Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

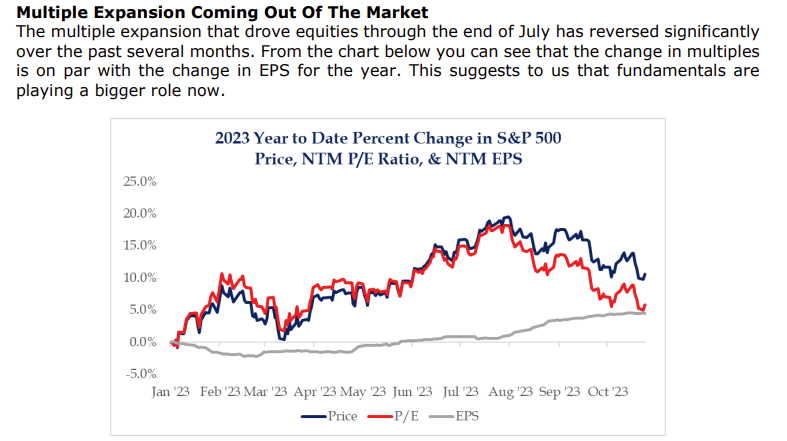

Dave: With earnings mostly flat, changing valuations and seasonality have driven a good bit of this year’s moves in stocks

Source: Strategas as of 10.27.2023

Source: Strategas as of 10.27.2023

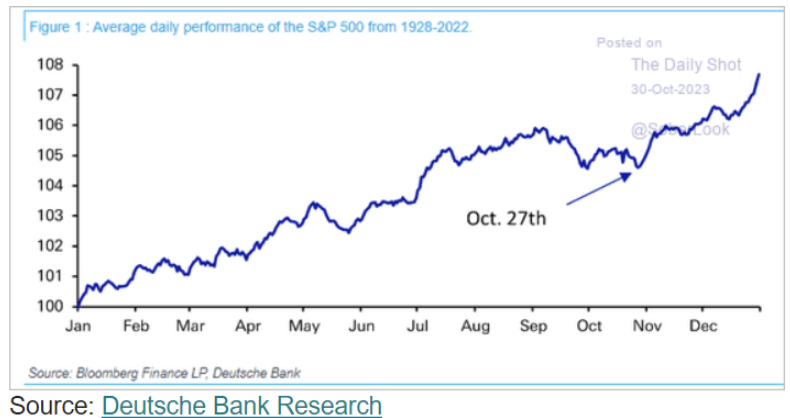

Mark: and the calendar is setting up as a supporting factor into year-end

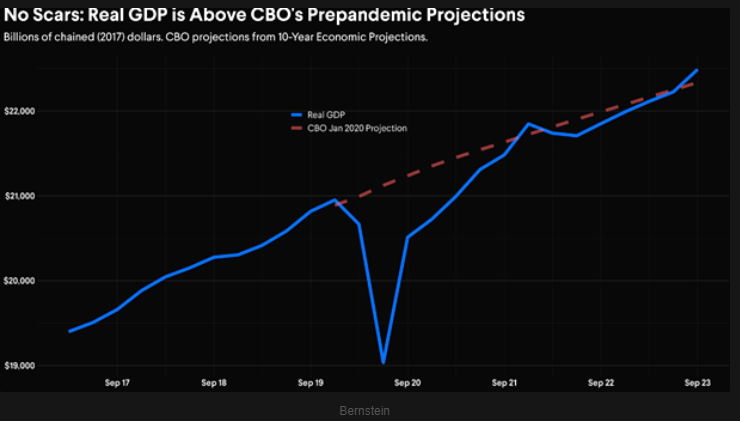

Joseph: While the US economy has now been fully restored to its pre-COVID trendline

Source: Bernstein as of 11.01.2023

Source: Bernstein as of 11.01.2023

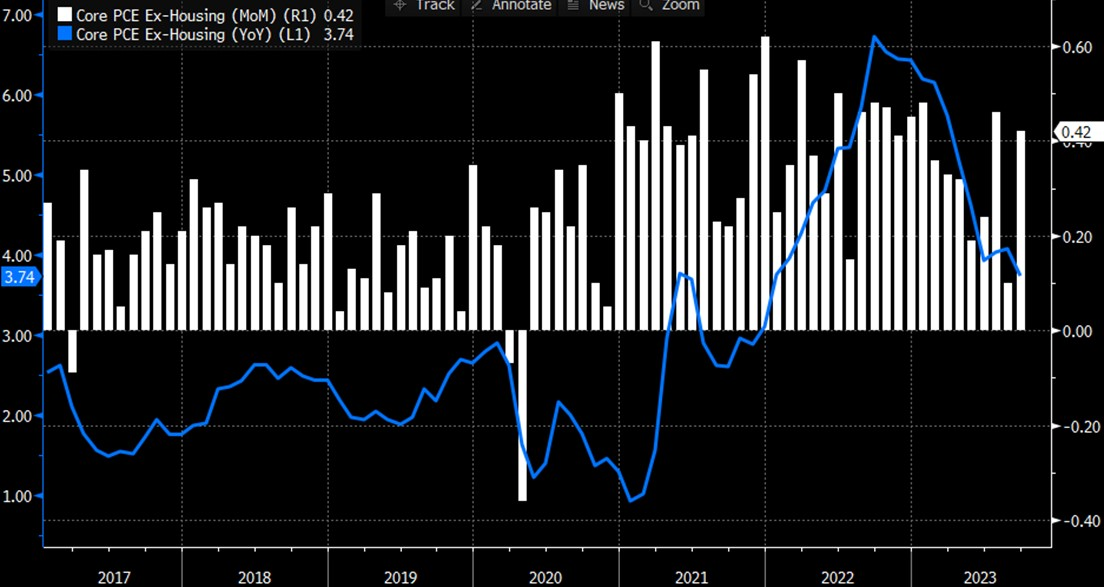

John Luke: the persistence of core inflation has moved the Fed into a restrictive rate policy to prevent inflation from running out of control

Source: Bloomberg as of 10.31.2023

Source: Bloomberg as of 10.31.2023

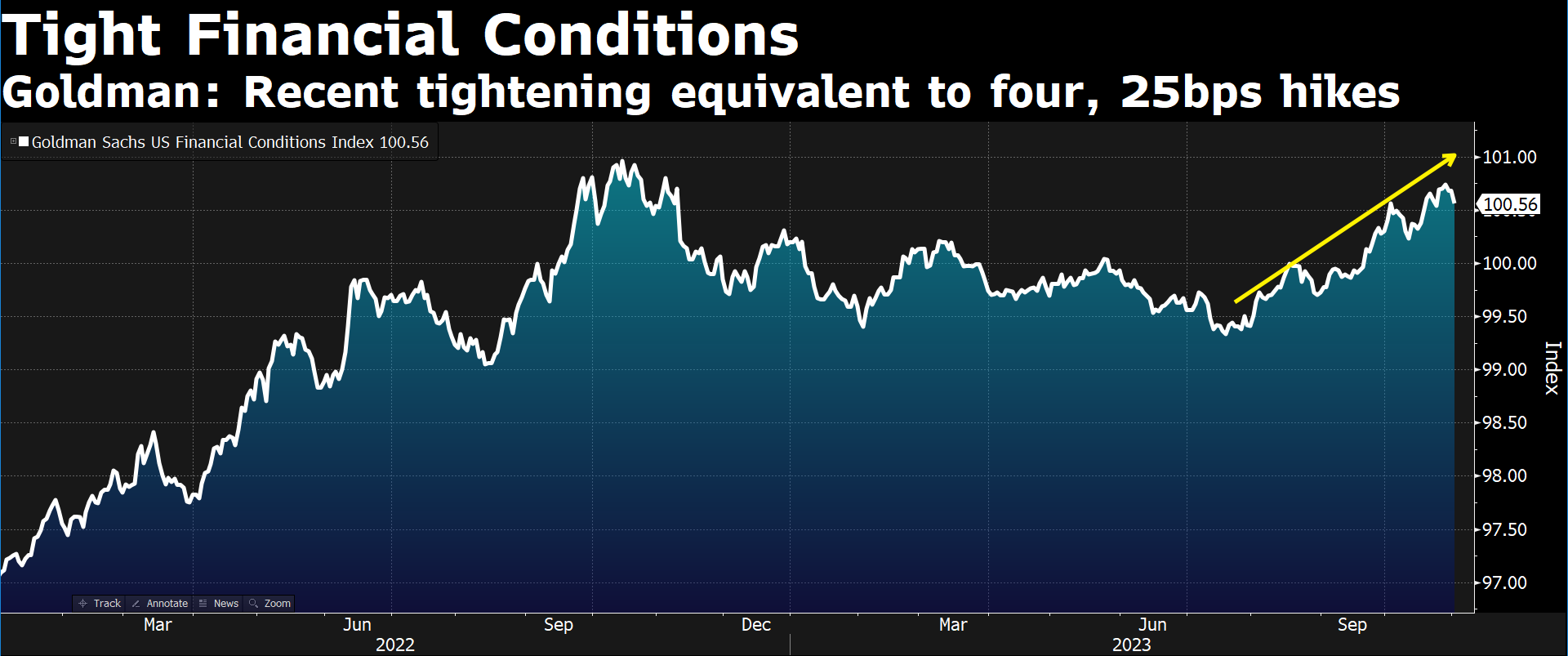

John Luke: Combined with the fall weakness in stocks, this has created tighter financial conditions beyond just Fed rate policy

Source: Bloomberg as of 11.01.2023

Source: Bloomberg as of 11.01.2023

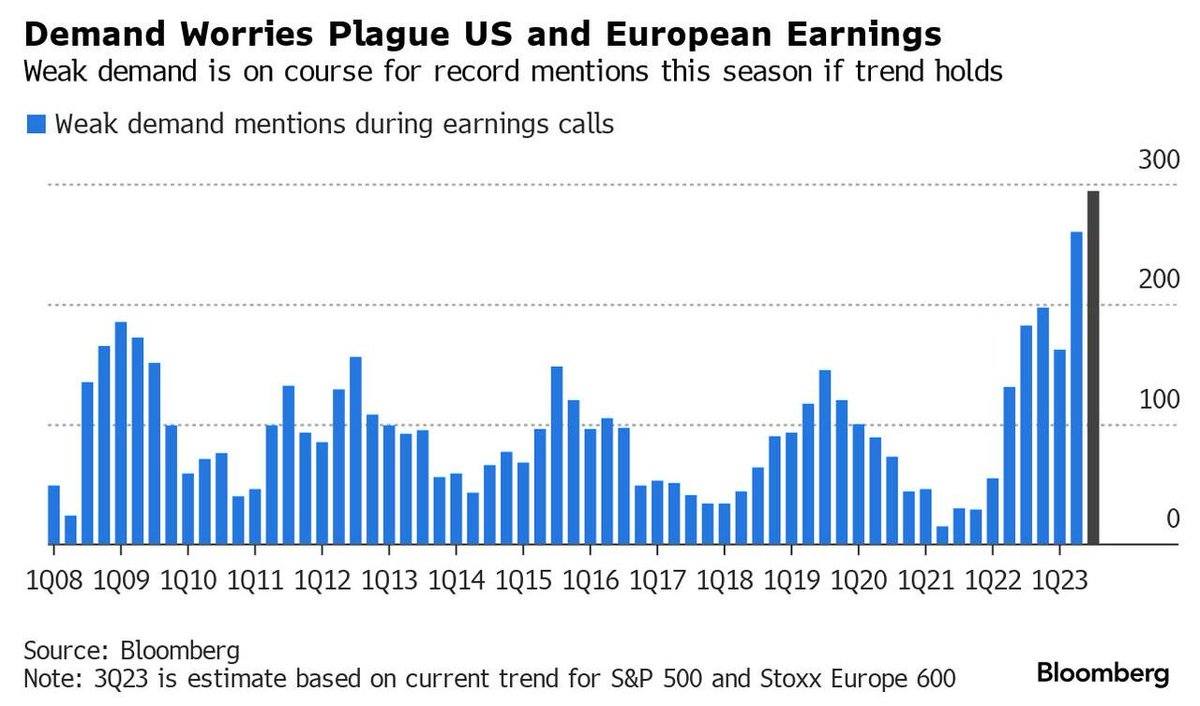

Brett: and led to some concern among corporations on their earnings calls

Data as of 11.01.2023

Data as of 11.01.2023

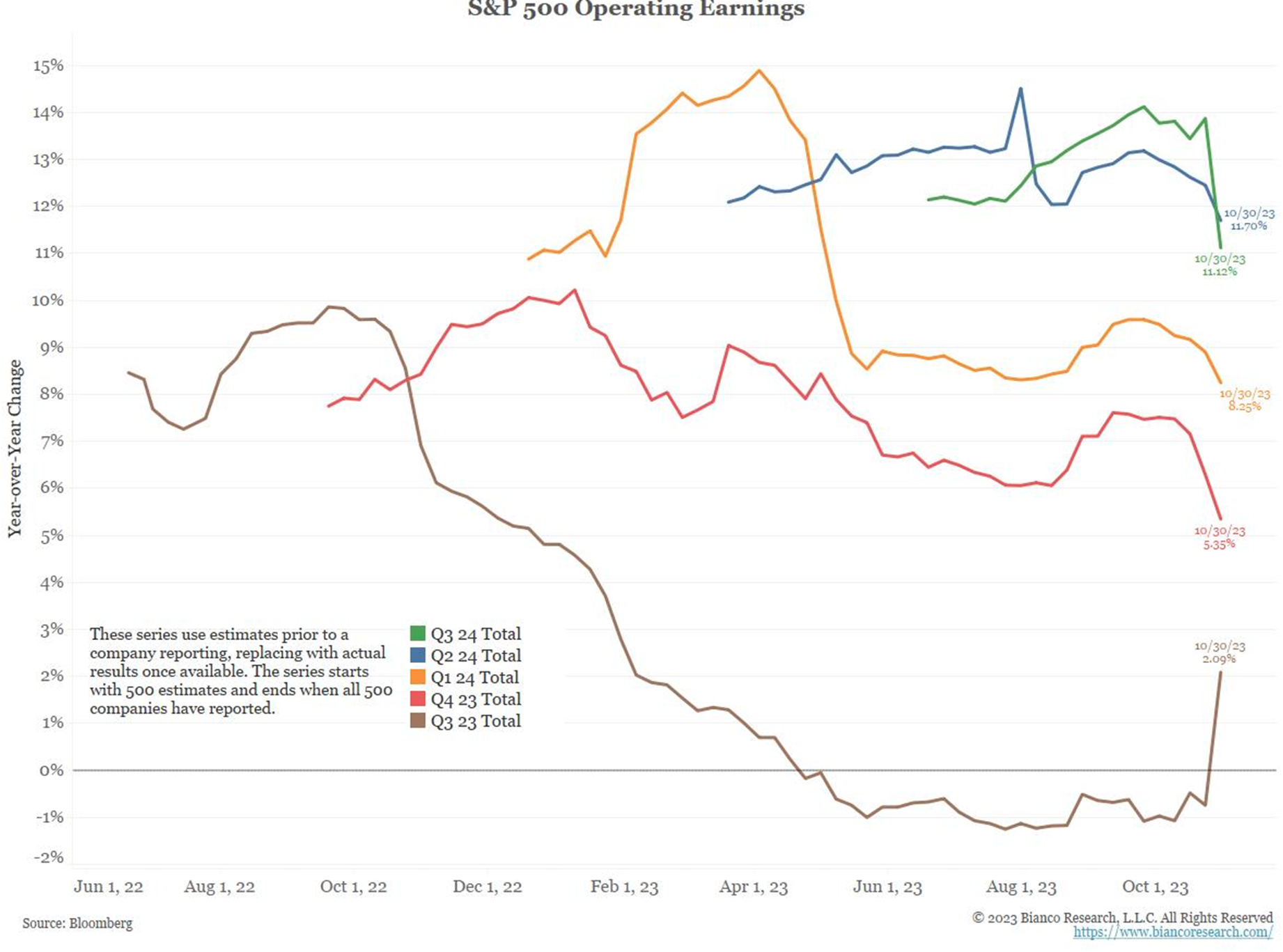

Dave: As far as earnings as a whole, we’re seeing low-to-mid single-digit growth rates

Data as of 10.31.2023

Data as of 10.31.2023

Joseph: though it’s generally leading to future cuts in earnings expectations, not improvements

Data as of 10.30.2023

Data as of 10.30.2023

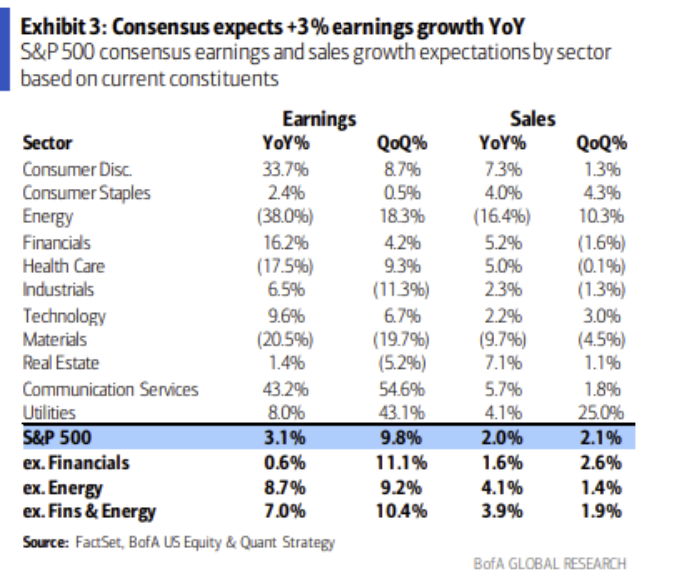

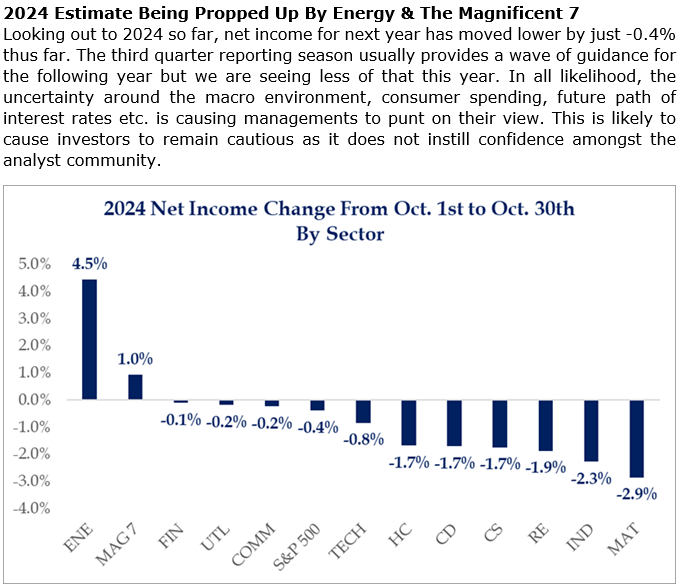

Brad: and future expectations are varying quite a bit based on sector

Source: Strategas as of 11.01.2023

Source: Strategas as of 11.01.2023

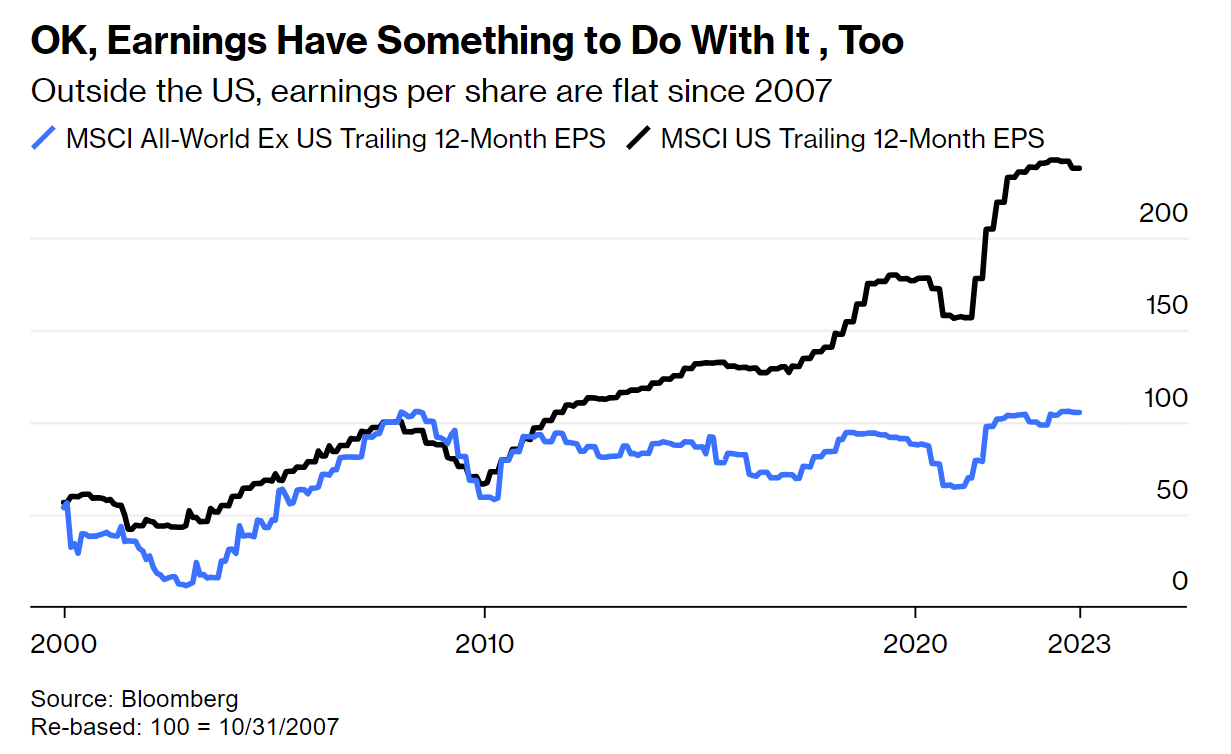

Beckham: Speaking of earnings, it’s pretty clear why US stocks have vastly outperformed foreign stocks since the GFC

Data as of 11.01.2023

Data as of 11.01.2023

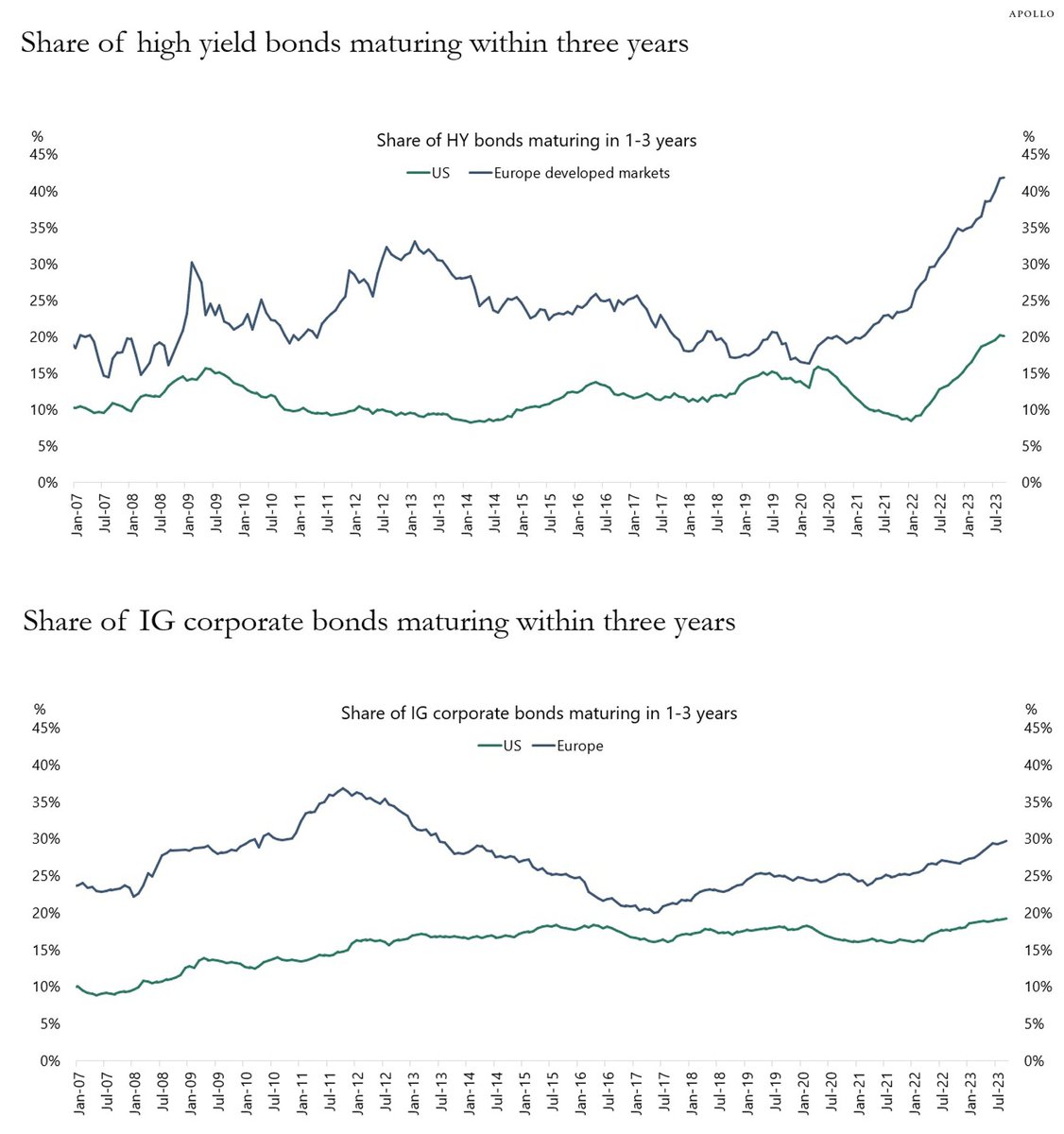

Brett: and with the contrasting mix of debt across economies, there’s reason to expect the business outperformance to continue

Source: Apollo as of 11.01.2023

Source: Apollo as of 11.01.2023

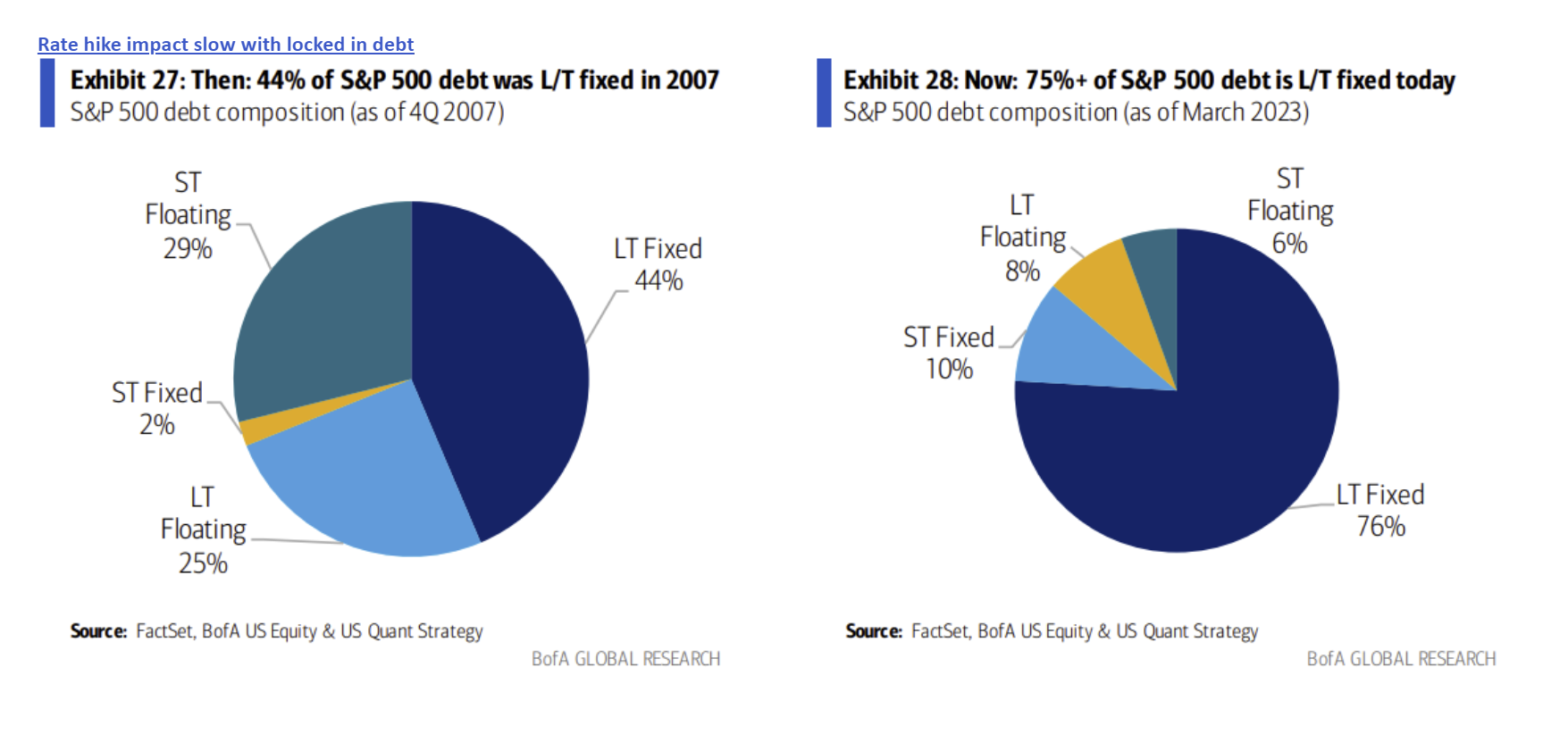

Dave: Going further into the contrast, US companies have vastly superior funding than they did going into the GFC

Source: BofA as of March 2023

Source: BofA as of March 2023

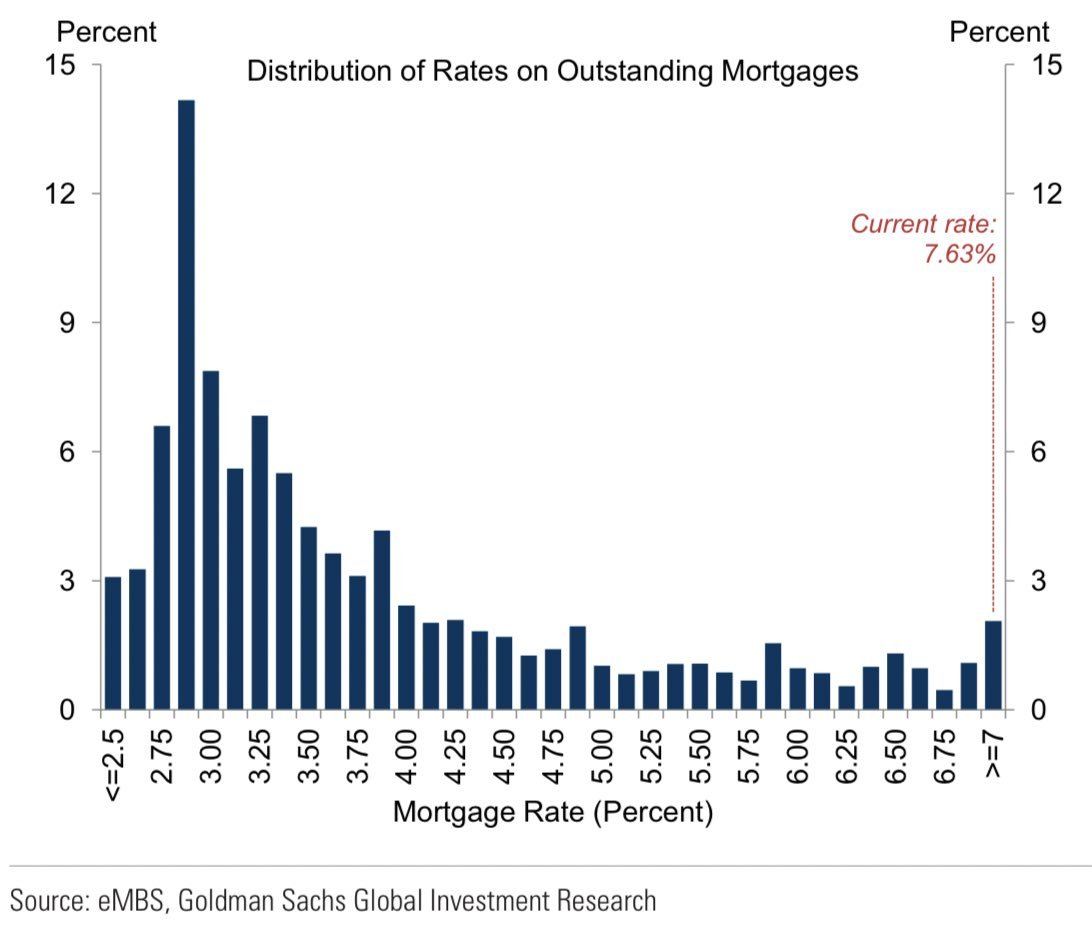

John Luke: as do individual homeowners

Data as of October 2023

Data as of October 2023

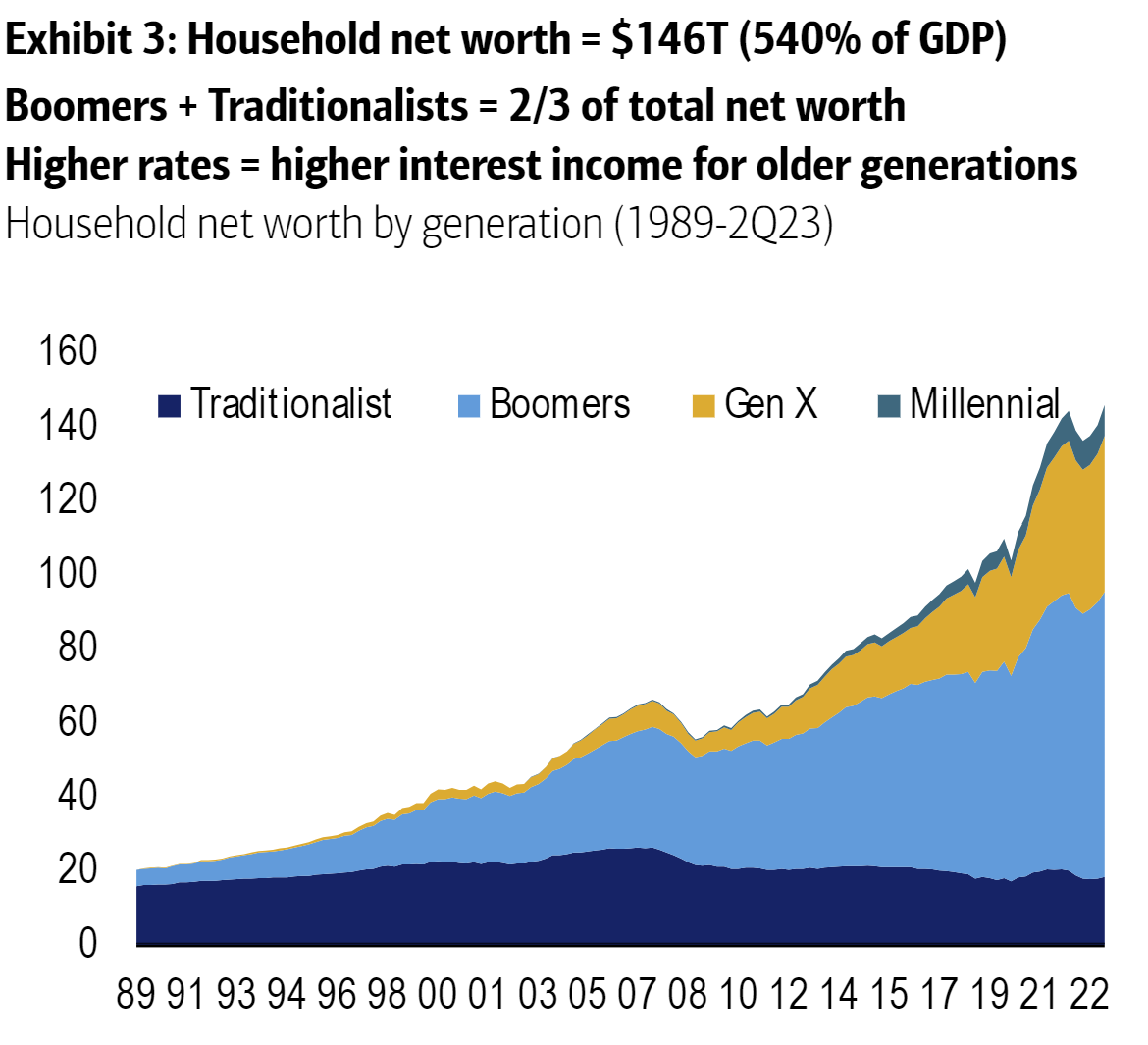

Dave: Perversely, higher rates have generally been good for older US consumers given their accumulation of savings

Source: BofA as of October 2023

Source: BofA as of October 2023

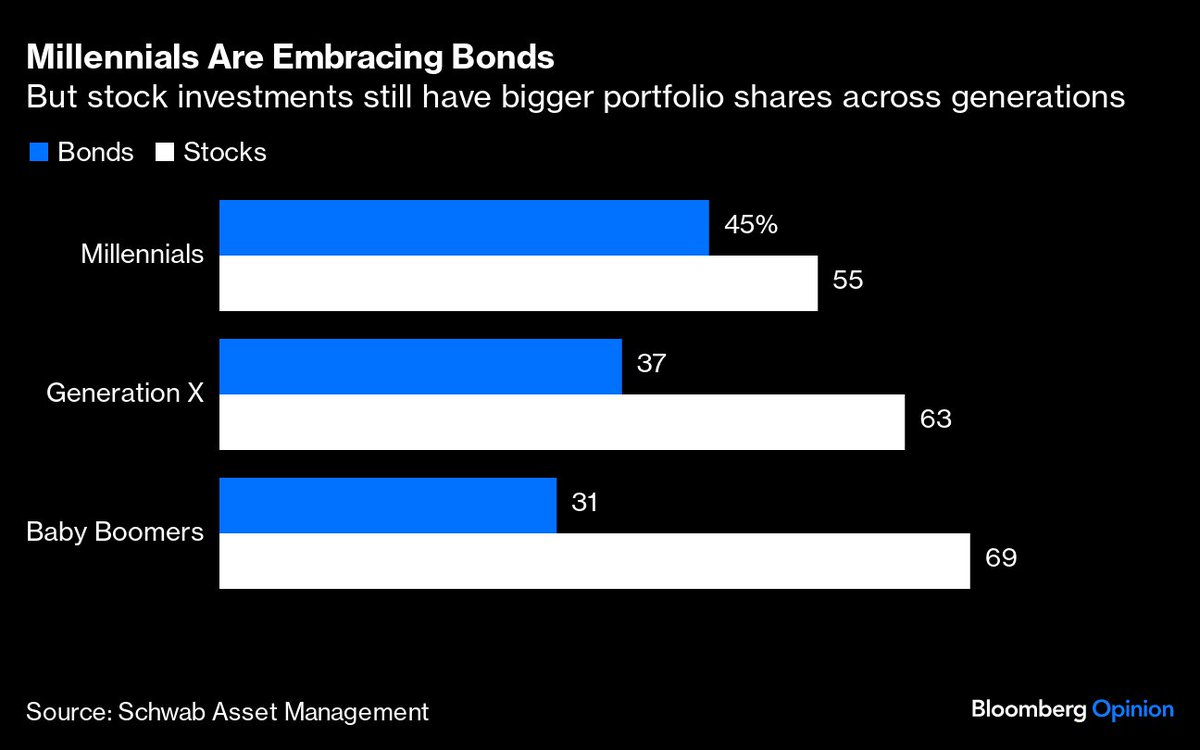

JD: and equally weird, young investors are allocating more to bonds than older investors… talk about longevity risk!

Data as of October 2023

Data as of October 2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2311-8.