Our PM team thought an update on the Aptus Compounder Stock Sleeve (15-stocks) made sense, as it has had lower-than-expected turnover thus far in 2021 (only 2 names). But that doesn’t mean we are not spending time on the strategy – in fact, it’s quite the opposite. We review and collaborate about it every single day.

One of the hardest parts of stock picking is being able to navigate through the noise – deciphering what information is material, and what is not. It’s been even more difficult over the past year due to the current environment. What hasn’t been difficult is trusting the management teams running all of the companies in this portfolio. We continue to believe the stock portfolio is the perfect concoction of valuation, growth, and quality.

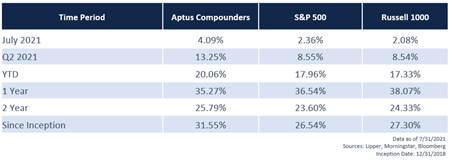

We’re not going to elaborate on performance, but we are very happy with how the portfolio has navigated a slew of different environments over the last year.

Given everything that has gone on over the last year, we have been very fortunate that we have been able to get back on the road to visit a few of our partners, and during this time, we’ve learned a lot more about each and every one of you. For instance, we’ve learned that we work with a lot of bourbon enthusiasts. Almost everyone is very competitive. And most of all, all of you are very analytical.

So, instead of focusing on our usual basketball halftime analogy – let’s visit a new one that incorporates: bourbon, competition, and analytics.

This month, horse racing has its “Mid-Summer Derby” – The Travers Stakes at Saratoga Race Course. A race that continues to have some of the biggest upsets in all of horse racing – Man o’ War in 1919, Secretariat in 1973, Rachel Alexandra in 2010, and most recently, American Pharoah in 2015.

We believe that there are many parallels between horse racing and stock picking. Patrons go to the track to make bets on horses and the odds change based on those bets – much like the stock market. If someone believes that a particular horse is likely to do better than the odds suggest, one will bet on the horse. But if all bettors predict a horse to win, the odds will reflect that decision, and the return on investment will be poor. This analogy holds true for the stock market.

It is our job to uncover stocks that are trading at odds that we believe are too high, given the underlying fundamentals. It’s our job to find stocks that consistently outperform expectations, that have a long runway for growth, even if they are racing at the highest level, i.e., the Travers Stakes. It’s our job to recognize a jockey, i.e., management team, that knows how to handle that horse – excel at its strengths, while navigating its weaknesses.

Holistically, we believe there are a lot of idiosyncratic factors that need to be considered when making an investment in a concentrated portfolio. Furthermore, especially in the current environment, there is a lot of macro uncertainty – taxes, tapering, inflation, etc. But, with so many unknown macro situations moving forward, it may be hard to admit, to yourself or others, that you don’t know what the macro future holds, but in areas entailing great uncertainty, we believe that agnosticism is probably wiser than self-delusion.

That is why we own some very distinguished companies. Because we can’t consistently and accurately predict an outcome with certainty. Even if you know a potential outcome with certainty, you have to know how the market will react to that news. This is a loser’s game.

This may sound wrong, but I would be disappointed with our efforts if every one of our stocks were outperforming the market. Because that means we have exposed our partners, unknowingly, to a substantial amount of risk – we just got that risk right. It is our job to discover 15 stocks that exhibit characteristics that fit our philosophy. But, more importantly, construct a portfolio that can minimize risk during a wide range of different environments. We need everything to come together in sync. When a few stocks shake, we will have a few stocks that bake, and vice-versa.

We strive to own stocks that outperform over longer periods of time, but with that, naturally comes periods where stocks can underperform. But with that, comes opportunity. And that’s how we view it.

With investing, it’s very easy to be right with the consensus view, but very hard to be more right. Following consensus provides no advantage – only from being more right than the others is where one succeeds. With that, it helps having an advantage.

What is our advantage? Our biggest advantages is time. One of our most difficult tasks, when qualitatively selecting a company to invest in, is the long-term execution of a management team. That’s why we have created the Aptus Sleeves – Core, Value, and Growth to help monitor the actions and effectiveness of management teams over the course of time. We want to invest in management teams that continually execute, have shared interests with investors and efficiently invest in the future.

To exploit this advantage, we need time. This sentence may make one believe that we have been underperforming – but that is far from the truth. We have navigated the current environment quite well. In fact, we remain highly convicted on every position in the Aptus Compounder Sleeve. To prove it, we’ll touch base on a few…

CHEMED Corporation (CHE):

Put simply, CHE has two business – Plumbing (Roto-Rooter) and Hospice (Vitas). From an execution perspective, the former has been the valedictorian and the latter being a part of the Breakfast Club. Unfortunately, given its Health Care sector-designation, investors have focused on the hospice side of the business, even though Roto-Rooter has far-exceeded the market’s expectations.

Roto-Rooter (~45% of EBITDA) has continued it momentum through the pandemic, and we believe that its market share gains are sustainable, similar to what happened during prior crises. Furthermore, Vitas, which has been hurt due to hospitals and nursing homes being closed to outside visitors (minimal profitable referrals), recently posted very strong commentary regarding the future environment in this space. Admissions from hospitals have returned to pre-pandemic levels, but nursing home admits have yet to rebound. But the company flagged a positive indicator that they have seen over the last few weeks – admits are above discharges with every month during the quarter improving. Management stated that they are confident that Vitas has already hit bottom and expects a recovery to continue.

CHE is the smallest company, as measured by market cap, in our portfolio. Smaller capitalization stocks trade very differently relative to their larger cap brethren, as these stocks have not entered the discovery phase. For instance, CHE only has two (2) sell-side analysts covering the stock, compared to a mid-cap name, like Roper (ROP), which has over ten – or a large cap stock, like Apple, which has over forty (40).

Given this, investors need to remain patient, understanding the rational and structural reasons for owning this very differentiated company. The fundamentals remain in place and we are more than comfortable investing new capital into this name.

Fidelity National Information Services, Inc. (FIS):

FIS provides software, services and outsourcing of technology to a wide range of financial institutions. All the data processing companies (FIS, FISV, and GPN) have fallen victim to underperformance as of late. Essentially, the market has been spooked that the merchant processing industry has become a “legacy” asset, off of lower-than-expected growth, creating the lowest relative valuations for many of these names in nearly a decade.

Now, let’s put that into perspective. Basically, all of these players have made business-altering acquisitions over the last 3 years, which should continue to propel their innovation in the merchant services business for years to come. For FIS, it was the WorldPay acquisition in 2019, which has been successfully integrated into the company – much better than analysts originally prognosticated.

Furthermore, over the more near-term, we believe the market had an overreaction to the company’s second consecutive beat and raise on their most recent earnings report. Given this draconian market reaction, most investors wouldn’t believe that the company, in fact, raised its top-line outlook to a level that was much higher than what Wall Street analysts were expecting. That said, a smaller than expected EPS raise, implying lower margins, is what seemed to take all of the attention.

Yet, in our view, the updated revenue guide, coupled with the extended mid-term revenue outlook of 7% – 9% through 2024, highlighted by high-single-digit banking growth, clearly shows that the WorldPay acquisition is bearing fruit. Simply put, the fundamentals are solid and nothing in the print or guide raises questions around the long-term mid-teen EPS growth expectations. As such, we believe the lower valuation is not warranted, given the market’s expectation for “legacy” assets to grow less than originally expected – which is simply not true given the substantial runway for continued growth well into 2024. Management’s commentary solidified this.

And Down the Stretch They Come:

Like investors, horse owners typically don’t own a single horse, they diversify their ownership – this is called a syndicate. This helps dampen the already volatile nature of returns in this industry – when some horses are racing, the others may be resting at a farm, or training. Typically, not all horses are racing or performing well at the same time.

Like this portfolio, that’s a feature – not a bug. If you want to try to outperform in all environments, you must own stocks that perform well in different environments. That’s why some shake, and some bake at different times.

We are very happy with how the portfolio is positioned moving forward. Ultimately, the market will reward companies that have long avenues for growth and that are trading at what we believe to be discounted valuations.

As always, thanks for trusting us with your capital.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed. This is not a recommendation to buy, sell, or hold any particular security. The holdings shown above are target portfolio weights and do not reflect the entire portfolio. The holdings are sorted by target portfolio percentage weight then alphabetized within each asset range. Actual portfolio investments will vary when invested. A complete list of holdings is available upon request.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Russell 1000® Index measures the performance of 1,000 large U.S. companies. The Index is market capitalization-weighted, represents a basket of larger capitalization stocks.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2108-10.