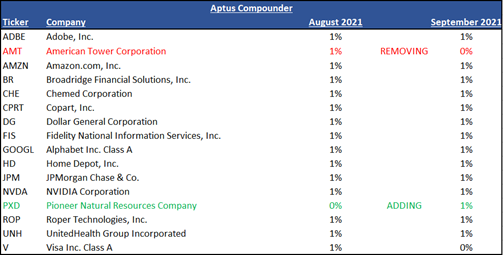

Aptus Compounder Update:

The Aptus Compounder Stock Sleeve is designed to give equity exposure to a group of individual stocks that we think offer attractive prospects through a combination of yield, growth, quality, and reasonable valuations relative to large cap peers.

Purchase:

We are purchasing Pioneer Natural Resources (PXD). Yes, I’ll be honest and direct with everyone here. Historically speaking, this is a different style trade for us, and it tends to be one with polarizing views, given the sectors performance over the last few years. But we are very comfortable with it. We all know that Energy stocks tend to trade with the underlying commodity, especially E&Ps. But what many may not know is the changing landscape amongst the group as a whole:

- Did You Know? Explorations and Production (“E&P”) have never traded at such low relative valuations to the S&P 500.

- Did You Know? E&Ps are the cheapest industry relative to the S&P 500.

- Did You Know? E&Ps have the highest FCF Yield relative to any other industry in the S&P 500.

- Did You Know? Many E&Ps have just initiated their maiden variable dividend, potentially bringing a whole new slew of generalist investors to the space, as they can return upwards of 75% of their previous quarter’s FCF to shareholders through a dividend.

This, amongst many other reasons are why we have never been so bullish on an industry and we’re ready to put our money where our mouth Is.

Sale:

Remaining frank, our sell candidate was originally not on our sell list. But, as we do with every name in this portfolio, we spend too much time analyzing the company’s most recent earnings report. We decided to sell American Tower Corp. (AMT) because we believe that the stock could have more downside than upside. As always, we want to put the odds in our favor, and when we see asymmetry to the downside, especially in a concentrated portfolio, we will do everything to minimize downside risk. We are selling due to:

- Through our Y + G Framework, we recognized that that the stock has had, from what we believe, a slowing organic growth profile over the next year, given the management’s guidance on the Sprint Churn. We believe that a slowing growth profile will finally be recognized by investors over the next few quarters, potentially muting returns in the interim.

- Currently, AMT trades at 32.0x P/AFFO (Adjusted Funds from Operations) – sporting a very high valuation relative to its history. For a Tower REIT company, with a slowing growth profile and a potential change in their accounting standards, the risk/reward Is not there, given heightened valuations.

- REITs are not monolithic. Historically, their performance has been based on a strengthening economy. But, more recently, we’ve witnessed tower REITs have a high correlation to movements in interest rates, i.e., when rates rise, tower stocks underperform.

Overall, we are happy with this this sell decision, as we believe that it Is de-risking the portfolio, while cycling assets into an area of the market where we feel more comfortable with our client’s capital.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

Information presented in this commentary is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Information specific to the underlying securities making up the portfolios can be found in the Funds’ prospectuses. Please carefully read the prospectus before making an investment decision. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy.

The S&P 500® Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices.

Investing involves risk. Principal loss is possible. Investing in ETFs is subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of the shares may trade at a discount to its net asset value(“NAV), an active secondary market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a fund’s ability to sell its shares. Shares of any ETF are bought and sold at Market Price (not NAV) and are not individually redeemed from the fund. Brokerage commissions will reduce returns. Market returns are based on the midpoint of the bid/ask spread at 4:00pm Eastern Time (when NAV is normally determined for most ETFs), and do not represent the returns you would receive if you traded shares at other times. Diversification is not a guarantee of performance and may not protect against loss of investment principal.

Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy call (251) 517-7198. ACA-2109-3