Q2 2023 Key Market Takeaways

1. Everyone was bearish to begin the year, and everything rallied – one of the most anticipated recessions in recent memory has yet to occur, as the consumer has remained very resilient in the face of higher-for-longer inflationary headwinds.

2. The U.S. officially exited its technical “bear market” this quarter with the S&P 500 up over 20% since its most recent bottom in October. One of the more perplexing aspects of this bottoming process has been the lack of breadth in U.S. Small Caps.

3. Mega-Cap stocks told the rest of the market that if you’re not first, you’re last, as Tech stocks had an adrenaline-fueled journey fueled by Artificial Intelligence (“AI”). The market witnessed the narrowest breadth in history for the first half, with just 25% of stocks outperforming the S&P 500.

4. Investors don’t know what to do with their hands, as many are conflicted on whether or not to chase parts of this market higher or sit on their hands, which collects a palatable nominal yield.

The S&P 500 Wanted to Go Fast in Q2 – The Ballad of the Magnificent Seven

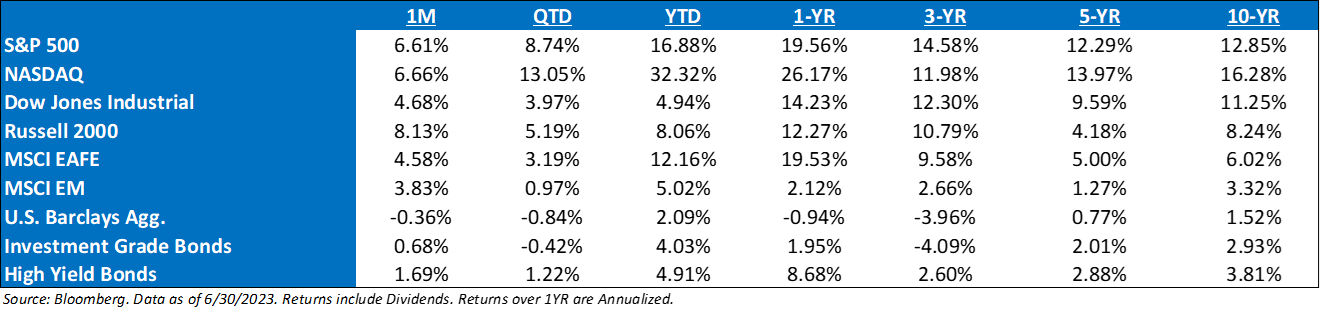

During the second quarter, investors took a page out of Ricky Bobby’s playbook – MegaCap Tech stocks told the rest of the market that if you’re not first, you’re last, as investors either owned technology exposure and outperformed or owned everything else and underperformed. Investors quickly saw the banking fears of Q1 fade into an all-out Artificial Intelligence (“AI”) FOMO trade in Q2, leading the S&P 500 higher by 8.7% for the quarter.

During the second quarter, investors took a page out of Ricky Bobby’s playbook – MegaCap Tech stocks told the rest of the market that if you’re not first, you’re last, as investors either owned technology exposure and outperformed or owned everything else and underperformed. Investors quickly saw the banking fears of Q1 fade into an all-out Artificial Intelligence (“AI”) FOMO trade in Q2, leading the S&P 500 higher by 8.7% for the quarter.

Optimism surrounding AI was the catalyst that led the S&P 500 to post its 3rd straight 7%+ quarterly gain, officially ending the technical “Bear Market”, with the index closing up more than 20% off of its October lows. This bottoming process hasn’t been the traditional kind, as U.S. Large Caps have outperformed U.S. Small Caps and the market breadth has been one of the weakest on record. In fact, the “Magnificent Seven”, a.k.a., collectively: AMZN, MSFT, GOOGL, META, TSLA, AAPL, and NVDA, contributed 76% of the market’s year-to-date gain. During a market bottoming rally, market participation tends to be strong, led by Small Caps.

One of the biggest surprises has been the U.S. consumers propensity to continue to spend capital in the face of heightened inflation. This has led S&P 500 earnings expectations to be very resilient and not needing to use any Tom Cruise witchcraft to put out the earnings expectations’ invisible fire. Sentiment surrounding earnings started to change in March, as did the performance of the market. Historically, month-over-month change in earnings revisions has one of the highest correlations to the direction of the market – as revisions go higher, so does the market and vice versa.

However, it seems that few investors are buying into this earnings revisions trend, choosing instead to camp out in the largest, most liquid, and most profitable names that have worked year-to-date. This is proving to further exacerbate the lack of market breadth.

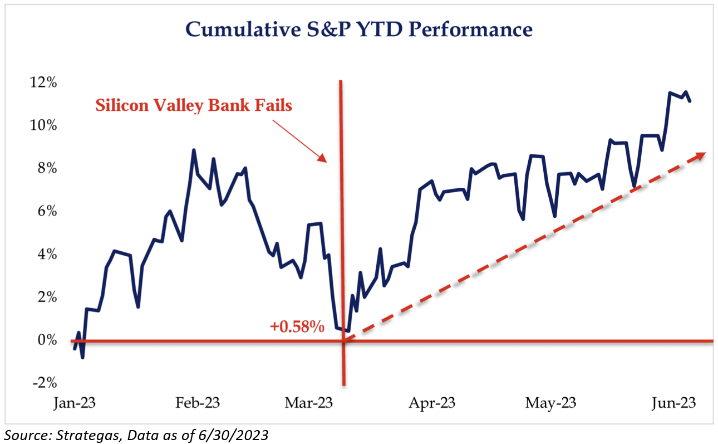

In addition to the AI-induced rally, it appears that the market interpreted that the right tail risk in interest rates, i.e., structurally higher rates for longer, was removed from the narrative after the recent banking failures. Many investors forget that the S&P 500’s performance was nearly flat in the middle of March. All the S&P 500’s return YTD was after the Silicon Valley Bank collapse, demonstrating that investors believe it will be difficult for the Fed to keep rates higher or elevated for a prolonged period of time, i.e., pivot.

Inflation has continued to take a pit stop, which has helped the overall sentiment on the market, as it has transitioned its focus to earnings growth. We still believe that the cost of achieving the heralded 2% inflation target will be costly, both economically and politically, for the Fed as we head into an election year. Unfortunately, we believe that the brunt of this cost will need to be felt in the labor market because wage inflation tends to be sticky and supportive of consumer spending, which is inherently inflationary.

Moving forward, we remain focused on many of the same issues that we held three months ago: 1) a deeply inverted yield curve; 2) a shrinking money supply; 3) corporate profits declining as operating leverage during volatile inflationary periods tends to cut both ways; 4) the tightening of bank lending standards, a development usually associated with job loss; 5) the lags associated with Fed tightening will soon be acutely felt; and, 6) a liquidity drain associated with the resumption of QT.

Given the end of the “Bear Market”, we’re unsure whether this new market regime is in its baby phase, who doesn’t know a word yet, but still omnipotent, with its golden diapers or has already transformed into grown-up/teenage Jesus. Only time will tell.

The Hero (Ricky Bobby): It Was All Shake, No Bake, as AI Drove Technology Higher, Leaving Behind the Avg. Stock

On the heels of the AI-induced rally, Tech stocks catapulted higher, as they are expected to be one of the largest beneficiaries of this innovation. In fact, the NASDAQ just had its best first half since 1983. The optimistic case is that investors are beginning to discount a revolutionary change in the economy that renders the old rules useless – meaning that the market can sustain a higher valuation as companies are becoming more profitable.

Reminiscing about recent bubbles, such as meme stocks, blockchain, and cryptocurrencies has created investor skepticism regarding the durability of this AI advance – asking themselves if it has gone too far? It is likely to take years to fully determine whether AI is revolutionary or evolutionary before we get an answer to that question.

Nonetheless, AI is expected to be the necessary growth and productivity narrative for an investing world that is in dire need of growth and productivity. AI promises both, and therefore investors compare this AI frenzy to the early days of the buildout of the Internet. We believe that the two major lessons of that analogy are:

- A lot can change over the first 10-15 years of a technology’s commercialization; picking long term winners/losers is very difficult at this early stage. Thus, maintaining flexibility is imperative.

- The lasting equity value creation from a technological innovation can be far more impressive than near-term ebbs and flows (bubbles and crashes) in equites at the early phases of a technology’s commercialization.

Nonetheless, this exuberance drove Technology stocks higher. The six-month stretch to start this year has seen the S&P 500 Tech index outperform the S&P 500 Ex-Tech Index by its largest margin on record. While there have been periods when Technology had better absolute six-month returns (think 2009 and 2020), there has never been a six-month period of such massive relative outperformance versus the rest of the market.

The Villain (Jean Girard): Performance Chasing Can Lead to a Silent Equity Volatility Tax

Given the pessimism in the market and the equity rally witnessed this year, it’s a real-life reminder that investors need to keep their engines running, by owning more stocks, less bonds, but with guardrails. This allows the structure of the allocation to work to their benefit during these types of fitful rallies, without any degradation to downside protection.

Investors currently do not know what to do with their hands, i.e., deciding whether to chase parts of this market higher or sit in fixed income, which finally has a palatable nominal yield, though flat on a real basis.

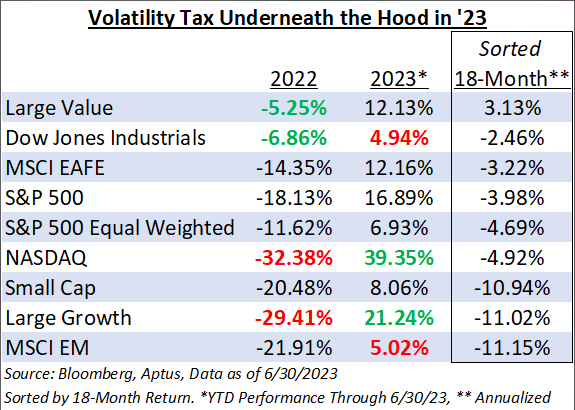

This year has been a great case study of the volatility underneath the hood of the S&P 500 with performance almost a mirror image for tilts/exposures versus last year. Unless investors swapped their allocation to the inverse exposure at the beginning of the year, when there was peak pessimism, they would be behind YTD, but still ahead since year-end ’21.

What many investors fail to consider is the necessity to avoid the friction of volatility and large losses, as the focus on recent returns has only been over a 6-month period. If you slightly zoom out to only 18-months, many people would be surprised that the NASDAQ, which just had its best first half since 1983, is up almost 40%, greater than its loss last year. Yet, it has still negatively compounded capital over this short period. Investors need to remember that they do not earn the arithmetic return of investments; they earn the compounded rate of return.

This is a prime example of the silent volatility tax imposed on investors who chase returns. In fact, it can end up being a double whammy, if the investments begin to swap relative momentum. That’s why Ben Graham said it best: “the essence of investment management is the management of risks, not the management of returns.” Rather than attempting to time markets based on volatile and lagging macro data, we suggest outcomes are better achieved through diversifying equity exposure among investment styles and remaining invested throughout the economic cycle. If you incorrectly chase returns, you may end up sounding like a dog with peanut butter on the roof of your mouth trying to explain the mistake to your client base.

Conclusion: Well, Let Me Just Quote Colonel Sanders, Who Said, “I’m Too Drunk to Taste This Chicken”

This year has been a great reminder that it pays to be a rational optimist when it comes to the markets. Pessimism about the long-term does not align in any way with a historic worldview. Investors can choose to believe that right now is the beginning of the end, but that is a bet against all of human history and against human nature itself. As has always been the case, progress occurs against an inevitable backdrop of catastrophe. Always has, always will. Invariably, you can always find what you are looking for and your investment results will probably mimic that worldview.

In a situation that has a long-term time horizon, such as many of your clients, it is never beneficial to make decisions based off short-term performance. Dealing with a client’s hard-earned capital tends to be accompanied by emotions, and making decisions in this state of mind tends to lead to uninformed and low conviction decisions. In times such as these, it will behoove you to stick to a plan and stay true to your structure.

At the end of the day, if you remain a rational optimist, there’s a high likely chance that you’ll wake up every morning and piss excellence.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2307-11.