Our stated mission is to help advisors help clients reach their LONG TERM goals, so we generally try and keep your inboxes uncluttered. That said, we know you’re on the front lines…with major stock indexes down 25-30% in 3 weeks and credit spreads widening, a little perspective can’t hurt. We want to help your coaching efforts as needed, so here’s a quick update from our vantage point.

Dec 31, 2019

At year-end, investors were celebrating a great(and mostly unexpected) 2019. Everything was up, and markets managed to overcome a mid-year economic slowdown and the great trade war with China…remember that? The gains were almost entirely driven by a rise in valuations/expectations, but with those kinds of gains not many cared.

Jan 31, 2020

Solid start to 2020. Coronavirus entered the radar of those of us involved in markets every day, but market reaction was mostly limited to China. Foreign stocks and U.S. value stocks lagged, but what else is new?

Feb 19, 2020

U.S. stocks made all-time highs, yippee! We are the envy of the world, and immune from whatever ails the rest of global markets. Even Apple’s warning about Coronavirus impacting its earnings outlook was taken in stride.

Feb 28, 2020

What in the world was that?! In 7 sessions, the S&P 500 fell 12.5%, straight down from the day of its record high. The seemingly low 2.01% yield in 30 Year Treasury Bonds fell like a rock, to an unthinkable 1.67%. Institutions and asset managers were officially awake, and the investing public was about to see monthly statements that looked a lot different than the past 12.

March 12, 2020

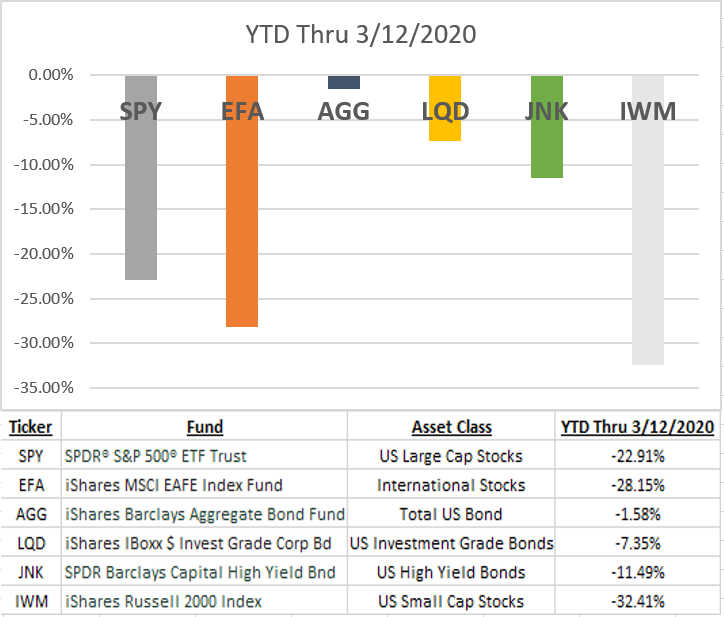

Whatever day you read this, bond yields are substantially lower than those “refinance now!” levels, and stock prices have continued to fall. But there are new developments…a price war in oil, and a sudden but not-all-that-shocking explosion in credit spreads. The progression of events has resulted in the ugly picture investors are starting to grasp from the headlines:

Source: Bloomberg

Tomorrow and Beyond

Hate to say it but the truth is we have no idea. We pray for the safest possible outcome of this pandemic; as risk managers who constantly assess the impact of correlation and contagion we take it very seriously from both a health and economic perspective. But we have little control over that.

What we can control is our positioning, and believe we’ve done everything possible to prepare portfolios for times like these. We’re not going to liquidate, and we’re not going to wrap entire portfolios in bubble-wrap hoping we can time things perfectly.

If you’ve read our notes, we’ve been conservative with risk and taken every precaution possible over the past 12 months…reduced foreign stocks, added hedges, reduced bond duration, reduced credit exposure, you name it. We’re not a money market; we’re here to help you help clients reach their goals, usually centered on present and/or future spending.

The Remaining Risks

There are two primary types of risks we always consider:

Drawdown: the risk of losing money. Can strike w/o warning and hard to overcome if too large.

Longevity: the risk of outliving your money. Trading short-term security for long-term shortfall. Sneaky.

We believe bonds have become significantly more risky, when you consider risk #2 above. Without taking undue risk, we simply can’t find opportunities to generate safe income in the bond market. That can change with changing prices, but for now we’re not adding to bonds just so we can feel better about day-to-day volatility.

The Opportunity

Stocks are currently in a drawdown approximating 25%, but the positive from that is that as a whole they are now less risky and offer more upside. Remember this picture?

Moving Forward

We’ve said that a portfolio entrusted to our management is a fragile package in our hands to be taken from Point A to Point B. We’re constantly thinking through the lens of helping you give clients the answers they need to the following 3 questions:

Am I going to be OK?

Can I maintain my family’s quality of life?

Can I improve it?

We feel GREAT about questions 1 and 2 today, and moving forward. Given the environment, giving a “Yes!” to question 3 is not a certainty, and probably not first on your mind OR client’s minds, today. But we’ll feel really good that one, too, as the storm passes. Our ability to adapt, and generate deployable cash from our hedges, gives us a ton of confidence about our potential to capture the next sustained upside the market gives us.

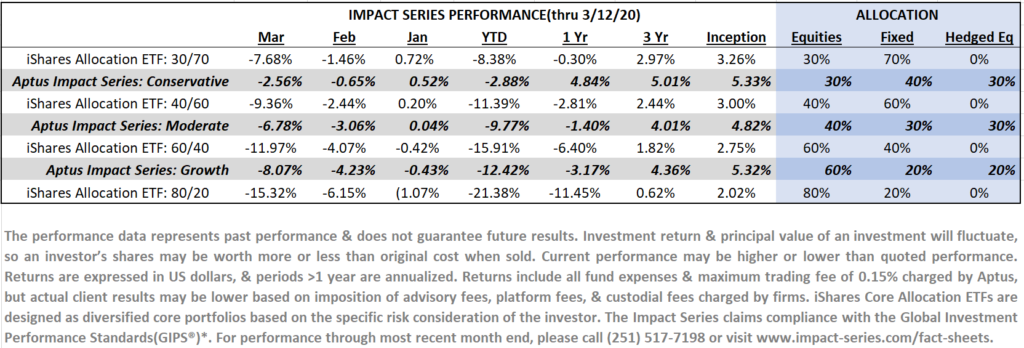

Your Portfolios

We hesitate to focus on short-term performance, but with the extreme conditions of the past few weeks we want you as comfortable as possible with the way your clients are positioned. The graphic below, through March 12, gives a good representation of the performance in both the up and down markets seen since the 1/1/17 inception date of the models. If you feel any clients should be positioned higher or lower on the risk scale please let us know and we can discuss the pros/cons of any particular model.

As always, thank you for your trust and please get yourself signed up at our new Content Hub where we’ll be adding new white papers and placing all of our updates. And consider our phone lines wide open as needed.

The Aptus Team

251.517.7198

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy.

Portfolio holdings information as of February 28, 2020. There is no assurance that the specific securities listed will remain in the Portfolio. Asset allocation and portfolio holdings may differ from the model among accounts in the composite. Aptus employs a diversification strategy using a combination of tactical and strategic, active and index-based Exchange Traded Funds to represent specific asset classes. These representations should not be considered a recommendation to buy or sell an ETF. As with all investments, ETFs have risks. For more information or a prospectus, please contact your Investment Advisor.

The Impact Series Benchmarks are the iShares Core Allocation ETFs. iShares Core Asset Allocation ETFs are designed as diversified core portfolios based on the specific risk consideration of the investor. Each iShares Core Allocation Fund offers exposure to US stock, international stock, and bond at fixed weights and holds an underlying portfolio of iShares Core Funds. Investors choose the portfolio that aligns with their specific risk consideration. iShares Core Allocation ETFs offer investments to meet a Conservative (iShares Core Conservative Allocation ETF), Moderate (iShares Core Moderate Allocation ETF), Growth (iShares Core Growth Allocation ETF), and Aggressive (iShares Core Aggressive Allocation ETF). Source: Blackrock. The volatility (standard deviation) of the Impact Series may be greater than that of the benchmark.

*The Impact Series claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. The Impact Series has been independently verified for the periods January 1, 2017 through December 31, 2018. The verification report is available upon request by calling (251) 517-7198. Verification assesses whether (1) the firm has complied with all the composite construction requirements of the GIPS standards on a firm-wide basis and (2) the firm’s policies and procedures are designed to calculate and present performance in compliance with the GIPS standards. ACA-20-63.