“It’s remarkable how much long-term advantage I’ve found by trying to consistently be not stupid”

-Mr. Xavier from Jacob Taylor’s Rebel Allocator

January Recap

- An eventful start to the year, and bond proxies outperformed. The S&P 500 gave up its early lead to finish the month flat. Continuing the theme from last year, domestic large caps outpaced small and international markets by over 2% during January.

- The 10-year yield fell sharply again and hit multi-month lows as fears of a global economic slow-down hit markets. Bottom line, the bond market continued to send outright worrisome signals about future economic growth, not just in the U.S. but also globally.

- The coronavirus became the first story of 2020. The virus is expected to reduce Q1 Chinese GDP growth by 1.6%, sparking fear around the world that the virus threatens to choke off the expected rebound in global growth.

The Market Backdrop

The biggest allocation decision we can make is the percentage of stocks and bonds we own. While the case can be made that stocks are expensive, we’d ask, relative to what? Definitely not bonds…

Let us try to explain the unexplainable bond market. The current 10-year treasury bond yields 1.52%. That’s a dollar and a half for every $100 people are loaning the government. Not to mention, that $1.52 WILL NOT GROW. If you think about that $1.52 as earnings – people are paying over 65x earnings that are guaranteed not to grow!

Our Choices

Allocation decisions are driven by the relative options we are given. When thought about that way, stocks at a trailing Price to Earnings of 20x (ish) don’t seem all that bad. We continue to underweight bonds and international stocks, continue to focus on consistent yield, and continue to own explicit exposure to hedging techniques (forms of insurance against market drops).

We wrote about the risks we’ve been seeing back in the 3rd quarter of 2019. Most of that sentiment remains, as we are placing greater emphasis on the ability to reduce our exposure to potential drawdown. Volatility started to pick up as January ended, though fear is fading in early February.

Our overall aim is to tilt allocation away from areas that we think can be a drag on future returns(bonds!) and do so without injecting additional risk. Our ability to hedge away a portion of the risk associated with stocks is crucial to this point.

Hedging in Action

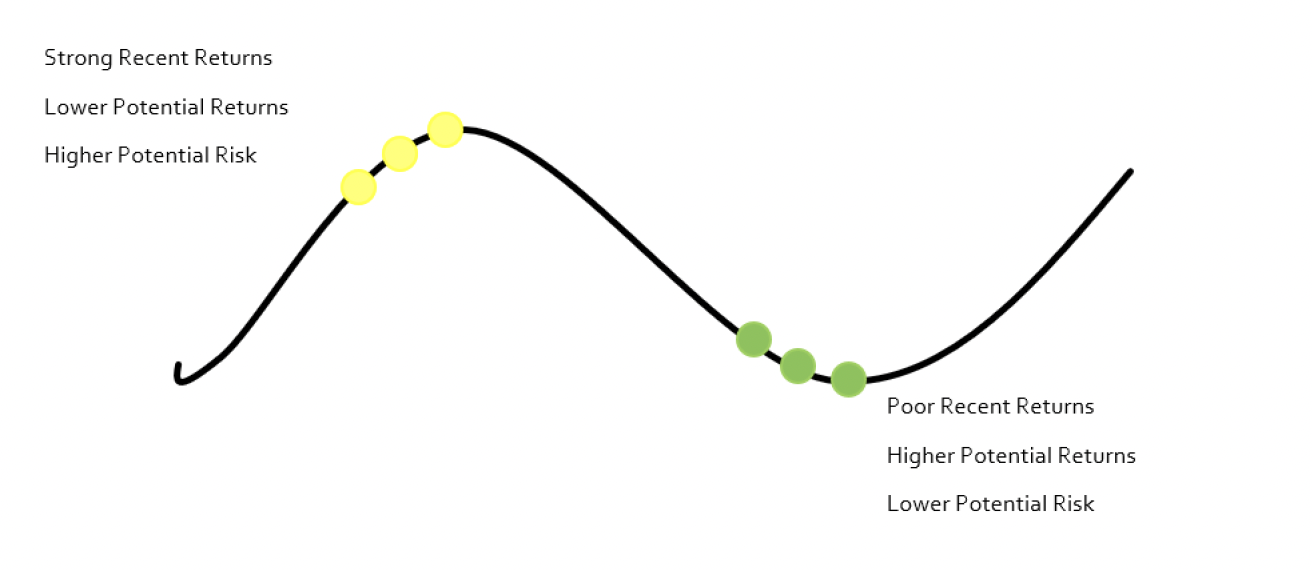

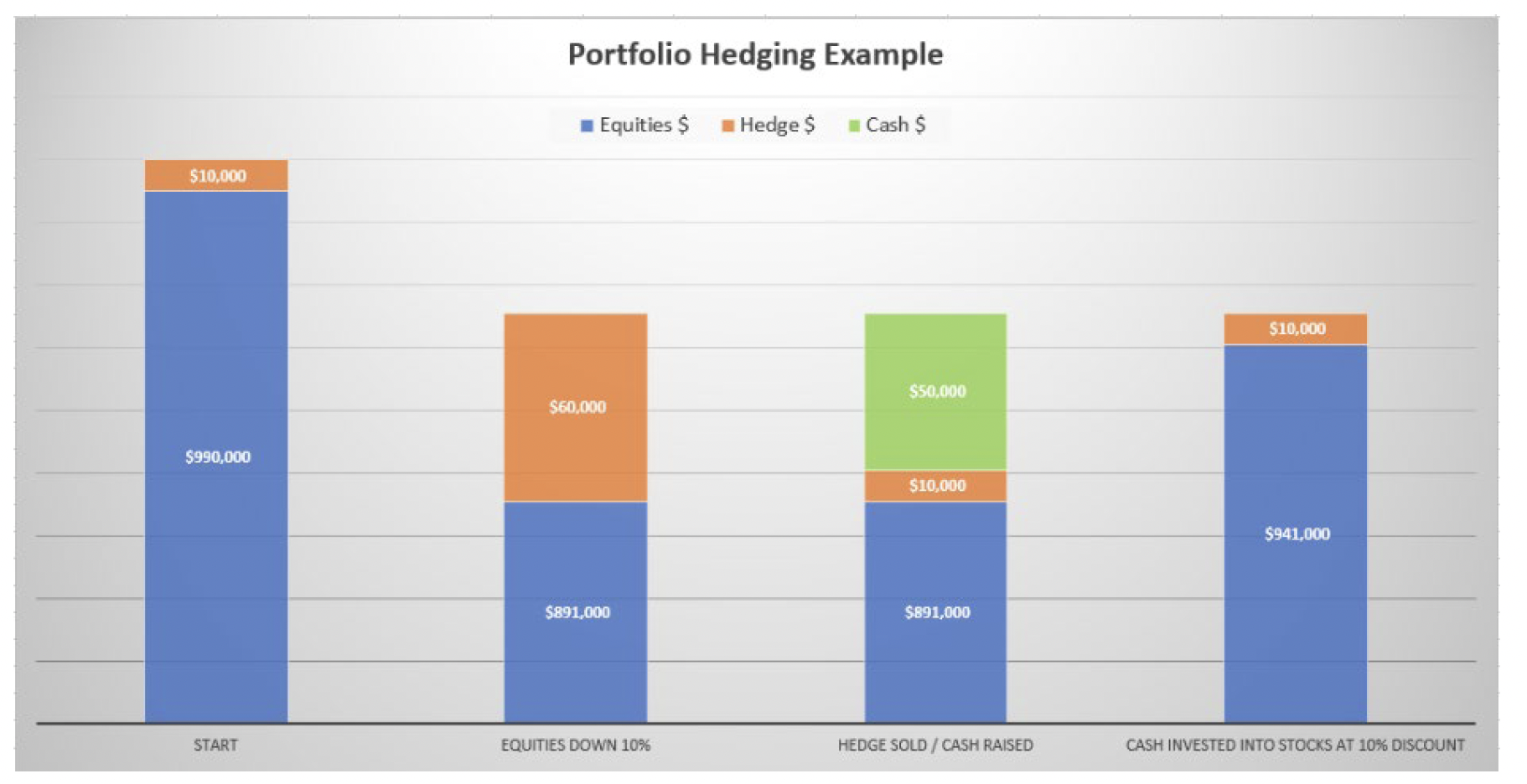

Remember the colored dots? We’d love to say we “buy green, sell yellow” but come on. That said, the structure of our hedges is designed to create dry powder in a selloff. It feels closer to the yellow dots than the green ones, either way we take comfort in a proactive hedging approach that keeps us both protective and opportunity-seeking. See the illustration (as in, “picture to help explain” not “promised outcome”) below:

The above example is shown for informational purposes only and should not be interpreted as actual historical performance of Aptus Capital Advisors, LLC. Results are hypothetical and do not reflect trading in actual accounts. The actual results of individual clients will differ due to many factors, including individual investments and fees, individual client restrictions, and the timing of investments and cash flows. Clients should not rely solely on this or any other performance illustrations when making investment decisions.