Who is John Galt?

President Biden won the electoral college by 74 votes, but he won the “swing states” by only just 65K votes. So, even though it may not look like it on the surface, this was a narrow margin of victory for the current President. The election ended with the House Democrats holding the smallest majority in 140 years and the Senate Gridlocked at 50-50.

We believe that President Biden was elected with a limited mandate:

- To get the pandemic under control, and

- Get economy back to pre-COVID levels

But Georgia changed everything when Biden surprisingly won two GA Senate seats to ultimately control the Senate with the Vice President owning the deciding vote. Biden took this victory believing that the country is now looking for substantial change. He took it that he actually has a much larger mandate that he needs to fulfill, despite the narrow margins in Congress, pressing his bet that voters want more government following the pandemic.

The key to this was to first deliver on his limited mandate: the economy is accelerating and COVID is receding. With these conditions in place, last week, President Biden outlined the biggest expansion of the federal government matched with the largest tax increase since 1968. Biden senses the post-COVID era is a once-in-a-generation opportunity to massively restructure US fiscal, monetary, and social policy.

“We don’t have a trillion-dollar debt because we haven’t taxed enough; we have a trillion-dollar debt because we spend too much.”

-Ronald Reagan

Broadly speaking, the focus in Washington has shifted from stimulus (which was easy to pass) to infrastructure and social agendas. For a bit of background, the Biden administration has effectively split the infrastructure/social agenda into two different infrastructure bills.

The first, the “Build Back Better” plan for (mostly) physical infrastructure is supposed to be primarily paid for via corporate tax increases. The second part, called the American Families Plan, is a social agenda that was presented last week and will aim to be paid for by an increase in personal taxes.

But, if we step back, the reality is that unless something materially changes, what actually passes Congress likely won’t be that close to what’s being proposed. Because of the extremely slim Democratic majorities in both the House and the Senate, we should expect material changes to these proposals if they are to pass.

“Republicans believe every day is the Fourth of July, but the Democrats believe every day is April 15.”

-Ronald Reagan

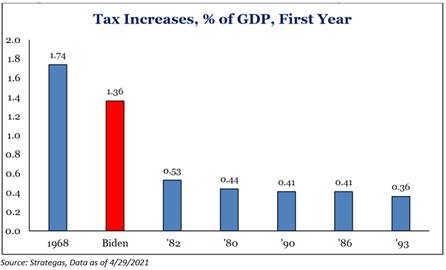

The Biden tax increases are close to $3 trillion of new taxes over the next 10 years. If Biden got everything he wanted, the tax increases would be roughly 1.3% of GDP and nearly 3x larger than the tax increases over the last 40 years from Obama, Clinton, Bush, and Reagan, which averaged around 0.4% of GDP. We have not raised taxes at this scale since the late 1960s when tax increases equated to 1.7% of GDP.

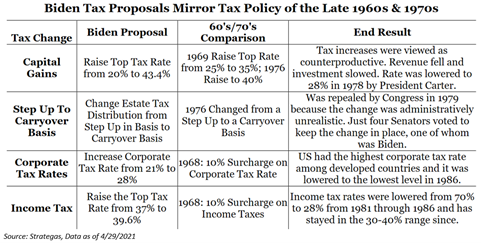

In addition to the macro similarities, there are some common threads among the individual provisions to the late 1960s and 1970s tax changes. Many of the egregious tax changes that were enacted during this time period, were ultimately quickly changed, as they missed their intended mark.

“Government’s view of the economy could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.”

-Ronald Reagan

Last week, we got our first glimpse at the proposed tax plan to pay for the physical and social infrastructure agendas. In terms of the proposals, much of the plan was what Biden campaigned on and telegraphed since becoming president. But there were some new details that warrant attention, which we highlight in below:

- Individual Income Taxes – Raise the top individual income tax rate to 39.6% for those making over $400k.

- Imposing The 3.8% Medicare Investment Tax on All Income Over $400k – Biden is proposing that the 3.8 percent Medicare tax on investment income be applied to other forms of income, most notably small business income. The idea being that investors can divert their incomes into small business vehicles to avoid the 3.8 percent tax. When President Obama proposed this initially, it was focused on small business income and we will need to see more details.

- Capital Gains & Dividends – Tax capital gains and dividends as ordinary income for those with incomes over $1 million. Tax rate would be 43.4 percent. Equalizing capital gains with ordinary income would end the carried interest spread.

- Estate Tax – We read the Biden plan as similar to the Bernie Sanders plan, which imposes an unrealized capital gains tax at death by “making sure the gains are taxed if the property is not donated to charity.” In a nutshell, getting rid of the “step up in basis” for estates.

- Make Permanent Loss Limitation Rules – The 2017 Trump tax cut limited private companies from using losses to offset other income. But that provision expires in 2025 and Biden proposes to make the change permanent.

- Eliminate Like-Kind Exchanges – Biden proposes to end like-kind exchanges at incomes over $500k.

- Tax Enforcement – Earlier this week we remarked that there was a hole in the financing of the Biden plan when pharmaceutical pricing changes were removed. Biden fills that gap with tax enforcement by proposing to give $80bn to the IRS with the hopes of collecting $700bn in more revenue over 10 years. Other reforms would include more reporting on investment data from financial institutions.

“No government has ever voluntarily reduces itself in size. Government programs, once launched, never disappear. Actually, a government bureau is the nearest thing to eternal life we’ll ever see on this earth!”

-Ronald Reagan

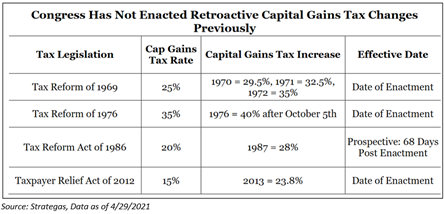

The biggest question an investor can ask themselves right now is: What is the Effective Implementation Date of these Potential Tax Changes. We will not be able to get this information until the end of the process, but we can look towards history to see if it provides any type of guidance:

– Corporate Taxes – This is an interesting one. If corporate taxes are pushed back to 2023, that is a bullish signal because, one, you get a lot more corporate earnings in 2022, but secondly, you change the probability on if this tax change will actually go into effect. If it gets pushed back, the tax change will then have to go against the mid-term election, which could possibly change the overall outcome. Corporate taxes are much easier to make prospective than individual capital gains and dividend taxes. But, we would expected that corporate taxes would be enacted prospectively, much like they have been done in the past.

– Individual Taxes – We believe that individual taxes could get started right away on the date of implementation, but investors have actually seen these types of taxes to be retroactive on the state level, i.e., 1993 and 1968. But we believe that these chances are quite low, given that even Senator Bernie Sanders’ state tax proposal suggests that they should not be enacted retroactively. Thus, we believe that these taxes will go into effect on the date of enactment.

– Capital Gains Taxes – Investors have never seen capital gains taxes be retroactive. We would assume that this trend will continue. We also do not believe that the tax increase will be prospective to give investors.

“The nine most terrifying words in the English language are: I’m from the government and I’m here to help.”

-Ronald Reagan

Bottom line, there are risks of higher taxes from these proposals, but they remain a long, long way from becoming law. And, at this point, we believe history would tell us that making portfolio decisions based on tax proposals in such slim majority government is not a good long-term solution.

Again, history has shown that taxes will most likely not be retroactive this time around. And that is a big sticking point here because it gives investors time to prepare, time to plan, and more importantly, time to execute and implement that plan, without any material changes to their current tax situation.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2104-18.