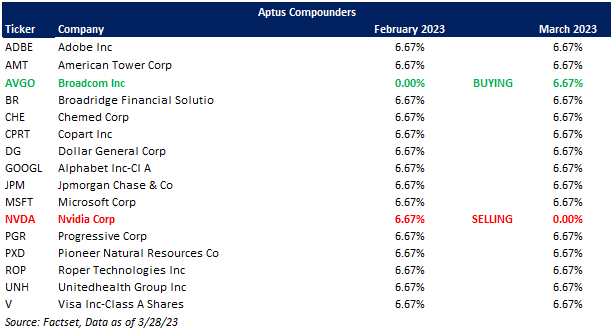

Aptus Compounder Update

The Aptus Compounder Stock Sleeve is designed to give equity exposure to a group of individual stocks that we think offer attractive prospects through a combination of yield, growth, quality, and reasonable valuations relative to large cap peers.

Sells

We have held NVIDIA Corporation (NVDA) since January 2021 – we’ve owned it during its highs (2021, 2023), but also during its re-valuation lows (2022). Yet, we’ve continued to be amazed by Jensen Huang, CEO of NVDA, ability to adapt to the current and everchanging environment. Whether it be through his swift actions during the China restrictions of November 2022 or being the first mover in the Artificial Intelligence (“AI”) space.

We continue to very much like the narrative around NVDA, as accelerated computing is here and it’s real as Moore’s law slows (or dies), a situation NVDA appears uniquely suited to benefit from as they deliver both the hardware and soft ware environments needed to drive the datacenter cost and power efficiencies that are increasingly becoming unattainable using only CPUs.

We are being cautious by selling this name, as investors have become enamored of the generative AI opportunity and have been searching for the purest way to play the narrative. Our purchase of Broadcom Inc. (AVGO) allows us to keep our high-quality semiconductor exposure, but at a much cheaper valuation and substantially higher yield.

Purchases

We love the long-term narrative around semiconductors and believe that the defensive Broadcom Inc. (AVGO) is a play for the “cyclically nervous,” given better visibility and control in their semiconductor business, software that supports margins and lowers volatility, free cash potential and margin performance, cash return, and inexpensive valuation, with the VMware deal poised to drive further upside.

In a nutshell, AVGO designs, develops and supplies a broad range of semiconductor and infrastructure software solutions. Outside of normal business operations, we love the company’s “wash, rinse, and repeat” mentality when it comes to M&A, which has allowed the company to efficiently grow and diversify its business.

AVGO checks a lot of boxes for our “compounder” mentality, yet we believe that the stock trades at an unjustified 30% discount vs. semi peers despite double-digit EPS growth and best-in-semis profitability, FCF generation, and returns. We attribute discount to software/mainframe cynicism and conglomerate discount, but we believe investors under-value the sum of AVGO’s parts. With the recent VMWare acquisition taking the company to 50% software revenue, we believe that the company should no longer trade in parity with other pure-play semiconductor companies.

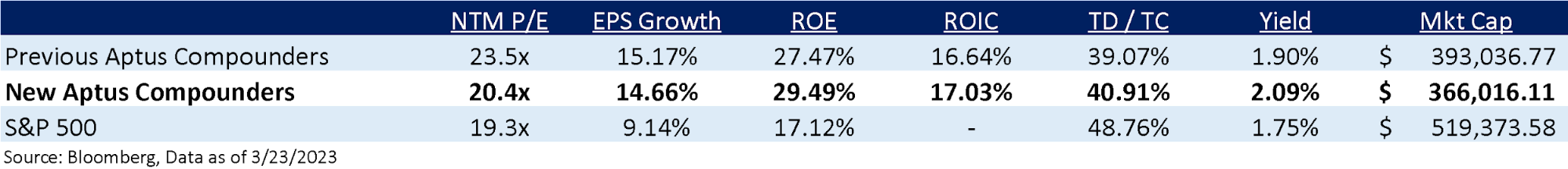

In a way, we are swapping like-minded securities, yet one trades at a much lower valuation with a 3% dividend yield, and we love how it transforms the characteristics of the entire portfolio:

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

Information presented in this commentary is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Information specific to the underlying securities making up the portfolios can be found in the Funds’ prospectuses. Please carefully read the prospectus before making an investment decision. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy.

The company identified above is an example of a holding and is subject to change without notice. The company has been selected to help illustrate the investment process described herein. A complete list of holdings is available upon request. This information should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the holdings listed have been or will be profitable, or that investment recommendations or decisions we make in the future will be profitable.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy call (251) 517-7198. ACA-2303-25.