Aptus Compounder Update

The Aptus Compounder Stock Sleeve is designed to give equity exposure to a group of individual stocks that we think offer attractive prospects through a combination of yield, growth, quality, and reasonable valuations relative to large cap peers.

Sell

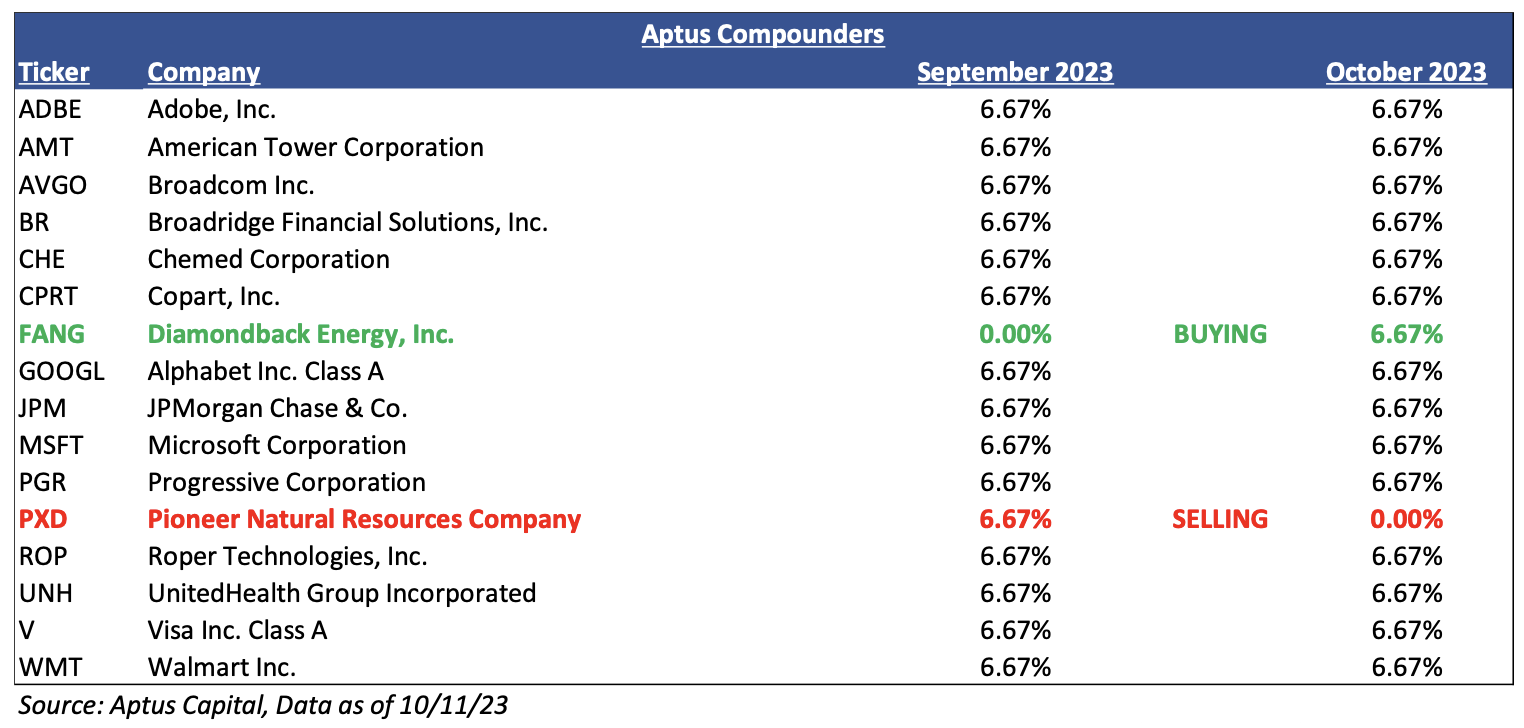

We are happy to announce that one of the holdings within the Aptus Compounders strategy was officially acquired by Exxon Mobil Corp. (XOM) on 10/11/2023, thus we are selling Pioneer Natural Resources Company (PXD), as we believe that the upside is now limited.

The ownership of PXD has been a great example that return can come from something besides valuation expansion. In fact, during our holding period, the stock has basically had no change in valuation. Yet, since the original purchase of PXD in the strategy on 9/1/2021, the stock has returned 95.71%, with 1/3 of that coming from dividends (remainder from growth). In fact, PXD has outpaced our benchmark, the S&P 500, by 95.69% during this timeframe – the benchmark has essentially been flat since the PXD purchase.

We are not surprised that PXD was purchased, as Scott Sheffield, the current CEO, has a history of selling E&P companies. Moreso, there has been an outstanding rumor since April 2023 that this acquisition could occur. A potential acquisition was part of our thesis, but by no means did ownership hinge on this occurring. If we were to continue holding PXD, shareholders would ultimately receive shares in lieu, which would still yield an energy exposure through XOM, but we decided to redeploy the capital instead.

Purchase

It should come to no surprise that we will take the proceeds from the sale and keep the capital in the Energy sector. We believe that there is a structural disconnect between the continued need for fossil fuels and the amount of investment capital flowing into the space. We are purchasing Diamondback Energy, Inc. (FANG).

We believe that FANG is poised to generate robust free cash flow (“FCF”) in the current cycle, the balance sheet is well positioned, and returns to shareholders are supportive of a higher valuation (at least 75% of FCF will be returned to investors). The management team has been a leader with respect to growth discipline and return of capital. We believe FANG will continue to opportunistically focus on incremental M&A assuming the deals are accretive. Not to mention, the management team, much like PXD, has a strong history of execution.

FANG recently accelerated shareholder returns to an impressive ‘at least 75% of FCF. We like the balanced returns approach that includes a base dividend, along with variable dividend and share repurchases (allocation between the two depending on the market conditions). More recently, the company has favored share repurchases, but we believe that this could switch to an increase in their variable dividend – this is already after a recent 5% bump to the base dividend.

We continue to believe that the landscape for Energy companies is changing and that the market will soon reward these companies with a higher valuation.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

Information presented in this commentary is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Information specific to the underlying securities making up the portfolios can be found in the Funds’ prospectuses. Please carefully read the prospectus before making an investment decision. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy.

The company identified above is an example of a holding and is subject to change without notice. The company has been selected to help illustrate the investment process described herein. A complete list of holdings is available upon request. This information should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the holdings listed have been or will be profitable, or that investment recommendations or decisions we make in the future will be profitable.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy call (251) 517-7198. ACA-2310-15.