Properly Adjusting Portfolios for Potential Inflation

As the inflation narrative has been front and center following record fiscal and monetary influence from global governments, inflation fears have crept back into markets for the first time in almost a decade. To potentially combat this environment, we have decided to add an “inflation sleeve” component to our overall allocations.

When we think about what inflation is, i.e., the trajectory of prices, one area that has become increasingly important to recognize is the merits and shortcomings of the various inflation measurement tools. We want to make sure that we are correctly measuring the state of inflation in the economy.

We want our allocations to be allocated to best protect ourselves from the actual inflation rate – not the Consumer Price Index number. In fact, we believe that only using the CPI may actually harm your financial situation. Contrary to general understanding, the CPI does not correctly measure the general price level of a basket of goods. It is not designed to do so; it serves other aims.

Thirty years ago, it did represent a fixed basket of goods and services, which is how we naturally think that inflation is measured. But it has been repeatedly altered, with each change serving to reduce the reported figure.

While we believe IVOL delivers a better approach to owning inflation protected bonds than purely owning TIPS, we do not believe it can deliver the desired protection moving forward and allows us an opportunity to tweak our “inflation sleeve” exposure.

Q2 Rebalance Rationale:

We are making the following trade:

Sell IVOL:

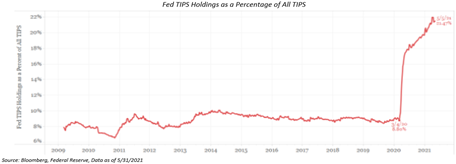

We are rotating out of IVOL, as we believe that potential from here is limited due to a supply/demand imbalance within the TIPS markets. In the last fifteen months, the Fed has accumulated over ~21% of the TIPS market. As shown below, this figure was ~8% prior to the pandemic.

Given that we believe that there is a looming Fed tapering announcement likely in the future, we believe that real rates could skyrocket, as the Fed effect has driven yields into deeply negative territory.

Thoughts on the limited upside:

The 10-year TIPS are currently paying 0.9% below inflation. Inflation will have to rise by at least that much over the next decade just to maintain its purchasing power. If inflation fears pick up, TIPS prices might rise, but only for investors who hold them to maturity, as they will cap their return at inflation, minus 0.9%. Bottom line is that the loss of purchasing power by holding fixed income that is earning negative real returns has the potential to create long-term issues for household wealth.

For a real-world example using the most recent 5yr TIPs new issue: CUSIP 91282CCA7 was created in an originating auction on April 22, 2021, when it generated a real yield to maturity of -1.631%, the lowest in history for any TIPS auction of any term. The Treasury set its coupon rate at 0.125% – the lowest it will go for a TIPS. Investors had to pay a sizable premium, about $109.41 for about $100.32 of value, after accrued inflation and interest were added in. If inflation does not pan out at these current levels, you’re looking at what we would consider suboptimal returns.

Introduction of the Aptus “Inflation-Sleeve” – Buy INFL:

By purchasing the Horizon Kinetics Inflation Beneficiaries ETF, we tilt our exposure to investing primarily in equity securities of companies that we expect to benefit, either directly or indirectly, from the rise in real asset pricing. What does that mean? We are gaining exposure to specific assets that we believe should benefit from an expected increase in inflation without corresponding increases to expenses.

As we look to add a layer of inflation protection to the allocation, we prefer royalty and streaming companies, which straddle various industries – energy, industrial and precious metals. Unlike commodity producers, these firms have asset-light balance sheets, so they are immunized against rising input costs. Royalty and streaming firms merely provide capital to commodity producers. In return, they receive either a royalty payment or a specified quantity of commodity by product at pre-negotiated discounted prices.

The fund also gives investors a differentiated exposure to inflation – financial exchanges and brokers. Since volatility in financial markets is almost a given if inflation arises, we want exposure to exchanges and brokers in our defensive inflation basket. These firms typically do well when volatility and trading volumes rise, regardless of the direction of the asset.

We believe the INFL ETF gives our portfolios exposures to a distinct universe of companies. These business models either have potential to benefit strongly from an inflationary economy or, in the alternative, can potentially prosper despite an inflationary economy. More importantly, they do not require an inflationary environment to excel.

In fact, from our perspective, they have done pretty darn well during recent deflationary environments in their various sectors, even severe deflationary environments – much like what we have seen over the last two decades. They have been able to generate a higher level of profits through the ups and downs of a full business cycle – higher, in fact, than the majority of conventional businesses can manage.

So, not only do the companies not require the appearance of inflation, but we believe they also actually enhance the quality of businesses in a portfolio.

So Why Not Own Underlying Commodities or Miners?

Investors often quickly assume that direct exposure to precious metals or miners are the best way to hedge against inflationary environments. While sometimes true, it often depends on the type and longevity of the inflationary environment.

While we believe that commodities can be a good hybrid approach to inflation-proofing portfolios, as they work in periods of both high inflation and stagflation, investing in commodities as an inflation hedge is very difficult. From an equity perspective, inflation can often be more of a headwind than a tailwind to commodity producers as their input costs (wages, electricity, machinery, energy) tend to rise. At a point, producers may pass on these costs and may underperform the physical commodity price.

What most investors understand to be inflation beneficiaries – and which they use as hedges – are indeed cyclical companies that are either ‘boom’ or ‘bust’ when the prices of their commodities rise or fall, i.e, very volatile. Those would be oil companies, mining companies, steel companies, wood products companies, and so forth. What is the common denominator here? They tend to all have very asset-intensive balance sheets. They must own vast property, plant & equipment (oil reserves and mines, offshore drilling platforms, massive factories) and often incur substantial debt to fund those assets, an additional risk to investors.

Most importantly, when there is not inflation, these businesses do not earn much. But, if there is inflation, they have the opportunity to earn a great deal for a long period of time because their basic operating assets are already in place. As the price of what they sell dramatically rises, production volumes should also increase.

As expected, there are some major risks to this – if inflation is only a transitory phenomenon, the potential for success can quickly deteriorate. Surprisingly, these companies have historically endured a self-fulfilling prophecy. As commodity prices increase for a long period, these companies tend to do poorly. Why?

First, each company naturally wants to produce more of what they sell, whether silver or iron ore, so they begin to buy additional property and equipment. They compete with one another for these limited supplies (among other things like labor). Therefore, the largest items on their balance sheet – from which they generate their sales and earnings – are themselves subject to inflation. This can drastically reduce their operating margins even as sales continue to rise.

Finally, the increased production eventually inflates the supply of the commodity in question. Not to mention the companies have expanded large amounts of capital to increase production, driving the cost structure higher. Then, supply and demand adjust and the price of the commodity falls – boom and bust.

Why Not Get the Best of Both Worlds?

Companies that exhibit exposure to a hard asset, coupled with an asset-light balance sheet are the ideal business models for our “inflation sleeve”. The revenues from these types of companies directly benefit from the underlying asset, with no intermediary operating activity or expense required. These are the royalty companies, like Texas Pacific Land and Wheaton Precious Metals, in which INFL grants us exposure to. They receive a payment directly from a third party, once that party has extracted and sold the resource, regardless of the commodity. A hard asset company does not own assets, it owns revenue rights. If the price of the resource rises, that is an immediate increase in revenues to the hard asset company. Most importantly, almost all that revenue becomes an increase in pre-tax profits because there is almost no incremental operating expense associated with increased production.

An eye-opening figure that exemplifies the asset-light nature of a royalty business that is a direct beneficiary to inflation: Royal Gold, which has an $8 billion market cap and interests in almost 200 properties, only has 23 employees. There is exceedingly little in the way of operating assets or personnel upon which inflation can act to increase their cost of doing business. There are not that many hard asset companies in the world – we have looked – and, with rare exceptions, you will not find them in indexes. From our perspective, they improve the business quality of a portfolio and reduce the cyclicality – they are not a ‘bet’ on inflation.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2106-11.