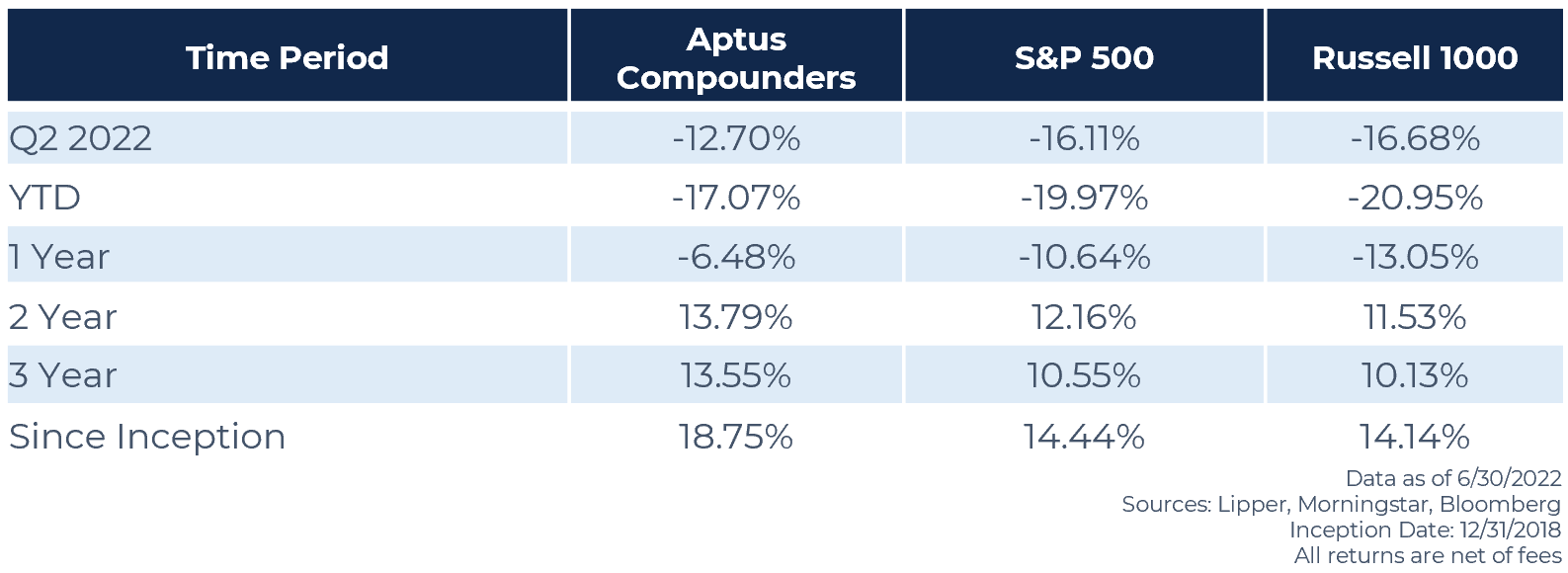

It’s no secret that the S&P 500 is off to one of its worst starts ever. With price data only going back to 1927, the first six months have produced the fourth worst start to any year on record, only beating 1932, 1962, and 1970. During this stretch, the more cyclical sectors, such as Energy, outperformed, and consequently, provided downside protection.

This has been somewhat anomalous to historical periods that were characterized by volatility, which have typically been led by the most stable, highly recurring revenue companies – think Technology. While we strive for the highest degree of certainty, we fully recognize that investing is a probabilistic enterprise.

We understand that diverse styles of investing can act as “defensive” in different environments. Understandably, across an entire portfolio, say of 15 highly concentrated stocks, that there will be some winners and a few losers. That is why conflating risk with uncertainty is critical. That’s why we are consistently evolving in our process, following the data, mitigating dogma.

The only thing that tends to be consistent is that things change. And as John Maynard Keynes said, “When the facts change, I change my mind – what do you do, sir?”.

We continue to believe that the current environment calls for a different way of thinking. Within the Aptus Compounders portfolio, we believe that we have navigated the current situation well. Though, we do believe that there is more work to do – seeking alpha ultimately comes from risk mitigation. A large contribution of our relative performance in the first half of the year was done at the portfolio construction stage.

We are content with our performance through Q1 and Q2 ’22 but understand that our work is not complete. We will continue to uncover companies that we believe are undervalued with strong growth prospects, as market volatility tends to create opportunities.

Since we cannot always properly forecast the direction of the market, we know that we need to keep a consistent and repeatable process – both qualitatively and quantitatively. There was a time when the latter, quantitative measures (price/earnings, dividend yield, price/book, etc.), could signal which stocks were likely to outperform, i.e., Buffett in the 1950s and 1960s. Much of his success was due to the difficulty in obtaining and sorting through data then. He had to plough through Moody’s and Value Line publications, examine hundreds of stocks, and do calculations manually.

Things are different today. First, because of the widespread use of databases and computers, quantitative measures of undervaluation are easily observed by virtually all professional (and many retail) investors. They are arbitraged away and are less predictive of outperformance. So quantitative screening alone is unlikely to produce a durable edge. Qualitative factors have to be considered.

As we have done in the first few Aptus Compounders Halftime or Full-Time Newsletters, let’s hone in and focus on one aspect of our investment philosophy.

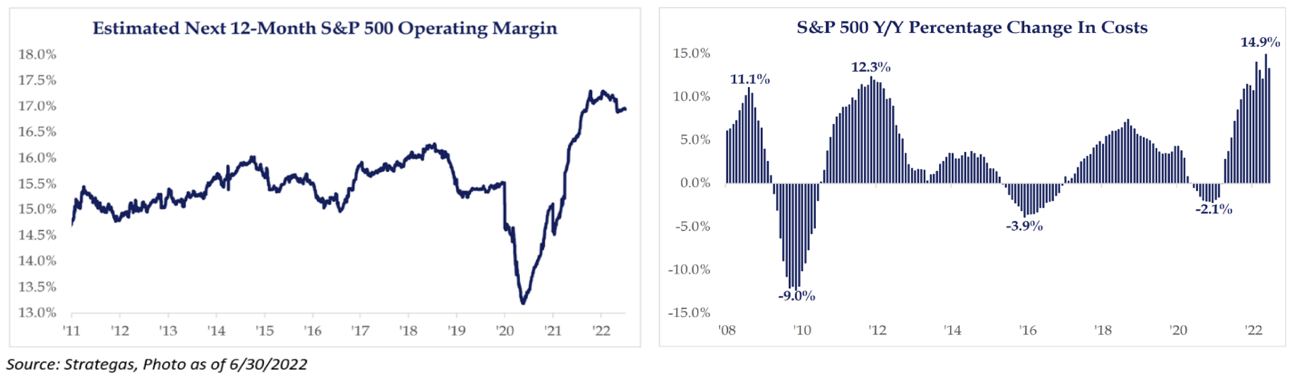

As the market continues to navigate a hawkish Fed and a transition to a Quantitative Tightening environment due to inflationary forces, we wanted to focus on corporate profitability. For one, historically speaking, highly profitable companies tend to outperform over longer periods of time. But we believe that in this environment, to be successful, the playbook is slightly different. We believe that the market will reward those companies that have pricing inelasticity in their business models – defending its margins. The rate of change is more important than the absolute value.

We believe that it is becoming increasingly difficult to be optimistic on profits. The combination of higher wages has increased unit labor costs, and, at the same time, real GDP has continued to soften. This has put pressure on profitability. The repercussions of this could create an environment where U.S. corporations encounter a profitability recession.

This reinforces the rationale for owning high-quality companies that have pricing inelasticity – the ability to pass on increased costs without creating demand destruction, i.e., defending profit margins. We could do the following exercise with any of our holdings, but let’s focus on Chemed Corp. (CHE).

Put simply, CHE has two businesses – Plumbing (Roto-Rooter) and Hospice (Vitas):

- Roto-Rooter – Think of the pricing power in a plumbing company’s business model. When you have an “incident”, it needs to get resolved quickly, or there could be substantial foundational issues. In a recent conversation with the CEO, he mentioned that any time someone clicks on Roto-Rooter on Google’s Ad page, they get charged $80 – ouch! But, given national brand awareness, the company tends to be the plumber of choice. Thus, who cares if they have to pay $80 per click, if they have a very high success rate of getting a customer – a plumber costs $180 just to walk in the door, and that’s before service charges. This is a prime example of pricing power, as the company can increase prices, immediately, to accommodate for higher input costs.

- Vitas – The largest part of overall expenses for Vitas is labor. Given the uptick in labor costs, especially in the healthcare space, it has been detrimental to Vitas’ margins. Though, this is not the full story. We believe that it is only detrimental to Vitas’ margin in the short-term. Not because we believe that labor difficulties will subside, it’s because the largest component of the Medicare reimbursement system is labor. Every single year in October, hospice companies have their government reimbursement rate reassessed – it can either go up or down. The largest component on whether this rate goes up or down is labor. This is a hindsight metric, but one that helps fully negate the headwinds of labor difficulty.

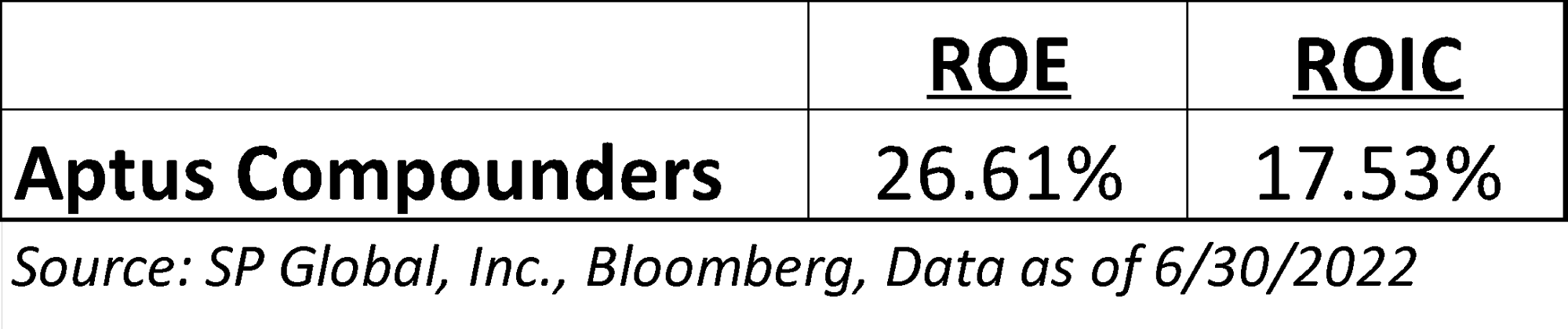

Holistically, our portfolio has both a higher return on equity (“ROE”) and return on invested capital (“ROIC”) than the S&P 500’s Operating Margin.

These qualitative factors cannot be recognized by machines that have started to arbitrage out the inefficiencies within market fundamentals. Thus, these factors, can help us create a durable edge, as we roll up our sleeves and do the hard work when evaluating each company for portfolio consideration.

We continue to remain convicted in every single holding in the Aptus Compounders Stock Sleeve. Not only that, but we are also very happy with how the portfolio is positioned moving forward. Ultimately, the market will reward companies that have long avenues for growth and that are trading at what we believe to be discounted valuations.

As always, thanks for trusting us with your capital.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The Russell 1000® Index measures the performance of the large cap segment of the U.S. equity universe. The Russell 1000 Index is a subset of the Russell 3000® Index, representing approximately 90% of the total market capitalization of that index. It includes approximately 1,000 of the largest securities based on a combination of their market capitalization and current index membership.

The company identified above is an example of a holding and is subject to change without notice. The company has been selected to help illustrate the investment process described herein. A complete list of holdings is available upon request. This information should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the holdings listed have been or will be profitable, or that investment recommendations or decisions we make in the future will be profitable.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2207-17.