Drawdown Patrol Investing

Upside Capture Through Downside HedgingOur approach is designed to produce what every investor wants, potential for growth and income while defending against their most feared risks. Today’s backdrop requires different thinking; here is ours.

Why Invest?

To meet future spending needs, right? Putting today’s dollars under the mattress is not going to get it done. We design portfolios to help harness the power of compounding, meet client needs, and empower advisors to consistently deliver on the following three questions:

Am I going to be ok?

Can I maintain my family’s quality of life?

Can I improve it?

What Are the Risks?

The primary investing dangers we worry about generally fall into one of two categories:

Longevity Risk

Sneaky, hard to recognize in the moment

Drawdown Risk

Can strike without warning

How Can We Balance Risk and Return?

Improve on Diversification

- Prudent allocation to areas of higher potential return (stocks).

- Reducing drawdown and the emotions that come with it.

- Turning market drawdowns into opportunity.

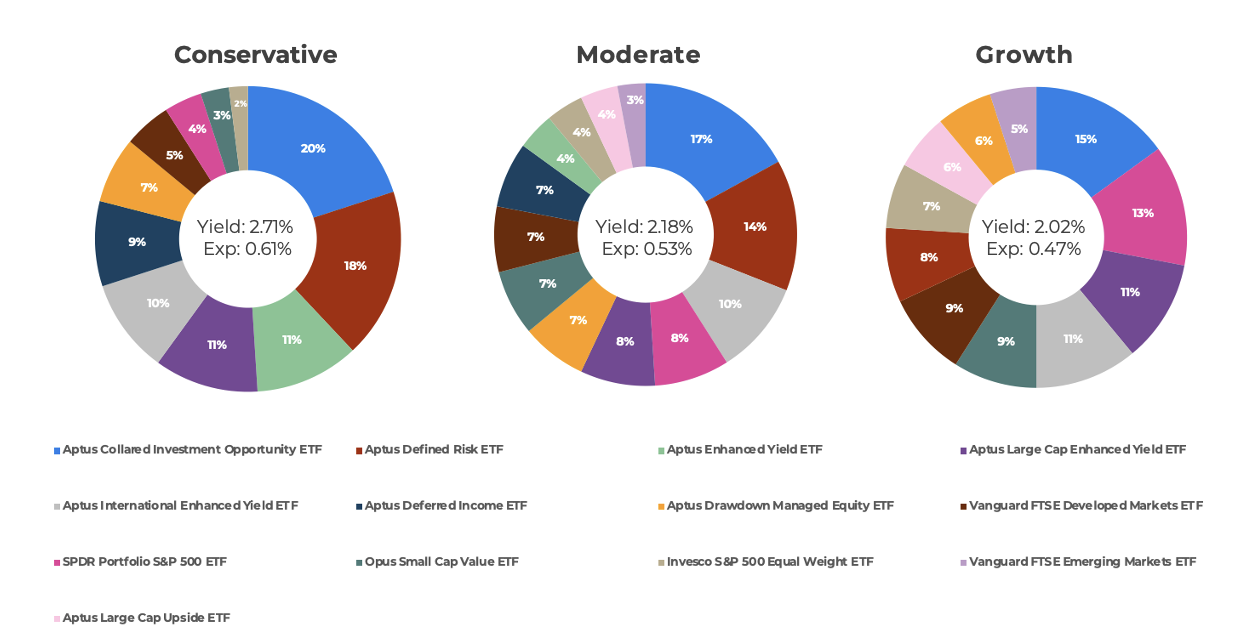

Turnkey ETF Models

Risk-based, multi-manager ETF models available with no strategist fee through platforms including Schwab Model Market Center, Riskalyze Partner Store, Adhesion/Vestmark, Envestnet, and SmartX.

Holdings as of 11/30/2025