It’s been quite some time since we highlighted a single stock in our Aptus Compounders sleeve. To be quite honest, it makes complete sense given the level of market uncertainty here. We know that volatility creates opportunities – especially in the equity world, as not all stocks are created equally. Let’s focus on a stock that has performed quite well through this period. In fact, as of 6/27/2022, the stock is up 6.6% YTD, outperforming the S&P 500 by 24.1%. Surprising to many, this is not an energy stock – in fact, it’s quite different than an energy stock – it’s the discount retailer, Dollar General (ticker: DG).

See the compliance approved Bull/Bear Case Study here.

Let’s dive in:

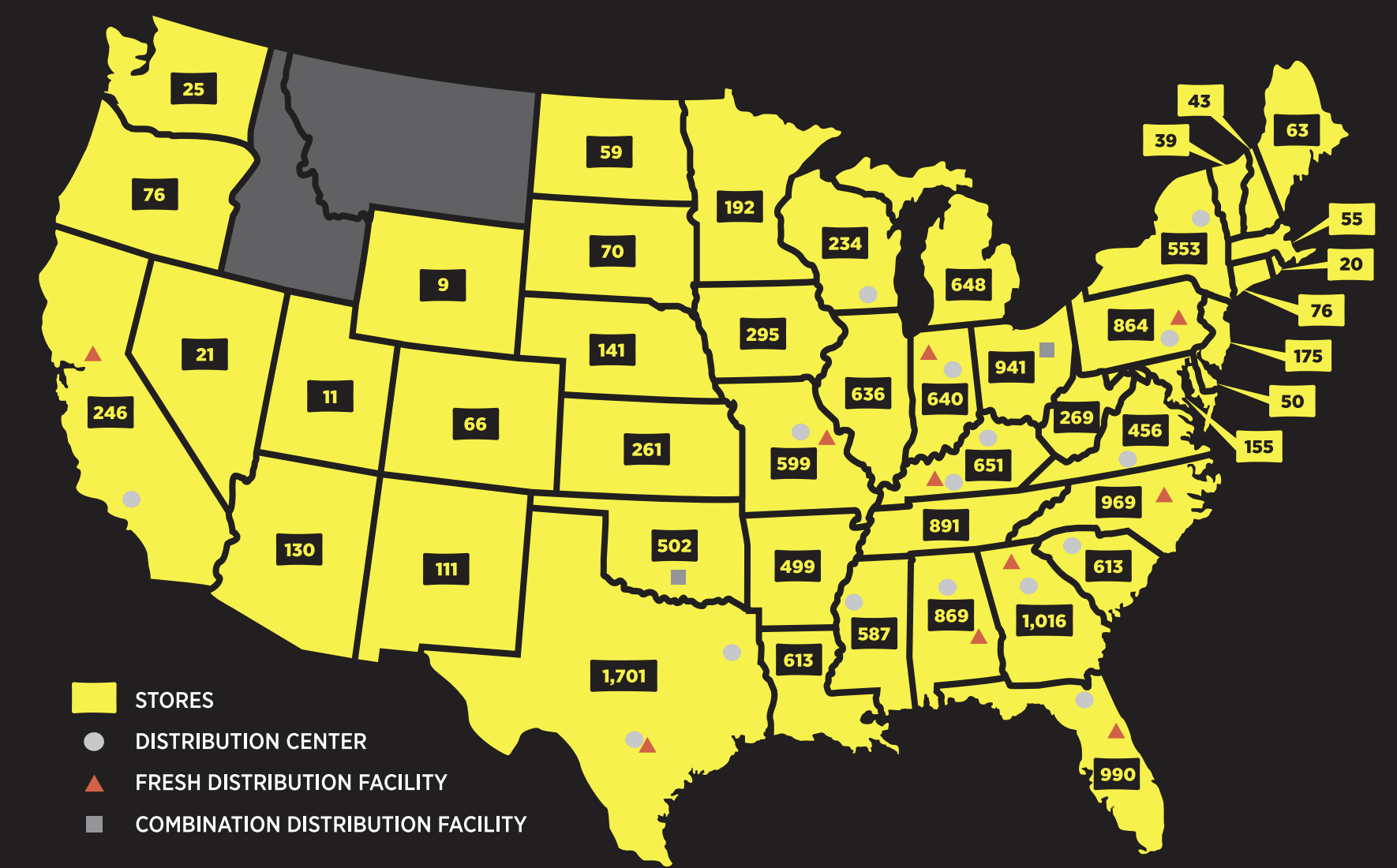

What Does Dollar General Do?: Dollar General is the largest dollar store chain in the United States by revenue and second largest by store count. The company generated roughly $37.4bn in revenue in 2021 and operates more than 18,000 stores in 44 states offering an assortment of everyday items, including highly consumable merchandise, seasonal, home products and basic apparel.

Source: Company Annual Report, Data as of 5/27/2022.

Source: Company Annual Report, Data as of 5/27/2022.

What is our Overall Thesis?: DG remains an attractive “all-weather” investment opportunity. In our view, DG has the capabilities and real estate growth strategy (multiyear) to gain market share by targeting quick “fill-in” trips for cash-strapped consumers, in a wide variety of economic environments. While there are investor questions on the low-end consumer’s spending power, employment still remains strong and DG’s value (low price points, small packing sizes, etc.) to that customer is even more important in today’s inflationary environment. Furthermore, rising fuel prices (currently ~$4.60/gallon) could lead to consumers to shop more closely to their home (75% of the U.S. population is within five miles of a DG store). Finally, while cost/supply chain inflation remains a concern for the value retail space, we believe DG’s private fleet is a competitive advantage (~20% savings vs. third-party fleets).

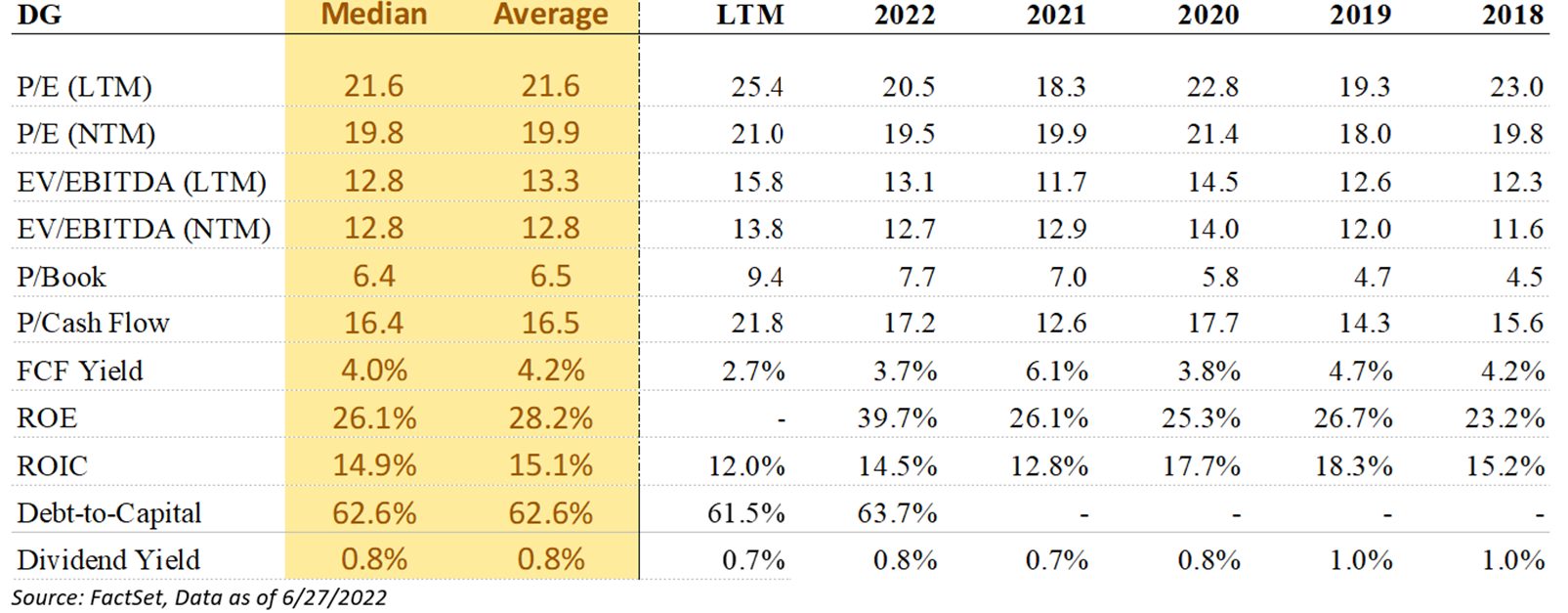

Why Do We Have Conviction? We believe the combination of DG’s NCI and pOpshelf initiatives alongside the ongoing consumer trade-down related to the current inflationary environment provide the company with ample opportunities to drive growth moving forward. DG currently trades at ~19x P/E and ~15x EV/EBITDA on a FY’22 basis, relatively in line with historical averages.

Yield + Growth Framework

0.88% + 10.75% = 11.63%

Yield: The current indicated yield of 0.88%. The more impressive aspect is that DG has been able to grow its dividend by 10% on average a year since the div. initiation, while keeping the dividend payout ratio ~20%, allowing plenty of room for investment regarding growth.

Growth Rate: SS Comp + Inorganic Growth + Margin Expansion from Strategic Initiatives + Share Repurchases = Growth Rate: 4.25%% + 2.50% + 0.50% + 3.50% = 10.75%

Other Thoughts on SS Comp Growth: DG is confident that their core customer remains in relatively good shape, buoyed by a strong job market. That said, DG has observed notable changes in shopping behavior, including, 1) softer discretionary sales and trade down into private label assortments, 2) shorter trip distances with more customers shopping closer to home, and 3) smaller basket sizes.

Other Thoughts on Margin: Margins on consumables are better than they were three years ago. Margins in consumables have benefited from DG Fresh, while Health & Beauty margins are more similar to non-consumables and DG has been deliberately growing that part of the business. DG is probably one of the few companies growing their margin during this period.

Other Thoughts on EPS: EPS growth should accelerate meaningfully in 2H 2022 as sales comps get easier and DG laps short-term gross margin headwinds from freight and LIFO (“Last-in-First-Out”).

Valuation Analysis

We think DG’s strategic initiatives should help mitigate margin pressures and provide support to margin, and ultimately, valuation. The strategic initiatives include including:

1) DG Fresh

2) Expanded health offerings

3) NCI rollout

4) Cooler door expansion

5) Digital enhancements

7) DG’s private fleet expansion

8) Real estate projects, among others.

While strategic initiatives won’t expand the current multiple in our opinion, it should help insulate it as the market has started to punish those companies that are witnessing margin compression. As mentioned above, DG may be one of the few companies where we may see margin expansion in the current environment.

Bull Case

- Accelerated Store Remodels/Relocations & Incremental Store Openings:

The most important driver of Dollar General’s performance has been the success of its real estate projects. A traditional store remodel delivers a 4% to 5% comp lift and the DG Traditional Plus or DG Plus remodels deliver a 10% to 15% comp lift. Importantly, management plans to accelerate new store openings to 1,100 stores and remodels/relocations to 1,580 stores, with ~70% of store remodels in the DG Traditional Plus or DG Plus format (higher comp lift). As a result, a greater percentage of the store base will be in an updated format. The greater percentage of remodels mixed with an acceleration of new store openings and instore initiatives should continue to drive solid sale sales growth in the future.

- International Expansion is a Nascent but Potentially Lucrative Opportunity:

We believe DG’s expansion into Mexico provides ample growth opportunities. While the company has previously acknowledged it will take time to achieve scale in the region, we believe this initiative could provide meaningful benefits to the company over time.

- Incremental Value Adds:

DG noted that its NCI and pOpshelf initiatives continue to present attractive growth opportunities.

- To this end, NCI is available in >13,000 stores and the company indicated that NCI stores continue to generate an incremental 2.5% total comp sales lift on average in the first year after implementation as well as drive a meaningful improvement in GM.

- DG also noted its pOpshelf opportunity is significant, with the company highlighting strong customer reception, healthy average basket sizes, and robust unit economics. With 90%of products below $5, we view pOpshelf as well-positioned in the current environment.

- Increased Share Repurchases and Cash Dividends:

Over the last five years, Dollar General has returned almost $6B in capital via dividends and share buybacks to shareholders. This equates to 14% of current market cap – a staggering figure. This policy should help the stock outperform during market volatility, as it has in recent periods.

Bear Case

- Too Many Stores:

Admittedly, with the changing retail environment, there is a big worry about the potential of Dollar General having too many stores. Dollar General is one of the few companies increasing its store footprint during the new Amazon age.

- Very Competitive Environment:

Dollar General competes against many retailers, i.e., grocery, big box, drug stores, etc. Competition is very high and at the end of the day, the consumer decides where to shop. Therefore, if management is unable to successfully drive store traffic, Dollar General’s top line growth would diminish.

- Macroeconomic Slowdown:

A negative change to macroeconomic factors could reduce customer’s spending and thereby negatively impact Dollar General’s profitability. To note, many of Dollar General’s customers have limited amount of income to spend on discretionary products; therefore, any impact to their disposable income could drive decreased sales and earnings for Dollar General.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns.

All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The company identified above is an example of a holding and is subject to change without notice. The company has been selected to help illustrate the investment process described herein. A complete list of holdings is available upon request. This information should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the holdings listed have been or will be profitable, or that investment recommendations or decisions we make in the future will be profitable.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2206-25.