Bears Sound Smart; Bulls Continue to Make Money

Bears Sound Smart; Bulls Continue to Make Money

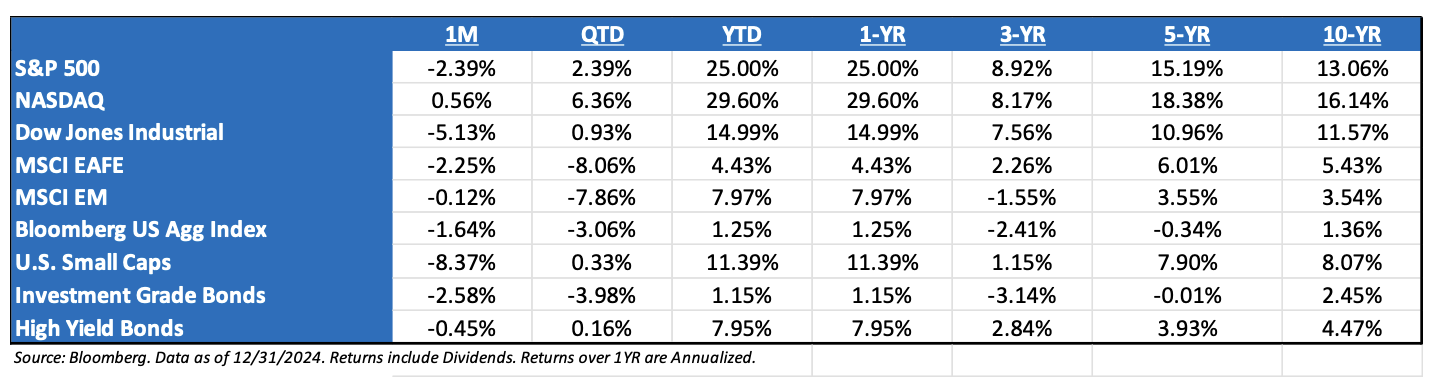

It was Déjà vu for the markets in 2024, as the S&P 500 returned 25.0%, officially entering into the third year of the current bull market rally. In fact, this was the first time since 1998 and 1999 that the S&P 500 produced back-to-back years of greater than 20% total returns. The superlative for “back-to-back years” above 20% for NASDAQ only dates to 2020 and 2021.

The rally in stocks in 2023 was mostly driven by hope of market friendly events: the end of rate hikes and start of rate cuts, the economy slowing to a soft, not hard, landing, AI profit explosions and positive geopolitical resolutions. The rally this year has been driven by the partial realization of those hopes: growth did slow but didn’t contract (soft landing), the Fed did aggressively cut interest rates, AI demand and excitement didn’t waver, and geopolitical crises didn’t get worse (although they didn’t get better).

As we enter 2025, the question for markets is whether the positive events realized in 2024 can last.

Does the soft landing stay in place, or does it deteriorate?

Does the Fed keep cutting rates or do they pause?

Does inflation fall to 2% or rebound?

Do pro-growth policy hopes get realized?

Yet, International didn’t experience that Déjà vu, as they continue to not be invited to the party. U.S. stocks outperformed the rest of the world by over 20% in 2024. This outperformance really kicked into gear in the last quarter of the year. European stocks trailed U.S. stocks by their largest margin in the 25 years since MSCI started tracking data. The lack of current and projected growth, alongside International lacking the narrative-du-jour –artificial intelligence – led to continued underperformance. The MSCI EAFE has not had back-to-back returns of over 20% since 2003 & 2004.

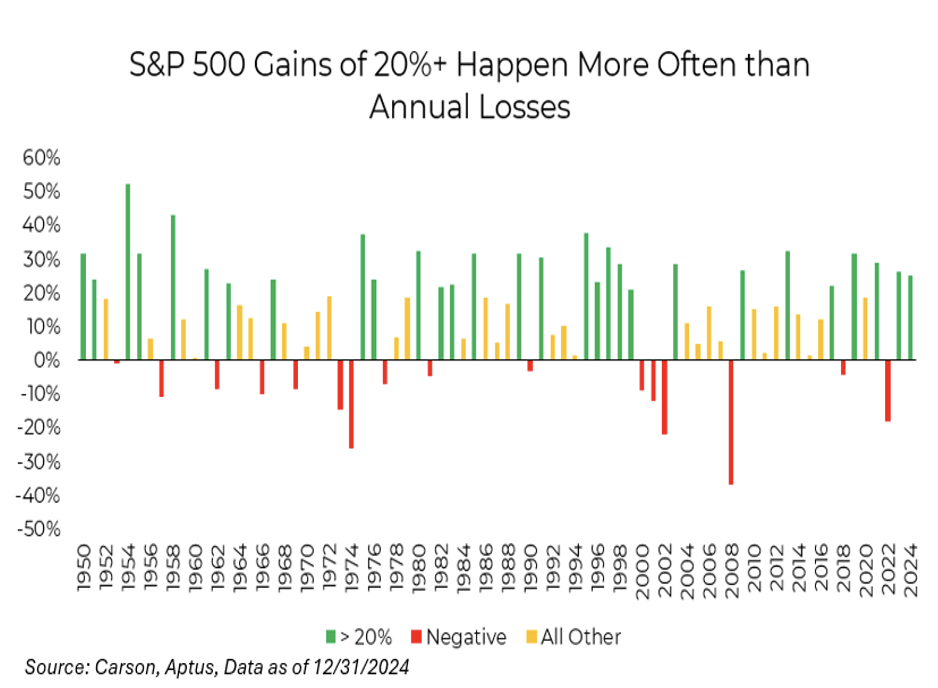

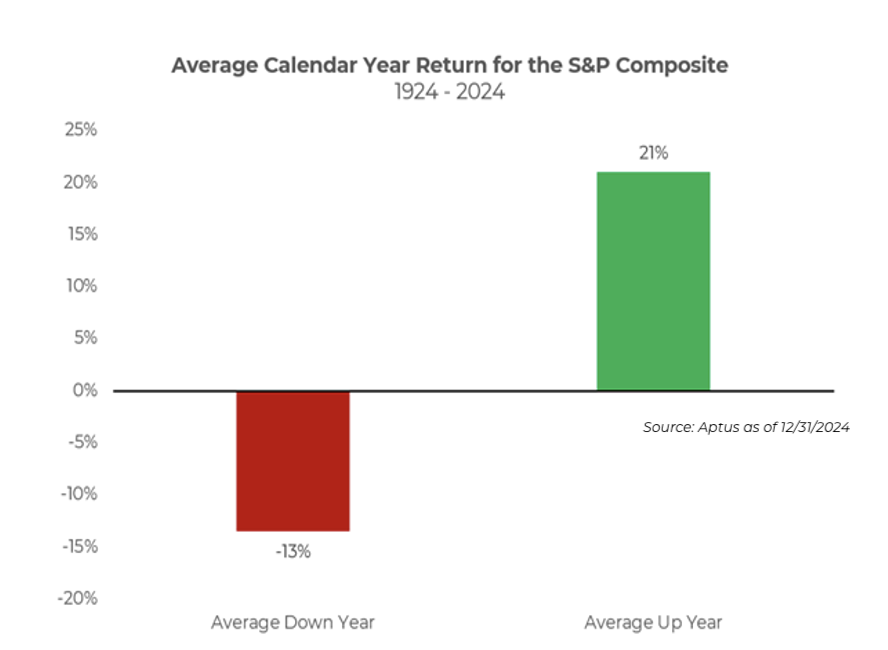

The strength in the domestic market isn’t something that should scare investors, as patience continues to be a more fruitful investing characteristic than being clever, i.e., trying to time the market. Large gains tend to happen more often than you think. In fact, since 1950, the S&P 500 has had more years with a return greater than 20% (22) than overall down years (21).

When dissecting returns from our Yield + Growth Framework, the majority of returns since 2020 have come from earnings growth – contributing ~63% of total return, while yield and valuation expansion have only contributed 15% and 22%, respectively. This landscape for returns is healthy – as the economy grows and businesses become more efficient, as does the market, i.e. it’s not completely funded by hopes and dreams through valuation growth.

For the time being, it looks like the prospects for continued monetary accommodation, relatively easy fiscal policy, and regulatory easing should continue to keep animal spirits alive for both investors and dealmakers.

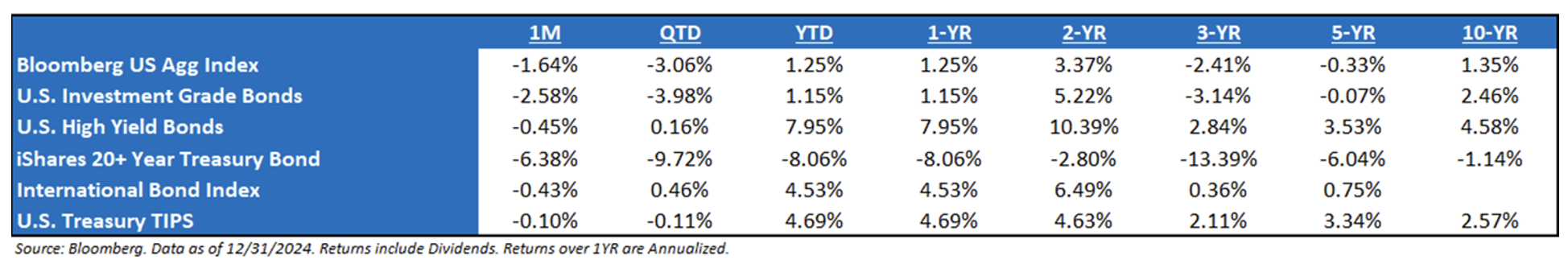

The Fixed Income Fireside Chat: Why are Bonds Struggling with the Fed Cutting?

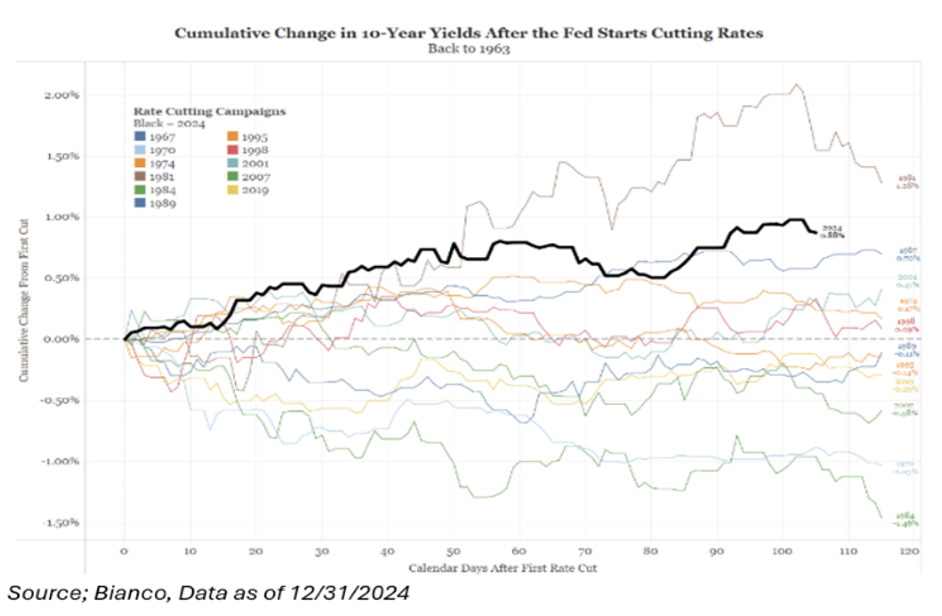

Simply said, this has been a very unusual rate-cutting cycle. Bucking the trend of history, interest rates have been rising since Jerome Powell and the Federal Reserve started their rate hiking cutting cycle in September. Since this meeting, the Fed has loosened policy by 100 basis points (i.e., 4 cuts), while the 10YR U.S. Treasury has almost had a like-minded move in the opposite direction – rates have increased ~90 basis points during this period.

The only other time that rates have witnessed a movement like this was in 1981 – a pivotal year in the bond history book, as then Fed Chairman, Paul Volcker, had to take unprecedented actions to attack unanchored inflation. We don’t want to make a direct comparison to this period of time, as inflation remains very much anchored over the long run, but we do want to understand why this period is an outlier.

The outlier comes from the long end of the yield curve, as it has altered from the typical playbook of rate cuts, which has historically seen lower long-term yields, why?

-

- The re-introduction of the term premium, as the government has a slew of Treasury refinancing needs coming in 2025,

- Slower-than-anticipated Fed cutting cycle, alongside disagreement between Fed Chairs, as to what and where policy should be heading,

- The resilient consumer leading to stronger current economic growth, and

- The expectation for continued use of fiscal policy to drive nominal growth under a President Trump regime.

Even though this short-term movement is an outlier, we prefer to focus on the terminal rate, which, over longer periods of time, may be a better determinant of the direction of the market. At the beginning of the year, the terminal rate was expected to be ~3.0%, but with the inflation proving to be stickier and the potential remaining for a reacceleration, the bar has shifted to a level closer to ~3.8%.

Why Does this Matter to the Market?

-

- Lower Rate Cuts Next Year: Essentially the Fed will be a less-powerful bullish force for the markets in 2025, as this could hinder growth.

- Recent Change in Fed Language: There was a change in language in the Fed statement that some interpreted as the Fed signaling it may be done with rate cuts for the time being.

Put differently, while fewer-than-expected rate cuts are a disappointment in the near term compared to market expectations, the facts tell me that the rate-cutting cycle is still in place, and, as a result, Fed policy remains supportive for stocks—just less so than before.

At the end of the day, we would expect continued volatility in interest rates, as the Fed continues to somewhat disagree where current rates and the terminal rate should be.

The Equity Fireside Chat: Can the Party Continue?

One of the most profound questions amongst investors is if the Magnificent Seven (“Mag 7”) will turn into the “Lag 7”, given the common belief that the market could be vulnerable to a reversal of trends if the cluster of tech-proxies propping up the market fell out of favor.

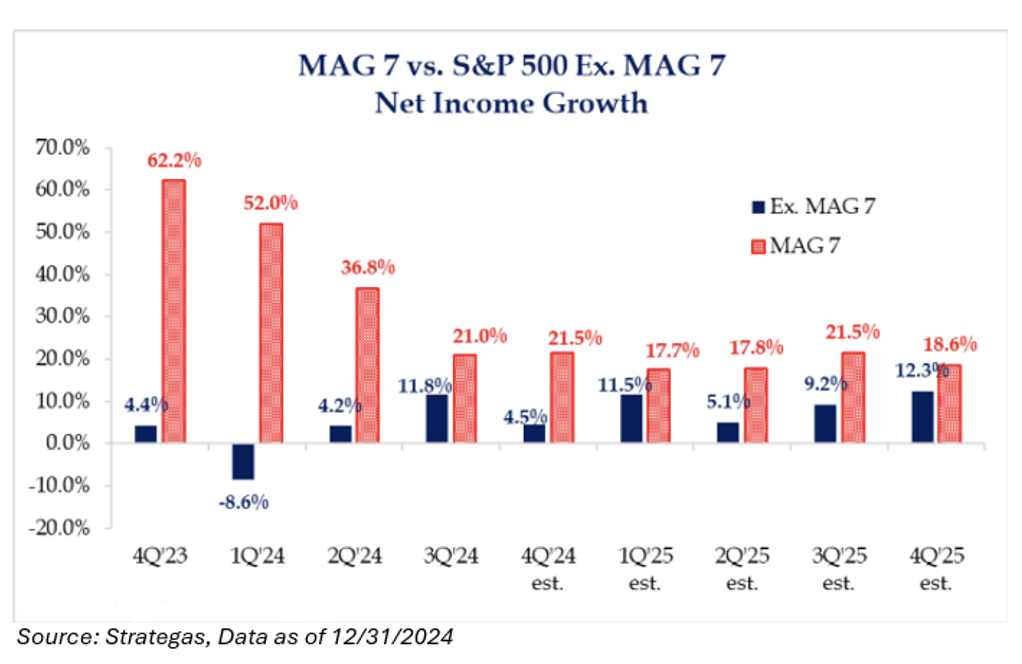

Though, we’d argue that it may be challenging to bet against this small cohort of companies. The biggest reason for this is the growth rates that they are expected to see next year are more thandouble that of the remaining 493. At 17-21% growth, money is going to continue to be attracted to these companies despite the elevated valuations, even in a potential market pullback.

More recently, many investors learned that if the Mag 7 does pull back, which is inevitable, it doesn’t presage poor future performance at the benchmark level. During the broadening rally in Q3 2024, the market witnessed this exact scenario but was insulated by the strong performance in the “average stock”.

While a short-term pullback in equity markets wouldn’t be surprising, history would suggest that it’s too soon to fade equities. Since its October 2023 low, the S&P 500 has rallied 44.1%. It may feel like the market can’t go higher, but history says that it’s not time to be short the market. While it’s always fun to try to call a market top, it tends to be more efficient to avoid fighting the market trend. But that doesn’t mean that pullbacks do not happen – they occur quite regularly and are very healthy.

Even after strong years of performance, it does not mean that the market is ready to take a breather. Since 1950, the market has witnessed 21 years (excluding 2024) of S&P 500 performance above 20%. The following year, the market was higher 81% of the time with an average return of 10.6%. It pays more to be patient than creative.

Then, it’s always great to remember that an “average” return year of 8% – 10% rarely happens – only 4 times since 1950 (~5% of the time). The moral of the story is that investors need to be prepared for more tails, both left- and right-tails, especially as the market now exhibits the characteristic of operating leverage.

But, in case there is turbulence, our allocations own volatility as an asset class. And owning long volatility is like salt. Not very appetizing by itself (low return), but when added to a dish it can make everything taste better. You can’t subsist on salt alone, nor would you be tempted to try. But it’s a powerful enhancer when deployed properly.

Like salt, long volatility is the magic elixir that allows our allocation to be overweight stocks, underweight fixed income, but risk neutral. We believe that this is the most efficient way to deploy capital in the current environment, as the animal spirits can remain very much alive, given the amount of fiscal and monetary stimulus being pumped into the market to engineer nominal growth.

For Aptus 2025 Market Outlook, please click here.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2501-3.