U.S. large caps, as measured by the S&P 500, continued their dominance in the first half of 2024, led by the largest mega-cap stocks, coined The Magnificent Seven (“Mag 7”). This year’s first half ranks as the 12th-best start for the S&P 500 since 1950 – the S&P 500 is +15.3% year-to-date. Over the last six quarters, the index is up more than 40%, seemingly tracking ground every day, with over 30 new all-time highs reached already this year. Not only that, but volatility has remained quite muted, as the S&P 500 has gone nearly a full year without a daily decline of more than 2%. Despite this, more than half of the constituents in the Index trade below their 2021 highs.

Index gains continue to be powered by a group of Technology (or Tech-proxy) stocks– Apple, Microsoft, NVIDIA, Amazon, Google, Meta, and Tesla. Last year, these seven stocks gained 76% on average, accounting for more than 60% of the Index’s 26% gain; the other 493 stocks in the Index gained 8% on average. While this year’s individual returns amongst the seven have been more dispersed, they have gained 33% on average, more than doubling the broad Index return. NVIDIA Corp. (NVDA) is the main outlier, up +149.5%. The remaining 493 stocks in the Index are collectively up 5%. Added together, the Mag 7 have returned nearly 110%, on average, over the last six quarters, while the other 493 stocks in the Index are up 13%.

Given this well-known concentration of returns in the Index, we remain firm believers that trading is like a pie crust; the more you mess with it, the worse off it is. And more often than not, an investor’s best trade is no trade. This is exactly what the strategy has decided to do in 2024, as our most recent trades occurred last September and October.

One of the hardest parts of stock picking is being able to navigate through the noise – deciphering what information is material, and what is not. It’s been even more difficult over the past year and a half due to the current environment. What hasn’t been difficult is trusting the management teams running all the companies in the fund. Given current market conditions, we continue to believe the stock portfolio is the perfect concoction of valuation, growth, and quality.

I once read that optimism is a way of explaining failure, not prophesying success. Said another way: saying you are optimistic does not mean you think everything will be flawless and great. It means you know there are going to be failures and problems and setbacks, but those are what motivate people to find a new solution or remove an error – and that is what you should be optimistic about.

We won’t always be correct with every single name we own in the Aptus Compounders portfolio – that’s why it’s a portfolio of stocks. But we can promise you that we will continue to learn, being pragmatic about positioning in the current environment because all an investor needs to do is compound your probability of success.

Portfolio Update:

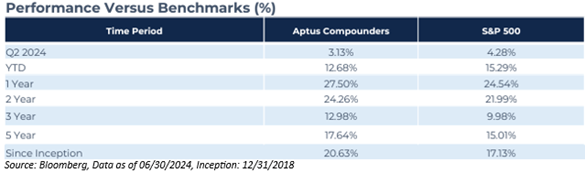

Aptus Compounders slightly trailed its S&P 500 benchmark during Q2, by 1.3%. After outperforming by +10.6% in 2023, the strategy has given up a bit of that outperformance with its second straight quarter of relative underperformance. A lot of the drivers of relative performance last year took a breath in the first half of 2024. The relative underperformance versus the S&P 500 (-2.61% year-to-date) has simply come from not owning NVIDIA (NVDA), which contributed 4.57% to the index’s absolute performance. Despite this, the strategy has still outperformed the index over the last twelve months, by 3.0%. The strategy continues to have exposure to the artificial intelligence (“AI”) renaissance through the ownership of Adobe Inc. (ADBE), Alphabet Inc. (GOOGL), Broadcom Inc. (AVGO), and Microsoft Corp. (MSFT).

During the quarter, AI stocks were the weapon of choice. This after the market witnessed a short-lived expansion in market breadth during Q1 ’24. Managers who did not own Apple Inc. (AAPL) or NVIDIA Corp. (NVDA) during the quarter faced a relative disadvantage of 1.88% (44% contribution to S&P 500’s Q2 ’24 return) and 1.32% (31% of S&P 500 return), respectively. In total, AAPL and NVDA contributed 75% of the S&P 500’s quarterly return. Despite not owning either stock, Aptus Compounders surprisingly saw stock selection add value (+0.49%), although sector allocation detracted (-1.61%).

The Compounders’ performance was led by Broadcom Inc. (+21.53%) and Alphabet, Inc. (+20.82%), as both benefited from stronger-than-expected earnings reports, bolstered by continued innovation and guidance surrounding artificial intelligence AI. Specifically, the former (Broadcom Inc.) expertly navigated a sizeable cyclical correction in much of its business, and should benefit from continued AI ramps and a cyclical recovery elsewhere. Not only that, Broadcom’s wash-and-repeat M&A playbook continues to work, as the VMWare integration is ahead of schedule.

Chemed Corp. (-15.42%), the parent company of Roto-Rooter and Vitas, was the largest loser, as their earnings report showed weakness in the Roto-Rooter business, specifically regarding consumer spend. We were encouraged to see continued strong momentum at VITAS, which saw another quarter of double-digit census growth. Importantly, the average daily census grew well above admissions on solid growth in length of stay, which drove VITAS margins above management’s internal expectations. As less sophisticated operators struggle with labor access, management expects VITAS to continue to see solid topline momentum into the future.

A since-inception holding, Copart Inc. (-6.49%), also underperformed due to lower average selling price (“ASP”), though volumes helped insulate the damage. We remain firm believers in management’s long-term vision and appreciate the: 1) the wide moat in salvage, 2) secular tailwinds driving total loss rate, 3) growth in non-insurance vehicles, 4) total addressable market opportunity with Purple Wave, and 5) fortress balance sheet of $3.0 billion in net cash.

As mentioned, we made no trades during the quarter. We continue to like the balance of the overall portfolio, which benefits from its diverse exposures. While turnover was slightly above average last year, we like the current positioning and it has held up well this year despite not owning some of the largest contributors to the index. We’ve learned with time that sometimes the best trade is no trade, recognizing that patience can be more challenging yet more rewarding than reacting poorly to short-term underperformance. All in all, we remain confident in how we are positioned in the Aptus Compounders portfolio.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2407-28.