The first quarter of 2023 started out with a bang. Q1 experienced what felt like three distinct market cycles condensed into three months. January experienced a perceived “Soft Landing” where inflation was seen as falling quickly while the economic data was on the softer side. The market interpreted this as ammunition for a lower terminal rate and quick Fed Pivot, stocks and bonds rallied.

February turned into the “No Landing” scenario where inflation and employment data firmed. The market began pricing a higher terminal rate and a higher for longer fed given a resilient “Goldilocks” economy.

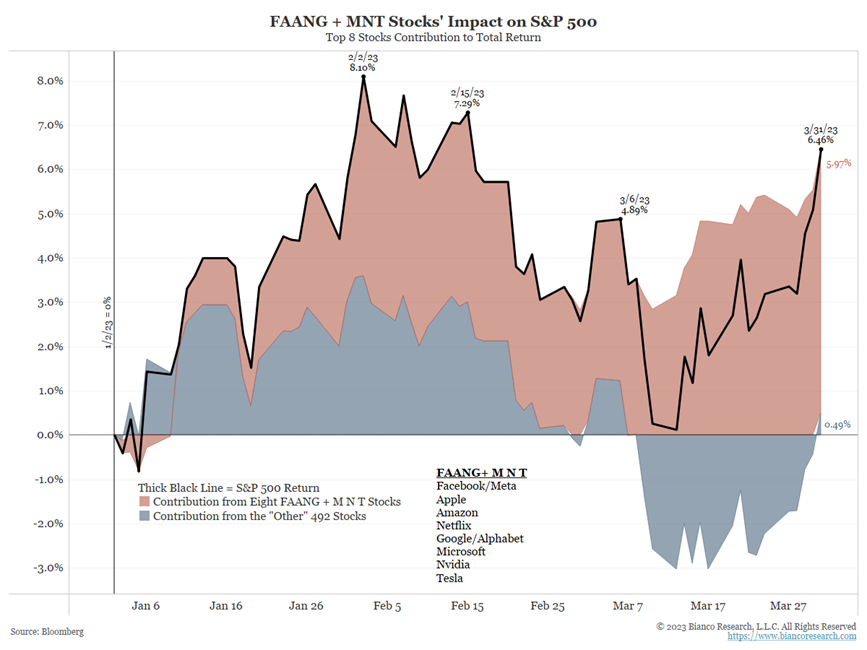

Finally, with March came a higher likelihood of a “Hard Landing” scenario following the collapse of several banking institutions and the freezing of some credit markets. This led the market to anticipate quick Fed cuts. The perception of Fed balance sheet expansion and rate cuts led to a return to the preference of growth assets. The Nasdaq Index (NDX Index), led by mega- tech was up 20.77% for the quarter with an impressive 11.39% rally in the last 2 weeks of March.

Source: Bianco. As of 3/31/23.

Source: Bianco. As of 3/31/23.

Model Rebalance

We have a small rebalance across the board (all models) which we think will serve portfolios well given the market outlook and present (and ongoing) volatility. In line with our theme for 2023 “Year of the Yield”, we’re slightly increasing our JUCY allocation. The increase is funded by trimming 1-2% each of our holdings of DRSK, ADME and SPLG.

Bump up JUCY

Back in November we launched JUCY. It’s our take on a combo of treasuries and an option overlay to provide real positive yield without the credit or duration risk typical to most high yielding vehicles. We are beyond excited by the prospects of this fund and how it impacts the hurdle rate set for other investments within our portfolios.

Valuations, Tradeoffs, and Our Portfolios

The market seems to be priced for a soft landing and no recession.

We’ve recently asked audiences for their estimate for 2023 earnings per share, and a multiple on those earnings. (Saying a company earns $2 to the bottom line and trades at a 10x multiple means it has a stock price of $20 (2 x 10). You can do the same thing with the overall S&P 500.)

The answers have been ~ $215 for earnings and ~ 18x on the multiple. That simple math of multiplying earnings by the multiple paid on those earnings (18 x 215) would put the S&P 500 Index at 3,870 – roughly 6% BELOW today’s price of 4,115 as I type.

The simple example above assumed earnings remain close to current estimates and multiples remain elevated relative to history. Both ‘cup half-full’ estimates.

JD mentioned in his most recent note JD March 2023 Note, when you look at the simple math of the earnings and multiples on S&P 500, it’s hard to get excited about the near term prospects for returns.

Returns are generated from Yield, Growth and Valuation expansion/contraction. We now have an investment option that pays a double-digit yield with 1-3YR Treasury type volatility (SHY ETF). To us it makes sense to hunker down and collect the yield versus the alternative of banking on earnings resiliency and a continuation of heightened multiples.

We are bumping up our yield across the portfolios. The increase is funded by trimming a 1-2% of other fixed income exposure and 2-4% in equities depending on the composite.

Tax Loss Harvest IDME

We will also be taking the opportunity to selectively tax loss harvest (“TLH”) IDME in non-qualified accounts as we make the conversion to IDUB. We will be using the iShares Core MSCI Total International Stock ETC (IXUS) as a proxy. For those accounts with gains, as we recently did an exercise to opportunistically TLH in November, it is important to know that there is no action required. The strategy will seamlessly transition from IDME to IDUB. For more information on the strategy change, please click here.

To Conclude

We are excited for the opportunity to tactically bump up the JUCY allocation across our portfolios. We believe JUCY enhances the yield profile and dampens the volatility of our overall allocation. The addition takes advantage of higher market yields and higher market volatility (which equates to more income from the options overlay) to provide more income return across the allocations.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

When a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2304-17.