HNW Holdings Update

The HNW sleeve is designed to give equity exposure to a group of individual stocks that offer attractive prospects through a combination of yield, growth, quality, and reasonable valuations.

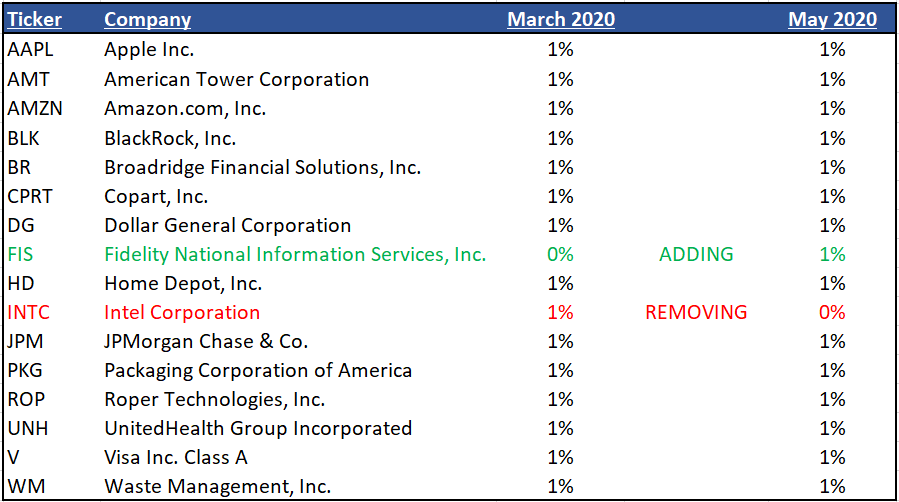

Holdings as of 5/1/2020

Purchases

Fidelity National Information Services, Inc. (FIS) is a financial services technology company with a steady stream of recurring revenue. In 2019, FIS made a transformational acquisition of Worldpay, a payment service provider that offers shops online services for accepting electronic payments. Furthermore, FIS’ legacy business is among the largest core banking software providers for many large banks.

Simply put, we believe Wall Street under appreciates the strategic value of the recently announced Worldpay acquisition. The deal structurally changes the growth profile of the company essentially overnight on top of enhancing the margin profile as well. In short, we believe the deal makes a lot of sense and we expect the stock to re-rate higher once investors begin to fully appreciate this transformative combination.

Sells

We’ve decided to sell Intel Corporation (INTC), the largest semiconductor maker in the world, as we lowered our overall growth rate for the name, bringing its “Yield + Growth” below our double-digit threshold. Thus, we decided to allocate into the faster growing FIS. Furthermore, from our perspective the stock appears to be already reflecting a lot of optimism as it trades with a valuation that is at the upper end of the historical range. Given this run, we decided to move on.

Disclosures

The Impact Series is a model portfolio solution developed by Aptus Capital Advisors, LLC. Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy call (251) 517‐7198 or contact us here. Information presented on this site is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities or to advise on the use or suitability of The Impact Series, or any of the underlying securities in isolation. Information specific to the underlying securities making up the portfolios can be found in the Funds’ prospectuses. Please carefully read the prospectus before making an investment decision.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment and tax professional before implementing any investment strategy.

SPDR S&P ETF Trust is an exchange-traded fund incorporated in the USA. The ETF tracks the S&P 500 Index. The Trust consists of a portfolio representing all 500 stocks in the S&P 500 Index. It holds predominantly large-cap U.S. stocks. This ETF is structured as a Unit Investment Trust and pays dividends on a quarterly basis. The holdings are weighted by market capitalization. The volatility (standard deviation) of the Impact Series may be greater than that of the SPDR® S&P 500® ETF.

Investing involves risk. Principal loss is possible. Investing in ETFs is subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of the shares may trade at a discount to its net asset value(“NAV), an active secondary market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a fund’s ability to sell its shares. Shares of any ETF are bought and sold at Market Price (not NAV) and are not individually redeemed from the fund. Brokerage commissions will reduce returns. Market returns are based on the midpoint of the bid/ask spread at 4:00pm Eastern Time (when NAV is normally determined for most ETFs), and do not represent the returns you would receive if you traded shares at other times. Diversification is not a guarantee of performance, and may not protect against loss of investment principal. ACA-20-111.