Developments over the Past Month:

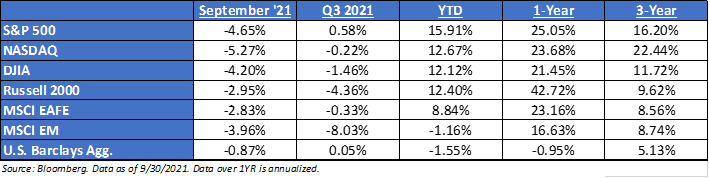

- Recap: After successfully testing it’s 50-day moving average nine times so far in 2021, the S&P 500 finally broke below this threshold in September and has tested the 100-day moving average now twice. As of month end, in 2021, the S&P 500 has seen a peak-to-trough pullback of 5.0%. Historically, the market tends to on average see three (3) 5% pullbacks and one (1) 10% pullback during a calendar year.

- Equity Fundamentals: As equity valuations come under scrutiny amid the rapid rise in real rates, investor focus will increasingly assess whether earnings growth can continue to lead the market higher. 3Q earnings season kicks off when the largest Banks report during the week of Oct. 11th. Consensus expects S&P 500 EPS growth to decelerate to +27% year/year in 3Q. We believe there is upside to consensus estimates but expect the frequency and magnitude of EPS beats will moderate from 1H 2021. Four key risks to watch: (1) Supply chains, (2) oil, (3) labor costs, and (4) China growth. Aggregate EPS downside risk from these factors appears relatively contained today.

- The Bond Market Finally Woke Up in September: The bond market woke up from its slumber, as the 10-YR Treasury yield broke out of its trading range since early July, finishing the month at 1.45%. The swoon in bond yields, which also happened last summer, we believe had been more technically driven than fundamentally driven as the Treasury has taken its cash balances from ~$1.7 trillion to ~$300 billion since March, limiting new treasury issuance, while at the same time QE and excess bank liquidity has created meaningful artificial demand. As expected, given the increase in nominal yields, created a tough environment for traditional fixed income.

- Continued Problems out of China: China risks moved to the front burner this past month as Evergrande highlighted risks associated with China’s property market/bubble. And questions as to what degree China is willing to continue to attempt to drive strong GDP growth if this comes with continued property inflation, and with it systemic risks. If China decides the chase for maximum GDP growth is not worth it, the world is going to need another long-term driver of growth, and this has long term ramifications for risk assets globally.

- C. Risks Likely to Take Center Stage Over the Next Few Weeks: DC will start garnering more attention in the coming weeks as the political calculus around passing infrastructure bills and the debt ceiling debate likely guarantees some market moving headlines.

- Debt Ceiling: Ahead of the September 30 debt expiration of federal government funding, the House and Senate were able to pass a short-term budget resolution to keep the government funded until December 3 that includes disaster relief funding and funding for resettlement of Afghans.

- Infrastructure Bill / Reconciliation Package: Speaker Pelosi delinked the reconciliation bill and the bipartisan infrastructure bill, saying that negotiations on the reconciliation bill were not far enough along to continue to pair passage of the bills because the size of the reconciliation package had to come down. Congress (as of this writing) is working to pass a 30-day extension of the Highway Trust Fund, which expired 9/30 without the infrastructure bill passing.

- Taxes: We believe taxes will continue to be a large part of the reconciliation package, as Corporate and Individual taxes should account for $1000M and $900M, respectively, when we consider on how to pay for excess spending.

- Q3 Earnings Preview: We expect upside to consensus estimates but believe the frequency and magnitude of EPS beats will moderate from 1H 2021. 1Q and 2Q 2021 earnings results easily surpassed consensus expectations: The share of companies beating EPS by more than a standard deviation averaged 71%, a record high, and the average EPS beat equaled 21%, well above the long-term average of 6%. However, economic and earnings growth are decelerating and base comparables have become more challenging. Nonetheless, the bar for 3Q earnings results appears fairly low. Despite an aggregate 17% beat in 2Q S&P 500 EPS, bottom-up 3Q and 4Q EPS estimates were only revised up by 3% since the start of 2Q earnings season.

- 2019 S&P 500 operating earnings = $165. Bottoms-up for 2020 = $142 (was as low as $125 in June). 2021 = $202

- S&P 500 Fwd. P/E is at 22x. CAPE Ratio is 35x. EAFE is 16x forward P/E, while EM is at 13x. R1V is 17x v. R1G at 31x.

Client Talking Points –October 2021

- President Biden outlined the biggest expansion of the federal government matched with the largest tax increase since 1968. Biden senses the post-COVID era is a once-in-a-generation opportunity to massively restructure US fiscal, monetary, and social policy. In our opinion, this is a big experiment. We’ll wait to see how infrastructure and taxes pan out. It appears that this dramatic change in societal direction has proved to be difficult for some moderate Democrats to get on board with.

- We have expected bond yields to reflate as the pandemic improves and economic activity begins to normalize. The spread on the 2s and 10s has historically expanded as wide as 300 bps (~130bps as of September month-end)

- With the recent Merck therapeutic news, we believe that this should create an environment of increased optimism surrounding the resumption of normal economic activity, our expectation is that rates will continue to rise, and market leadership will shift away from tech rrowth into more downtrodden components of the market, much like what we saw at the end of September.

- The first half of the year was led by a bunch of one-hit wonders, i.e., most likely not repeatable – a very dovish Fed, a successful economic reopening, and $8T of stimulus. None of which are expected in the second half of the year. Moving forward, the market may have to navigate a slew of negative headlines – increased taxes, higher-than-expected inflation, continued supply bottlenecks, and the possibility of a new Fed Chair. All in all, we believe that this can create an environment of increased volatility.

- We feel it will be worth watching the general trend of economic and fundamental data, and when it will begin to decelerate. It’s tough to get better than the best. Are we already at peak growth? What happens after peak growth?

- Longer-term, we believe valuations and bond yields will eventually matter, and both will lower expected returns for balanced portfolios.

Disclosures

Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy call (251) 517-7198 or contact us here. Information presented on this site is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy.

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 11.2 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 4.6 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

The Nasdaq Composite Index measures all Nasdaq domestic and international based common type stocks listed on The Nasdaq Stock Market. To be eligible for inclusion in the Index, the security’s U.S. listing must be exclusively on The Nasdaq Stock Market (unless the security was dually listed on another U.S. market prior to January 1, 2004 and has continuously maintained such listing). The security types eligible for the Index include common stocks, ordinary shares, ADRs, shares of beneficial interest or limited partnership interests and tracking stocks. Security types not included in the Index are closed-end funds, convertible debentures, exchange traded funds, preferred stocks, rights, warrants, units and other derivative securities.

The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities.

The Russell 2000® Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000® is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set.

The MSCI EAFE Index is an equity index which captures large and mid-cap representation across 21 Developed Markets countries*around the world, excluding the US and Canada. With 902 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI Emerging Markets Index captures large and mid-cap representation across 26 Emerging Markets (EM) countries*. With 1,387 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. This includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities and collateralized mortgage-backed securities. ACA-2110-1.