Market Update

During the second quarter, the Mega-Cap Tech stocks told the rest of the market that if you’re not first, you’re last, as investors either owned technology exposure and outperformed or owned everything else and underperformed. Basically, investors quickly saw the banking fears of Q1 fade into an all-out Artificial Intelligence (“AI”) FOMO trade in Q2, leading the S&P 500 higher by 8.7% for the quarter.

The so-called “Magnificent Seven,” which appears to be the biggest winner of the AI trade, has driven the market, as they have a story that is impossible with which to argue – a new technology that promises to transform business controlled by companies that, by and large, hold tons of cash and are in no way capital constrained. It is likely to take years to fully determine whether AI is revolutionary or evolutionary, but in the absence of significantly higher long-term interest rates it may not make much of a difference to the likes of Microsoft, Apple, Google, Amazon, and Facebook. They have the time and the capital to get the benefit of the doubt.

One of the hardest parts of stock picking is being able to navigate through the noise – deciphering what information is material, and what is not. It’s been even more difficult over the past year due to the current environment. What hasn’t been difficult is trusting the management teams running all the companies in the fund. Given current market conditions, we continue to believe the stock portfolio is the perfect concoction of valuation, growth, and quality.

I once read that optimism is a way of explaining failure, not prophesying success. Said another way: saying you are optimistic does not mean you think everything will be flawless and great. It means you know there are going to be failures and problems and setbacks, but those are what motivates people to find a new solution or remove an error – and that is what you should be optimistic about.

We won’t always be correct on every single name we own in the Aptus Compounders portfolio – that’s why it’s a portfolio of stocks. But we can promise you that we will continue to learn, being pragmatic about positioning in the current environment because all an investor needs to do is compound your probability of success.

Portfolio Update

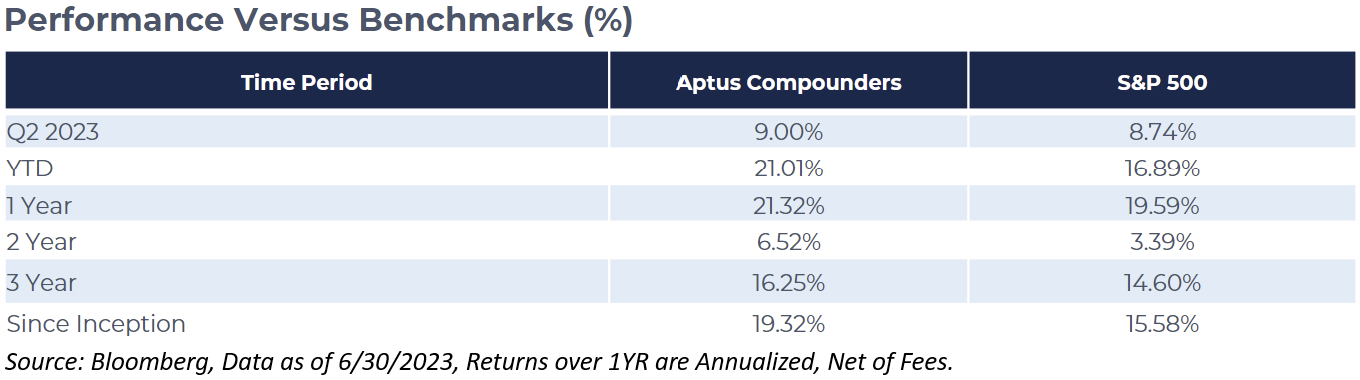

Aptus Compounders outperformed the S&P 500 during the quarter and for the year, by +0.3% and +4.1%, respectively. The strategy is up 21.0% on the year, outperforming the benchmark due to strong security selection. In fact, all of the outperformance and some came from securities held in the strategy, as our sector exposure detracted from performance, specifically Energy and Staples. Even though our portfolio tends to have a smaller relative exposure to the mega-cap stocks, which have driven the majority of the performance in ’23, we outperformed as we held some of the smaller cap names that have done well. We continue to believe our bias of what we consider to be high-quality characteristics that exhibit pricing power, profitability, pricing inelasticity, and competitive moat, leaves us excited for how the portfolio is currently positioned. We remain convicted.

The performance data represents past performance & does not guarantee future results.

Investment return & principal value of an investment will fluctuate, so an investor’s

shares may be worth more or less than original cost when sold. Current performance may

be higher or lower than quoted performance. Returns are expressed in US dollars, &

periods >1 year are annualized. Returns are calculated net of all fund fees and expenses.

Net returns shown include the deduction of the highest sub-advisory fee charged to our

clients in sub-advisory arrangements, 0.15%. This is the maximum subadvisory fee paid

during the time periods presented, and individual accounts may pay a lower effective fee.

For our fee schedule please refer to Form ADV 2A, which is available upon request.

Actual client results may be lower based on imposition of additional advisory fees,

platform fees, & custodial fees charged by firms.

The strategy’s best performer during the quarter was Broadcom, Inc. (+35.9%) as the company continued to benefit from the hype surrounding artificial intelligence (“AI”). We believe that Broadcom may be one of the few initial companies what will have tangible benefits from the innovative technology. Adobe Inc. (+26.9%) is also an AI beneficiary as it has seen results of subscriber growth in its generative AI-supported photoshop program, Firefly. Both of these companies benefitted from valuation expansion, as sentiment around the names continued to increase. As always, we did have a few under-performers, specifically Dollar General (-19.1%), as the company has a very difficult quarter. Newly added Progressive Corp. (-7.4%) also trailed, given some headwinds in FL.

During periods of volatility, we tend to have elevated turnover, given market dislocations. Year-to-date, turnover remains elevated, even though we did not make any trades during the quarter. As a reminder, we had two trades that positioned the portfolio to be more defensive in nature. We sold our two best performing stocks, Nvidia Corp. and PulteGroup, as we believed that the stocks would take a breather, given their ferocious rally during the quarter. With these trades, we continued to bring down overall portfolio valuation, while increasing the dividend yield of the portfolio. With our proceeds, we purchased Progressive Inc. (PGR) as we believe the company embodies a competitive moat that can provide a long-term runway of growth. Lastly, we bought Broadcom Inc. (AVGO), which is a play for the “cyclically nervous”, given better visibility and control of their semiconductor business. The latter, performed well in the quarter.

Conclusion

Lastly, let’s touch base on the Aptus Compounder’s competitive advantage. Our biggest advantages is time. One of our most difficult tasks, when qualitatively selecting a company to invest in, is the long-term execution of a management team. That’s why we have created the Aptus Sleeves – Core, Value, and Growth to help monitor the actions and effectiveness of management teams over the course of time. We want to invest in management teams that continually execute, have shared interests with investors and efficiently invest in the future.

To exploit this advantage, we need time. This sentence may make one believe that we have been underperforming – but that is far from the truth. We have navigated the current environment quite well. In fact, we remain highly convicted on every position in the Aptus Compounder Sleeve.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible. The S&P 500® Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2307-22.