Our team looks at a lot of research throughout the day. Here are a handful that we think are good summations of investor activity, from buzzy stocks to profit margins, to data centers and a solid economy, to weak housing and limited equity supply. Have a great weekend, Go USA!

Ten: It’s been an amazing run for high beta stocks

Graphic via WSJ 09.26.2025

Brett: and it’s not just a few stocks diverging from the high beta movers

Source: Bespoke as of 09.25.2025

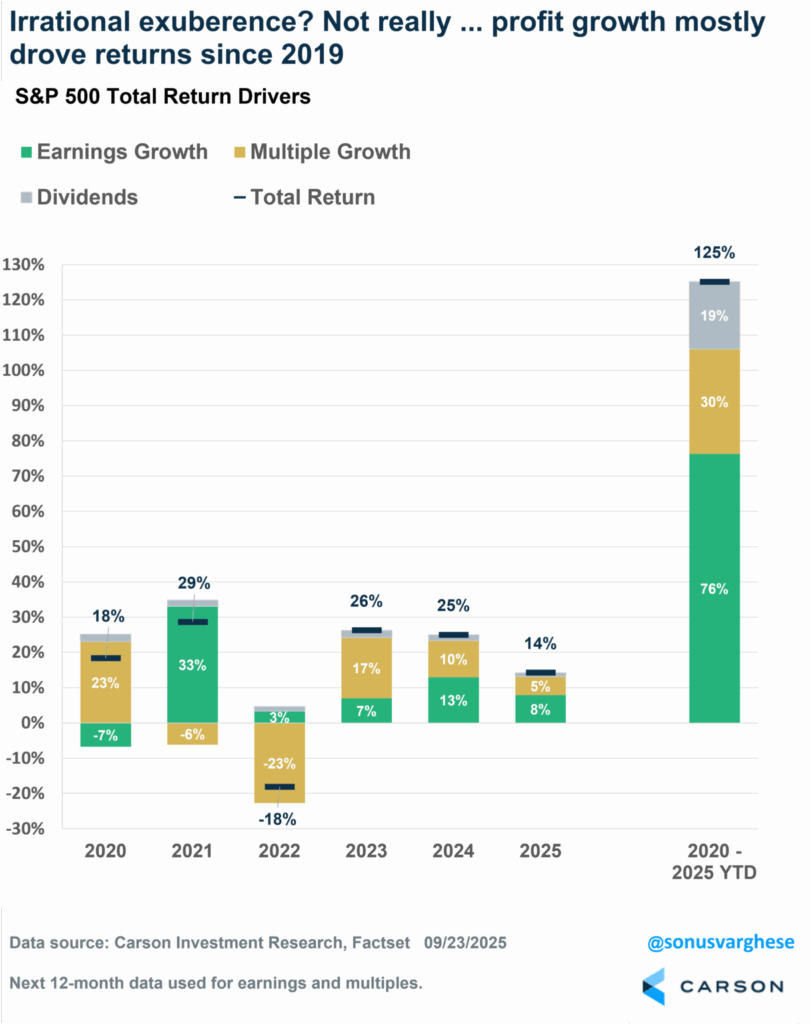

Beckham: People want to say stocks are overvalued, but this era has seen very strong earnings behind the move

Jake: and it’s the ability of large US companies to improve profitability that’s behind the multi-decade expansion

Data as of 09.19.2025

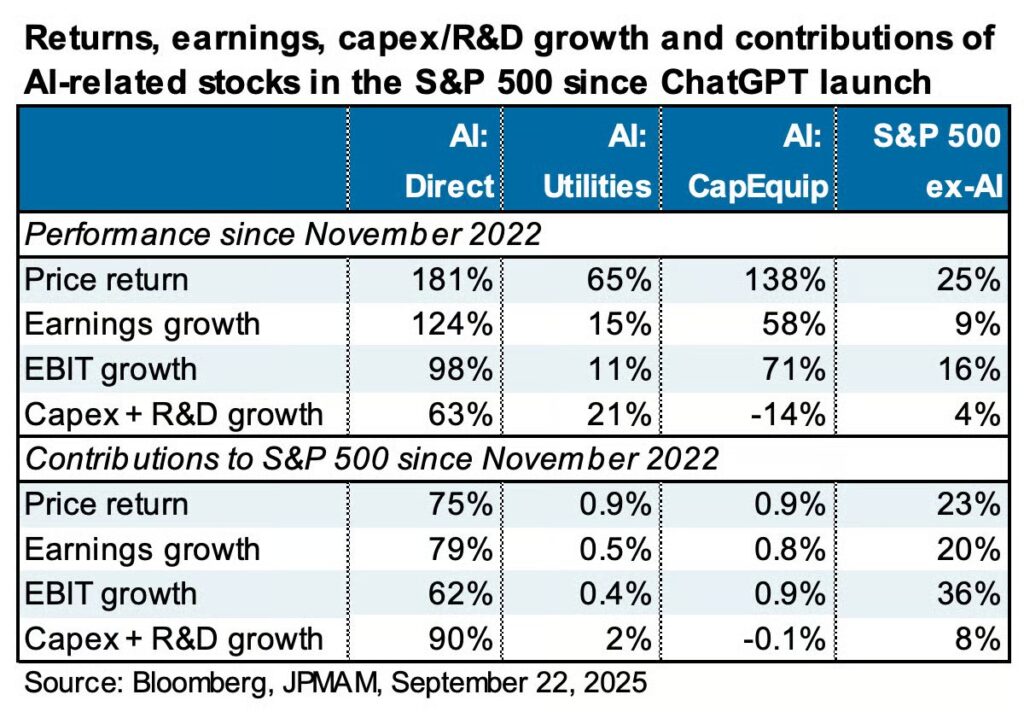

John: In the past couple of years, it’s hard to deny the impact of artificial intelligence (AI) investment as a major driver of sales, earnings, and ultimately, stock prices

Dave: with no end in sight to the AI-related investments by our largest companies

Data as of August 2025

John Luke: and no end in sight to the business dominance by the best and biggest

Data as of August 2025

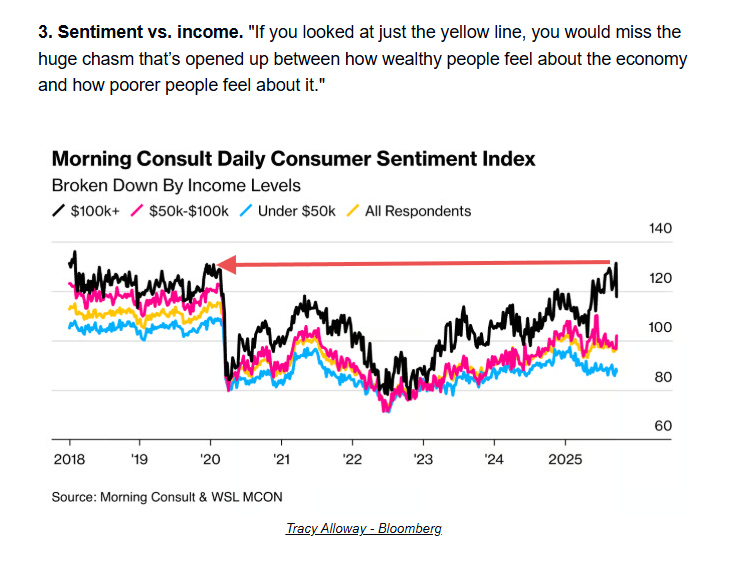

Joseph: We all know about the disparity of confidence and spending by higher-income groups vs. lower

Data as of 09.22.2025

Dave: a trend that is likely to stick as companies do more with fewer people

Source: Apollo as of 09.26.2025

Brian: even as overall growth estimates continue to rise

Source: Atlanta Fed as of 09.26.2025

Ten: The most notable drag on economic growth continues to be housing

Data as of 09.19.2025

Brett: an environment least impactful to the wealthiest groups, who are more likely benefit from equity ownership

John Luke: and deepening the divergence between owners with equity vs. aspirational owners hoping to enter

Source: Piper Sandler as of August 2025

JD: It’s easy to forget, but prices are heavily impacted by simple supply and demand, and fresh supply has been limited

Beckham: as companies are willing to become much larger before tapping the public markets

Graphic via Scott Galloway as of 09.19.2025

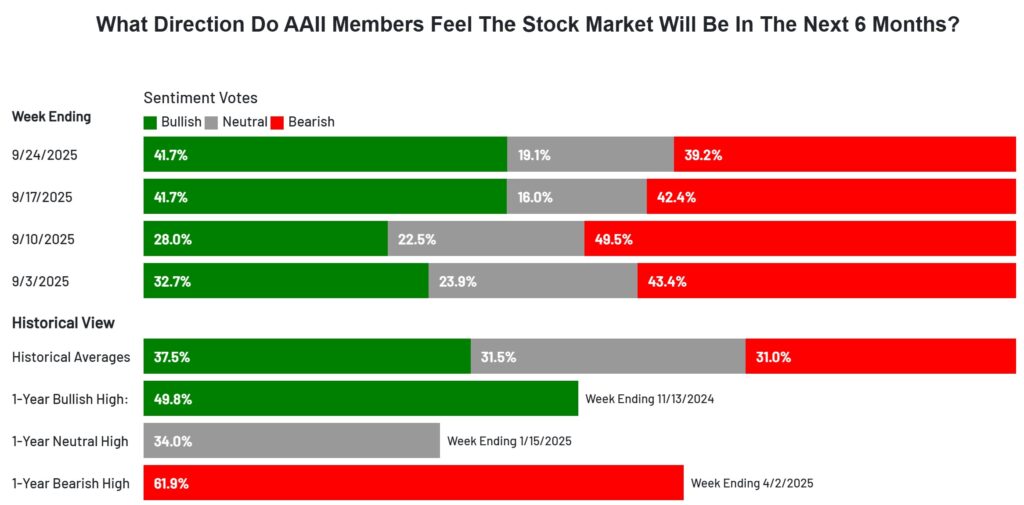

Joseph: Eventually, bearish sentiment caves to the fear of missing out, even among the last to give in

Source: AAII as of 09.24.2025

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2509-22.