Aptus Compounder Update

The Aptus Compounder Stock Sleeve is designed to give equity exposure to a group of individual stocks that we think offer attractive prospects through a combination of yield, growth, quality, and reasonable valuations relative to large cap peers.

Overall

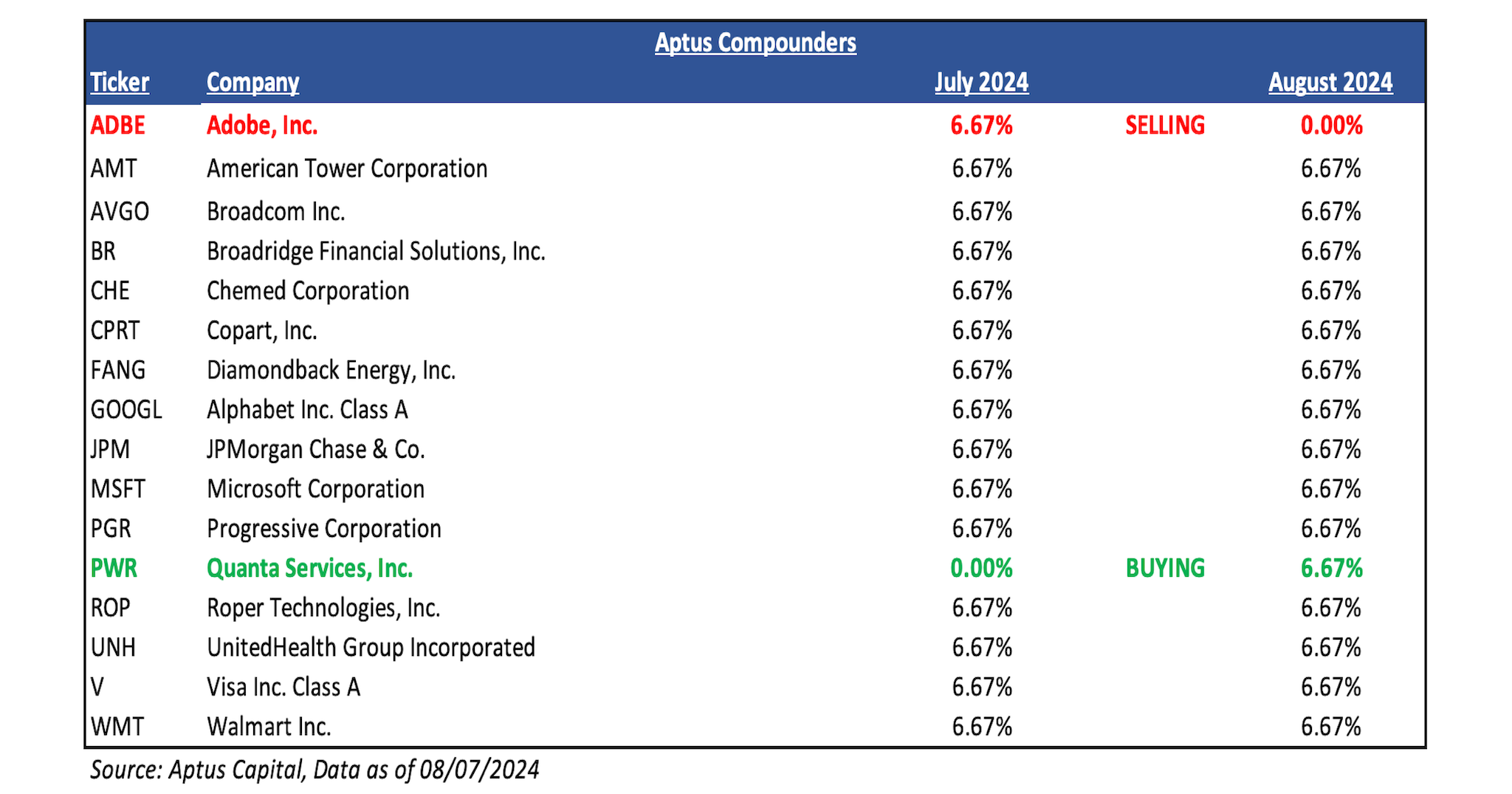

It has been a while since Aptus Compounders has had a trade – this has been purposeful. Behaviorally, investors want trades, especially during periods when the market is going straight up or witnessing some volatility. But, truthfully, sometimes no trade is the best trade. There is a substantial amount of work that goes on behind the scenes vetting each one of these companies to make sure that we have full conviction in the management team to execute their strategy over longer periods of time. As we’ve always said, the best way to win over longer periods of time is to utilize time to your advantage. And that’s the most important elixir for these stocks to succeed – the namesake of this strategy is to increase one’s odds of successfully compounding capital, and we believe that all of the current holdings exhibit characteristics that can allow them to do so.

Patience is necessary. I’ve continued to say that it pays more to be patient than clever, and for the most part of this year, the strategy has been underperforming its benchmark, the S&P 500. Solely due to not owning NVIDIA Corp. (NVDA). As of 08/02/2024, the strategy started outperforming the benchmark, as we patiently waited for the most opportune time to make a trade.

Sale

The strategy has held Adobe, Inc. (ADBE) for almost four years, as it has served as a pivotal position in helping the strategy correlate in the Technology sector. The overall transition to a subscription-based model for ADBE has been very instrumental to owning this name and considering it a compounder – the management team, led by Shantanu Narayen, has done a great job internally positioning the company for success, i.e., bringing Firefly, its AI-based program, to the market in very quick fashion. Unfortunately, we believe that there are some exogenous forces that can potentially disintermediate the company in the future. The company showed their cards with the multiple they were willing to pay for their now failed acquisition of FIGMA (50x Revenue) and news that FIGMA’s most recent round of fundraising came in 40% below that attempted acquisition price tag does not reflect well on management either. ADBE’s reluctance to build a web app to challenge FIGMA, the aggressiveness of Canva to enhance their AI capabilities with an AI startup acquisition (Leonardo.ai), and constant new competition in the AI space from the likes of tech giants like Microsoft provide a great deal of concern for the competitive edge that enticed us to purchase ADBE in the first place.

Purchase

After the recent pullback in Quanta Services, Inc. (PWR), a name that we have followed for a very long time, we finally believe it is an opportune time to initiate a position in the Aptus Compounders portfolio. PWR is a core holding for energy transition portfolios as the go-to picks & shovels pure play for domestic energy transmission and communications infrastructure. As the leading specialty construction services franchise in this field, we are attracted to PWR’s alignment with the electrification of everything megatrend, which overlays a commendable track record of consistent earnings growth, ROCE, and shareholder returns. Present valuation, not surprisingly toward the upper end of historic ranges, aptly reflects the scarcity of PWR’s enviable thematic alignment with a blue-chip earnings/cash flow pedigree.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

Information presented in this commentary is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Information specific to the underlying securities making up the portfolios can be found in the Funds’ prospectuses. Please carefully read the prospectus before making an investment decision. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy.

The company identified above is an example of a holding and is subject to change without notice. The company has been selected to help illustrate the investment process described herein. A complete list of holdings is available upon request. This information should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the holdings listed have been or will be profitable, or that investment recommendations or decisions we make in the future will be profitable.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy call (251) 517-7198. ACA-2408-14.