It causes Aptus much chagrin that the widespread notoriety for bourbon only started in the early 1980s, almost two hundred years after Kentucky started distilling an unlikely combination of corn and limestone water. Nobody knows, definitively, the origin of bourbon, but enthusiasts do know that the refined process took centuries to perfect. Though Aptus’ process is not aged in charred oak barrels, the firm has decades of combined experience in the investment space. During this time, Aptus has refined their investment philosophy and created a desirable and timeless batch of quality and value.

Aptus’ philosophy is rooted in the belief that simple beats complex. It’s difficult to convince people to buy into simplicity; it’s hard to believe that complex problems don’t require complex solutions. In fact, we’ve often found in this business that the simplest or most effective data is sometimes neglected on the account that it’s not intellectual enough.

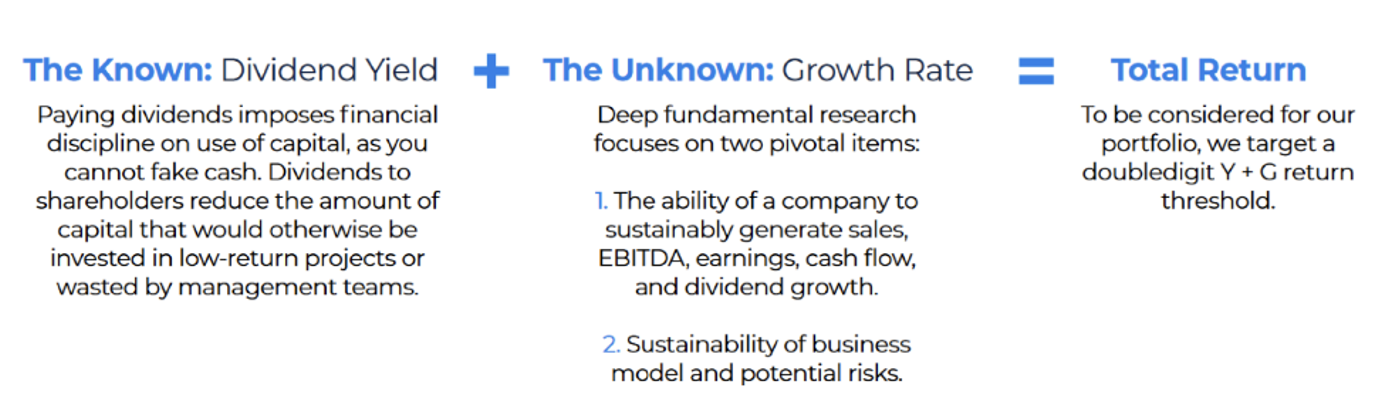

Through our Yield + Growth Framework and our bias to owning both qualitative and quantitative quality, we believe that we have found a simple solution that allows investors to own a concentrated basket of stocks that has the ability to outperform over a full business cycle.

Over Time, Yield Plus Growth Drives Total Return

With this in mind, the investment approach seeks to own companies with the following characteristics:

By looking at these four factors, we believe that we tilt the odds to compound our probability of success. In fact, when you combine all four of these factors, they outperform each factor on a stand-alone basis. The result of the process is a portfolio of 15 high-quality securities with reasonable valuations, attractive growth prospects, and a durable competitive advantage.

This process helps us uncover our favorite type of stock, Compounders.

What is a Compounder Stock?

First, we do not believe that all stocks are created equally. We also believe that Morningstar’s antiquated style box has been a huge influence in driving investors to see stocks as either value or growth. We think this classification falls woefully short, is highly sector-driven, and fails to separate our favorite stocks of all, Compounders.

In a nutshell, we attempt to take the perspective of an owner, by tuning out short-term market noise and investing in businesses that we believe have the best opportunity to compound shareholder capital over many years and through many different market environments. While there isn’t just one way to skin a cat, we believe consistency leads to positive outcomes and this holds true for investing in businesses over a long time horizon.

We have a high hurdle for new ideas, but not too high that we cannot source new ideas. We seek to invest in businesses that we believe have an edge. Whether it be a competitive moat, long runway for organic growth, outstanding “Outsider” management, capital-light model, pricing inelasticity, consistent recurring revenue, or first-mover advantage. More importantly, we look for businesses that we believe have a distinct advantage over their competitors.

Many people try to make this investing game much more difficult than it should be – there’s no reason to always swing for the fences when singles and doubles will suffice. You buy good businesses for less than fair value. Sure, we can all argue about fair value, as there are always surprises in the future trajectory of a business. This game has some wrinkles and drama, but at its core, it’s simple when done correctly.

Conclusion

Each investment strategy is and likely should be different from the next person – it’s good to be different. We believe that too many investors focus on cloning others, such as Warren Buffett when it’s a mistake. It’s not who they really are. In the world of bourbon, not everyone is going to be Pappy Van Winkle. There are other bourbons, each with their own twist, that merit excellence. Instead of replicating Pappy, we want to take the valuable lessons and nuggets we obtained from studying the greats and apply them to our own processes, experiences, and personality.

We once read that optimism is a way of explaining failure, not prophesying success. Said another way: saying you are optimistic does not mean you think everything will be flawless and great. It means you know there are going to be failures, problems, and setbacks, but those are what motivate people to find a new solution or remove an error – and that is what you should be optimistic about.

And, over the years, we continue to be optimistic, while being pragmatic about improving our process. We won’t always be correct on every single stock that we own in the Aptus Compounders portfolio – that’s why it’s a portfolio of stocks. But we can promise you that we will continue to learn and adjust the portfolio as we see fit because all you need to do is compound your probability of success.

Access our Equity Case Studies here.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2304-14.