When we made the Aptus Compounders sleeve available to advisors in 2018, we never put much thought into the actual strategy name. It just came naturally to us, and we ran with it. We didn’t put much thought into how the name embodied exactly what we were looking to accomplish. Our job is to steadily compound capital over longer time periods, by hedging capital in drawdowns and participating with markets during rallies. The basic math that there is upside in less downside is one of the most efficient ways to accumulate capital to meet personal goals.

So, what is a Compounder? In our view, it’s a company that has the right management in place in the right industry, and possesses the strong fundamentals required to be in position to compound shareholder capital at above-market rates through multiple market cycles. While there is more than one way to skin a cat, we believe that consistency in process leads to positive outcomes, and this holds true for investing in businesses over a longer time horizon. Bottom line, we believe short-term panics caused by investors with shorter time horizons gives us an advantage.

The Compounders portfolio will rarely own the hot stock OR the most hated stock. We find our balance somewhere in between, as our focus tends to be outside of those areas. Many forget that compounding capital isn’t always about owning the “best” names, it’s about not owning the worst names.

On our 5YR anniversary, let’s walk through our compounding mentality alongside a few lessons learned during the strategy’s tenure.

We are firm believers in time arbitrage. That is why we have such little turnover in the strategy. The S&P 500 Index year-over-year returns are less normally distributed than most would think. Said another way, it’s far better to think long-term than it is to chase short-term returns in an effort to mirror a year-over-year normal return distribution. To show the time arbitrage thesis, take into consideration the following statistics (h/t Raymond James):

- The top 10% returning stocks in the S&P 500 contributed 65%-81% of total returns on a rolling 10-year basis, and the top 1% constituted 13%-19% of total returns. This shows the power laws of investing that aren’t predicted by a normal distribution curve.

- Holding onto winners is likely harder than finding them. Of these top 10% performers, most of them spend the majority of a 10-year holding period outperforming the equity markets. However, 95% of the outperformers had at least one period of 20%+ year-over-year underperformance, and 45% had at least one period of 50%+ year-over-year underperformance.

Moral of the story: let time do the heavy lifting.

We know that mistakes will be made. We attempt to put into practice a myriad of lessons learned throughout our career that we try to adhere to when making decisions on the Compounders strategy; let’s call these the seven (7) deadly sins of investing (they’ve been named by investors before us, but these are our definitions). They are as follows:

Pride: Overconfidence leads to some quite specific implications. Investors tend to be too confident in their ability to predict returns, and in what proportion of returns come from stock picking vs other drivers. This is why we have a heavy focus on portfolio construction.

Envy: The desire to keep up with peers can distort behavior, leading to either insufficient or excessive risk-taking and hurting returns. Asset managers should focus on the real-world liabilities faced by their clients. Envy can lead to chasing momentum and group thinking.

Wrath: Leads to underperforming positions being sold too soon. But also leads to managers being fired too soon. Asset owners would benefit if the fund measurement period was longer than just one year.

Sloth: The industry is not working hard enough on portfolio construction, risk management, and asset allocation. Sloth can also lead to failure to understand costs and paying too much for the wrong products.

Greed: In a competitive world there is pressure on analysts to have strong research conclusions. The problem is that it leads to selective analysis and data fitting. In practical terms, the assumed required level of statistical significance is often wrong.

Gluttony: Excessive concentration, excessive trading, and crowding are all examples of ‘gluttonous’ behaviors in investing. Better portfolio construction and risk management can help mitigate this.

Lust: Investors can fall in love with stocks, themes, and recent runs of success. This leads to over-valued “glamour” stocks. The good news is this creates opportunities.

Many try to make this investing game much more difficult than it should be; there is no reason to always swing for the fences when singles and doubles will suffice. You buy good businesses for less than fair value. Sure, we can all argue about fair value, as there are always surprises in the future trajectory of a business.

This game has some wrinkles and drama, but at its core, it’s note hard when done correctly. Emotionally driven decisions rarely tend to be the most rational. This means that one should only make decisions when one has a calibrated conviction.

Over the past 5 years, we appreciate that many investors have trusted our conviction, as we have taken many contrarian bets, some that many have not agreed with – think Pioneer Natural Resources (PXD) and PulteGroup Inc (PHM). We look forward to our future conviction.

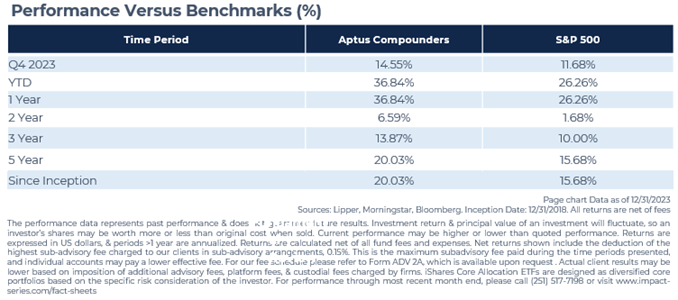

We didn’t talk about performance for the entirety of this investor letter, purposefully. It’s no secret that we are quite proud of our returns. But it is simply a byproduct of our process.

Onward and upwards.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices. It is not possible to invest directly in this index.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2401-32.