You Have to Know Where You’ve Been to Know Where You’re Going

The profile of the global equity market through the current recession has, so far, been more extreme than most cycles. The market fell into a recession much faster than average (the fastest since 1929), while the rebound has also been much swifter than any correction in history.

From our perspective, the speed of the bear market was understandable given the almost complete stoppage of economic activity experienced in the early part of the year, while the sharp pace of the recovery owes much to the unusual nature of the recession and the scale of policy support.

If you look at the underlying reasons that a bear market occurs, you can classify them as follows:

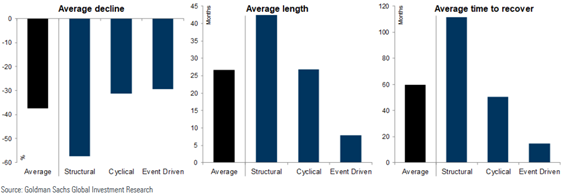

- Cyclical bear markets are the most common, typically driven by rising inflation and interest rates.

- Structural bear markets are preceded by major imbalances and asset bubbles and typically associated with banking and/or real estate crises.

- Event-driven bear markets are typically the result of exogenous shocks that de-rail an economic cycle and corporate profitability.

Historically, the cyclical and event-driven ones tend to be similar in depth (while structural bear markets tend to be much deeper). That said, the event-driven ones tend to happen more quickly and revert to previous levels in a shorter period. In that sense, the profile of this bear market has not been so unusual.

The other reason why the equity rebound has been so impressive from the trough in March is that the scale of the economic shock as a result of lockdown measures was so severe that it prompted a repeat (and extension) of the monetary response in the aftermath of the financial crisis, although this time it was supplemented with significant discretionary fiscal easing. This combination went a long way to moderate tail risks for investors by re-establishing a ‘central bank put’, while also introducing a ‘fiscal/government put’, moderating concerns about longer-term structural damage to economic and productive capacity.

Why is looking at the market in this lens important? Well, this recovery is very much different than anything we have ever seen before, due to the aforementioned reasons. But, bottom-line, we believe investors can’t always look to history as a guide on how to navigate current market conditions. The market is continuing to evolve, and for investors to stay relevant, we believe they need to evolve with it.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2012-12.