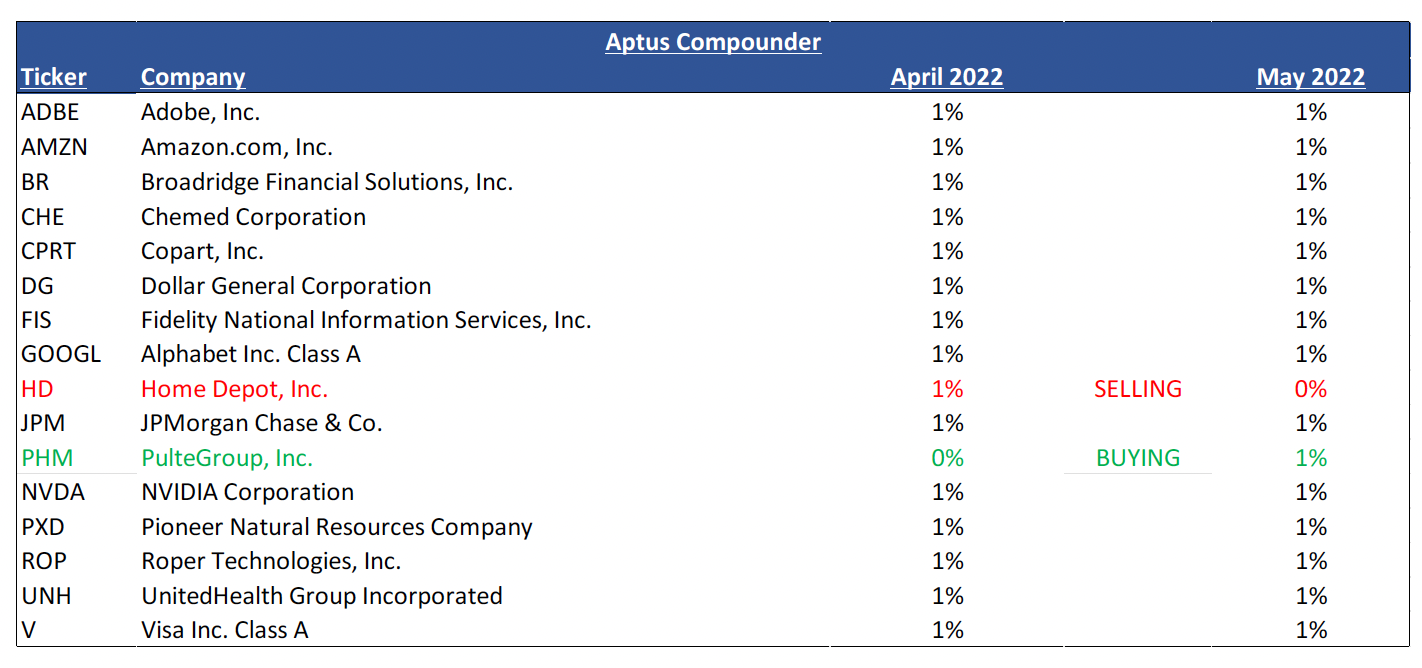

Aptus Compounder Update:

The Aptus Compounder Stock Sleeve is designed to give equity exposure to a group of individual stocks that we think offer attractive prospects through a combination of yield, growth, quality, and reasonable valuations relative to large cap peers.

Purchases:

To the surprise of many, we have actually owned a homebuilder before in the Compounders portfolio – Lennar Corporation (LEN) – it was actually one of our maidan holdings. Now, we are owning the industry again, but this time, it’s going to be through PulteGroup, Inc. (PHM). I understand that this trade, much like our Exploration and Production (“E&P”) trade last September with Pioneer Natural Resources (PXD), may turn some heads, especially given the recent volatility in the markets, the potential for a recession, and skyrocketing mortgage rates. Let’s dive in.

We believe that Homebuilders and Exploration and Production (“E&P”) companies have a lot of the same structural characteristics. Both have severely underdeveloped ecosystems, both trade at historically low valuations, and both industries have started to focus on free-cash-flow and returning it to its shareholders. The only major difference between the two has been sentiment. And here lately, we believe that sentiment has finally changed – those valuations have begun to matter in this space.

As with any trade in this market, there is risk. More importantly, that’s why we are focusing on overall valuation – which, historically speaking, has been a great indicator of future returns and outperformance during bouts of volatility. This trade is solely based off relative valuation as PHM trades at less than 1.0x forward book value and it has a catalyst for prolonged growth. That means that the market believes the company can sell all of their assets off their balance sheet at only 80% of market value. Given the current demand for housing and an underbuilt network in residential homes space in the U.S., we believe that the market is mispricing this opportunity in the market.

Sells:

Home Depot, Inc. (HD) just had an amazing report – they put the hammer down – it was an outlier in the space, especially relative to the more retail-based stocks, i.e., WMT, TGT, etc. HD’s report refuted fears of a housing-related slowdown by delivering a high-quality beat in Q1 ‘22 and moreover raising its FY ’22 outlook. Comps sustained their positive trajectory even against the hardest comparison ever and -100bps drag from cooler weather. EBITDA also rose +3% reflecting HD’s capabilities managing both inflation and required efficiency-driving investments. We believe the outlook for repair & remodel demand remains strong and home price appreciation is offsetting slower turnover stifled by higher mortgage rates.

We continue to like Home Depot, Inc. (HD), but the stock has traded with a pretty tight correlation to Homebuilders this year on the fear of increased mortgage rates. Yet, as we come out on the other side, we believe that PHM’s less than 1.0x Book Value will have the potential to drive incremental returns with more direct exposure to this same thematic space. Not to mention, Homebuilders have the opportunity to repurchase around 10% of their shares outstanding over the next twelve months.

We have been watching this trade for quite some time – we are very convicted on this relative play – we have just been waiting on the right time to execute this trade. And homebuilder’s relative performance versus the benchmark has shown us that the sentiment overhang may finally be priced in.

Additional Research:

PulteGroup, Inc. (PHM) Case Study

PulteGroup, Inc. (PHM) Research Report

Disclosure

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

Information presented in this commentary is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Information specific to the underlying securities making up the portfolios can be found in the Funds’ prospectuses. Please carefully read the prospectus before making an investment decision. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy.

The company identified above is an example of a holding and is subject to change without notice. The company has been selected to help illustrate the investment process described herein. A complete list of holdings is available upon request. This information should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the holdings listed have been or will be profitable, or that investment recommendations or decisions we make in the future will be profitable.

Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy call (251) 517-7198. ACA-2205-17.