Below is a brief rationale behind the rebalance directions given by our PM team. We will be working through these changes and anticipate being fully positioned in early February. You can expect to see the updated models from us in the coming days.

The highlights of this rebalance are below:

- Increase Developed and Emerging Market Equities

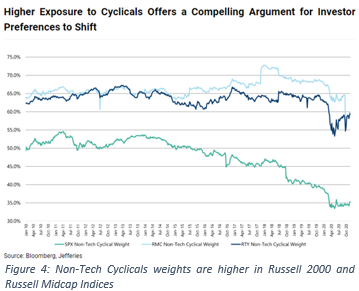

- Increased Smaller Cap exposure

- Reduce Hedged Equities

To start, here is a blurb from our March 2020 model rebalance rationale:

“Future growth prospects on the other side of this worldwide slowdown should be attractive.”

Our last major rebalance in March 2020 was during a time when markets were in chaos. Volatility was spiking, equities were selling off and our economy was just beginning to shut down. We have seen an incredible recovery in markets, as evidenced in Figure 1 above showing performance since the last market peak on February 19th, 2020.

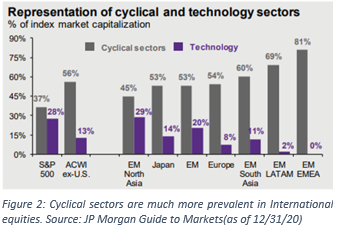

As it relates to this rebalance, we are looking to increase cyclicality in our portfolios by decreasing hedged equity and bond allocations. While we are still holding true to our Drawdown Patrol methodology, we are using improving economic conditions, accompanied by global growth, as a backdrop to seek higher upside capture in portfolios. To do this, we are adding to Developed and Emerging Markets and moving down the capitalization range in our domestic equities, all areas that have more cyclicality and have historically performed well when markets are coming out of recessions.

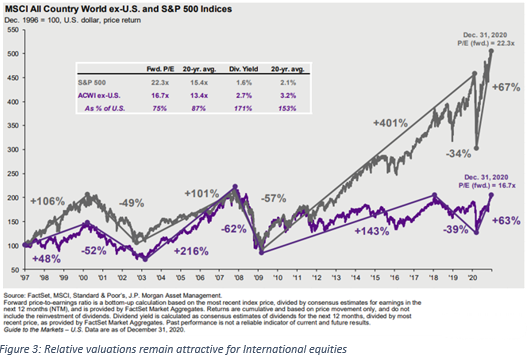

While we are focusing more on upside capture, we are not chasing performance or sacrificing all the strong downside protection we strive to have in our portfolios. Despite the recently strong performance in International, we think valuations remain attractive and the gap in longer-term performance remains wide. We see the increases in risk as small tweaks, more pronounced in our more aggressive portfolios. In the more conservative portfolios, we are shifting away from traditional bonds that we feel hold a great deal of risk in that interest rates are near all-time lows, prospective returns could be meager, and the benefits of strong returns in selloffs look to be muted.

Moving forward:

As global economies recover after they were sent reeling from the pandemic, we feel we are in a good position to be able to increase exposures in riskier areas we believe will benefit. We are seeing global macro analysts forecast increased growth, with optimism we will see reopening economies soon as the vaccine is distributed. With this rebalance, we feel the models are positioned to further benefit in multiple environments and we feel good about the participation levels in both up and down markets moving forward.

Plans for redeployment:

Where it applies in your portfolios, you will see an increase in International Equity (SPDW/SPEM), Smaller Capitalization exposures (OSCV/RSP), Aptus Defined Risk (DRSK), and non-traditional fixed income with Quadratic Interest Rate Volatility and Inflation Hedge (IVOL). There will be decreases to Risk-Managed positions; Aptus Collared Income Opportunity (ACIO) and Aptus Drawdown Managed Equity (ADME) and traditional bond exposures (SPAB, ICSH)

Please reach out with any questions at all. As always, thanks for your trust.

The Aptus Team

Disclosures

The Impact Series is a model portfolio solution developed by Aptus Capital Advisors, LLC. Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training.” For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy contact us. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities or to advise on the use or suitability of The Impact Series, or any of the underlying securities in isolation. Information specific to the underlying securities making up the portfolios can be found in the Funds’ prospectuses. Please carefully read the prospectus before making an investment decision.

Investing involves risk. Principal loss is possible. Investing in ETFs are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of the shares may trade at a discount to its net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a Funds ability to sell its shares. Shares of any ETF are bought and sold at Market Price (not NAV) and are not individually redeemed from the fund. Brokerage commissions will reduce returns. Market returns are based upon the midpoint of the bid/ask spread a 4:00pm Eastern Time (when NAV is normally determined for most ETF’s), and do not represent the returns you would receive if you traded shares at other times. Diversification is not a guarantee of performance, and may not protect against loss of investment principal.

This information should not be relied upon as investment advice, research, or a recommendation by Aptus Capital Advisors (“ACA”) regarding the funds, the use or suitability of the model portfolios, or any security in particular. This material does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon.

Carefully consider the funds within the model portfolios, investment objectives, risk factors, and charges and expenses before investing. The yield and expense ratio data is sourced from Bloomberg and more information on specific funds can be found in the fund’s prospectus or summary prospectus which can be obtained by visiting the fund’s website. Read the prospectus carefully before investing. In the event that a proprietary Aptus product is recommended and utilized, Aptus will receive a fee in accordance with the applicable prospectus.

The Aptus model portfolios were created in 2017. Neither Aptus nor any other party has invested in these models prior to 2017. Aptus makes no guarantees, representations or covenants regarding the ability of these model portfolios to achieve objectives or any particular results. Aptus expects that an investor’s financial advisor will perform all appropriate suitability analysis.

Past performance is not indicative of future results All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk. Aptus model portfolios are subject to specific risks. Investor’s return and principal value of investment may fluctuate such that an investment, when liquidated, may be worth more or less than their original investment. The more aggressive the Aptus model selected, the more likely the strategy will contain a larger percentage of riskier asset classes.

Holdings of individual client portfolios may differ, sometimes significantly, from target portfolio allocations shown. Market movements may cause portfolio holdings to be temporarily outside of target allocations. The target allocations are subject to change without notice. ACA-2101-18.