Talking Points – Compounders

Overview: The volatility during the year has presented us with a few opportunities to take advantage of depressed pricing in some high-quality companies. Not only did we find some great deals, these trades focus on executing the following:

- Increase portfolio stock dividend yield to be greater than the benchmark,

- Bring down the overall valuation of the portfolio without sacrificing quality or growth, and

- Harvest losses.

Buying:

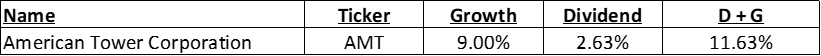

- American Tower Corporation (AMT)

What Do They Do? AMT owns cell phone towers through a Real Estate Investment Trust (“REIT”) structure.

What is Our Thesis? American Tower Corporation (AMT) has established a dominant business in the global cellphone tower space – no other peers even come close to the exposure that AMT has internationally, as measured by revenue. AMT’s management team has done an exceptional job of allocating capital to both reinvesting in future growth/technology, as well as distributing capital back to shareholders through dividends. As growth in connectivity and data consumption continues, we believe AMT is well positioned to reap the benefits in both its U.S. and global businesses. Globally, AMT has the global infrastructure in place to maximize the benefits of connectivity expansion, as the technology cycle catches up outside the U.S. Furthermore, the U.S. has seen a huge uptick in cellular data usage, which has an annualized 30% increase in data consumption over the last five years. This could provide ample opportunity to upgrade its equipment, all while garnering higher marginal business.

![]()

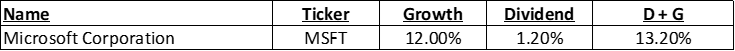

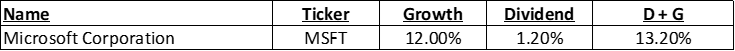

2. Microsoft Corporation (MSFT)

What Do They Do? Microsoft Corporation, leading developer of personal-computer software systems and applications.

What is Our Thesis? We see a collection of sustainable advantages in the Microsoft story including: 1) strong positioning in fast-growing, innovation-heavy markets including public cloud, gaming, and digital advertising; 2) significant scale advantages from the cumulative effect of years of investment; and 3) deep, established relationships with enterprise software purchasers and essentially universal brand recognition, which 4) positions Microsoft as a “low risk” vendor that can take share regardless of (or perhaps especially during) periods of soft economic conditions.

Selling:

- Amazon.com, Inc. (AMZN) – Given valuation, we think AMZN could trade range-bound until there is evidence of the macro storm clearing and a sustainable improvement in profitability.

- Fidelity National Information Services (FIS) – We have been very disappointed in the management team’s execution. We continue to very much like the name, given its valuation, but too many knocks to the name have taken this name off of our “high-conviction” list.

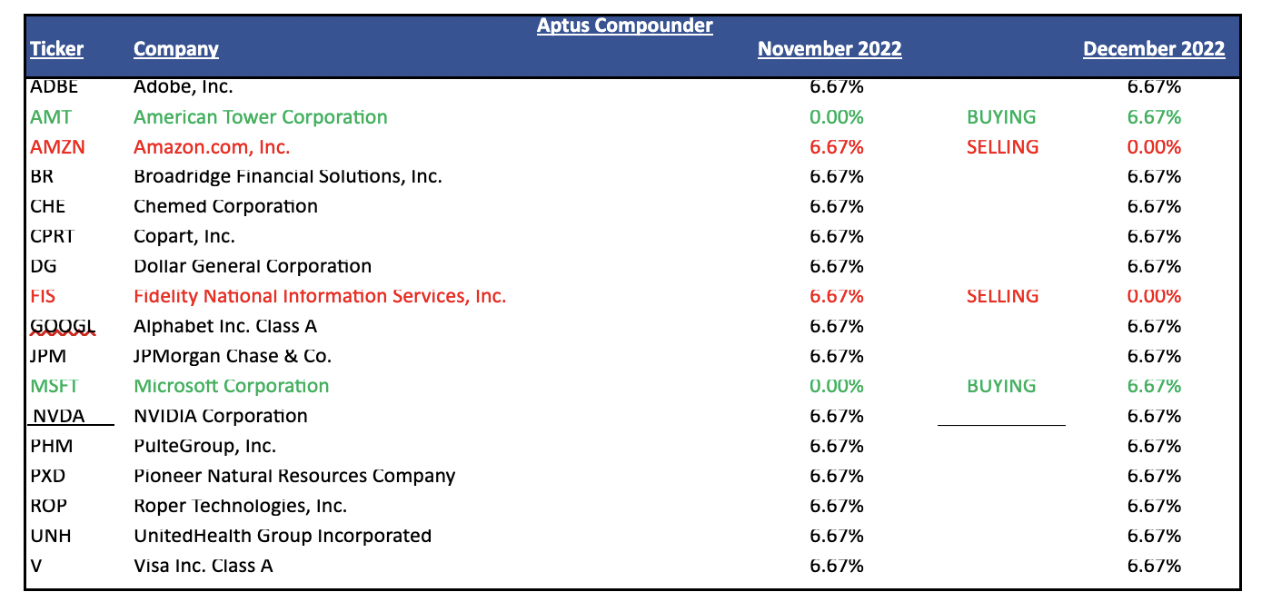

Aptus Compounders Trade Rationale

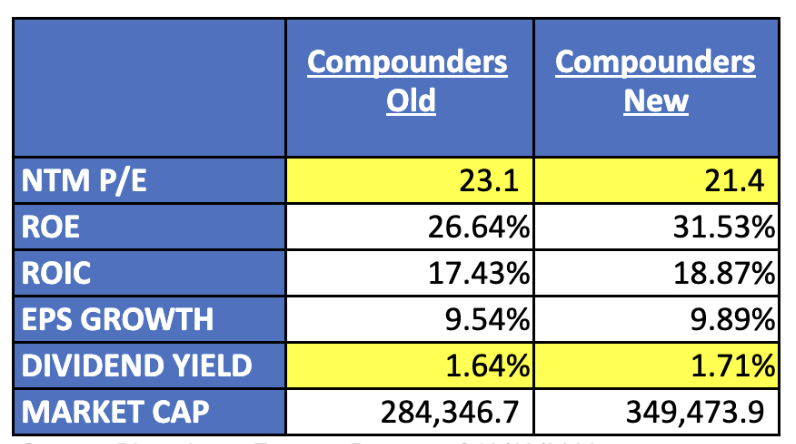

We’ve been accustomed to saying that portfolio construction is just as important as having the correct names in the Aptus Compounders Stock Sleeve. While we remain very convicted in all of the names within the portfolio, we wanted to take advantage of the volatility to find names that we believe are high-quality companies, but also check the box of bringing down overall portfolio valuation, while increasing dividend yield, without sacrificing quality or growth.

Given our belief that cheaper valuation and higher yield will begin to play a larger role in the composition of total return, we wanted to put our money where our mouth was. By selling Amazon.com, Inc. (AMZN) and Fidelity National Information Services, Inc. (FIS) and purchasing Microsoft Corp. (MSFT) and American Tower Corp. (AMT), we were able to do just that.

Source: Bloomberg, FactSet. Data as of 12/12/2022

As you can see, we are bringing down portfolio valuation (23.1x 🡺 21.4x), even with the sale of our lowest valued name, FIS. Not only that, but we are also increasing the portfolio’s yield with sustainable and growing dividends. With these trades, we were able increase our yield to be greater than the S&P 500’s yield of 1.66%.

Sell Rationale:

AMZN – At its core, we are selling AMZN because we believe that there are other viable candidates that will get an investor the same or better growth profile and fundamental stability at a cheaper valuation. We have full faith in the company’s cloud-based servicing company, AWS, but do think that the stock is pricing in too much of a consistent growth profile, given the valuation. Coupled with that, the retail side of the business is also seeing weakness.

We’ve continued to say that Amazon does well when it is harvesting, not when it is investing. Though, many of the capital- intensive investments are in the rearview mirror, the company has seen rising costs which will reduce the visibility of when operating margins will inflect higher. Furthermore, AMZN has highlighted softening throughout the quarter on macro weakness, which makes us more near-term cautious on growth.

We think AMZN could trade range-bound until there is evidence of the macro storm clearing and a sustainable improvement in profitability.

FIS – We’ll willingly admit that this company has been the most frustrating stock to own during the existence of the Aptus Compounders portfolio. Given a few management missteps, we believe that the company will be on a long road to redemption.

Fundamentally, we believe that there is further risk to next year’s earnings estimates, as we believe the Street is baking in close to a best-case for timing/magnitude of cost saves, and 2) while we’re hopeful an investable story emerges around margins, FCF, and achievable medium-term targets, the path to a re-rating in the near-term is challenging with banking growth decelerating, our belief that margins are unlikely to expand until the second half of next year, and Merchant undergoing a multi- year transition.

We do think that this company is ripe for an activist investor right now, which could ultimately prove for this trade to be the wrong decision. FIS has gotten so cheap that even just spinning off the merchant business would unlock value and you don’t need to assume any heroic multiple to get meaningful upside. Yet, given that no one has stepped to the plate, like Elliott with PYPL, we are comfortable moving on from the name.

While the company’s most recent earnings guidance could fully well be the “kitchen sink” moment, we decided to sell the name due to multiple messaging missteps from the management team, alongside a lack of execution from a cost perspective.

Company Overview:

American Tower Corporation, organized as real estate investment trust (REIT), is the largest independent U.S.-based owner of cellphone towers. The company’s rental and management operations include leasing antenna space on multi-tenant communications sites to wireless service providers, radio and television broadcast companies, and wireless data providers.

Highlights:

American Tower is the largest of the Tower REITs and the largest REIT. Compared to its tower peers, AMT has differentiated itself by more aggressively expanding into international markets—particularly developing countries. For the most part, this has allowed the company to drive a modestly higher growth rate. However, the inherent risks of investing in the developing world have resulted in higher churn in some markets, particularly India. That said, the worst of the churn seems to be behind the company, and a return to strong organic growth is expected for the next few years.

Bull Case:

- Competitive Moat → Economies of Scale – Investors always ask why don’t Telecom carriers own cell phone towers themselves? AMT estimates that carriers that want to build and operate their own towers over 20 years would have to spend $445K. Leasing a tower from a REIT, like AMT, will save them about $200K, providing a competitive advantage for carriers to use cellphone tower REITs. Cellphone tower owners can offer lower prices to tenants as the business is highly scalable because there is very little marginal cost to adding new tenants to assets already in place.

- Stability During a Downturn – We believe cell phone towers are a great business thanks to the long-term leases with its tenants, which tends to average between 5- to 10-years in duration. Not to mention, these contracts usually come with a 3% annual rental increase built into the provisions. In our opinion, this creates a recession-resistant nature, meaning that the counterparty risk tends to be low, and that cash flow stability across economic cycles is very high.

- Longer Runway for Future Growth Internationally – The growth seen in the U.S. market is expected to bleed into international markets. Wireless markets have been following similar growth trajectories as the U.S., and 45% of AMT’s towers are outside the U.S. This global scope affords a compelling runway for reinvestment. Globally, data usage is similar to that in the US, but emerging markets like India, Brazil, and Mexico have longer growth runways due to being about 10 years behind in terms of mobile networks.

Bear Case:

- Capital-Intensive Business – Though a highly stable industry, cell phone towers tend to be a highly capital-intensive business. Each year, telecom giants invest about $30 billion to improve and maintain 4G networks, and every decade- or-so, a new standard, i.e., 5G now and 6G coming in the late 2020s, means a never-ending capex hamster wheel.

- International Risk Exposure – AMT roughly generates 45% of its revenues from international sources, with a significant amount of that being in emerging markets. Overall, and relative to cellphone tower peers, the company has increased risks – geo-political, regulatory, corruption, and FX volatility.

- Concerns in India – Collections issues with Vodafone Idea Limited (VIL) in India resulted in $48m of incremental revenue reserves and payment shortfalls this past quarter. Performance in India has long been an overhang on AMT. We think the worst is now in the past, as the market has shrunk to just four players from twelve (limiting future churn, all else equal), but tenant health remains a concern. We don’t believe that this will inhibit the company’s growth profile as it appears already discounted by the market.

Overall Thesis:

American Tower Corporation (AMT) has established a dominant business in the global cellphone tower space – no other peers even come close to the exposure that AMT has internationally, as measured by revenue. AMT’s management team has done an exceptional job of allocating capital to both reinvesting in future growth/technology, as well as distributing capital back to shareholders through dividends. As growth in connectivity and data consumption continues, we believe AMT is well positioned to reap the benefits in both its U.S. and global businesses. Globally, AMT has the global infrastructure in place to maximize the benefits of connectivity expansion, as the technology cycle catches up outside the U.S. Furthermore, domestically, the U.S. has seen a huge uptick in cellular data usage, which has an annualized 30% increase in data consumption over the last five years, which could prove ample opportunity to upgrade its equipment, all while garnering higher marginal business.

![]()

Company Overview:

Microsoft is the world’s largest software company and the leading provider of operating systems for the PC and server markets. The company’s ubiquitous Windows operating system had 95% share of the global PC market in 2013 and 63% of the global server market. Additionally, Microsoft Office continues to be the dominant productivity suite. The company is also a leading provider of video game and entertainment consoles and video games through its Xbox platform. With its purchase of Nokia Devices & Services, Microsoft is the leading mobile phone vendor and entered the tablet market with its Surface line. Microsoft’s Azure is a leading provider of cloud-based Platform as a Service. Founded in 1975, Microsoft’s is based in Redmond, WA and has 128,000 employees globally.

Highlights:

Microsoft has high visibility and a clear line of sight into double-digit revenue growth for the foreseeable future. Other reasons to like the story include: 1) safest large- cap investment option, 2) multiple growth drivers, 3) levered to favorable secular trends,

4) ensuing profitability and free cash flow from strong revenue growth, and 5) continuing return of capital to shareholders.

Bull Case:

- Cloud Investments Driving Sustainable Moat in Large and Fast-Growing Market – Microsoft’s significant investments in scaling its cloud platform, Azure, have driven strong returns, becoming the #2 player in a sizable and growing market that can support multiple winners and continues to consolidate among the largest players. Microsoft’s history with enterprise IT purchasers (and ease of integration with its workplace products) has helped the company come to the forefront of the on-prem to cloud shift.

- Cloud Innovation a Force Multiplier for the Remainder of the Portfolio – Microsoft’s investments in cloud technology, aside from the IaaS and PaaS capabilities of Azure, are powering notable advances across its product portfolio, in areas as diverse as CRM/ERP offerings, security, gaming, and advertising. Microsoft is able to invest at a scale that most other competitors in these markets cannot match, and we do not view investment in Azure as a standalone, rather as a multiplier for the rest of its product portfolio.

- Durable Growth Potential – From FY18-FY21, Microsoft sustained a 15% CAGR, adding ~$60B of revenue to $168B total. Even more impressive, most of this came organically with $23B from Azure, $12B from Office, and$5B from Gaming (LinkedIn added $5B). We expect Microsoft to maintain a mid-teens CAGR from FY21-FY24 off an already large $168B base.

Bear Case:

- Negative Margin Pressure in the NT as Azure Mix Increases – Microsoft could see some near-term gross margin pressure as the Azure business grows as a percentage of overall revenue. While Microsoft’s on-premises offerings offer a high margin profile, growth in these lines of business is decelerating. The company believes its SaaS offerings (EMS, Office 365, LinkedIn, and Microsoft Dynamics) are close to reaching steady state gross margins, however the IaaS and PaaS business still has room for margin leverage. Ultimately Microsoft believes it could achieve gross margins that surpass AWS margins (55-60%).

- Application Spending is Highly Cyclical – Enterprise application spending has proven to be highly cyclical, given the more discretionary nature of applications projects. During an economic slowdown, when firms are faced with shrinking IT budgets, projects involving application upgrades, migrations or new installations are often deferred. This could present a higher degree of risk for bookings deceleration for Microsoft and other application vendors, in the event of an economic slowdown.

- Azure Growth Could Slow – While we maintain the view that public cloud remains early days, a material slowdown in Azure growth could impact the stock and future growth.

Overview:

We see a collection of sustainable advantages in the Microsoft story including: 1) strong positioning in fast-growing, innovation- heavy markets including public cloud, gaming, and digital advertising; 2)significant scale advantages from the cumulative effect of years of investment; and 3) deep, established relationships with enterprise software purchasers and essentially universal brand recognition, which 4) positions Microsoft as a “low risk” vendor that can take share regardless of (or perhaps especially during) periods of soft economic conditions.

Disclosures

Past performance is not indicative of future results. Investing involves risk including the potential loss of principal. This material is not financial advice or an offer to sell any product. The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Aptus Capital Advisors, Inc. reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Forward looking statements cannot be guaranteed. The holdings identified above represent all of the securities purchased, sold, or recommended for the adviser’s clients. A complete list of holdings is available upon request. This is not a recommendation to buy or sell a particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein. Information was obtained from third party sources which we believe to be reliable but are not guaranteed as to their accuracy or completeness.

This content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2212-21.