Topics for this Musing:

- Quick Market Commentary

- Stock of the Quarter

Before I start, please remember that we do great individual stock work for concentrated positions of clients. I have opinions and convictions that I’m more than willing to spew.

We were very fortunate with the performance of the Compounders sleeve last year and hope to continue that momentum in ’24. In today’s musing, we’ll be highlighting Aptus’ most recent addition to the portfolio – Diamondback Energy, Inc. (FANG).

Compounder Factsheet

Compounder Philosophy

Compounder Case Studies

Quick Market Commentary

Now that we are past earnings, here are a few facts on the market that really stick out to me:

Where does valuation figure into the Magnificent Seven vs the S&P 493 Debate?

The PE ratio on the Magnificent Seven is 29x, which places it in the 81st percentile of post-GFC history. The PE ratio on the S&P 493 is 18x – placing it in the 88th percentile of the same lookback window. So, while I concede that the former is superficially much higher than the latter, based on looking at each cohort relative to its own history, it’s not at all obvious to me that the 493 are all necessarily “cheap” in comparison. In this context, look at NVDA – it has added around $1.7T of market cap over the past 16 months, and the P/E has barely budged, i.e., earnings are driving the stock’s performance (Think back to our Yield + Growth +/- Valuation Framework).

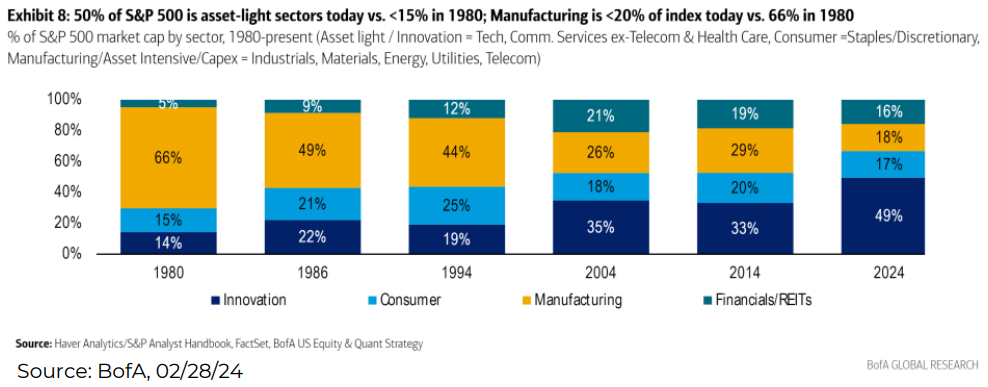

Is Something Structural Going On?

This isn’t breaking news and it’s something I’ve been saying a lot on TV lately: US mega-cap tech companies have some of the biggest and best balance sheets in the world. They generate huge free cash flow and return a large chunk of that to shareholders (recall the recent buyback math for AAPL, GOOG, META, et al – META actually announced a dividend!).

Here’s another stat that I find eye-popping: the Magnificent Seven reinvests 60% of that cash flow into growth capex and R&D. Think about the compounded power of that over time and note that it’s more than 3x what the other 493 S&P companies reinvest. There are elements of winner-take-all at play here, and it’s not something I’m willing to structurally fight – own more stocks, less bonds, and remain risk-neutral.

My Favorite Valuation Chart

Only time will tell if the market is “overvalued” or “undervalued”, but we don’t think comparing today’s S&P 500 valuation to its history, especially longer-term history, might be the best comparison. A fair value approach to the index based on long-term trends in earnings and cost of equity would have grossly underestimated S&P 500 returns in recent years.

As always, given that NVDA is a hot topic (and the comments above), let me know if you’d like my written commentary on the stock.

Stock of the Quarter – Diamondback Energy, Inc. (FANG)

Why Did I Decide to Review FANG? Many folks have reached out to me asking about the company’s recent acquisition of Endeavor (privately held).

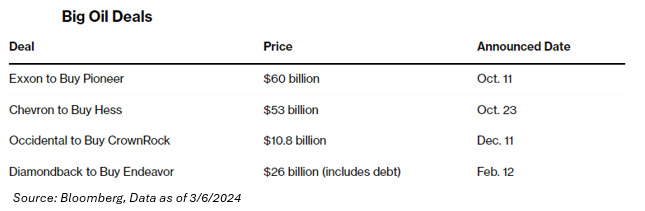

One of the biggest things catching my eye in the energy space has been the record amount of mergers & acquisitions, or M&A (XOM à PXD | FANG à Endeavor | CVX à Hess / etc.). We are nearly 10 years into the meteoric rise of US Shale, alongside major basins being more mature, we’ve seen inventories start to decline and productivity start to wane. So, to maintain their foothold in the Permian basin and elsewhere, oil majors are snapping up prized plots.

From a sector perspective, one of the big rationales for owning Energy was the capital allocation changes happening across the spectrum. This has continued as free-cash-flow yields continue to increase, providing more levers for companies to return cash to shareholders. This is partly a function of capital scarcity due to institutional divestitures and political pressure that has helped constrain Oil & Gas capital expenditures (“CAPEX”). In any event, the result is the highest-ever cash flows which have been helping bolster the return to shareholders via fixed/variable dividends + share repurchases.

As I mentioned above, the path to new reserves has been the same playbook for many companies, via M&A. Rather than exploring for and/or developing new projects, large companies are pursuing a more risk-averse strategy of buying existing production. In 2023, the North American energy sector had seen $270B worth of M&A deals.

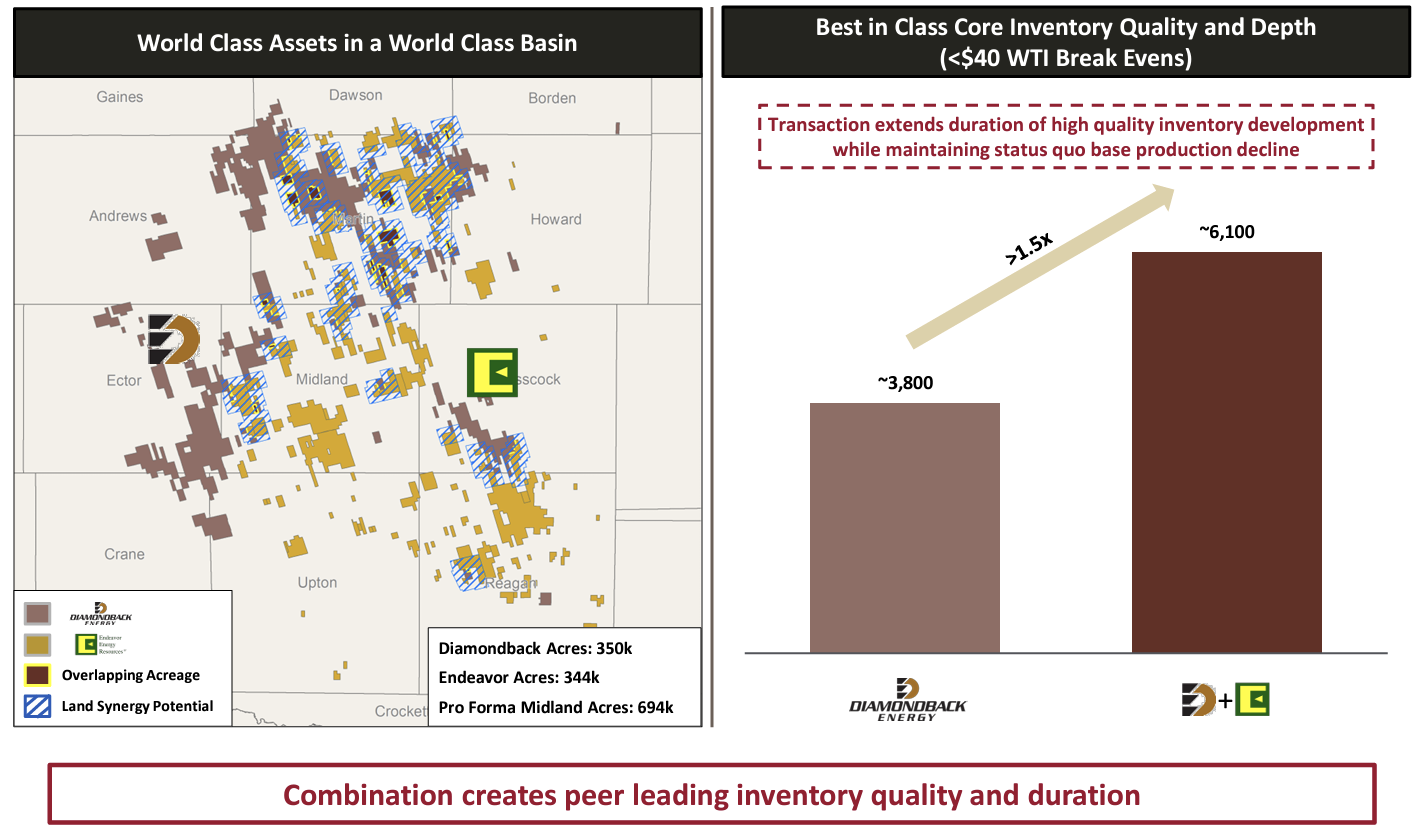

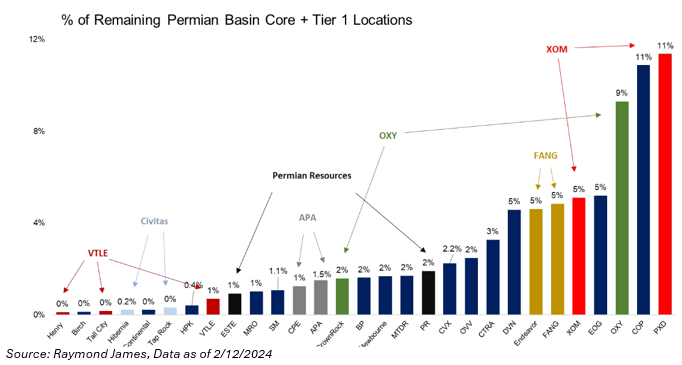

Given this onslaught of M&A, FANG took advantage of multiple competitors being tied up with other deals to pounce on the crown jewel of private companies in the Permian Basin. Following XOM-PXD pending merger and OXY’s recent acquisition of CrownRock, FANG became the only logical player to take down the long sought-after private. Thus, FANG and Endeavor are merging in what is the fourth energy mega-deal announced in the last six months. The combined entity will be the third largest producer and 5th largest acreage holder in the basin while sitting tied for third in core-inventory locations.

Source: Diamondback Investor Presentation as of 02.12.2024

Source: Diamondback Investor Presentation as of 02.12.2024

However, whereas in the other three, the acquirer trailed the S&P energy sector by an average of -1.15% and the S&P 500 by an average of -2.30% on the day of the announcement, FANG soared, outperforming both by 8.28% and 9.47%, respectively.

Which begs the question, why? Most analysts agreed that FANG paid a fair to full price for Endeavor… it wasn’t like they got a bargain. Perhaps the answer can be found plastered on every single slide of the merger pitch deck put out by FANG, which read “The Must-Own Permian Pure Play.” Haughty, perhaps. Presumptuous, definitely. But when you look at it, they’re right.

With PXD out of the picture, FANG/Endeavor’s scale and complementary acreage position in the most prolific US shale basin make it the go-to E&P for energy-hunting portfolio managers, like myself. Moreover, in some respects, Endeavor was seen as the ultimate prize. Founder Autry Stephens started the company in 1979, having come from humble beginnings on a peanut and watermelon farm. Long thwarting reported acquisition attempts from multiple public behemoths, Endeavor rose as the major privately held producer in the Permian. His patience paid off; post-transaction, Mr. Stephens’ net worth is pegged at just under $26B, placing him at 64 on Bloomberg’s wealth list.

Hat tip to a member of our own team, Joseph Sykora, CFA, who used to do boots-on-the-ground work in the Permian, so we’ve very much had our ear to the ground in this space.

Alongside the announcement, FANG offered up even more good news: they are increasing the base dividend by 7% to $3.60/share annually. That being said, they also reduced the minimum payout from 75% of free cash flow to 50% of FCF in an effort to quickly reduce debt associated with the deal and provide the company with more financial flexibility going forward. The 75% minimum payout was previously the highest in the industry (along with PXD). We believe this is the smart business decision.

All-in-All: Simply said, FANG bagged a Unicorn.

In our opinion, this deal is an absolute homerun for Diamondback, with the company now asserting itself as the premier pure-play E&P in the country. Other details of the deal we like are the 18-month lock-up for the Endeavor stockholder group which should go a long way towards easing any selling pressure put on by the acquired party. Diamondback now has zero inventory concerns, with a huge quantity of known strong locations alongside a considerable amount of upside should more zones become viable. Overall, we would expect multiple expansions in the wake of the deal as FANG takes their place as the sitting King of the Permian.

Momentum / Technicals

FANG took a turn for the better when it announced it was acquiring Endeavor Energy Resources on 2/12, breaking out on 3.5x average volume. This volume has created a floor for FANG @ the $160 level, and further momentum into earnings on 2/20 pushed it to the $180 area (new ATH). It has historically moved in $20 increments as can be seen in the below chart.

With price and volume confirming direction (up) the trade now becomes one of trend vs fundamental value. Price will, most likely, hang around $180 until its 20 or 50 sma’s catch up to it and continue on trend (up) and look to test the round $200 number before attempting its next major pause.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2403-15.