The HNW solution is designed to give equity exposure to a group of individual stocks that offer attractive prospects through a combination of yield, growth, quality, and reasonable valuations. Numbers below are relative to the SPDR® S&P 500® ETF (SPY) as of 3/23/2020.

- Dividend Yield: 2.41% (HNW) vs. 2.47% (SPY)

- Price to Earnings Ratio: 15.34x (HNW) vs. 18.12x (SPY)

- Price to Book Ratio: 2.56x (HNW) vs 2.75x (SPY)

Purchase Summary

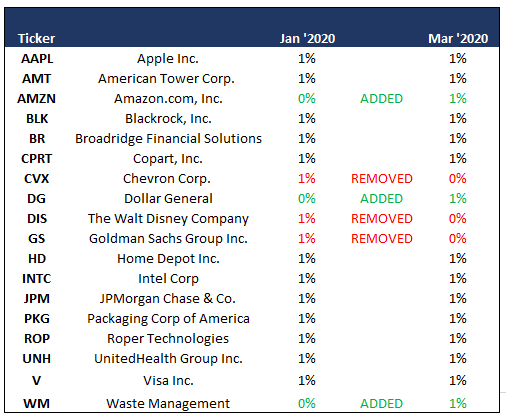

Given the current market correction, we are proactively taking the opportunity to rebalance part of the HNW portfolio into what we think are high-quality stocks at depressed valuations. These new “all-weather” holdings not only exhibit superior downside protection, but also have the fire power in up markets. In our opinion, both Dollar General (DG) and Waste Management (WM) have a competitive advantage against their respective peers, which allows each company to sport high returns on invested capital all while growing profitability. Lastly, we’re adding the 800- pound gorilla Amazon (AMZN). Although AMZN doesn’t pay a dividend, we believe the growth potential available through their capital allocation, historic growth and killer management team merits the valuation and addition to the portfolio. We believe picking up shares at a 20+% discount to the highs (and even cheaper to our calculation of intrinsic value) gives us ample potential for price appreciation and a great long-term compounder.

Sale Summary

We are taking some risk off the table with all of our sells. First, we have decided to sell Chevron Corp. (CVX) as it is too difficult to fundamentally forecast future growth in this industry when both the 2nd and 3rd largest oil producers are acting irrationally, driving down the price of oil during an environment when demand has been substantially muted. Furthermore, we decided to shift out of The Walt Disney World Company (DIS) due to lower prospective growth avenues, i.e, low Y + G, coupled with increased poor sentiment from investors after their most recent earnings report. The company blew earnings out of the water, but the market still decided to punish the stock due to stretched valuations and substantial growth in capital expenditures within the Disney+ segment, muting future earnings growth. Not to mention the effects of COVID-19 on park attendance, as this entire industry has been hit extremely hard. Finally, we decided to lower our weighting in the Financial sector, selling our lowest ranked security, Goldman Sachs (GS). Granted, we believe the stock is undervalued, hence our previous ownership, we just decided to take some chips off the table given the potential for a prolonged low interest rate environment and potential exposure to loan losses from heightened credit risk.

Company Details: Entries

Dollar General Corporation (DG):

We view DG as one of the top “all weather” investment opportunities in hardline retail, given the company’s high consumable products mix (~78% of sales), multiyear store growth opportunity and strong financial position. Admittedly, the economic environment is highly uncertain, but DG shares have held up better than the market over the last few weeks, highlighting the company’s defensive characteristics of selling mostly consumer staple products. Moving forward, we think Dollar General’s results should benefit incrementally in 2020 and beyond from 1) accelerated store remodels/relocations, 2) incremental store openings, and 3) the continued rollout of margin accretive initiatives (DG Fresh, NCI, Private Label). In addition, shareholders should continue to benefit from increased share repurchases and cash dividends.

Waste Management, Inc (WM):

Given an underappreciation of broad-based strength in the (perceived low-growth) waste industry, we believe Waste Management has effectively harnessed the cycle, posting its best top-line trend (dollar improvement) in two decades, shifted its baseline FCF and cash flow conversion higher, levered to improving CPI prints, and garners upside at the current stock price and valuation. While valuation relative to overall growth has historically been a barrier for some investors, including ourselves at one point, we note that following the recent modest pullback in shares, WM is now trading effectively in line with both its 10- and 5-year average relative to the S&P 500. Not to mention, WM is trading below its peers in the industry, which is not warranted, given WM’s market share and economies of scale within their business model.

Amazon.com, Inc. (AMZN):

Amazon is a fundamentally sound business, the company owns one of the most powerful brands in the world, and it has an unparalleled logistics and distribution network setting it apart from other players in online commerce. Massive scale provides cost advantages in both e-commerce and cloud computing, generating an additional layer of competitive strength for the business. Management has proven an exceptional track record of successful innovation and sustained growth over the long term.

Company Details: Exits

Chevron Corporation (CVX):

It is too difficult to fundamentally forecast future growth in this industry when both the 2nd and 3rd largest oil producers are acting irrationally, increasing production, driving down the price of oil during an environment when demand has been substantially muted due to the coronavirus. From a portfolio construction perspective, we like to trim our loser and let our winners run. In this case, it is the former, as CVX has been a large loser in the portfolio as oil has dropped from $69 in the beginning of January to its current levels around $23. I believe the irrationality will continue longer than expected, as Saudi Arabia has the capital to weather this storm and Russia has a much more diversified economy that can help insulate some of the loses.

The Walt Disney Company:

Going into this market correction, DIS’ valuation become somewhat stretched as investors started to buy into the success of Disney+, even though it was a small portion of their overall revenue. On the company’s most recent earnings report, Disney blew out the Street’s consensus on almost every estimate, especially Disney+ subscribership at 26M v. 20M expected. But, with these blow out earnings, the market was the ultimate judge, as the stock fell post announcement by almost 4%. This shows that the stock was priced for perfection, something that we have learned is very difficult to outperform with this type of investor sentiment. Furthermore, the company stated that they will continue to invest heavily in content for Disney+, which is expected to mute earnings going forward into the future. With this information, we re-evaluated our consensus D + G rating for the company and decided that the current prospective growth was not worth the risk of holding the company, thus we decided to allocate capital elsewhere.

Goldman Sachs (GS):

We’d be the first to acknowledge that Goldman Sachs is trading at very low levels – in fact, 70% of book value. But, given the current interest rate environment, we decided to lower our exposure to financials, specifically bank like securities. Relative to the S&P 500, we were overweight this sector, which has hurt our relative performance. Much like CVX, we tend to cut losers in the portfolio, which we measure at a 15% relative underperformance versus the S&P 500. Goldman Sachs hit this threshold over the past few weeks, thus we have decided to cut our position in the security. Couple this with a decreasing growth rate in our D + G framework, as the company continued to invest in its consumer bank, which was seeing slower-than-anticipated growth rates. With all of these factors, GS was our worst ranked Financial name, thus we decided to cut it as we decreased our exposure to this sector.

Overall, we think the changes reduce our direct exposure to the economic cycle and upgrade the organic growth characteristics of the portfolio. We will soon post full profiles of each new holdings, in the meantime please reach out with any questions.

Disclosure

The Impact Series is a model portfolio solution developed by Aptus Capital Advisors, LLC. Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy call (251) 517‐7198 or contact us here. Information presented on this site is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities or to advise on the use or suitability of The Impact Series, or any of the underlying securities in isolation. Information specific to the underlying securities making up the portfolios can be found in the Funds’ prospectuses. Please carefully read the prospectus before making an investment decision.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment and tax professional before implementing any investment strategy.

SPDR S&P ETF Trust is an exchange-traded fund incorporated in the USA. The ETF tracks the S&P 500 Index. The Trust consists of a portfolio representing all 500 stocks in the S&P 500 Index. It holds predominantly large-cap U.S. stocks. This ETF is structured as a Unit Investment Trust and pays dividends on a quarterly basis. The holdings are weighted by market capitalization. The volatility (standard deviation) of the Impact Series may be greater than that of the SPDR® S&P 500® ETF.

Investing involves risk. Principal loss is possible. Investing in ETFs is subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of the shares may trade at a discount to its net asset value(“NAV), an active secondary market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a fund’s ability to sell its shares. Shares of any ETF are bought and sold at Market Price (not NAV) and are not individually redeemed from the fund. Brokerage commissions will reduce returns. Market returns are based on the midpoint of the bid/ask spread at 4:00pm Eastern Time (when NAV is normally determined for most ETFs), and do not represent the returns you would receive if you traded shares at other times. Diversification is not a guarantee of performance, and may not protect against loss of investment principal. ACA-20-75.