In the essence of continuing our inner George Costanza of doing the complete opposite of what normal nomenclature says, we are giving you Part 2 of this series alongside Part 1. So, let’s fast-forward into the future life of the boorish George Costanza – which we get a glimpse of in Larry David’s second hit series, Curb Your Enthusiasm, through a Seinfeld reunion show.

Since we last saw him, George married a beautiful woman named Amanda. And during this period, he became uber rich off of a popular iPhone application called iToilet, which helps people find acceptable public restrooms when you are not home.

Synonymous to today’s market, investors do not have to look very hard for locations that are accepting of publicly-traded crap, as stocks that are considered lower-quality have substantially outperformed lately – just read Part 1 of this series. But, much like the iPhone app and his newfound marriage – everything must come to an end. And, for George, he lost all of his money as he entrusted the infamous Wall Street scammer Bernie Madoff to invest his capital.

Luckily, his ex-wife, did not lose anything as she’d seen Madoff on the street one day. The way he was wearing his quilted jacket with the collar up “creeped her out” so she cashed in her part of the investments.

In year one of the recovery, it paid to be George, as it can be financially rewarding, though intellectually difficult to comprehend. But, now that we are officially entering year two of the recovery, which tends to be more rational, thus investors need to be more like Amanda – shy away from the flashy momentum investments by playing it safe. Remember, in the end, George isn’t Penske material.

It’s a Game of Risk, World Domination

In attempting to prepare a presentation on risk management, George learns that “in order to manage risk, we must first understand risk, how do you spot risk, how do you avoid risk, and what makes it…so risky?” After substantially outperforming since the market bottom, what makes going “all-in” on low quality stocks…so risky? Well, simply put, over longer periods of time, valuations matter and quality outperforms.

Since the market bottom, “iToilet companies”, i.e., low-quality stocks, have outperformed high-quality stocks. Financial theory tells us that quality should trade at a premium (avg. of 11% premium historically), but these stocks now trade at the biggest discount to low-quality on a NTM P/E basis since the end of the Global Financial Crisis, making it, what we believe, a very interesting entry point into our bailiwick of stocks, compounders.

As you could imagine, outlier low quality rallies have historically been fueled by excess stimulus from the government. This definitely holds true for this time period as stimulus has now totaled 24.0% of GDP over the last twelve months. It also holds true for the “Tech Bubble” and Global Financial Crisis. But, we believe that 2021 will mark a peak in policy puts, and a de-rating of low-quality should follow, synonymous with history.

High-Quality’s Father was a Mudda, Its Mother was a Mudda….

We’ve all heard the old investing adage that the best way to pick a stock is to ask your UPS delivery person what they have been delivering lately. Obviously, this is somewhat antiquated, given the entrance of Amazon, but that didn’t stop Kramer from overhearing a horse tip from a delivery person on the subway.

But, unlike the horse, high-quality doesn’t have to break its maiden, as it has never had a negative 10-Yr return, even when you exclude dividends. In fact, high-quality not only tends to win in the long-term, but it also tends to win over the short-term.

Like a horse that runs well in the slop, high-quality stocks that trade at a discount may look messy right now, but they have the potential to reward investors with a winning ticket.

The Contest

One of George’s more embarrassing moments, in which he was caught by his mother, sparked a contest amongst the crew – though, hopefully The Contest that we are about to propose won’t result in one of us falling over in shock and going to the hospital. We won’t directly mention what the Seinfeld contest was, as NBC thought the topic was not suitable for primetime television, so, we’ll call it a competition of the “master of domain”.

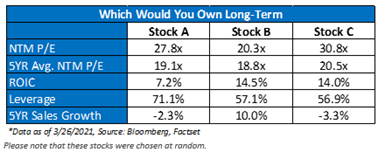

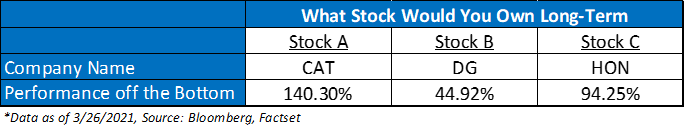

Instead of swiping left or right, we’ll let you decide which investment you think has outperformed best since the market’s bottom on March 23rd, 2020 – Stock A, Stock B, or Stock C.

Well, we believe that Stock B is the obvious choice, given its relative valuation and growth potential. But it was actually the worst investment out of the three by a longshot.

There’s no doubt that this environment has been very difficult for active investors. Much like I wrote earlier, the first year of a recovery is intellectually difficult to comprehend. But, this has set up, from what we believe, as a great time to start focusing on your core investments. Specifically, the stocks that we consider strong operators – stocks that have historically outperformed over full business cycles, not just fitful rallies.

It’s MOOPS!

In the words of Bubble Boy’s mom, “it’s not really a bubble, it’s a divider”. We agree, as we are not going to go to the length of saying that this low-quality rally off the bottom is a bubble, because it isn’t. This market reaction is normal coming out of a bear market, especially given the fact that it has been backed by the Fed. This should be expected. And this is why we have conviction moving forward, that high-quality will bounce back, as it always has.

It is possible that this lower-quality rally may have some legs left, but we have conviction and comfortability of making this call of rotating back into quality right now. Like many trends in the market, when a rotation occurs, it can happen fast and, more importantly, can happen at a grandiose scale. We believe it’s better to be invested, than caught with your tail between your legs by missing out on the potential rotation.

In a world of reddit and retail mania, you’ll always have your naysayers touting the next hot stock, the legitimacy of bitcoin, and that high-quality stocks are dead, but just remember George Costanza’s favorite quote: it’s not a lie if you believe it.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2103-15.