Before we highlight one of the Aptus Compounder’s holdings (15-stock, high-conviction strategy – shoot me an email if you have any questions on this unpackaged SMA strategy), let’s touch base on two things today:

- Given the recent volatility, if you have any specific holding or portfolio level questions, please don’t hesitate to reach out to us. We are here to help. As many of you know, a few of our strategies are our best expression of owning volatility as an asset class, the S&P 500 had sold off ~6.5% (NASDAQ closer to -10% / Small Caps were -16%) given the headline risk around tariffs. We love how we are positioned.

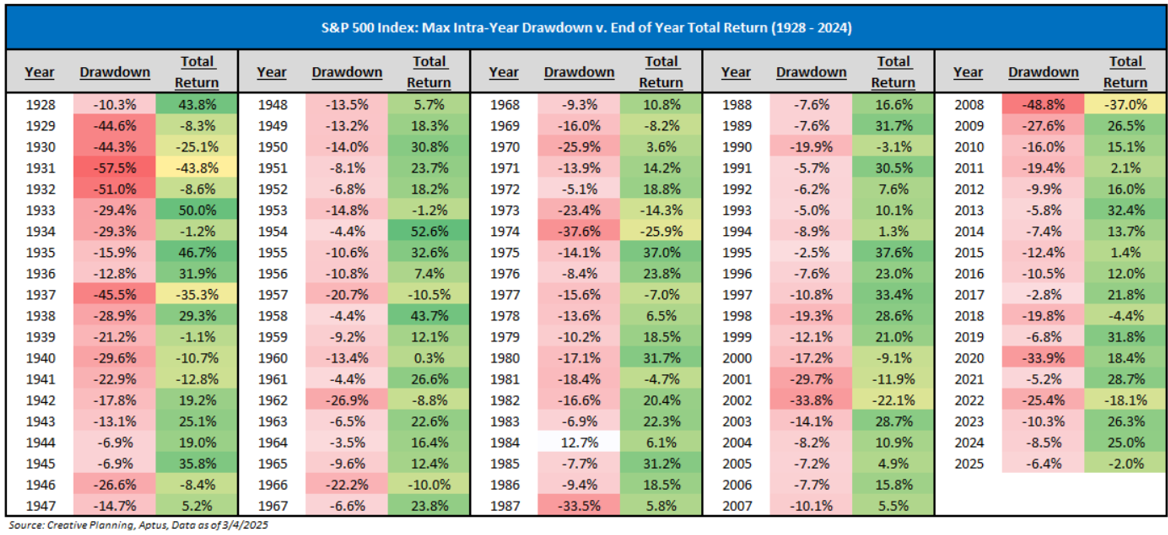

Historically, the market experiences three 5%+ pullbacks per year on average. These corrections are healthy and should not be alarming. The data below shows that these pullbacks are common rather than extraordinary. Since 1928, the largest intra-year drawdown averages -16.0%, yet year-end returns typically remain positive. The message here is clear: it pays to stay patient, not reactive.

Lastly, in my opinion, this feels like a normal pull back, as the areas of the market that have been hit the hardest are the places that many would consider to have had irrational exuberance in their returns since the election, i.e., high-beta stocks, highly-valued stocks, and the most risk-on areas of the market have led the pull back. When these areas of the market are leading the pullback, it tends to be a healthy and short-lived correction.

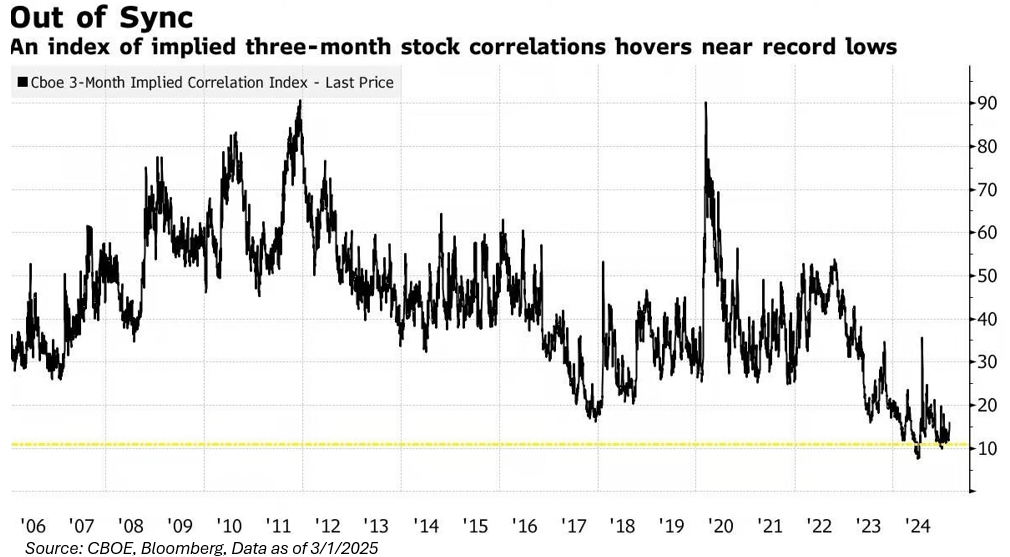

- I’ve slowed down on my individual stock writing for the “Aptus Musings”, but given the recent pullback in the market and the moving pieces under the hood of the S&P 500, I thought I’d bring it back. For reference, dispersion across names in the S&P 500 is in the 98th percentile over the last five years. This means that there is a lot of dispersion amongst names and low correlation, i.e., names are doing wild and crazy things as we are going through a period of time where CY 2024 earnings are being reported and a potential / threat for a substantial amount of change in Washington, D.C. policy.

In today’s musing, we’ll be highlighting Aptus’ most recent addition to the portfolio – NVIDIA Corp. (NVDA).

Compounder Factsheet

Compounder Philosophy

NVIDIA Corporation

Tech’s negative trend is probably one of the most important equity market developments to start 2025. It doesn’t mean good charts can’t be found within the sector, but the likelihood of consistently picking winners goes down without the sector at your back. But this type of weakness does breed opportunity, and we continue to believe that there is opportunity to own NVDA.

As of 3/4/2025, NVDA is -13% from its recent ATH, but the weakness in the stock feels more like a hedge fund de-grossing story for the entire semiconductor / AI space than a fundamental growth worry. And when you get pullbacks that are caused by this type of liquidity event, it’s tough to recognize when the selling will stop, so I cannot call a bottom. However, we believe that NVDA is hitting a point of valuation support.

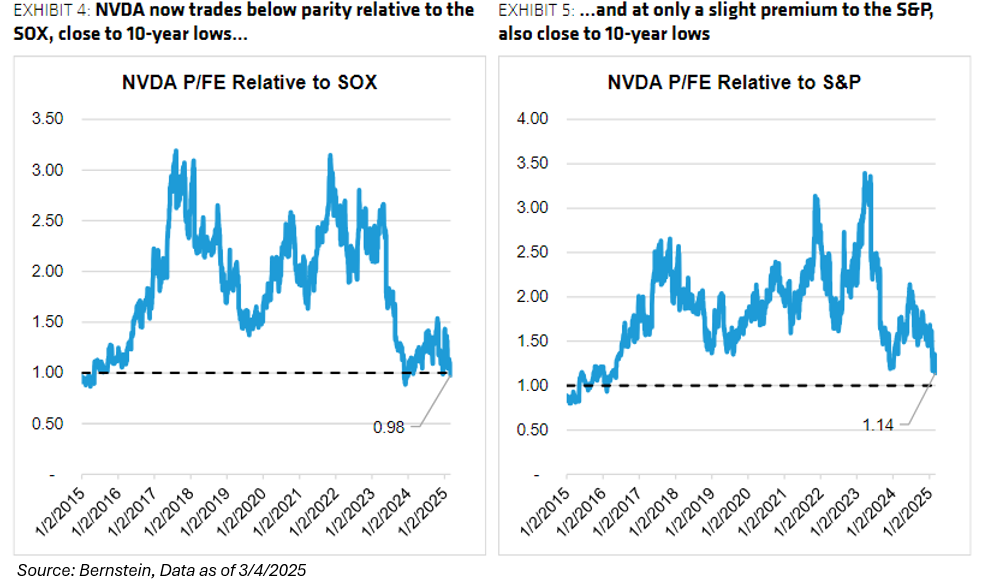

Let’s talk valuation because I feel like that is the go-to scapegoat as a reason not to own the stock. The stock currently trades at 25x forward earnings:

- NVDA now trades BELOW parity relative to the PHLX Semiconductor Sector Index (SOX) – something the market has seen only once or twice in the past decade;

- NVDA only trades at a slight S&P premium, the lowest they have been since 2016.

And this is the cheapest valuation the stock has seen, and it’s at the beginning of a new product cycle, which baffles me. The stock tends to do well during new product cycles, such as the Hopper. Though I do recognize that the Blackwell introduction has not gone as smoothly as Jensen would have liked, a few of our research partners have stated that Blackwell witnessed $11B of shipments in January, suggesting that the floodgates have been opened.

We don’t just like the valuation of NVDA, we love it. And we love the growth opportunity because the U.S. is already starting to price in a slowdown of growth – and this is before the tariffs debacle. Then, global growth is also undoubtedly slowing. We believe that this leaves the AI trade as an idiosyncratic area of growth. The scarcity growth premium might find its way back to NVDA.

So, what is there for investors to worry about?

Increased Regulation: Given the current trade tensions, there could be more restrictions and bans on China shipments. I would note that NVDA’s China sales, while reaching record levels (~$17B in FY25), are at the lowest % of revenue (13%) in the last 10 years.

AI Diffusion Occurs in May: These are basically new rules that place additional controls on where advanced AI components can be shipped. Said another way, it will force customers in many countries to obtain new licenses in order to purchase sizable amounts of NVDA hardware. We believe NVDA’s H20 shipments to China should be unaffected by the new controls as they only seem to apply to components already impacted by prior controls (the H20 is low enough performance to be exempt from restrictions).

The AI Trade is Long in the Tooth: Personally, I think that this is a bit premature. Why? Sentiment has clearly pivoted for now on the AI group. However, spending intentions seemingly continue to rise, plus a new product cycle is just kicking off. For example, there continues to be outsized investments in capex and R&D have supported the exceptional performance of US stocks during the past decade. In 2025, the Magnificent 7 companies will boost their capex by 31% YoY to $331B. If you simply rewind history back to October, just four months ago, these companies were “only” expected to spend $263B on capex (+13%).

Given how noisy 2025 has been so far, I think being quiet isn’t such a bad thing. Even though there was tremendous angst going into NVDA’s recent earnings results the other week, I would characterize the print as relatively quiet. It appears that the company is through the worst of the ramp issues, with all Blackwell configurations now in full production across the board. Gross margins at 71% might be a minor nitpick, but I won’t argue that getting product out the door should be the primary consideration at the moment, given that demand seemingly remains off the charts and the company still sees them coming back into the mid-70s range by year-end.

Overall, the secular story around that demand seems as robust as ever as the market moves from pre-training to a post-training world, with management remaining bullish that compute requirements are only growing stronger from here.

Overall Thesis

We see NVDA as a major beneficiary of the 4th tectonic shift in computing, in which parallel

processing captures share in the computing market. We believe that the market underappreciates NVDA’s businesses and its transformation from a traditional PC graphics chip vendor into a supplier of high-end gaming, enterprise graphics, cloud, accelerated computing, and automotive markets. From our perspective, the company has executed consistently and has a solid balance sheet with what we believe to be a demonstrated commitment to capital returns. We understand the unwelcoming landscape regarding China and the U.S. restrictions but believe that they are manageable over time.

And don’t mention valuation to us – it trades at 25.2x forward earnings, a level lower than most of the Magnificent Seven. At this valuation level, it’s the stock’s weakest level in a year and close to 10-year lows. In fact, the stock now trades below parity relative to the SOX (something we have seen only once or twice in the past decade) and at only a slight S&P premium, the lowest they have been since 2016.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022. ACA-2503-11.