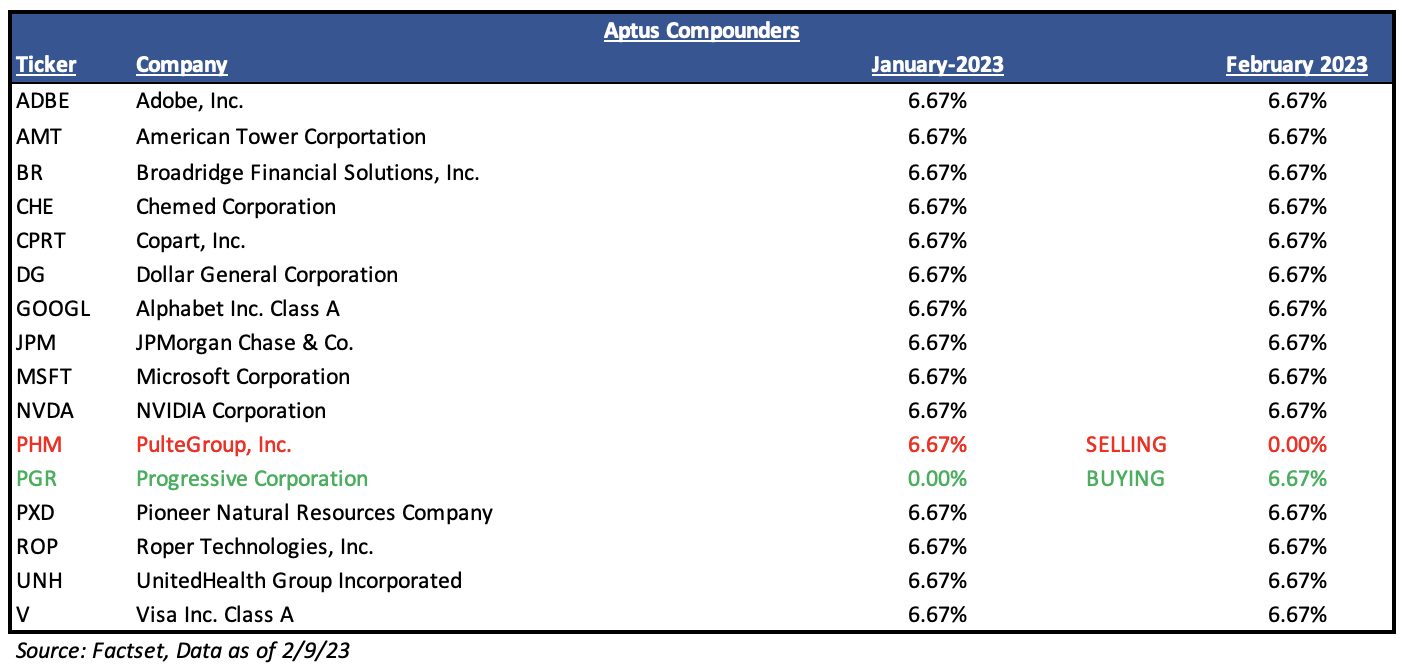

Aptus Compounder Update

The Aptus Compounder Stock Sleeve is designed to give equity exposure to a group of individual stocks that we think offer attractive prospects through a combination of yield, growth, quality, and reasonable valuations relative to large cap peers.

Sells

Let us first say this – we are selling PulteGroup, Inc. (PHM), not due to fundamental deterioration, but due to portfolio construction reasons. We strongly believe that PHM is undervalued at current levels, even after the recent share appreciation. In fact, we would love to own PHM in the future if the “Yin and Yang” of the portfolio allows.

We purchased PHM when it was trading below tangible book value (“TBV”), i.e., the market was valuing the company below what the assets could be sold off the balance sheet for at market value. As of 2/7/23, PHM continues to trade below its historical average of 1.5x TBV. The company has made quite a transformation since the global financial crisis – it has substantially de-levered its balance sheet along with transforming into a more asset-light business model. Historically, companies that have successfully navigated this transition have been highly rewarded by the market – semiconductors, trains, and most recently, E&Ps.

Sometimes it takes a nasty environment, much like we are witnessing now for the housing market, to recognize and reward the newfound resiliency of the more efficient business. We continue to remain very convicted in PHM. Yet, we believe that the Aptus Compounders portfolio is tilting too “risk-on” right now, thus we are realizing our gains made in the name and transferring capital into a stock that we believe embodies more “risk-off” characteristics.

Purchases

With the proceeds of our sale, we are purchasing Progressive Corporation (PGR). Albeit Flo, the company’s advertising figurehead, PGR is actually a high-quality company. In fact, we believe that it embodies a competitive moat that can provide long-term tailwinds around pricing inelasticity. We consider PGR to be a Consumer Staples company more so than a financial product.

Progressive has been one of the most successful auto insurance companies in terms of market share growth over the last 20 years, reflecting evolving consumer purchasing habits where call centers and the internet have become more prevalent. We believe Progressive is one of the best-positioned companies that we have fundamentally researched lately, considering the company’s competitive position that includes a more flexible pricing platform and technology solutions that monitor and price for distracted driving.

We continue to believe PGR should be a leading beneficiary from the dislocations in the auto insurance marketplace as most carriers continue to implement substantial rate increases over the next 12 months. We believe PGR’s approach to underwriting / auto insurance loss reserves could position PGR to continue to outperform on an underwriting basis reflecting the company’s pricing competitive moat.

We believe that PGR is undervalued relative to other areas of the market that have historically provided capital insulation during bouts of market volatility. Given the portfolio’s recent “risk-on” tilt, we decided to shift assets into a security that we believe could provide downside protection, thus creating an overall portfolio that we think is in parity with risk.

See updated Compounder Case Studies here

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

Information presented in this commentary is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Information specific to the underlying securities making up the portfolios can be found in the Funds’ prospectuses. Please carefully read the prospectus before making an investment decision. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy.

The company identified above is an example of a holding and is subject to change without notice. The company has been selected to help illustrate the investment process described herein. A complete list of holdings is available upon request. This information should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the holdings listed have been or will be profitable, or that investment recommendations or decisions we make in the future will be profitable.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy call (251) 517-7198. ACA-2302-13.