Investors should have one goal – to compound capital. A sufficient compounded return is at the heart of all things related to financial goals. The main objective of our investment team is delivering sufficient compound returns for our clients while maintaining a level of volatility they can tolerate. We believe our allocations deliver an innovative way to invest your hard-earned capital, given an uncertain short-term outlook for markets.

Our Message

Our message consistently reiterates the importance of asset allocation decisions, improving yield plus growth (Y+G), and being better in the tails.

-

- Asset Allocation Decisions drive 92%+ of long-term success.

-

- Improving the “Y+G” of your portfolio improves the compounded return.

-

- Better in the tails (via tackling Longevity Risk & Drawdown Risk)

3 Pillars to Control the Asset Allocation

-

- Stock/ Bond allocation → We want to overweight stocks versus a comparative benchmark allocation. We give our portfolios a better engine.

-

- Exposure to Risk Mitigation → This is two-fold; risk mitigation enables us to allocate to more stocks but also presents the opportunity to create capital to redeploy after markets trade lower (and future return potential is higher). This rebalance will slightly increase our hedged exposure.

-

- Enhanced Income → In contrast to the above statement on risk management, the ability to enhance yield is currently less attractive given muted volatility. As market environments change, your investment team is on the front lines to make slight tweaks to the allocations in response.

What You’ll See in this Rebalance

- Continue to Implement a Structure of More Stocks & Less Bonds.

- Slight Increase to the Average Stock and Quality Small caps.

- Lean into Volatility, as we believe the current cost of hedging is attractive.

Average Stock is Attractive

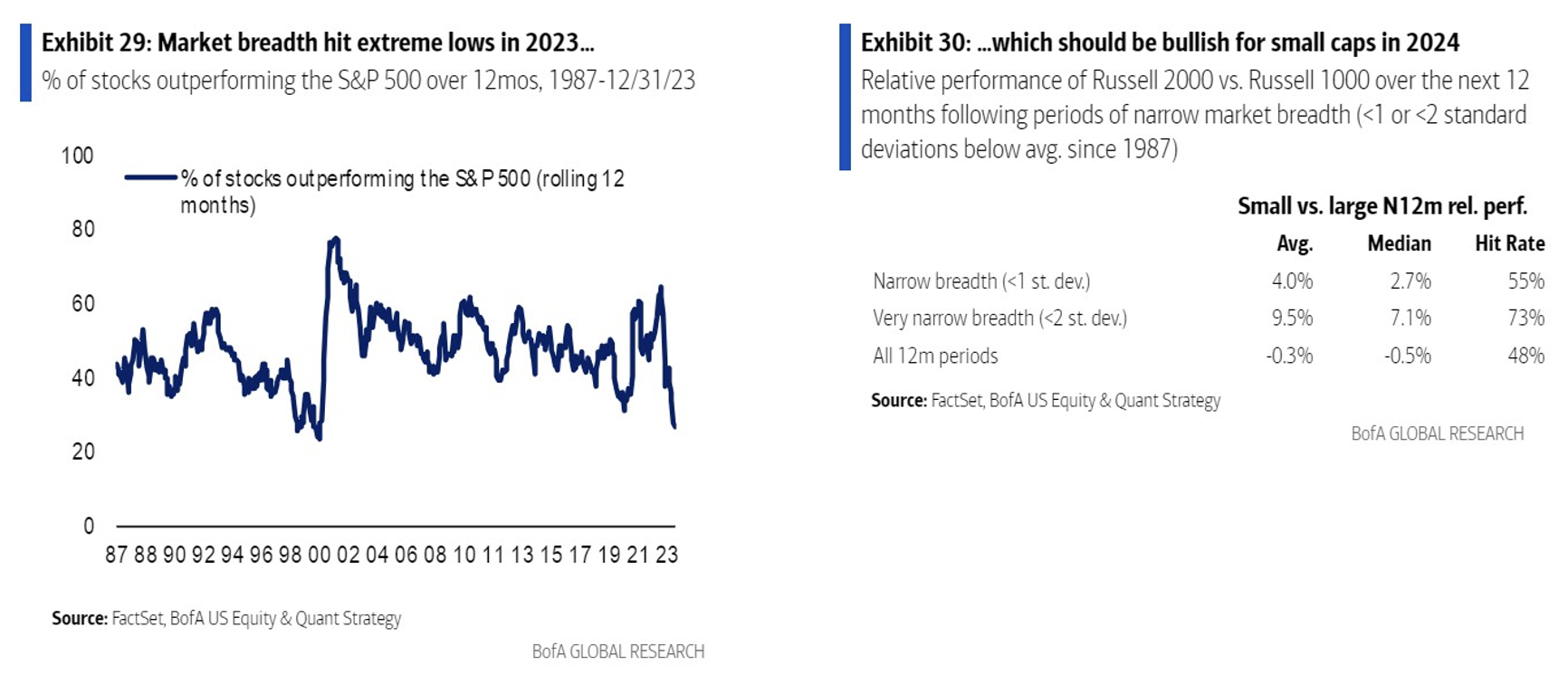

Source: Bank of America as of 01.19.2024

Source: Bank of America as of 01.19.2024

We believe only some parts of the equity market are priced for Fed dovishness. For equities, lower rates mechanically mean future cash flows are discounted at a lower discount rate, which increases the present value of assets. With the S&P currently at an expensive valuation, it could appear on the surface that cuts are already fully priced in.

However, the Mag7 were responsible for the majority of 2023 gains (~70%). We think there is an opportunity in the parts of the stock market that are still pricing in recession risk, like Small caps as well as the average stock. We believe those factors could outperform if recession is averted.

Ultimately, growth matters for equities. If the Fed fails to deliver cuts because growth remains robust, the growth upside surprise should be positive for earnings and thus equities. In line with this, equities have historically done well in soft or soft-ish landings.

-

- 2023 was a record-breaking year for bad market breadth. Historically, improving breadth has been bullish for small caps. Small caps have historically led following narrow markets.

-

- Profits look to be bottoming – which typically favors small caps.

-

- Macro support: Small caps / the Average Stock should benefit from Fed rate cuts.

-

- Small caps trade at a 25% historical discount to large caps. We believe our focus on valuation and quality can improve our allocations.

And while we don’t invest based on politics, small caps have historically done well between midterm and general elections so some pent-up buying could be lurking.

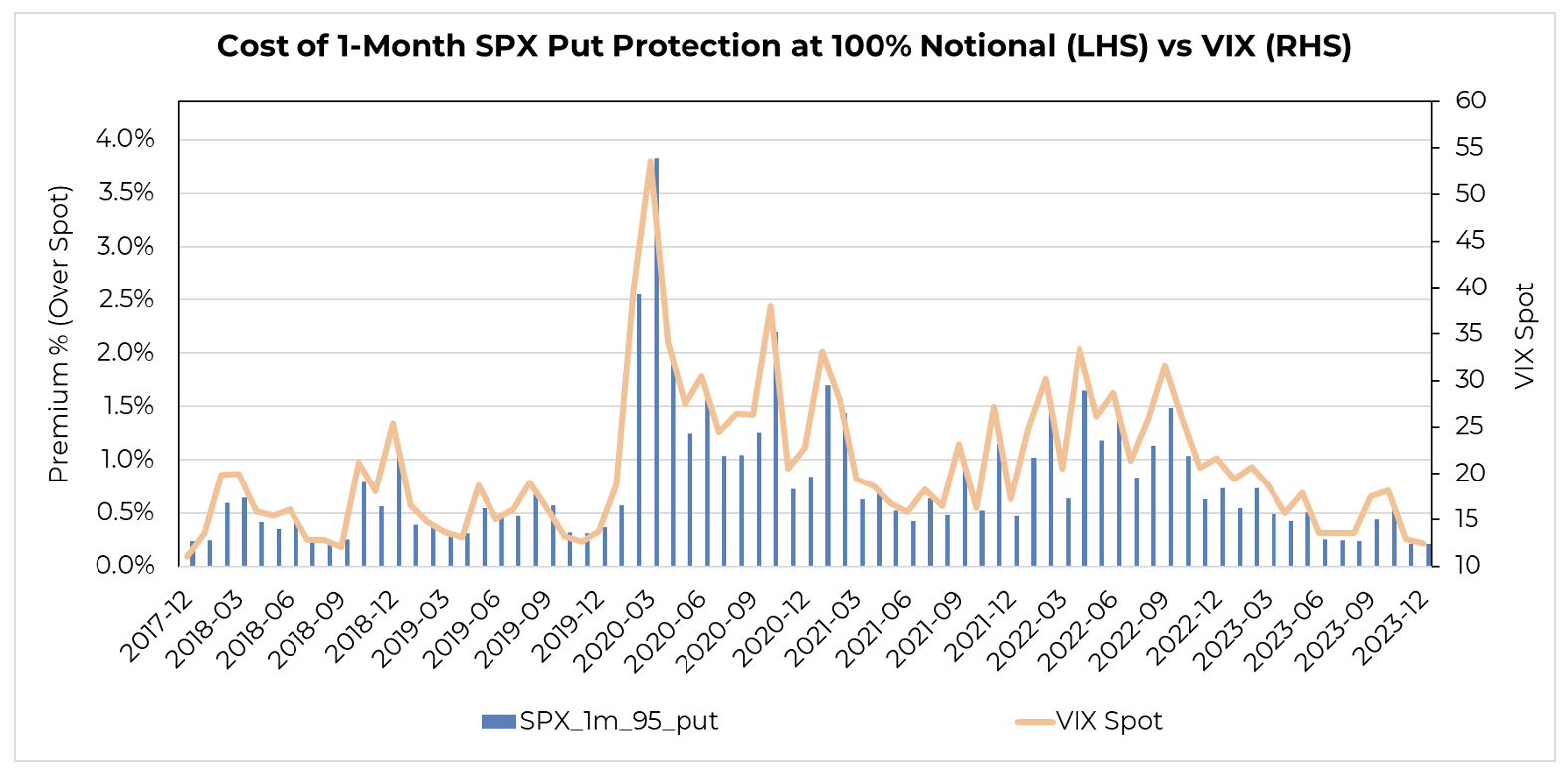

Cost of Hedging is Near Recent History Lows

The cost of hedging is back down to levels we haven’t seen since 2017. The graphic below shows the premium cost for a 1-month out, 5% Out of the Money (OTM) Put contract on the S&P 500 Index. The smaller the Premium % (measured by the blue bars in the chart below), the cheaper the cost of protection.

Source: Aptus Research as of 01.19.2024

Source: Aptus Research as of 01.19.2024

Given the cost of protection is inexpensive compared to recent history, we are confident in our ability to protect against left-tail market environments.

With this rebalance we will slightly increase risk-managed exposure at the expense of strategies focused on enhancing income. This is a small tweak, but we believe offers an opportunity for our portfolio to maintain the strategic overweight to stocks while maintaining guardrails to protect against the unknown.

Final Thoughts

We believe longevity risk is the biggest risk most investors face, often without them realizing it. Investors should focus on real returns, not nominal returns. The willingness to forgo equity risk in favor of perceived safety will have implications for the ultimate compounded return achieved.

We make asset allocation decisions that give us the best chance to produce real, sufficient, compounded returns into the future. We believe investors will be rewarded for taking on equity risk. In fact, we think equity risk is a necessity, and portfolios positioned based on the golden age of bonds are introducing longevity risk. We have attempted to challenge the status quo and improve our allocations by focusing on Y+G and being better in the tails.

We believe the Three Pillars of our Investment Methodology best prepare us to navigate markets and keep clients invested in an allocation that gives them the best opportunity to reach their long-term goals.

Please ask us for our recent asset allocation presentation (kudos to Dave!) where we deep dive into our differentiated story on portfolio construction.

As always, we thank you for trusting Aptus with your investments. Please let us know how we can help!

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

This content or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2401-36.