HNW Holdings Update

The HNW sleeve is designed to give equity exposure to a group of individual stocks that we think offer attractive prospects through a combination of yield, growth, quality, and reasonable valuations vs the S&P.

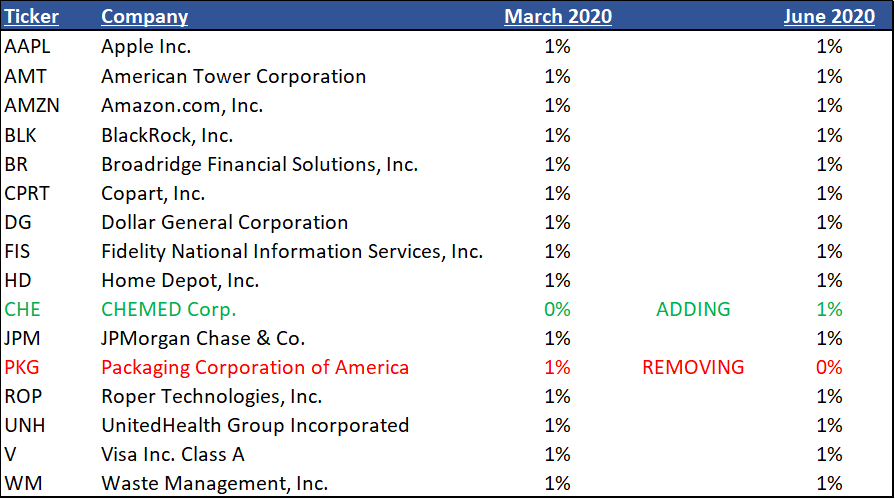

Purchases:

CHEMED Corporation (CHE) operates in two distinct business – one of the largest hospice operators (Vitas) and the largest provider of plumbing and drain cleaning services in the U.S. (Roto-Rooter). VITAS derives roughly two-thirds of Chemed’s total sales, and Roto-Rooter the remaining one-third.

We believe that CHE is a very strong operator with tailwinds on both sides of its business. On the Roto-Rooter segment, given its above peer margins, its asset-light model, the reduced exposure to economic cycles (due to its growing exposure to water restoration), and limited online competition, we believe that this line of business deserves an above-average premium relative to peers. Meanwhile, given the size of the VITAS platform (scarcity value), the positive outlook for the hospice industry, and the positive near- and medium-term outlook for Medicare reimbursement rates, we believe that VITAS also deserve an above-average premium relative to peers.

We believe CHE has proven to be a very strong operator, with minimal leverage at the corporate level, a growing dividend, and accretive share repurchases. With this, we believe that the company is very undervalued relative to peers, and should be an all-weather holding in a portfolio given its downside protection along with its outperformance in normalized market scenarios.

Sells:

Even though it has rebounded strong off the market’s low, we decided to sell Packaging Corporation of America (PKG), as our revised growth rate did not meet what we believe to be rigorous credentials to be considered for the HNW sleeve. PKG has performed well vs peers despite the current industry headwinds. But, the combination of low-upside to current valuations, combined with the very likely possibility that earnings may continued to be capped in the near future, given pricing concessions and lower volumes due to mill outages, drove us to reducing our growth rate, and ultimately selling the stock.

Disclosure

The Impact Series is a model portfolio solution developed by Aptus Capital Advisors, LLC. Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy call (251) 517‐7198 or contact us here. Information presented on this site is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities or to advise on the use or suitability of The Impact Series, or any of the underlying securities in isolation. Information specific to the underlying securities making up the portfolios can be found in the Funds’ prospectuses. Please carefully read the prospectus before making an investment decision.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment and tax professional before implementing any investment strategy.

SPDR S&P ETF Trust is an exchange-traded fund incorporated in the USA. The ETF tracks the S&P 500 Index. The Trust consists of a portfolio representing all 500 stocks in the S&P 500 Index. It holds predominantly large-cap U.S. stocks. This ETF is structured as a Unit Investment Trust and pays dividends on a quarterly basis. The holdings are weighted by market capitalization. The volatility (standard deviation) of the Impact Series may be greater than that of the SPDR® S&P 500® ETF.

Investing involves risk. Principal loss is possible. Investing in ETFs is subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of the shares may trade at a discount to its net asset value(“NAV), an active secondary market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a fund’s ability to sell its shares. Shares of any ETF are bought and sold at Market Price (not NAV) and are not individually redeemed from the fund. Brokerage commissions will reduce returns. Market returns are based on the midpoint of the bid/ask spread at 4:00pm Eastern Time (when NAV is normally determined for most ETFs), and do not represent the returns you would receive if you traded shares at other times. Diversification is not a guarantee of performance, and may not protect against loss of investment principal. ACA-20-152.