In today’s report, we’ll be covering Chemed Corporation (“CHE”) – in our opinion, one of the last, great remaining publicly traded conglomerate companies. Conglomerates were in vogue for the majority of the 20th century. They came about because most of the mergers in the 1960s and 1970s were conglomerates (buyer and seller operating unrelated businesses) since horizontal (same industry) and vertical mergers were closely scrutinized and often rejected by FTC regulators. Contrary to the hype, all those conglomerates petered out sooner or later for the simple reason that there was no economic justification for their existence. If an investor wishes to diversify and have stakes in, say, airlines, oil and gas, and insurance, they can simply buy shares in companies operating in these industries. Investors don’t need conglomerate companies to do the diversification for them.

And now, CHE is continually asked by shareholders if they should break apart into two publicly-traded companies and the CEO, Kevin McNamara, always has a resounding and emphatic… “No”. So, what are the two (2) businesses that Chemed runs?

The Che Guevara Business – Surprisingly, CHE and Che have a few things in common, though they remain far different. The latter was an expert in guerilla warfare and is notorious for his involvement in killings throughout Cuba, Venezuela, and Africa. The former is also known in the death space – though, unlike Che, they help assist in the most peaceful of manners. Over 50% of Chemed’s revenue comes from being the #1 hospice player in the United States, with the company VITAS.

The Cousin Eddie Business – Happy Christmas time. Cousin Eddie is most infamous for draining his RV’s waste into a sewer in the suburbs of Chicago in the movie, National Lampoon’s Christmas Vacation. However, he chose to use a different subset of verbiage while performing the act in a short bathroom robe that would barely yield the coverage of a Kentucky Derby jockey. Instead of performing this act, Cousin Eddie should have called Chemed’s other Business, Roto-Rooter, which happens to be the largest plumbing company in America.

Let’s dive in.

Chemed Corporation (CHE)

What Does the Company Do?

Chemed (CHE) is a conglomerate that operates in two distinct businesses:

VITAS Healthcare (55% of Revenues): Largest provider of Hospice Services for patients with severe, life-limiting illnesses with approximately 7% of the U.S. market share. Operates a comprehensive range of hospice services through 45 operating programs in 15 states and the District of Columbia.

Roto-Rooter (45% of Revenues): The largest provider of plumbing and drain cleaning services in North America with services to ~90% of the U.S. and 40% of the Canadian population. This is a fragmented market where Roto-Rooter maintains an estimated 15% of drain cleaning market share and only 2%-3% of same-day service plumbing market.

Why Have I Been So Impressed With the Company and Its Management Team?

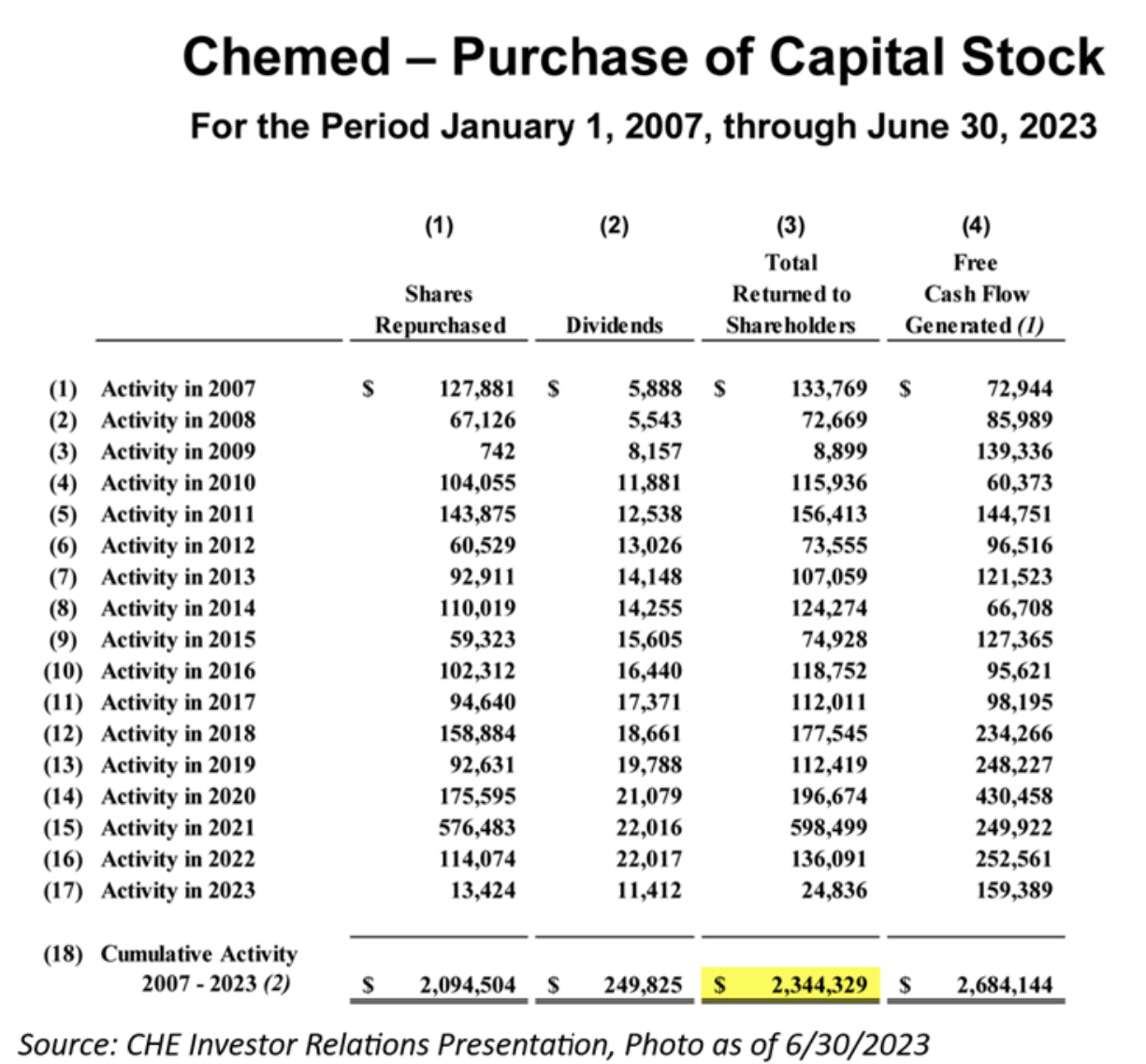

The below chart states everything that you need to know. Growing your dividend at double-digit rates and buying back over $2B (on an $8B mkt. cap stock) since 2007 shows the strength of this business, as this would not be possible if they were not able to grow revenue, expand margins and increase the bottom line.

What Has Impressed Aptus Lately?

It’s no secret that keeping and retaining labor has been a very difficult task for companies and CHE has been no different. In fact, it has substantially de-railed some of VITAS’ growth aspirations. But this past quarter was a pretty large clearing event and this is why the stock was +10% after the report.

This past quarter we were most impressed with the results of the company labor retention program, which we believe will set them up relative to peers for quite some time – having the right, consistent labor is in fact a competitive advantage in this space. The program was just another highlight of continued management execution during periods of adversity. Management had previously assumed a slight uptick in turnover and a slowdown in hiring at the end of the program, which fortunately did not materialize. The strong labor market for CHE has prompted management to increase its current year average daily census (“ADC”) growth guidance for the second consecutive quarter to 9.3-9.5% (from 6.5–7.5%).

VITAS is finally back to growth mode.

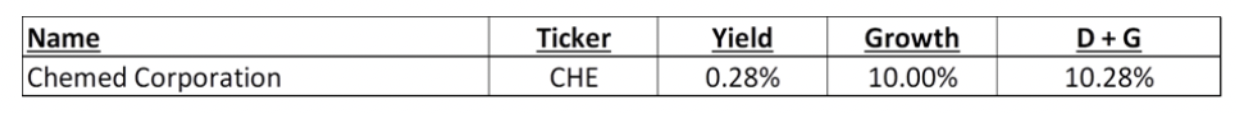

Walk Through the Yield + Growth Framework:

Chemed has multiple levers to successfully grow. Many believe that CHE likely has a GDP-like growth, given that the Roto-Rooter business and the Hospice business reimbursement is controlled by the government. This is not exactly true, particularly on the Roto-Rooter business (“RR”). The company has continued to grow organically, even via new lines of business, such as water restoration (which began in 2016). Inorganically, RR continues to snatch up non-controlled franchises. VITAS is unlikely to grow inorganically, as the compliance and integrations tend to be complicated, especially with a lot of government scrutiny – in a heavy reimbursement-based business, it’s sometimes best to not have the spotlight on you.

Nonetheless, the company has substantial room to grow with a lot of pricing power.

Sales Growth Rate + Roto-Rooter Inorganic Growth + Margin Expansion + Share Repurchases = Growth Rates: 6.50% + 1.00% + 0.50% + 2.00% = 10.00%

Should the Company Break Into Two Companies?

Surprisingly, when speaking with the management team, I don’t take a contentious stance here because I actually agree with keeping the companies together. Both sides of the business ying and yang with each other, as the RR business tends to be a bit more cyclical, given the exposure to restaurants, while VITAS is more of a staple. From a valuation perspective, I don’t think the move would benefit them, but if you want to have that conversation, we can take that offline.

From a portfolio standpoint, specifically in the Aptus Compounders 15-stock, non-diversified portfolio, I prefer to own a conglomerate. Since we’re limited in the number of holdings that the portfolio can have, I like increasing diversification with a business that performs work in the Health Care and Industrial sectors.

Why are We so Convicted in CHE?

We believe that CHE is a very strong operator with tailwinds on both sides of its business. On the Roto-Rooter segment, given its above-peer margins, its asset-light model, the reduced exposure to economic cycles (due to its growing exposure to water restoration), and limited online competition, we believe that this line of business deserves an above-average premium relative to peers. Meanwhile, given the size of the VITAS platform (scarcity value), the positive outlook for the hospice industry, and the positive near and medium-term outlook for Medicare reimbursement rates, we believe that VITAS also deserves an above-average premium relative to peers.

CHE has demonstrated to be a very strong operator, with minimal leverage at the corporate level, a growing dividend, and accretive share repurchases. With this, we believe that the company is very undervalued relative to peers and should be an all-weather holding in a portfolio given its downside protection along with its outperformance in normalized market scenarios.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein. Information was obtained from third party sources which we believe to be reliable but are not guaranteed as to their accuracy or completeness. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2312-8.