HNW Holdings Update

The HNW sleeve is designed to give equity exposure to a group of individual stocks that we think offer attractive prospects through a combination of yield, growth, quality, and reasonable valuations relative to large-cap peers.

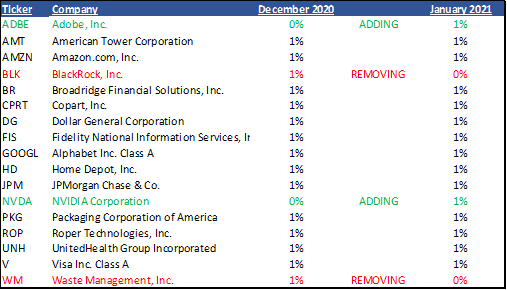

Purchases:

Adobe, Inc. (ADBE) is a leading provider of software solutions for creative and marketing professionals. From our perspective, the company features the best of both the internet and software industries, as they have highly predictable and profitable revenue streams with a vast open-ended total addressable market (“TAM”), and exposure to broad technology trends. Given that ADBE is levered to major internet themes, including the digitalization of content, shift to mobile platforms, and consumption of video across numerous channels, we think that the stock has a long runway for growth and an expanded multiple.

Even after the recent stock run, we believe that the market continues to underappreciate NVIDIA Corporation’s (NVDA) business transformation from a traditional PC graphics chip vendor into a supplier into high-end gaming, enterprise graphics, cloud, accelerated computing, and automotive markets. We believe the company has executed consistently and has a solid balance sheet and free cash flow profile to drive growth, all while demonstrating what we deem as a commitment to capital returns.

Sells:

We are selling one of the original holdings in the HNW sleeve, BlackRock, Inc. (BLK) as we believe that the market is pricing in a lot of optimism right now. The stock continues to reach new all-time highs, given the recent tailwinds from the Fed, recent trends of a shift within product mix to lower fee core business, and its extended valuation. This holding is considered to be a “holding period winner” by Aptus, which means that it has outperformed our benchmark, the S&P 500, by more than 50% since its purchase date. With this, coupled with an extended valuation, we felt comfortable harvesting gains.

On the other end, we decided to sell one of our underperforming stocks, Waste Management, Inc. (WM), as management’s recent execution of its Advanced Disposal Systems, Inc. acquisition has been slow and more costly to integrate, all while the company was trying to navigate the effects of COVID-19. Furthermore, the company does not meet, from what we view, our rigorous growth criteria per our “Y + G Framework”. During our investment committee meeting, we discussed, ad nauseam, what we learned from this holding, as we will do our best to not make the same mistake again in the future.

Disclosure

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Information presented in this commentary is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Information specific to the underlying securities making up the portfolios can be found in the Funds’ prospectuses. Please carefully read the prospectus before making an investment decision. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy.

SPDR S&P ETF Trust is an exchange-traded fund incorporated in the USA. The ETF tracks the S&P 500 Index. The Trust consists of a portfolio representing all 500 stocks in the S&P 500 Index. It holds predominantly large-cap U.S. stocks. This ETF is structured as a Unit Investment Trust and pays dividends on a quarterly basis. The holdings are weighted by market capitalization. The volatility (standard deviation) of the Impact Series may be greater than that of the SPDR® S&P 500® ETF.

Investing involves risk. Principal loss is possible. Investing in ETFs is subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of the shares may trade at a discount to its net asset value(“NAV), an active secondary market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a fund’s ability to sell its shares. Shares of any ETF are bought and sold at Market Price (not NAV) and are not individually redeemed from the fund. Brokerage commissions will reduce returns. Market returns are based on the midpoint of the bid/ask spread at 4:00pm Eastern Time (when NAV is normally determined for most ETFs), and do not represent the returns you would receive if you traded shares at other times. Diversification is not a guarantee of performance and may not protect against loss of investment principal.

Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy call (251) 517-7198. ACA-2101-14.