As one of the most searing dissections of 1980s yuppie culture, American Psycho has become a movie with a cult following, as it depicts Patrick Bateman’s journey of a part-time Wall Street brokerwith a full-time serial killer.

American Psycho is complex film. By the end of its run, focusing on the movie’s third act revelations, we as the audience are left wondering whether or not any of Bateman’s actions were real or if they were an “illusion” of his insanity.

The film isn’t about a psychotic murderer roaming New York’s streets, it’s about capitalist culture and the idea of wanting to stand out when everyone’s identity is the same. At its core, the movie is about Bateman doing a much better job at just playing a part than truly fitting in with others.

And this is exactly what investors witnessed in the market last year – during periods of heightened inflation, asset classes tend to share the same identity, i.e., heightened correlation, as traditional fixed income did not provide its historical safety net. Bonds did a better job at acting the part than truly fitting into an overall asset allocation, as rates skyrocketed, hurting bond prices, with inflation being more persistent than transitory.

In a way, traditional fixed income was its very own American Psycho, as investors thought that they had dinner reservations at Dorsia eating the sea urchin ceviche, but instead were taken on a date to Barcadia.

In a way, traditional fixed income was its very own American Psycho, as investors thought that they had dinner reservations at Dorsia eating the sea urchin ceviche, but instead were taken on a date to Barcadia.

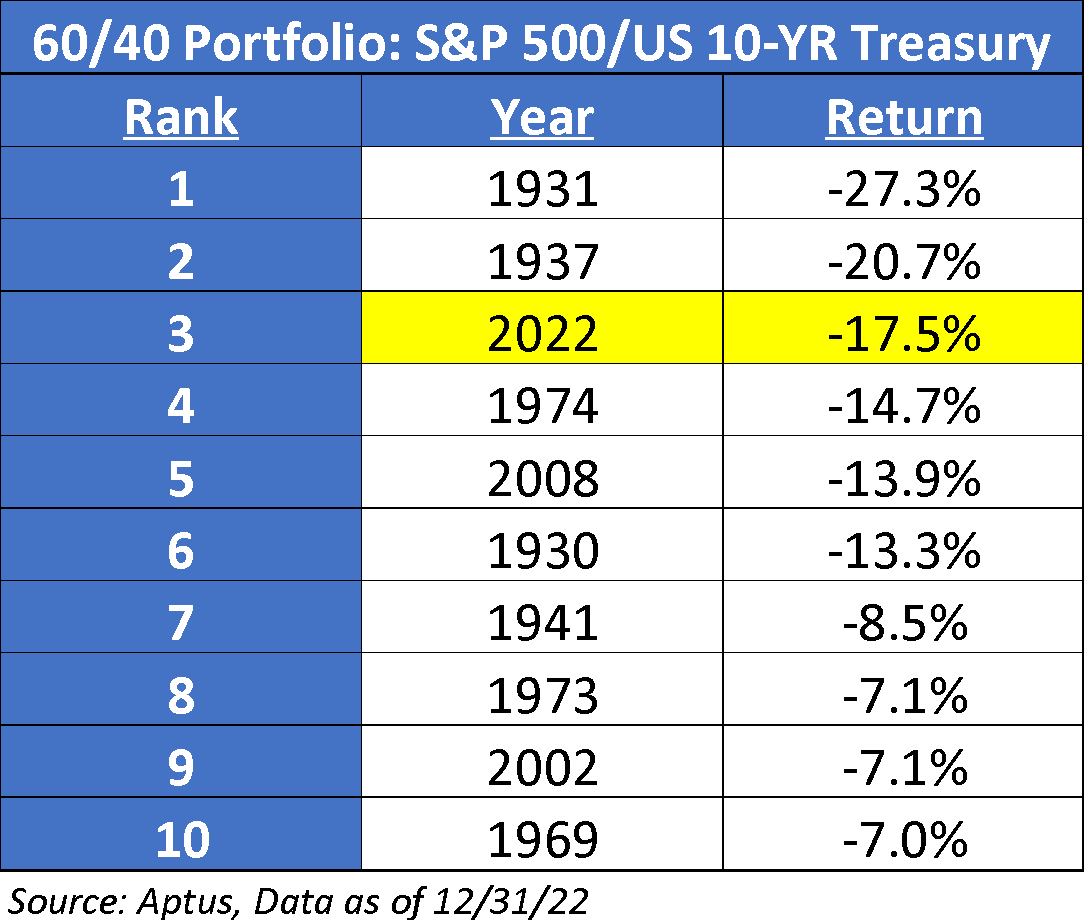

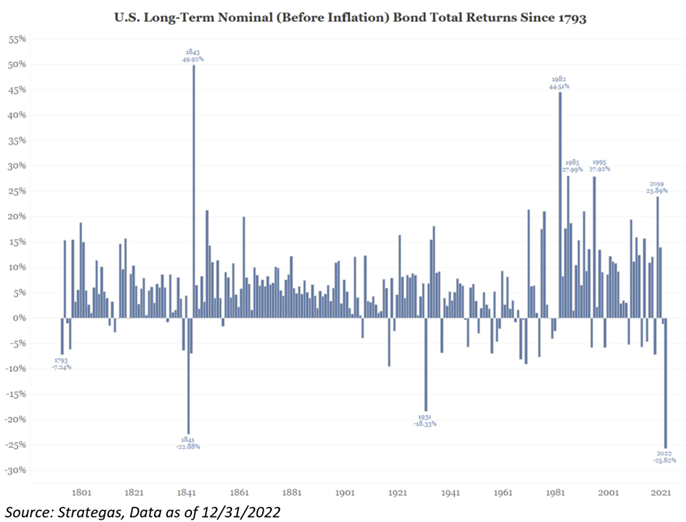

Given the performance of equities and bonds, it was not your average mom and dad recession – in fact, it was actually different this time. The main summary was that “risk-free” assets were down 33%, as it was the worst year on record for the 30-YR Treasury. The heralded 60/40 portfolio was down -17.5%, in its worst year since 1937. Investment-grade corporate bonds lost 15%, and high yield bonds lost 11%, bucking the historical trend.

For only the third time since 1926, both US stocks and bonds lost money last year (the two other occurrences were 1931 and 1969). Not only that, but the path for equities painted an extraordinary picture of what the market had to endure during the year:

- A CPI print that had a high-water mark of 9.1%,

- Rapid Fed Tightening totaling 425bps of rate hikes across just seven meetings, and

- Geopolitical tensions reminiscent of the Cold War

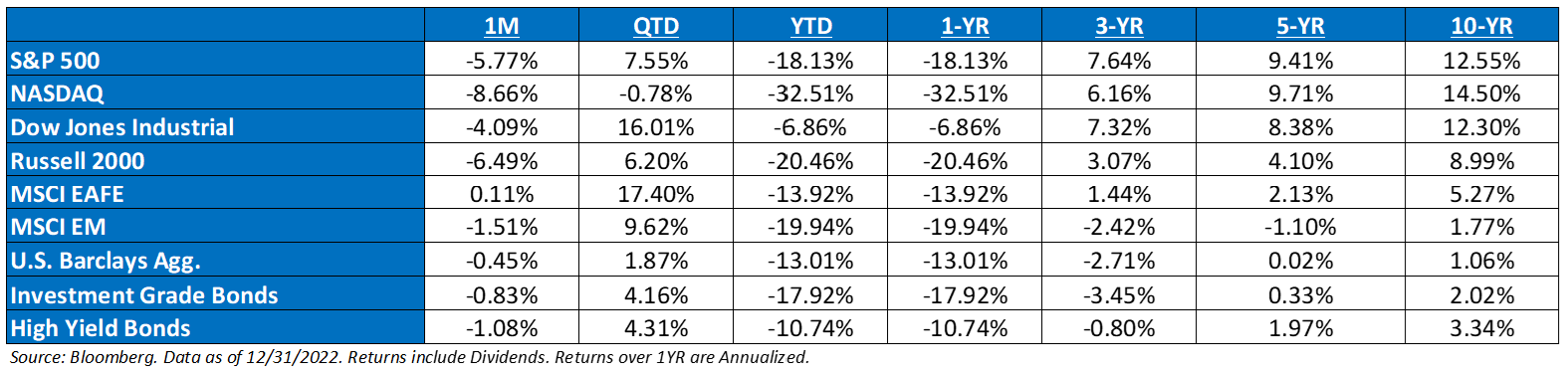

And yet, all through this, the markets rallied in Q4 ’22, almost exiting bear market territory. U.S. stocks returned 7.6%, while bonds gained 1.9%, bucking the trend of three consecutive quarters in which both were negative. Developed international stocks jumped 17.4%, boosted in part by the falling dollar, which started to weaken this quarter after a five-quarter torrent of dollar strength.

Overall, the fourth quarter’s gains allowed investors to feel like they were wearing a Valentino Couture suit, even though it only slightly improved the classification of investors’ ’22 returns.

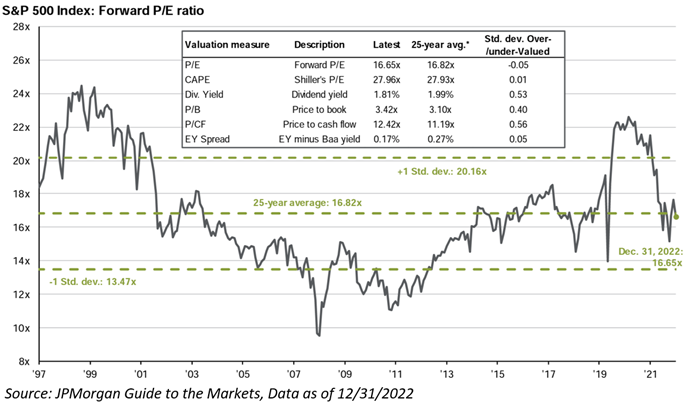

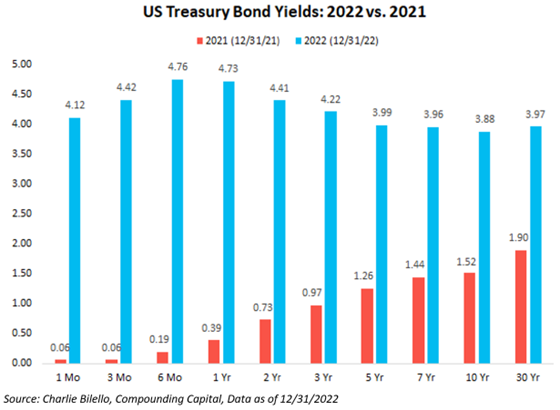

The high velocity spike in interest rates this year has been the reason for both equity and bond performance. Higher rates have hurt longer duration fixed income investments, as reinvestment risk is introduced. For equities, higher rates mean a higher discount rate, compressing valuations. In our opinion, rates have been driving the market’s performance all year, and may not likely change in the interim.

At its core, the rise in interest rates has been a byproduct of Federal Reserve policy and its ongoing fight against inflation. And what investors learned this year is that it is hard to overstate the importance of Federal Reserve policy when it comes to markets.

In Ben Johnson’s book Invest with the Fed, Johnson found that when the Fed was implementing expansive policy (i.e. lowering the fed funds rate), the S&P 500 annualized return was 15% (dating back to 1966). Conversely, during periods of restrictive monetary policy, the S&P 500 annualized returned was just 6%. Bonds also fare worse during restrictive monetary policy, with annualized returns 2.4% below periods of expansive monetary policy, when adjusted for inflation.

Given that we believe the Fed will continue to try to regain its credibility by keeping inflation anchored, we remain cautious on the markets. But there is a silver lining for long-term investors. Throughout the year, the market has had a reset not just on valuations, which entered the year at 21.5x forward earnings, but also on interest rates, as they have not been this high since 2007. The broad landscape appears much healthier than where it was to begin the year.

Long-term investors need to take a note out of Bateman’s methodical morning routine. Preparation is key to having a plan to help prepare for the future, as it is near impossible to predict. We believe the advantage of owning volatility as an asset class gives investors the opportunity to have the best business card at the table – whether it is bone, eggshell with Ramalian type or even a watermark. By owning volatility, we believe that this should help minimize regret and mistakes, ultimately keeping investors on the path to financial independence.

Investment Cults Weren’t Hip to Be Square

Many people don’t know that American Psycho was based off a 1991 novel by Bret Easton Ellis, in which he believes that the movie reached “cult status” due to its metaphorical message about greed in America. And coincidentally, the cult classic has caught up to the current society of investing. For years, investors have remained greedy, investing in unprofitable, “disruptive” technology, bidding valuations up to levels that were not sustainable, without any basic understanding of the investment. This created a self-fulfilling prophecy in which momentum continued to attract investors to the shiny object.

Ultimately, rising long-term rates were the kryptonite that caused the bubble to finally burst. During a period of high inflation, it is not surprising that long-duration equities whose present value is tied only to the terminal value of the stock and long-term interest rates, take on the characteristics of zero-coupon bonds.

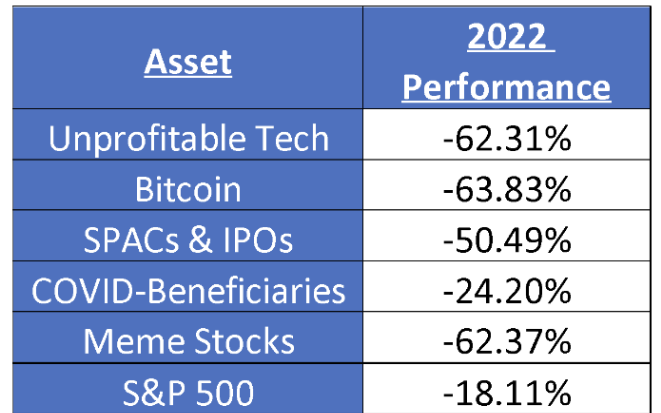

Long-duration securities weren’t the only “cult investment” that took a chainsaw to the back of the head, as cryptocurrencies, COVID-beneficiaries, SPACs, meme stocks, and unprofitable tech, were also victims of a Patrick Bateman-style “murders & execution”.

Not only that, but mega-tech cohorts have also been hit hard. The likes of Apple Inc., Microsoft Corp., Alphabet Inc., Tesla Inc., Amazon.com Inc., and NVIDIA Corp. have collectively shed $4.7 trillionof market cap during the course of ’22. Poetically, this ~$4.7 trillion figure roughly matches the amount of value lost by the entire Nasdaq Composite back in the dotcom bubble (~$4.6 trillion of Nasdaq Composite market cap lost peak to trough).

Moving forward, we believe that “cult investments” will remain the yuppies of the past, as the market should continue to favor the cash flows from shorter-duration equities, allowing investors to partially hedge the impact of inflation via reinvestment. In such an environment, it might not be surprising that the market is rewarding companies who are making shorter-duration capital allocation decisions returning cash to shareholders and dividend payments, over those who are making longer-term investments like M&A and capital expenditures. As a result, we believe companies that can fund their own growth without relying on the capital markets will continue being too hip to be square.

Source: Aptus, Bloomberg. Data as of 12/31/022

Historically, Bonds Work Best Within the Confines of a Group

Music plays a big part in American Psycho, and in particular, Patrick Bateman’s life. There’s several great 80’s songs throughout, but there are three specific artists featured in pivotal scenes throughout the film, Huey Lewis and The News, Phil Collins, and Whitney Houston, all of which, Bateman gives long-winded critiques. And for those that have followed Aptus for quite some time, you are aware of our longwinded critique of traditional fixed income.

Music plays a big part in American Psycho, and in particular, Patrick Bateman’s life. There’s several great 80’s songs throughout, but there are three specific artists featured in pivotal scenes throughout the film, Huey Lewis and The News, Phil Collins, and Whitney Houston, all of which, Bateman gives long-winded critiques. And for those that have followed Aptus for quite some time, you are aware of our longwinded critique of traditional fixed income.

Fixed income has been the undisputed masterpiece of asset allocations, as interest rates have allowed bonds to be on a four decade-long bull market. Historically, bonds work best within the confines of the group rather than a solo asset class, and we stress the word, asset class.

But, with the genesis of an environment of structurally high inflation, higher-for-longer interest rates, and a new phenomenon of quantitative tightening, bonds have neither worked as a solo artist nor a group.

In fact, this was the worst year on record for the U.S. Aggregate Bond Index, with a loss of -13.0%. The -2.9% loss in ’94 was the previous record holder with history on this index going back to 1976.

We believe that bonds, in an inflationary environment, don’t serve as a portfolio hedge as most investors expect. We see this trend continuing over the short and medium-term periods. Fixed income remains a difficult place to invest until its yield is greater than inflation.

But, for the first time in a long time, the treasury market is beginning to give investors some sort of yield. In fact, we believe that there could be competition for capital, as the percentage of stocks with yields greater than the 10YR Treasury is returning to its pre-GFC levels – less than 20% of the stocks in the S&P 500 have a yield > 10YR Treasury.

We’re not sure if the all clear sign has been given, as bond yields still have a negative real return, but do believe that there could be light at the end of the tunnel, which could allow bonds to once again work best within the confines of an asset allocation.

Reality v. Fantasy

A biting satire set in the Era of Excess, American Psycho gave audiences some scathing commentary of materialism and the empty pursuit of it, much of which still rings true today. With the Federal Reserve’s introduction of policy tightening in ‘22, we believe that the decade long Era of Excess called Quantitative Easing may finally be over. With this, we believe that investors need to start thinking differently about investing in the market.

Understanding the current environment, alongside having a plan to invest around it, can benefit investors over the long-term. But that doesn’t mean that the volatility in the market is completely over. In fact, it may be just the opposite. There are numerous events that continue to plague the market, potentially creating an overhang in the near-term: 1) structurally high inflation, and 2) growth frustration.

Yet, we know that the best arbitrage opportunity for stocks is time. Lengthening one’s time horizon has been a recipe for loss avoidance. This is a benefit unique to stocks. Remember, market timing is very difficult, as an investor needs to be correct twice – once on the purchase and once on the sale. Not only that, but panic selling can also result in outsized opportunity costs, as the best market days often follow the worst days.

The question facing viewers at the end of the movie is whether Patrick Bateman’s actions were real or an illusion of his insanity. In a sense, traditional fixed income was the Patrick Bateman of the markets this year, as there was only an illusion of a bond portfolio being a safe haven during market volatility – some kind of abstraction – only an entity. And one of the biggest question facing investors in the future is: will fixed income’s historical attributes be a reality or will they simply not be there.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2301-15.