The first half of 2023 was wild, and far from most expectations. Risk assets sold off during the Silicon Valley Bank collapse in March, then rose just as quickly. Through its resolution, and onto the First Republic collapse and fears of the Debt Ceiling debate, a handful of large tech stocks raced higher.

In general, the fear of these events packed more punch than reality. Investors were caught offsides and generally under-positioned to risk assets, likely spurring the chase higher in stocks. From March through May, the market experienced a massive rally on the heels of a few AI-centric technology stocks.

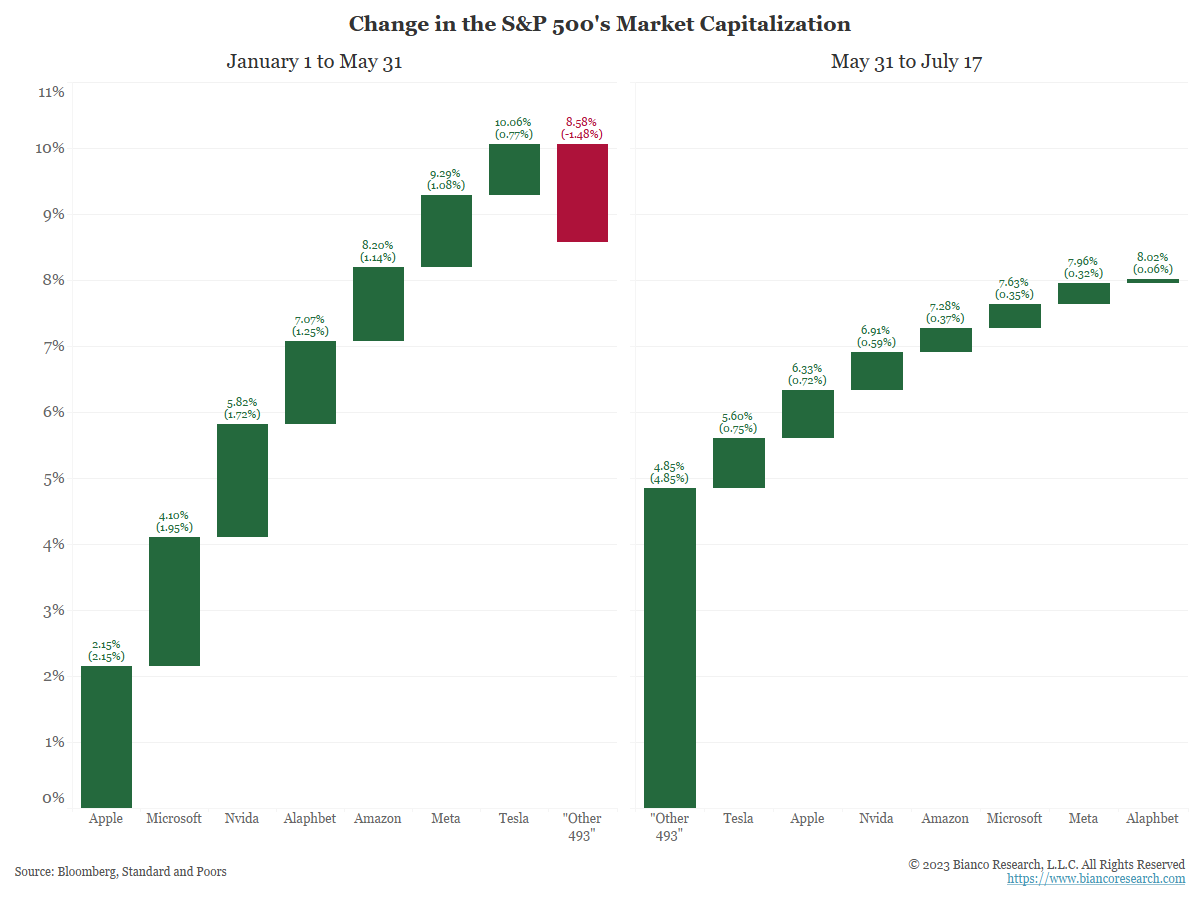

We will say it’s nice to see more than seven stocks driving the market higher, as the rally has finally expanded to the broader market…see the distinction in the “Other 493” before and after Memorial Day:

Source: Bianco Research as of 07.17.2023

Source: Bianco Research as of 07.17.2023

At the macro level, economic data remains strong as the consumer is healthy and the jobs market remains resilient, supporting markets. The economy seems to be adjusting to the higher interest rate environment while maintaining a more sustainable level of growth, as inflation continues to slide lower (although still above target) and pockets of speculation recede.

High Level Thoughts

We want to use this model rebalance to remind you of the investment philosophy guiding your portfolios, and emphasize the confidence that we have in our process and allocations.

Asset allocation decisions define about 90% of long-term investment outcomes. As we have always said, we believe that equities are better wealth accumulation vehicles than bonds or cash. Successful long-term outcomes are mostly dependent on 4 things:

- Creating a plan/budget and sticking to it

- Allocating to a diversified mix of quality assets

- Putting time on our side (i.e., time in the market, not timing the market)

- Minimizing large portfolio losses that can destabilize portfolios

The biggest risk we see in portfolios is the disregard of longevity risk. Longevity risk is the risk of running out of money or having to make lifestyle changes due to the under accumulation of wealth. Given the likelihood of higher structural inflation and negative real (after inflation) returns from traditional fixed income, we believe the traditional approach to asset allocation (balancing stocks and bonds) must be reconsidered.

Within our allocations, we like David Dredge’s simple race car analogy. The car that wins the race has a strong engine, but equally important, it has great brakes. We can improve the long-term return potential of portfolios by owning more stocks (stronger engine), but our ability to own volatility as an asset class (better brakes) is what allows us to manage the turns.

We implement distinct types of hedging across portfolios, which helps create a path to success whether markets are rising, choppy or flat out ugly. It is like fire insurance; you do not buy it after your house burned down…you buy it beforehand just in case something bad does happen.

The design is to participate in a rising market due to an overweight to equities, and to protect when things get scary through active hedges.

The “volatility as an asset class” theme extends to our yield + growth framework, beyond risk mitigation. Volatility can be viewed as a tool to enhance yield. It’s the combination of enhanced yield and risk mitigation that improves the yield + growth outlook of our portfolio construction process.

Model Rebalance

We are excited for the opportunity to rebalance the portfolios given the changes in markets thus far in 2023. We think the rebalance will serve allocations well, given our market outlook and the suppressed (cheap!) volatility. Below you will find the rationale regarding the trades, and color on how it will impact your portfolios.

Replace TDVG with DUBS/RSP

We believe that portfolio yield in the next cycle will likely matter more than it has in the last 10 years. Our newest ETF, the Aptus Large Cap Enhanced Yield (DUBS), gives us another lever to pull across the portfolios, with direct beta but double the yield. Within our equity exposure, DUBS gives us the opportunity to maintain a neutral stance versus the S&P 500 (no factor tilts) and still maintain our objective of higher portfolio income.

While we think the T. Rowe Price fund is a solid fund, its quality and dividend growth can be a drag. In this rebalance we want to reiterate the point of letting our stocks be stocks, and add the ancillary performance that comes from the options overlay, in this case the Fund strategy aims to earn 2x the S&P 500 income without the factor tilt.

Add BKAG to Preserve, Conservative & Moderate Given Increase in Yields

Our Fixed Income portfolio duration has been significantly shorter than our benchmark since late 2020. This has been timely, as bonds have performed poorly given the Federal Reserve’s aggressive interest rate hikes.

As yields have shifted higher and the FOMC has made progress on bringing inflation lower, we are marginally lightening our duration underweight. While it is possible that fixed income could underperform in real terms (after accounting for inflation), we cannot deny that on a nominal basis yields are as high as they’ve been in ~15 years.

Small Trim of OSCV

Our portfolios have been overweight Small Cap stocks for some time. We have shown a multitude of graphics that display the effectiveness of small caps during inflationary periods. We are keeping the overweight to Small Caps but using the run-up in markets plus the repricing of volatility (lower cost to hedge), to trim a bit in favor of more hedged equity.

Shift INFL into RSP/DUBS

Similar to the commentary on OSCV, we have favored cash-flowing businesses given the higher inflationary regime. INFL filled a portfolio void the last couple years where we wanted additional inflation protection, but in an untraditional way (i.e., other than TIPS/Gold). While structural inflation is likely to persist into the future, we expect the volatility of inflation to remain high, which favors more options-based strategies that can better take advantage.

Source: Aptus Research as of 07.20.2023

Source: Aptus Research as of 07.20.2023

Add RSP to Equity Lineup

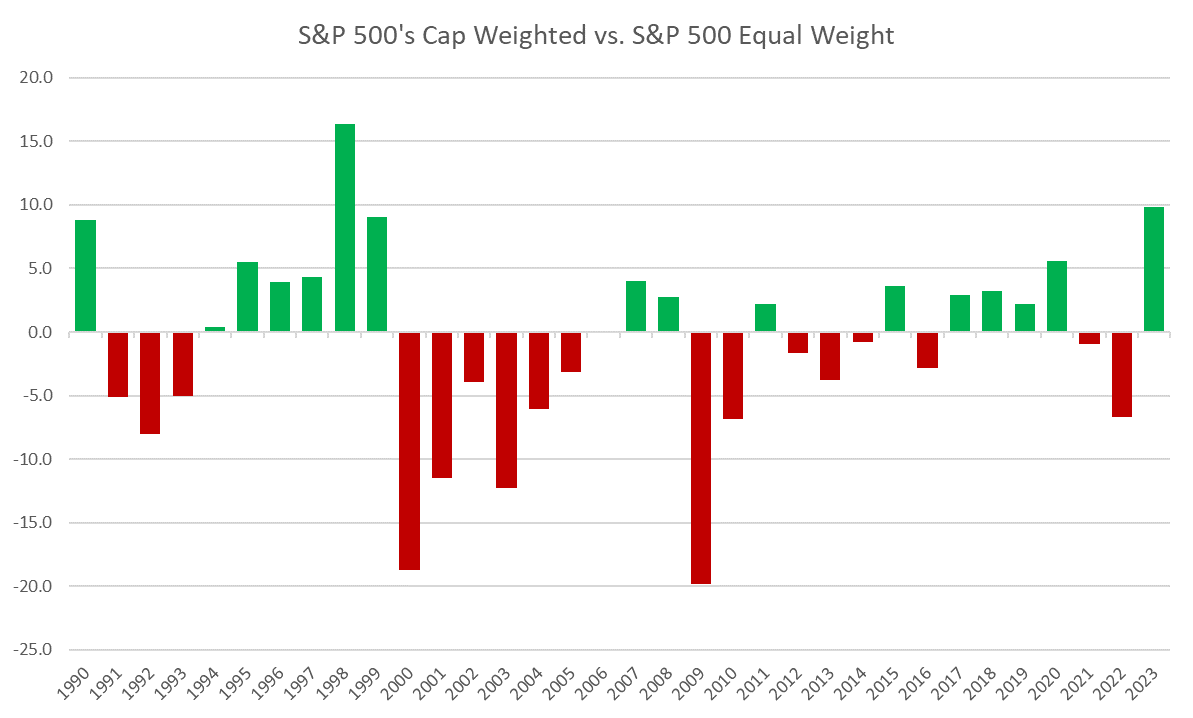

Long-term clients may remember a similar situation in late 2020 where the S&P 500, led by a few high-growth stocks, substantially outperformed the aggregate market (equal weight S&P 500). We added a slug of RSP into the portfolios following that growth runup, and given the multiple of the “S&P 493” (~15x earnings) vs the “S&P 7” at 36x earnings, we now see another opportunity to get better exposure via the same name.

Utilize IDUB

Similar commentary as DUBS, we believe that portfolio yield in the next cycle with likely matter more than it has in the last 10 years. IDUB gives us another lever to pull across the portfolios, improving our beta exposure to Developed & Emerging markets with double the income versus the benchmark.

Sell out of VDE in Growth & Aggressive Growth

VDE is a position that we’ve liked the last couple of years where we thought energy had structural tailwinds given the supply and demand dynamics. While we do continue to like energy over the medium term, we have been somewhat disappointed with the performance of energy stocks given the firmness of oil prices in the low $70s. While we will continue to favor energy in other manners (inside our funds), we are moving this explicit overweight back into our core equity holdings.

To Conclude

As always, we want to thank you for your trust in stewarding your clients’ hard-earned savings. We believe the way we continue to innovatively allocate your capital will have long-term positive results on their wealth. An outside-the-box manner of thinking is necessary to navigate the challenging market landscape we face.

Equity markets can be choppy over brief time horizons but historically rise, and we want our portfolios to have a stronger engine (more stocks) to participate in market upside, and better brakes (hedges) to protect against the unknown. We believe this combination should allow clients to be confidently prepared for any type of market environment.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

When a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 11.2 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 4.6 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2307-28.