Aptus Compounder Update

The Aptus Compounder Stock Sleeve is designed to give equity exposure to a group of individual stocks that we think offer attractive prospects through a combination of yield, growth, quality, and reasonable valuations relative to large cap peers.

Overall

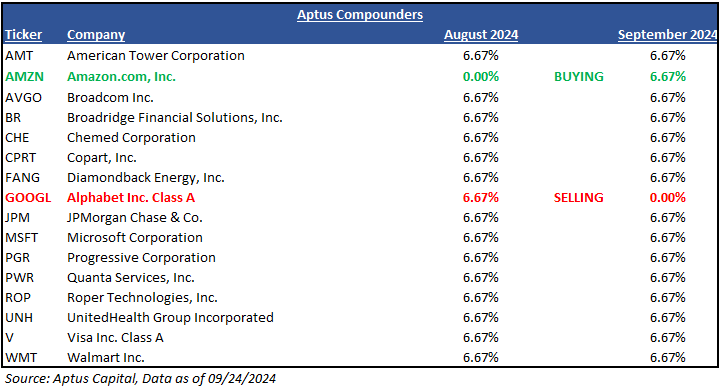

Given the concentration of the U.S. Large Cap benchmark (S&P 500), the Aptus Compounders strategy tends to own a few of the “Mega-Cap” names to bear some exposure, with the intent to minimize the risk of underperformance in case the weighting of the constituents narrows. Periodically, we cycle through a few of our most convicted mega-cap names, while always maintaining exposure to minimize tracking error.

Sale

The strategy has held Alphabet, Inc. Class A (GOOGL) since the global pandemic, as we swapped the company with Apple Inc. (AAPL) on 8/8/2020. Since purchase, GOOGL has outperformed AAPL by a few percentage points, while outpacing the strategy’s benchmark, the S&P 500, by over 35% (As of 9/20/2024). Thus, we believe that it has been a successful trade.

Even though we’d consider this to be a successful trade, it doesn’t mean that it has been smooth sailing during the strategy’s ownership of Alphabet – especially as of late. Our equity team is a firm believer that Alphabet, Inc. embodies all of the characteristics of ownership in the strategy – competitive moat, pricing inelasticity, and a reasonable valuation. The company has great businesses underneath its umbrella: YouTube, Waymo, etc.

But, as of late, there have been a few exogenous events that have made us believe that it may be difficult to get any kind of valuation expansion out of the stock moving into the future. Simply said, between the Artificial Intelligence (“AI”) search threat and the U.S. government’s actions against the company, we are tossing in the towel, as it has become one of the most frustrating positions to own in the portfolio. We believe in the company’s business, but like the Roman Empire, time remains undefeated, and the government barbarians are at Google’s gate. It’s hard to envision Google escaping the battles unscathed. Thus, we are cycling capital elsewhere.

Purchase

We believe that Amazon.com, Inc. (AMZN) is a fundamentally sound business, the company owns one of the most powerful brands in the world, and it has an unparalleled logistics and distribution network setting it apart from other players in online commerce. Massive scale provides cost advantages in both e-commerce and cloud computing, generating an additional layer of competitive strength for the business. In our opinion, we believe that management has demonstrated an exceptional track record of successful innovation and sustained growth over the long term.

The investment thesis on AMZN is still centered on 1) retail margin expansion, and 2) AWS acceleration. We believe there is runway in both, but the magnitude is likely to moderate compared to trends over the past two years, and the path is unlikely to be linear going forward. That said, AMZN’s dominant competitive position in two large consumer and software end-markets with its retail and cloud businesses provides a lot to be bullish about over the next 12-18 months.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

Information presented in this commentary is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Information specific to the underlying securities making up the portfolios can be found in the Funds’ prospectuses. Please carefully read the prospectus before making an investment decision. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy.

The company identified above is an example of a holding and is subject to change without notice. The company has been selected to help illustrate the investment process described herein. A complete list of holdings is available upon request. This information should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the holdings listed have been or will be profitable, or that investment recommendations or decisions we make in the future will be profitable.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy call (251) 517-7198. ACA-2409-26.