The S&P 500 Was Up This Quarter? Surely You Can’t Be Serious.

I am, and Don’t Call Me Shirley.

Airplane! is a comedy that does not conform to any known standard of parody. In fact, the movie is far from the likes of comedies today that are so hung up on being contemporary, radical, and outspoken that they forget to be funny. The film is littered with a slew of non-sequitur bits, outrageous sound effects, and hysterical one liners, many of which, are continually quoted today.

Airplane! is practically a satirical anthology of classic movie clichés – the flashbacks started right from the opening seconds that spoof Jaws to a flashback at an exotic Casablanca-style bar which is quickly turned into a scene from Saturday Night Fever.

This quarter itself felt like a flashback to a series of unfortunate events that had occurred during the Great Financial Crisis (“GFC”), as the market endured its first collateral damage from recent Fed policy through stress in the banking sector. And if you’re thinking to yourself that you don’t understand banks, well they’re large buildings that are intermediaries between depositors and borrowers, but that’s not important right now.

Like life, this market came at investors fast this quarter. Having shifted from recession fear in January to overheating worry in February, the market has had to shift focus sharply again to contend with banking stress and credit crunch fears in March.

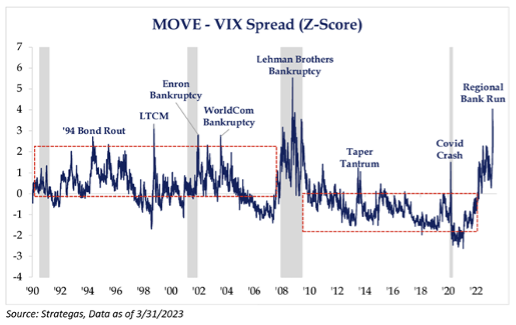

The trepidation from this mini-banking crisis has been fraying investor’s nerves, which in return has manifested into an unusually large bout of volatility in the treasury market. The daily whiplash in interest rate movements have likely left many investors feeling like they chose the wrong week to quit sniffing glue.

Yet, unlike the Treasury market, equities appeared to be somewhat insulated from the volatility with stocks getting airborne quickly, finishing the quarter +7.5%, posting strong back-to-back quarterly gains. Investors continued to focus on hope for an economic soft landing and, yet again, ignored what the Fed is saying and priced in dovish future monetary policy. To that point, the market is so focused on potential rate cuts that stocks ended the month higher than when they started, despite all the noise. Every single rally in stocks since this bear market began has been driven by the hope from markets that a Fed pivot or pause is imminent.

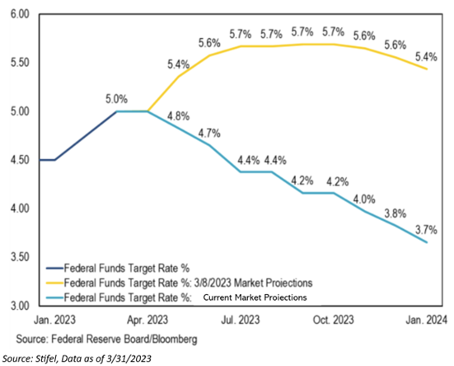

The most perplexing thing this quarter has been the striking difference in what the equity markets have been saying versus the bond markets. We believe that the equity market is pricing an economic growth slowdown, but not a recession. Contrary, the rates market is now pricing roughly 75 bp of Fed cuts through year-end, vs. roughly 100 bp of net hikes priced on 3/8/2023. Rate markets appear to already be assuming high odds of a serious downside scenario.

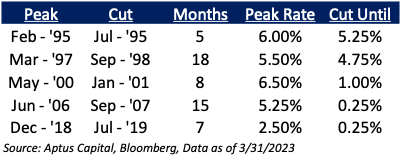

Given the volatility in rates, much of the focus during the quarter was on Jerome Powell, the Fed, and macroeconomic data, specifically non-farm payrolls and inflation reports, as it appears that the Fed’s dual mandate is at duel with each other. In disagreement with the current market projections, we believe that the Fed is going to maintain a “Hike and Hold” mentality throughout the year, as policy just became restrictive, i.e., Fed Funds Rate (“FFR”) > Inflation (Core PCE). Historically, the Fed has kept the terminal rate elevated for some time.

The Fed is finding itself in the rather odd position of having to tighten to control inflation and ease to control financial conditions at the same time. Though, we’d be remorse to say that if inflation reports continue to be more structural in nature, this could pin the Fed between the proverbial “rock and a hard place”. Now, we’re not saying that Jerome Powell has less experience than Ted Stryker, a rogue pilot with a drinking problem, on executing a successful soft landing, but the recent interest rate instability continues to show skepticism. To the extent to which the lags in monetary policy are long and variable, we continue to believe that caution is warranted in the current market environment.

The Fed is finding itself in the rather odd position of having to tighten to control inflation and ease to control financial conditions at the same time. Though, we’d be remorse to say that if inflation reports continue to be more structural in nature, this could pin the Fed between the proverbial “rock and a hard place”. Now, we’re not saying that Jerome Powell has less experience than Ted Stryker, a rogue pilot with a drinking problem, on executing a successful soft landing, but the recent interest rate instability continues to show skepticism. To the extent to which the lags in monetary policy are long and variable, we continue to believe that caution is warranted in the current market environment.

Throughout the movie, the shenanigans don’t stop, every extra second seems to accommodate another shot of something even more ludicrous. And, the same could be said about the market. It’s felt like each month has brought a new ridiculous problem. In a structurally heightened inflationary environment, investors will recognize that asset allocation decisions tend to become more difficult. That’s why being pragmatic in the current times is a necessity as investors can’t expect to put their investments on autopilot.

Conclusion

Right now, it’s likely that many investors feel like they are passengers on the ill-fated Trans-American flight from Chicago to Los Angeles. Given the aforementioned market backdrop, if you find yourself nervous investing in times like these, it’s OK, because I bet that you’ve been nervous lots of times.

For now, it feels like the markets have reached a cruising altitude and the captain has kept the “fasten seatbelt sign” on. We’re not sure when and where there will be turbulence in the future, but again, turbulence is normal. And, if you decide to eject your portfolio away from your long-term investing plan and go to cash, we believe that you could have a more awkward conversation with your clients than little Joey did with Clarence Oveur.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2304-8