inflation creates a reactionary Fed, and that is a problem to the recovery and asset valuations.

Bottom line

Given labor market conditions still notably below pre- pandemic levels as well as the potential implications on the recovery from the Delta Variant, we believe the Fed will look through the “transitory” cost pressures (inflation) and continue being over cautious in their approach of removing QE (life support) from the system. This likely equates to a slow and deliberate tapering process that continues to buoy asset prices. We believe the biggest near term risk to markets is the (perceived) tightening of financial conditions as the economy is still very much in recovery mode.

Ideally, a moderate steep-ening in the 10s-2s spread resulting from a new and sustainable rise in the 10-year yield and only slight increase in the 2-year yield would suggest the market is comfort-able with the Fed’s taper decision given the state of the labor market and inflation statistics. A controlled rise back towards 150 basis points in the 10s-2s over the coming months should be welcomed by investors.

Rate Hikes

As far as a rate hike, we believe the asset purchase tapering will end completely before the Fed considers modifiying their rate hike path.

Lastly, What Could Change our Base Case?

- Financial stability risks. As mentioned during the July meeting, several Fed Governors commented on “elevated valuations across many asset classes”. Many pin the rise in asset prices/speculative behavior on the prolonged period of low interest rates. Asset bubbles/rampant speculation are problematic for the Fed (especially when their policies are creating it).

- Persisent (More than Transitory) Inflation. The market continues to take the Fed’s word on elevated cost pressures as being transitory. While we certainly expect to see many of the elevated cost pressures to wane as supply chains correct/catch up and spending continues to shift from goods to services, the more sticker (and lagging) components of CPI do give room for concern (wages and rents). A continuation of VERY accomodative liquidity policy (QE) on top of historically low interest rates likely keeps inflation fears alive.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2108-12.