Who Is John Galt?

In 1957, Ayn Rand, an anti-statist public intellectual, wrote her magnum opus – Atlas Shrugged. The best-selling dystopian novel depicted a United States devastated by excessive taxation and government regulation.

In 1957, Ayn Rand, an anti-statist public intellectual, wrote her magnum opus – Atlas Shrugged. The best-selling dystopian novel depicted a United States devastated by excessive taxation and government regulation.

At its core, Ayn Rand’s main philosophy, objectivism, is the theory of a person as a heroic being, with their own happiness as their moral purpose. Happiness is the state of emotion that is created from the achievement of objective values. But these values and the means can only be identified by reason, and Rand holds that they cannot be achieved without virtues of integrity, independence, productiveness, and honor.

Rand holds that the mind, specifically human thinking, and the resulting intelligence is the primary source of individual wealth – something very different than how economists define the term. They define wealth as an economic output, while Rand argues that it is an input.

Rand’s preferred name for this group of intellectuals is Producers and is epitomized by John Galt in the novel as a man with unflinching commitment to facts. Producers understand that intelligence creates wealth. They grasp that a business’ success entails a long-range process of thought and planning carried out by a focused individual. Producers methodically plan, immersing themselves in each and every detail of a process, hoping for it to culminate into something value-additive to society. This vision tends not to yield instant gratification but can take years, even decades to come to fruition.

That’s why it’s important for investors to understand that intelligence is the primary input of wealth – not the increase in economic value – which is an output. Investors don’t just invest for today or tomorrow, but for the long term, which encapsulates a future that has not yet been created. Said another way, the output of economic wealth will be a byproduct of the intelligence correctly enacted today.

Proper financial preparation entails a long-range process of thought and planning carried out by a focused individual – though many of these small steps will go unnoticed by the masses, they are imperative to achieve financial independence. Our reasoning, not our daily manual labor, is the fundamental factor shaping and controlling how our allocations are positioned for the windshield, not the rearview mirror.

But, with intelligence comes the weight of understanding that we may need to be thinking differently because the current method of asset allocation may simply be a frozen form of current living intelligence.

But, with intelligence comes the weight of understanding that we may need to be thinking differently because the current method of asset allocation may simply be a frozen form of current living intelligence.

Aptus strives to create custom allocations that don’t just attack today’s environment, but one that we believe will look very different in the future. Understanding the necessity to put aside Keynesian beliefs of short-termeconomic noise to make proper, efficient decisions at the asset allocation. This helps negate longevity risk that is unintentionally injected into allocations due to the reliance on fixed-income ownership.

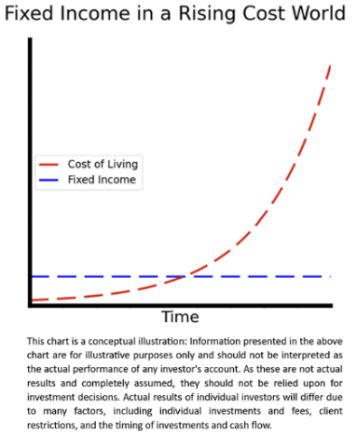

Our main philosophy: more stocks, less bonds, while remaining risk-neutral, is our proactive approach of thinking differently. Though it may feel safe, we believe that by owning bonds, investors are voluntarily throwing away their purchasing power, as fixed income cannot keep up with growing cost-of-living standards.

When creating allocations, it’s imperative that we take a long-term stance to compounding capital, thus, we recognize the hypocrisy of creating a single-year market outlook. This is even more apparent over the last twelve months as economist sentiment on the market has completely changed, as it’s worth noting that price moves narrative. With this, we try to take a more market-neutral stance, as we believe that the structure of an allocation will ultimately drive success for investors. Yet, understand the risks of what the bulls believe versus the thesis of the bears.

We are firm believers that the current investment landscape will be much different than what investors have been accustomed to over the last 40 years, and we hope to be the John Galt Line Railroad leading investors to the land of Galt Gulch.

We’ve often mentioned the Alan Watts quote: “Resisting change is like holding your breath, if you persist, you die.” And if we are not pragmatic, we will ultimately become a Looter, which is the key enemy of objectivism and the Producers, as they are those who do not independently think and solely utilize the intelligence of others, as a means for their own.

Be a Producer, not a Looter.

Will Atlas Consumers Shrug in ’24?

A mighty Titan, Atlas, is one of the most well-known gods in Greek mythology. Having been doomed to carry the weight of the heavens upon his shoulders by Zeus as punishment for his role in the Titanomachy, Atlas is memorialized both geographically (the Atlantic Ocean and Morocco’s Atlas Mountains) and literarily (Ayn Rand’s “Atlas Shrugged”).

A mighty Titan, Atlas, is one of the most well-known gods in Greek mythology. Having been doomed to carry the weight of the heavens upon his shoulders by Zeus as punishment for his role in the Titanomachy, Atlas is memorialized both geographically (the Atlantic Ocean and Morocco’s Atlas Mountains) and literarily (Ayn Rand’s “Atlas Shrugged”).

Investors waded into 2023 with fresh scar tissue after 2022, which was a year worth forgetting as the S&P 500 shed 19% and the Nasdaq 100 dropped 33%. “An imminent recession” in 2023 was the consensus view heading into this year, but much like the Titans, this depressed sentiment quickly became a myth.

U.S. Large Caps, specifically the Magnificent Seven (“Mag. 7”), took on the role of Atlas, carrying the weight of market returns on their shoulders. While economies and markets around the world struggled with faltering growth, the push/pull of inflation, tumbling oil prices, and geopolitical events reminiscent of the Cold War, the domestic economy and U.S. stocks did not shrug.

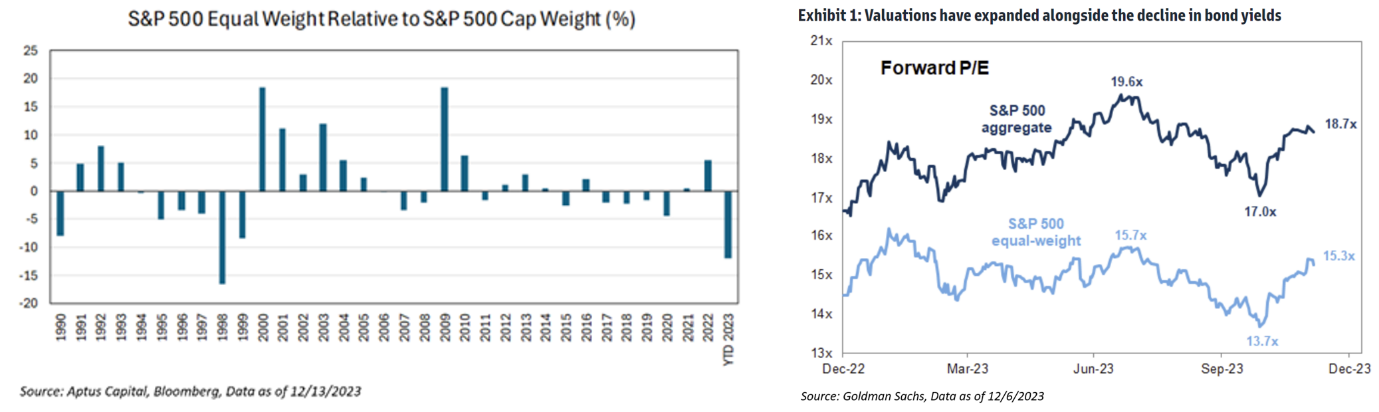

The word titan is synonymous with large, and it was the titans who fared best in 2023, with the S&P 500 up over 24%, driven by the mega-cap stocks. Trailing far behind were the mere mortals, as the average domestic stock jumped only 11%. This has been the worst relative performance year between the average stock and the cap-weighted S&P 500 Index since 1998. It should be noted that the equal-weighted index underperformed handedly again the following year in 1999 but went on to outperform the cap-weighted index for almost the entirety of the 2000s.

In the face of higher yields, the largest stocks have outperformed, which is a complete shift from what occurred in ‘22, leaving many investors flatfooted given the “higher-for-longer” mantra. Bond yields this year have likely risen due to the market’s improved perception of economic growth potential. Contrarily, bond yields rose last year because of heightened inflation and expected rate hikes. Outside of generative artificial intelligence (“AI”), the move in interest rates has been the factor contributing to the majority of this year’s returns in both fixed-income and stocks.

Over the past two years, the market has been enamored with the direction of interest rates. Not only that, but investors have continued to attempt to correctly time a monetary policy pivot, as recency bias has set the tone for an investors’ playbook after the Fed’s knee-jerk reactions to rates in 2020 and 2018. And, currently, the market still does not know the full definition of “higher for longer”.

Over the past two years, the market has been enamored with the direction of interest rates. Not only that, but investors have continued to attempt to correctly time a monetary policy pivot, as recency bias has set the tone for an investors’ playbook after the Fed’s knee-jerk reactions to rates in 2020 and 2018. And, currently, the market still does not know the full definition of “higher for longer”.

This caused a Yo-Yo in rates throughout the entire year: 1) down through April on the debt ceiling/banking crisis, 2) up on economic resiliency & Treasury General Account rebuilding, and 3) a late-year rate relief rally from a slowing economy. The only thing consistent for this year was that rates were highly volatile and credit spreads remained remarkably tight.

While a soft landing appears increasingly probable, the Fed must be cautious not to declare victory too early and stimulate an economy where inflation is not yet fully anchored, lest we repeat the mistakes of the past.

Many market participants believe that complex problems require complex solutions. We disagree. In fact, the market tends to be more simplistic than realized. This year was a prime example – interest rates ruled everything around the market. Equity markets have been supporting a soft-landing thesis heading into the end of the year, as the bond market is just taking recent global economic weakness as a sign for continued lower rates. However, the mathematical truth is that it is impossible to know whether investors are just passing through growth rates consistent with a soft landing before slowing into a recession or whether the economy will stay at growth rates similar to today. The market acted accordingly, sending both stocks and bonds higher on the year.

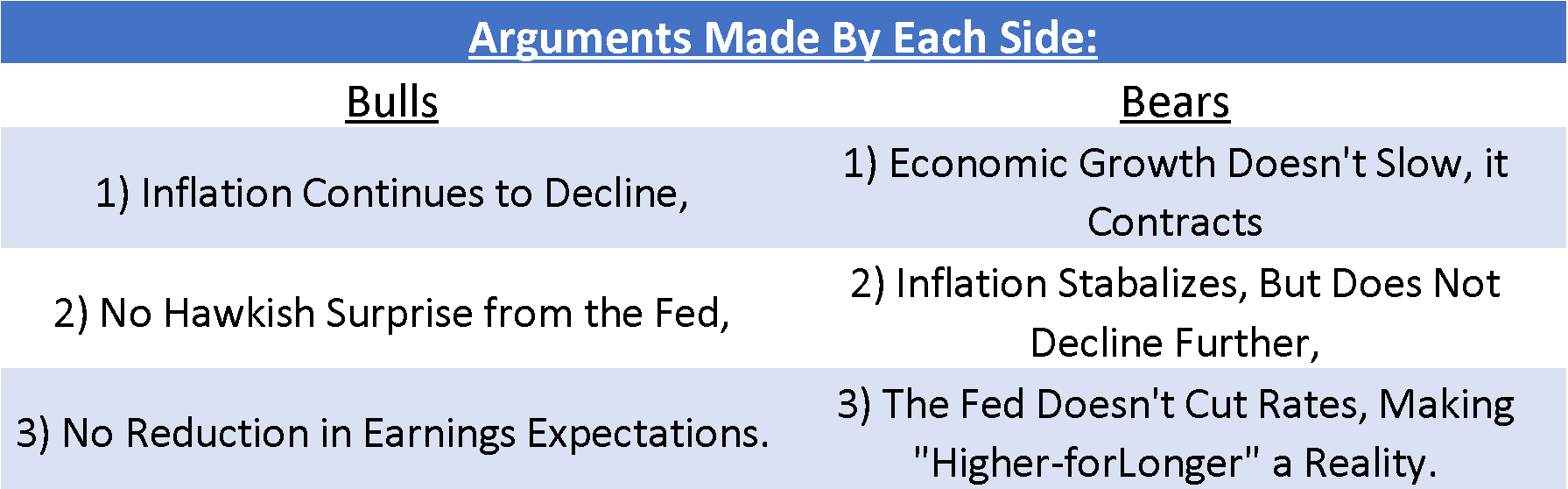

Much like the battle between the Olympians (Zeus & Poseidon) and the Titans (Atlas), the continued debate around a soft landing vs. hard landing has taken center stage and will likely continue well into next year. Simply put, the arguments for each side can largely be summed up with the following statements:

1. Bulls/Soft Landing: Everything that’s already priced in happens, and

2. Bears/Hard Landing: Everything we were worried about for ‘23 (when most were bearish) happens in 2024.

Heading into next year, we believe that the market will be fixated on one main thing: Will the Consumer Shrug?

Will Atlas Consumers Shrug?

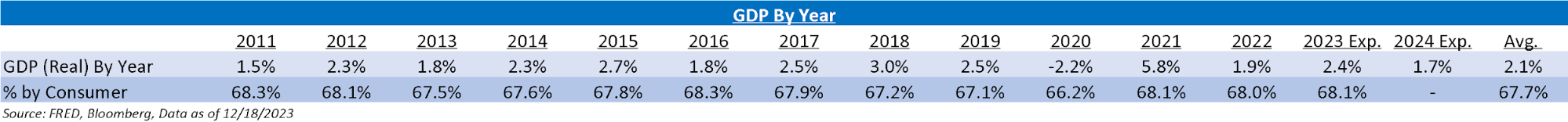

The preferred measure of economic growth is through Gross Domestic Product (“GDP”), which is the total market value of the goods and services produced within the United States in a year. The largest component of GDP tends to be contributed by consumer spending – totaling ~2/3rds of the calculation. Said another way, as the U.S. consumer goes, so goes the U.S. economy – or vice-versa.

There is a wide range of ramifications dependent on spending habits. Specifically, slowing GDP can create structural problems in the economy, as it is marked by lower real income, higher unemployment, lower levels of industrial production, and a decline in retail sales. All of which will influence the S&P 500’s earnings per share – which tends to be one of the most reliable factors when determining the market’s price direction.

This is exactly why we believe the market will be fixated on the consumer: If spending remains resilient, then earnings growth will likely drive the market and support a higher valuation multiple. But if the consumer shrugs due to 1) the potential for a recession, 2) a weakening labor environment, and 3) the ramifications of almost three years of compounded inflation lowering their purchasing power by 20%, could derail the economy.

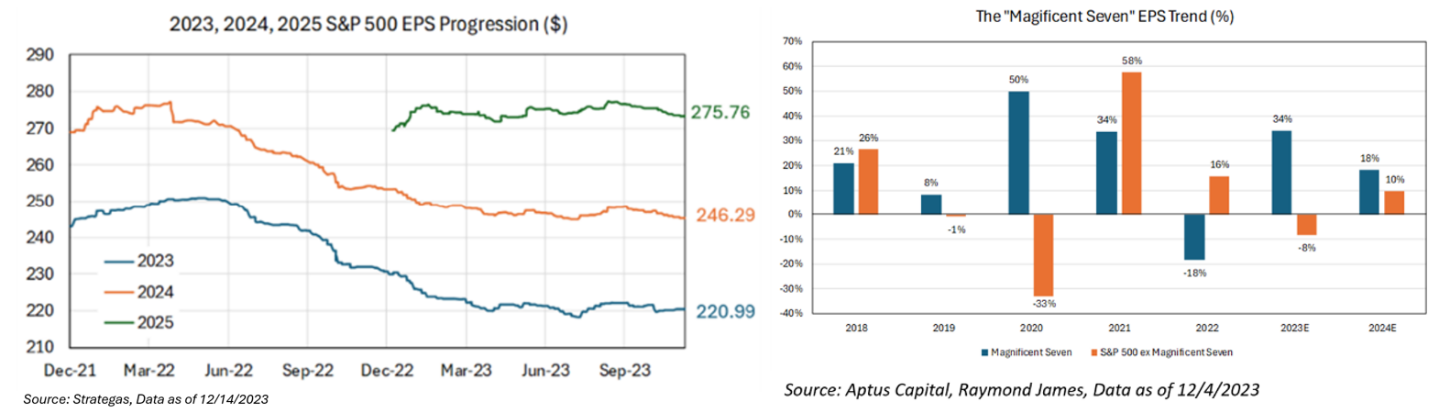

A common theme in ’23 was the anticipation that the consumer would run out of capital generated from the COVID-19 relief fund packages. But that could not have been further from the truth. In fact, the expectations for earnings in ’24 and ’25 reflect that a soft landing will occur, piloted by these spending habits. Year-over-year, the market has not seen any earnings growth, but the market is pricing in above-average growth over the next two years – 11.45% and 11.97%, respectively. Knowing that the market is a forward-looking mechanism, it should be surprising that the market was able to look through the paltry nominal growth since ’22. Like, ’23, these forward expectations continue to be driven by the largest stocks in the S&P 500:

Much like the S&P 500 performance can be supported by the “average stock” if the Magnificent Seven falters, GDP can be supported by the remaining third: investment spending. Infrastructure spending and the tight labor market could make a serious recession unlikely, as the government has shifted its focus from fiscal spending helping consumers to helping companies spur investments.

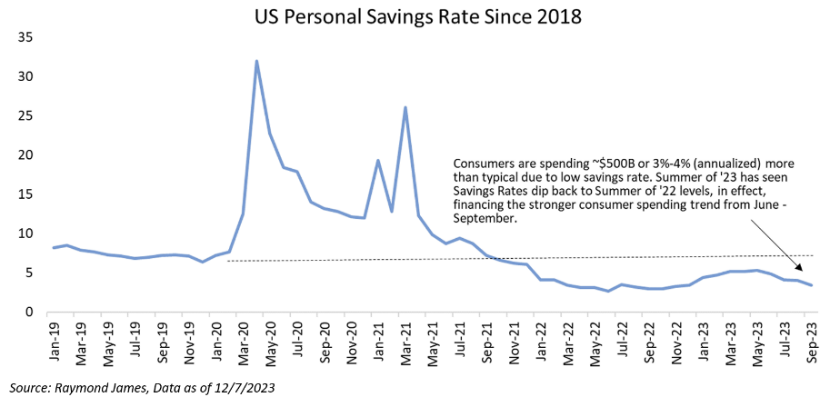

It feels consensus that the market expects the consumer to slow its spending in ’24, as excess savings have largely been removed. In fact, at current savings rates of 3%-5% (essentially at all-time low levels),consumersare spending ~$0.5 trillion or ~3%-5% above and beyond what they have historically maintained, i.e., the level of spending today is unsustainable, even if the economy remains strong. If this normalizes quickly, it could be painful; if this occurs over several years, it will be less impactful. The latter could be driven by individuals’ balance sheets, as they remain quite healthy due to a strong job market.

It feels consensus that the market expects the consumer to slow its spending in ’24, as excess savings have largely been removed. In fact, at current savings rates of 3%-5% (essentially at all-time low levels),consumersare spending ~$0.5 trillion or ~3%-5% above and beyond what they have historically maintained, i.e., the level of spending today is unsustainable, even if the economy remains strong. If this normalizes quickly, it could be painful; if this occurs over several years, it will be less impactful. The latter could be driven by individuals’ balance sheets, as they remain quite healthy due to a strong job market.

It behooves investors to remember that markets tend to invest in the rate of change in the near term, but the absolute levels over longer periods of time.

- The Rate of Change (chart above): Spending on the heels of the savings rate, and

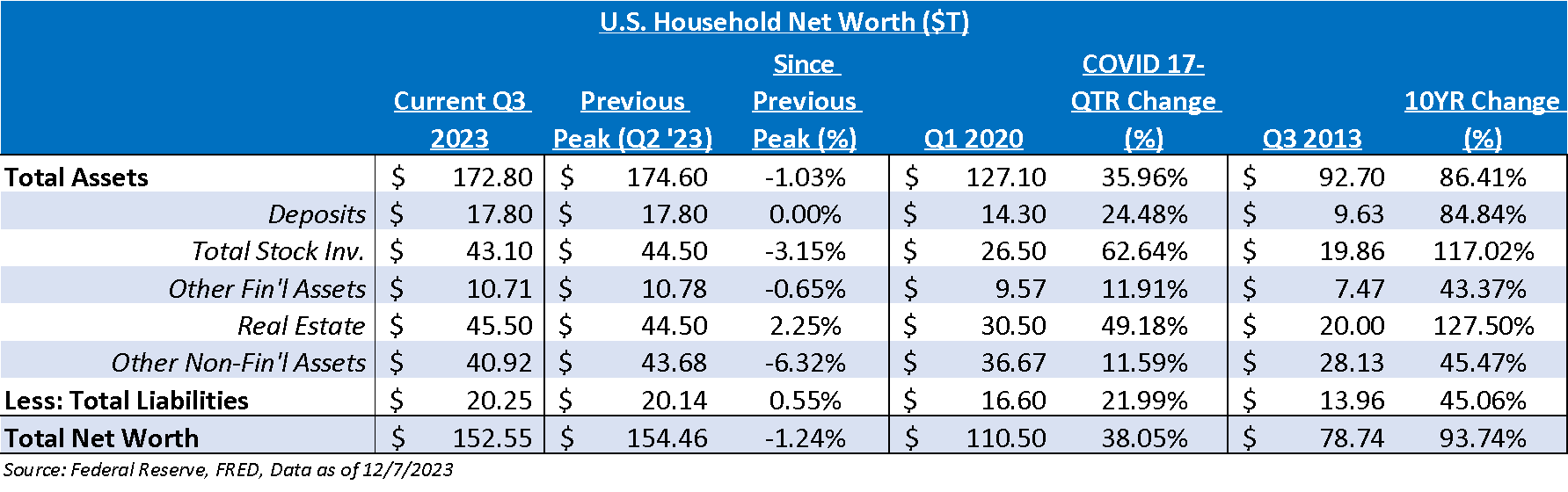

- Absolute Level (chart below): The level of U.S. household net worth remains strong showing the long-term strength of the consumer.

Market participants who skew bearish tend to sound the smartest, but it’s the bulls that are the ones that tend to make money over longer periods of time. Recently, there has been a lot of focus on economic data, specifically single data points, and depending on one’s thesis, any narrative can be written to prove or disprove a bullish thought, and vice-versa. That’s why it’s important to remember that only during periods of a recession and a recovery that economic data tend to portray the same message.

This means that investors need to continue to remain balanced – don’t get too bearish or too bullish. Don’t get too growthy or too deep value. Don’t get too defensive or too cyclical. Increase the horsepower of your allocation’s engine by owning more stocks, while remaining risk neutral through ownership of volatility. We are firm believers that a proper allocation structure and maintaining a process that executes on that structure will outperform over longer periods of time, specifically during periods of slowing growth and economic uncertainty, as well as long-term.

Looking Forward Through our Yield + Growth +/- Valuation Framework

Total return is derived from three different variables. The first, which tends to be known, is dividend yield. The second return driver is a measurement of economic growth, and the final factor is valuation which is a gauge of investor sentiment.

Words of Wisdom for the Year Ahead

We always end our annual outlook with a positive message, as the investment world tends to be lived through the lens of a pessimist. And, in confluence with our message about Ayn Rand and Objectivism, let’s focus on wealth, though not by measure of dollar or intelligence. But simply wealth of time – let’s talk about “Time Billionaire”:

The average lifespan of an American is 79.0 years. The length of 1 billion seconds is 31.7 years.

If you’re 47 or younger, that means you’re a time billionaire. You likely have 1 billion+ seconds left in your life. If you’re 20, there’s a decent chance you’re a multi-time billionaire. Our society places more value on being a dollar billionaire. We believe that people severely overvalue the dollar billionaire and undervalue the time billionaire. In our opinion, this is flawed.

Time is the most precious asset in the world. Everybody has the same amount of time each day. You can’t buy more of it. It’s the only thing in our lives that we can’t reacquire once it’s gone. On average, we spend: 26 years sleeping, 7 years trying to fall asleep, 13 years working, 8 years watching TV, 5 years eating, 3 years on social media, and 3 years commuting (plus a few random years on miscellaneous).

This leaves us with 6.8 years of free time – how will you spend yours?

We feel privileged to work with every one of you. We are blessed for all our new relationships, and for those relationships that we’ve had for a long time – we would not be who we are without each and every one of you. Everyone reading this outlook is the lifeblood of our company, and we couldn’t be more thankful for you being a part of our lives. We wish everyone a safe and healthy new year.

Happy Livin’,

The Aptus TEAM.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2312-22.