Left or right, blue or red, no matter the outcome on November 3rd, or even if there is no outcome on November 3rd, it won’t change the way we view portfolio construction.

The source of returns will still be yield, growth, or valuation change. What matters will still be the ability to compound capital within given risk constraints.

We do not deploy a portfolio approach that changes based on who is President. We deploy an approach that focuses on owning strategies that can grow your portfolio while avoiding drawdown. We focus on exposures to companies that exhibit all the characteristics of what we call a compounder.

We won’t rehash any of the election research here. We’d prefer to remind you of our process as it relates to the things that we think really matter:

#1. Don’t Drawdown

#2. Compound Capital

Keep in mind, we believe #1 is required to accomplish #2

Don’t Drawdown

Investing involves the risk of drawdown. Without risk, return would not exist. You cannot eliminate risk; you just need to minimize it. Big drawdowns impair our ability to compound capital for two reasons:

- Behaviorally – being down less is generally a good thing. We won’t belabor this point, but shallower drawdowns are good for the nerves – ours, yours, clients, everybody!

- Mathematically – big drawdowns make it tough to compound capital. Simple math, 50% down requires a 100% return to get back to breakeven. Shallower drawdowns require less on the upside to climb out of the hole.

All of this can be summarized into understanding the importance of upside capture relative to downside capture. Removing all the noise, this is the goal of portfolio management.

Lower downside capture provides flexibility in other areas. In other words, if downside can be reduced, we can be average on the upside and still compound capital well above some benchmark.

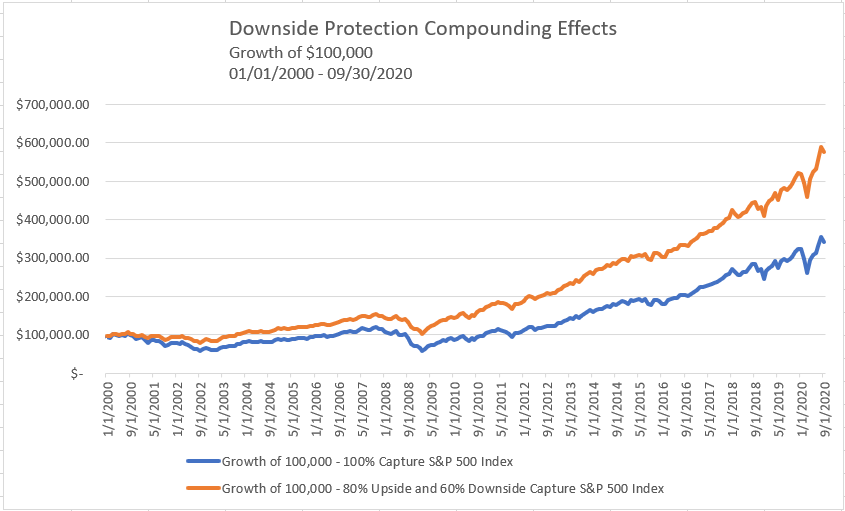

For example, the chart below shows the S&P 500 (the blue line) over the past 20 years. By definition, it’s 100% upside capture with 100% downside capture. The orange line shows a different path…only 80% of the upside, and 60% of the downside. While 60% downside capture still contains risk, look at how powerful this can be towards improving a portfolio’s ability to grow…even if you trail the market on the upside.

Source: Bloomberg, Aptus Research *Chart does not reflect actual Aptus strategy, just a comparison of different upside/downside captures*

Not only can reducing downside capture help outperform, by default it delivers a smoother ride. This is exactly the way we manage your portfolios. We cannot avoid all risk, but reducing the risk improves potential outcome…behaviorally and mathematically. Did we mention it’s good for the nerves?!

Compound Capital

Your portfolio is composed of different exposures. Underneath the funds, you own claims on the future cash flows from individual businesses (stocks). As the owner of these claims, we want the companies positioned to increase the value of your claims.

We do extensive work on this. You can read about our process here. Rather than bore you, we figured an example might be better. The point is to put election hype in its proper place, and remind ourselves that our portfolios consist of actual businesses run by actual people.

Chemed (CHE): Holding company that has competitive advantage in both divisions: hospice and plumbing. History of execution in both and a growth runway that should translate to a bright future. The election outcome will not change our desire to hold claims on this business! Contact us if you’d like to see the research.

Our team develops reports like this on dozens of companies; this is one example and If you’d like to see others just ask!

In Closing

Our hedges leave us defensively positioned moving into the election. We think the allocations are sound, built from our yield plus growth framework. Our focus is, and always will be, minimizing drawdown and owning securities positioned to compound your capital.

Reminder…simple beats complex. And as always, thank you for your trust.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Portfolio holdings information as of October 30, 2020. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein. Information was obtained from third party sources which we believe to be reliable but are not guaranteed as to their accuracy or completeness.

The company has been selected to help illustrate the investment process described herein. A complete list of holdings is available upon request. This information should not be considered a recommendation to purchase or sell any particular security.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2010-31.