Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

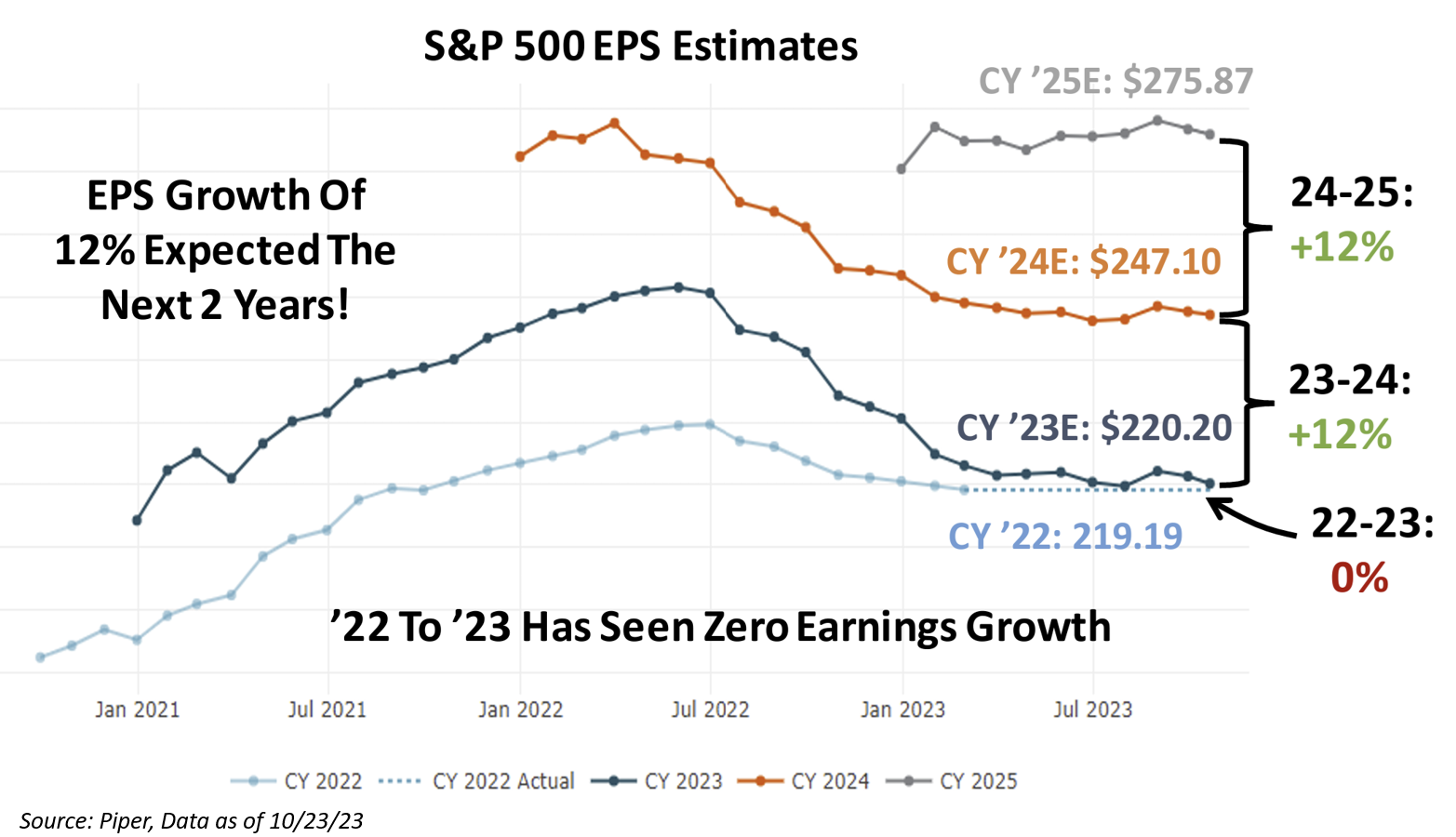

Dave: Investors are banking on a new period of earnings growth once this earnings trough is completed

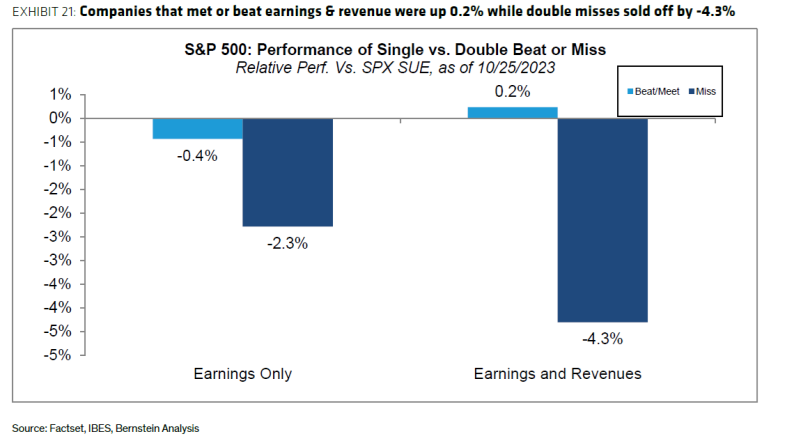

Dave: but the initial reactions to Q3 earnings have been less-than-inspiring

Data as of 10.25.2023

Data as of 10.25.2023

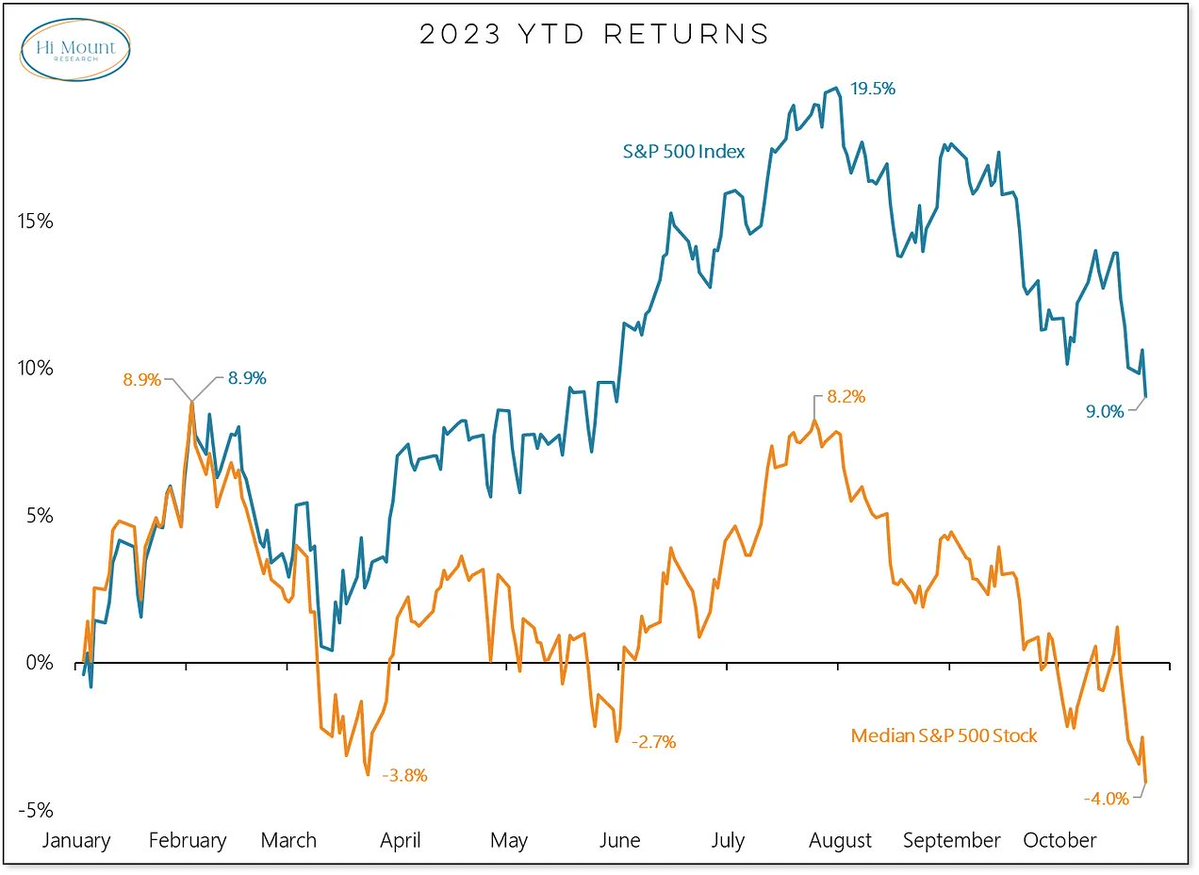

Beckham: We all know the “market of stocks” is falling way short of the S&P this year, and it really kicked in during the March banking crisis

Source: Hi Mount Research as of 10.25.2023

Source: Hi Mount Research as of 10.25.2023

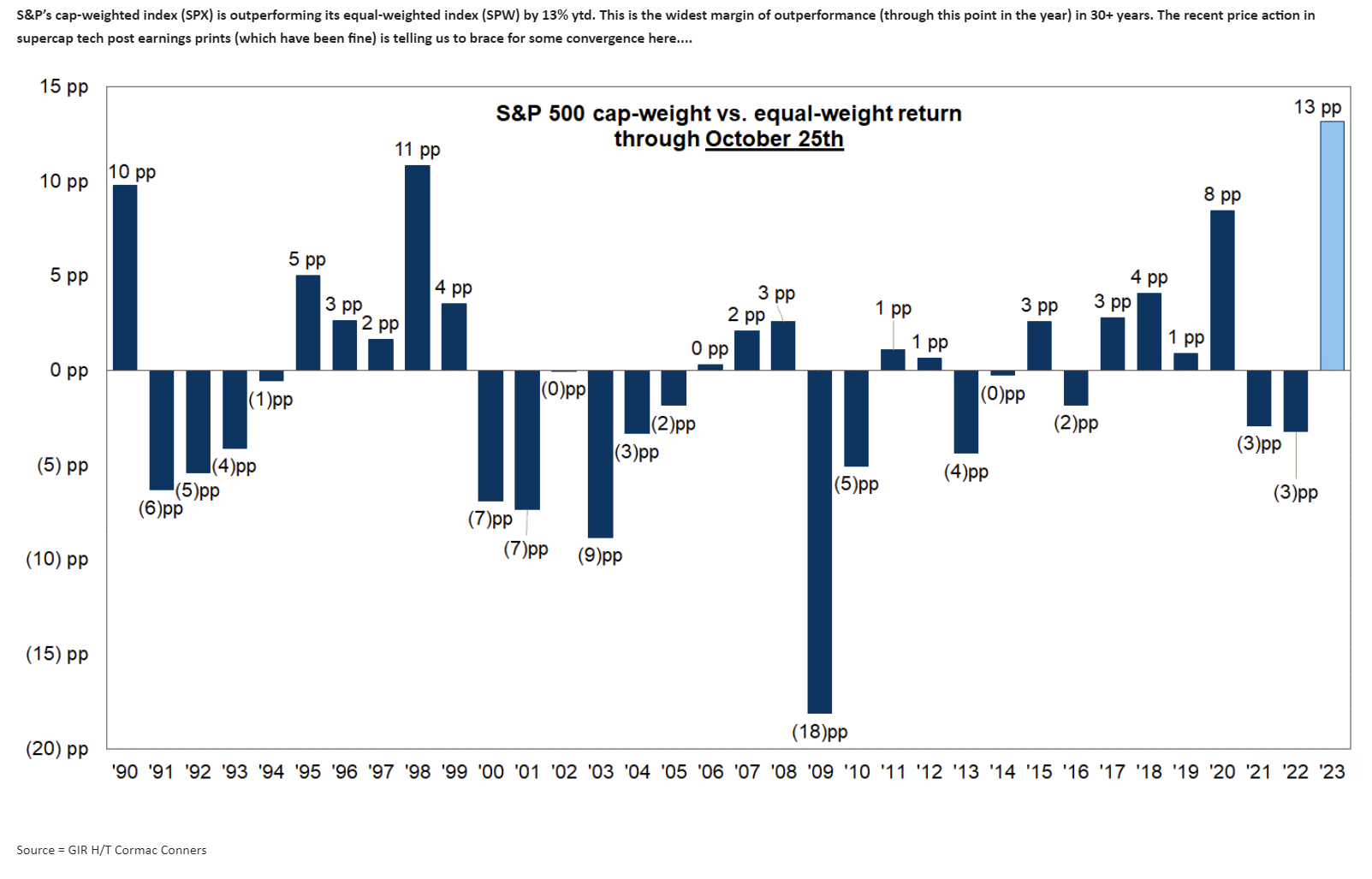

Mark: triggering a historic (double-digit) performance difference between cap-weighted S&P 500 and pretty much any other weighting scheme

Source: Goldman Sachs

Source: Goldman Sachs

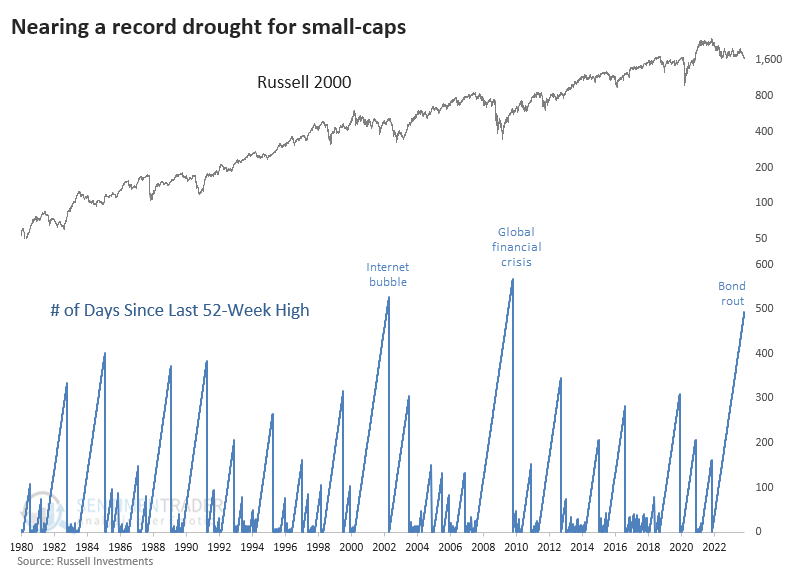

Brad: and extending the long hibernation of small-cap stocks

Data as of 10.25.2023

Data as of 10.25.2023

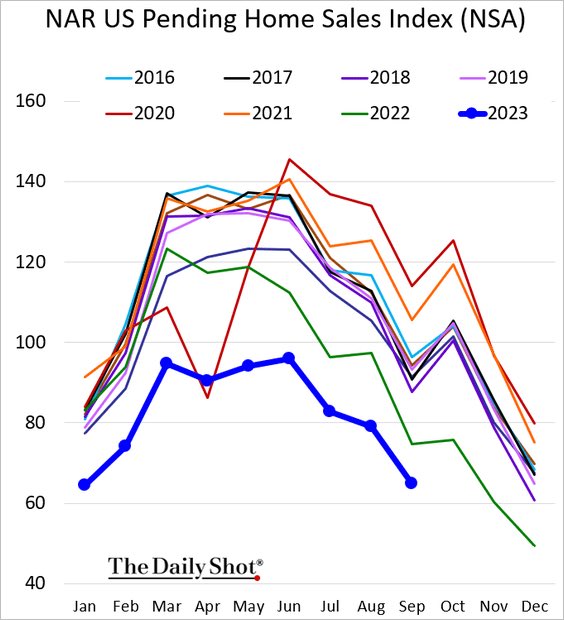

Brett: The economy is full of mixed signals, with housing activity well below recent norms

Data as of 10.25.2023

Data as of 10.25.2023

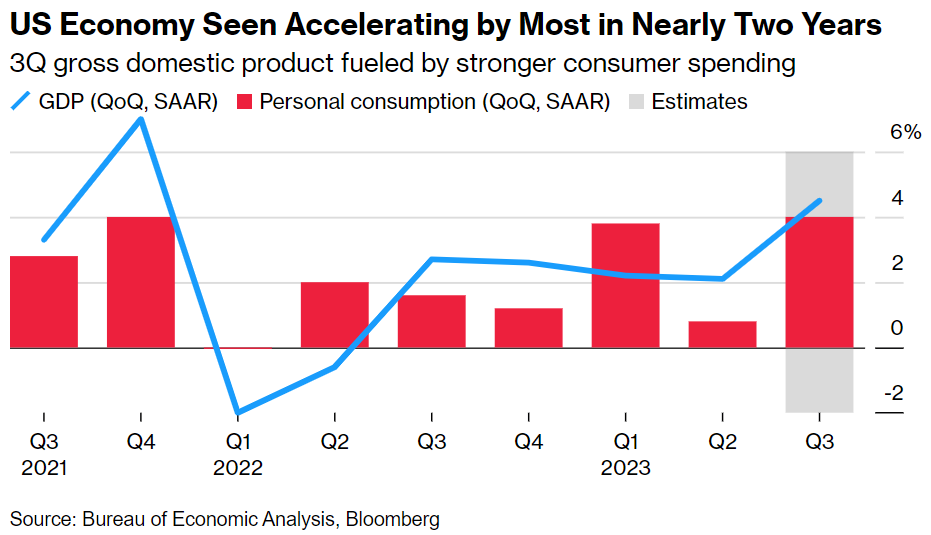

Dave: but GDP running near its highest rate of the recent past

Data as of 10.24.2023

Data as of 10.24.2023

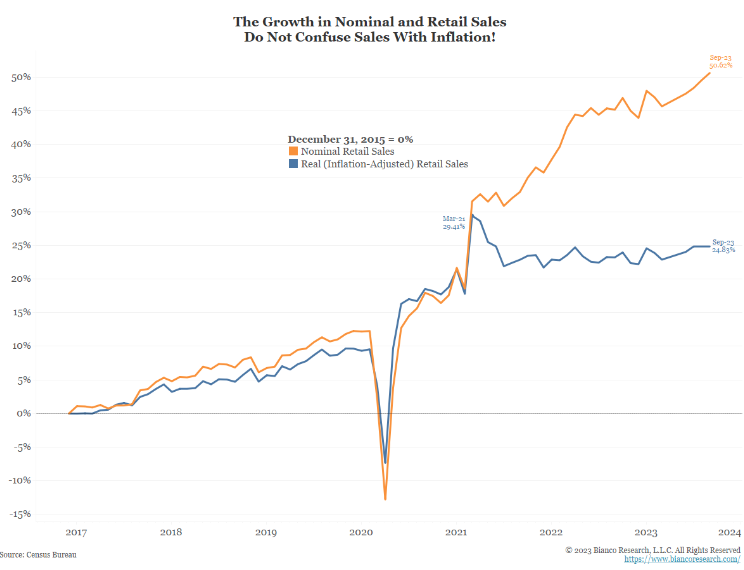

Joseph: and while GDP does calculate real data not nominal, it does seem like much of the retail “growth” is just rising prices not more units

Data as of September 2023

Data as of September 2023

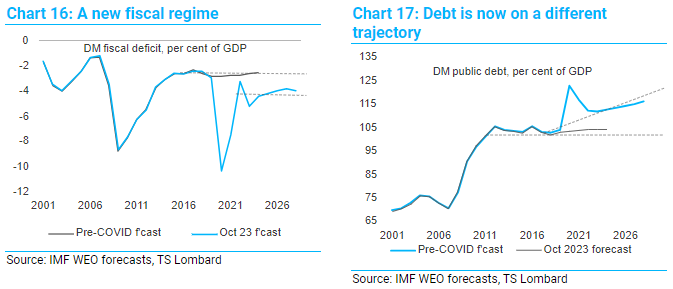

Joseph: The US government debt load and fiscal condition seems to be becoming an issue for bond market participants

Data as of October 2023

Data as of October 2023

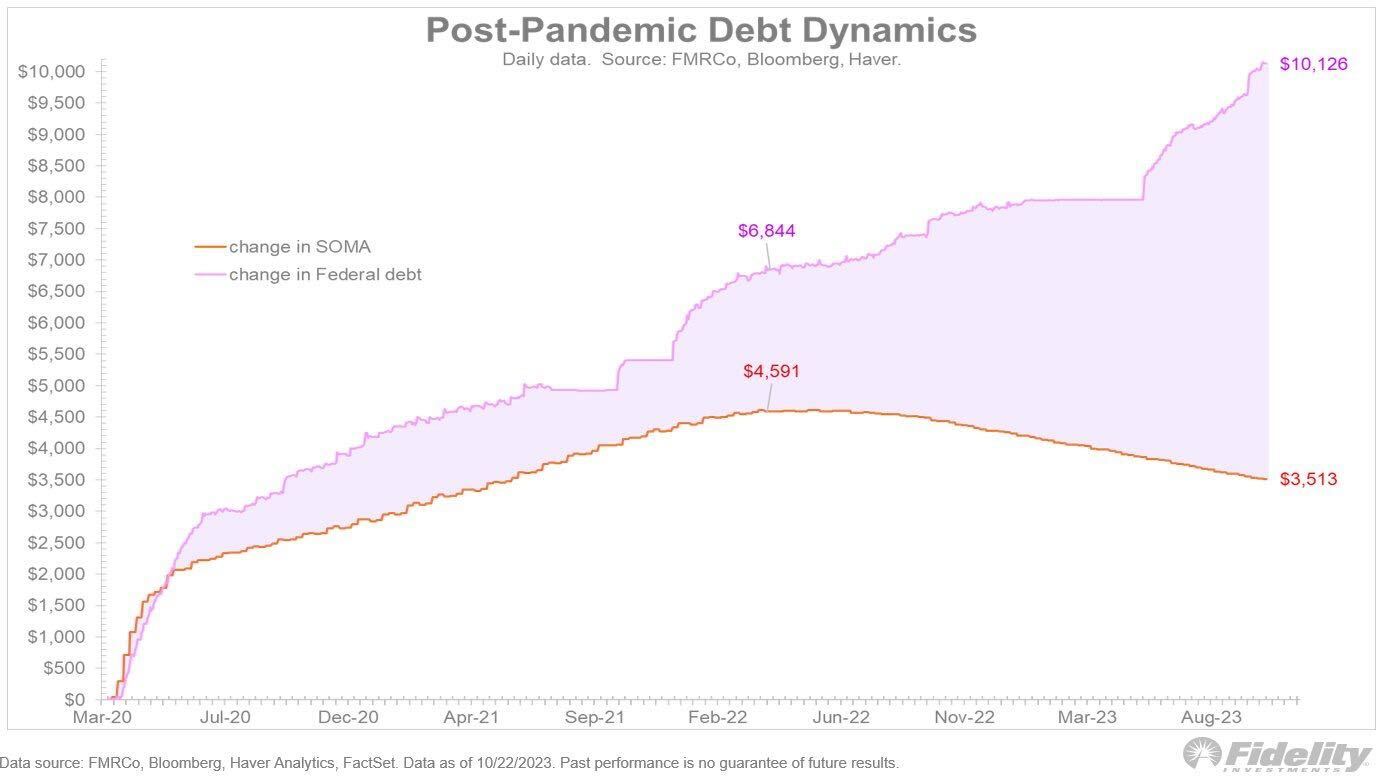

John Luke: and while SOMA is the new source to tap for liquidity

Source: Fidelity as of 10.22.2023

Source: Fidelity as of 10.22.2023

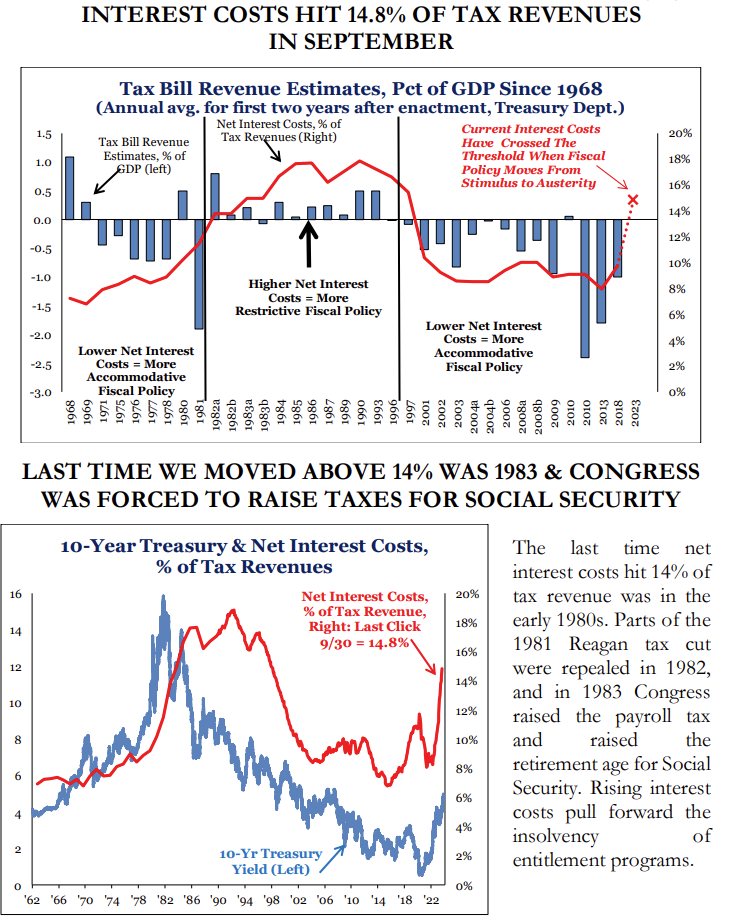

John Luke: the key point is that the “bond vigilantes” tend to force fiscal discipline when the cost of maintaining debt gets this high

Source: Strategas as of 10.23.2023

Source: Strategas as of 10.23.2023

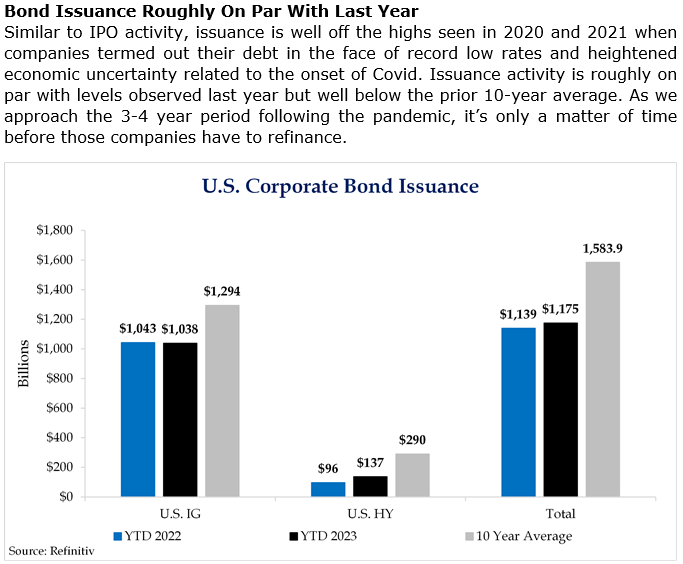

Brad: Despite much higher rates, there is plenty of refinancing taking place especially for smaller companies

Data as of October 2023

Data as of October 2023

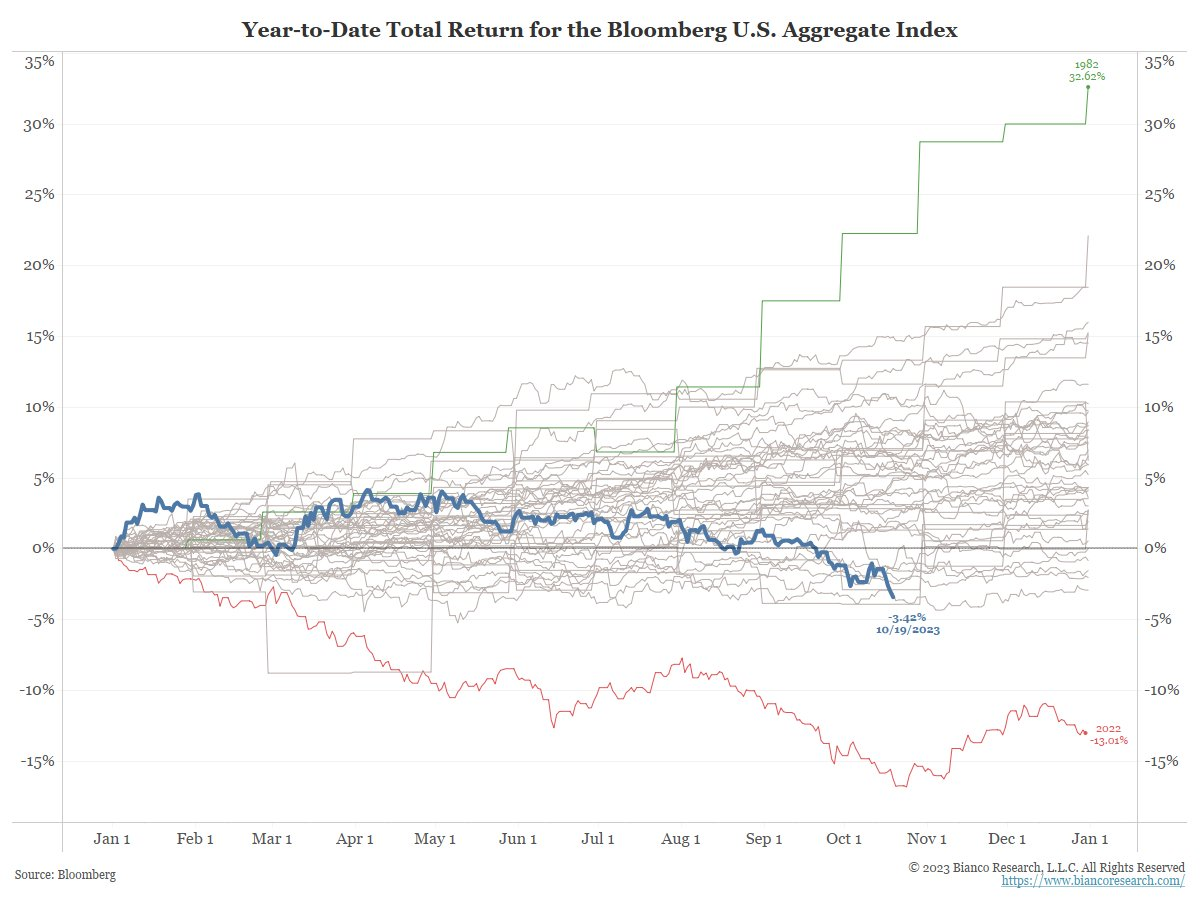

Dave: and despite another tough year for bonds, and complete lack of a bounce

Data as of October 2023

Data as of October 2023

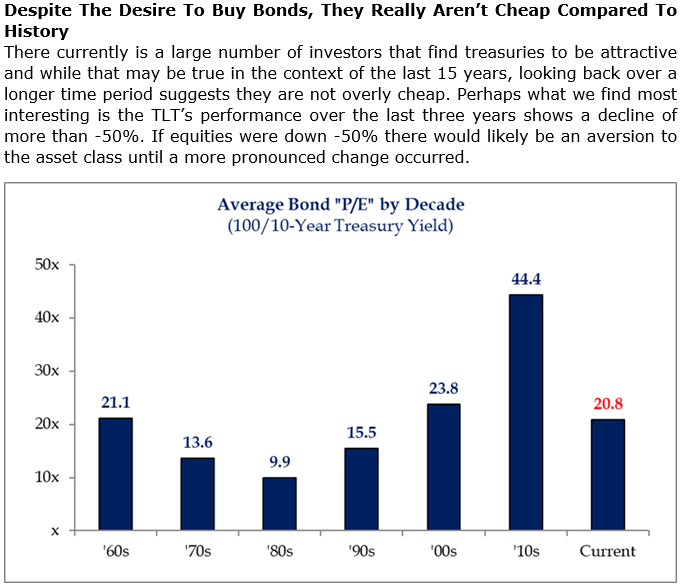

Brad: it would be hard to call bonds “cheap” relative to history

Source: Strategas as of 10.23.2023

Source: Strategas as of 10.23.2023

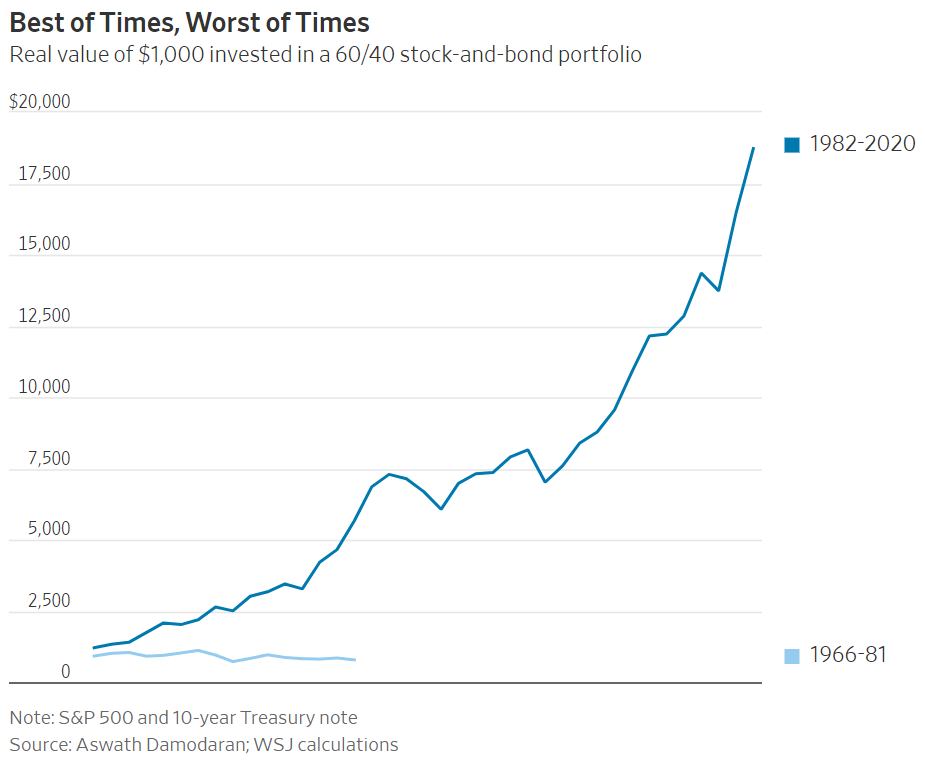

John Luke: The outcomes for 60/40 investors have been significantly different depending on the inflation regime

Data as of September 2023

Data as of September 2023

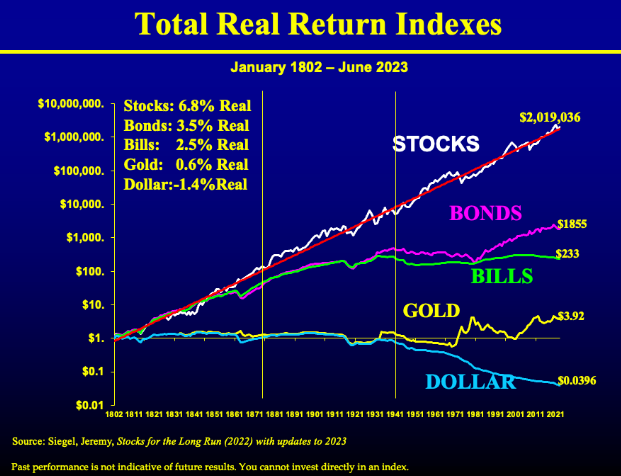

Brett: but it’s hard to find an argument against “Stocks for the Long Run”

Source: A Wealth of Common Sense

Source: A Wealth of Common Sense

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2310-23.