“What a year it has been” is an understatement for the performance of both risk and conservative assets so far in 2022. In 301 years, we are looking at the 4th worst return ever for government bonds through September.

Source: BAML. As of 09/30/22

Source: BAML. As of 09/30/22

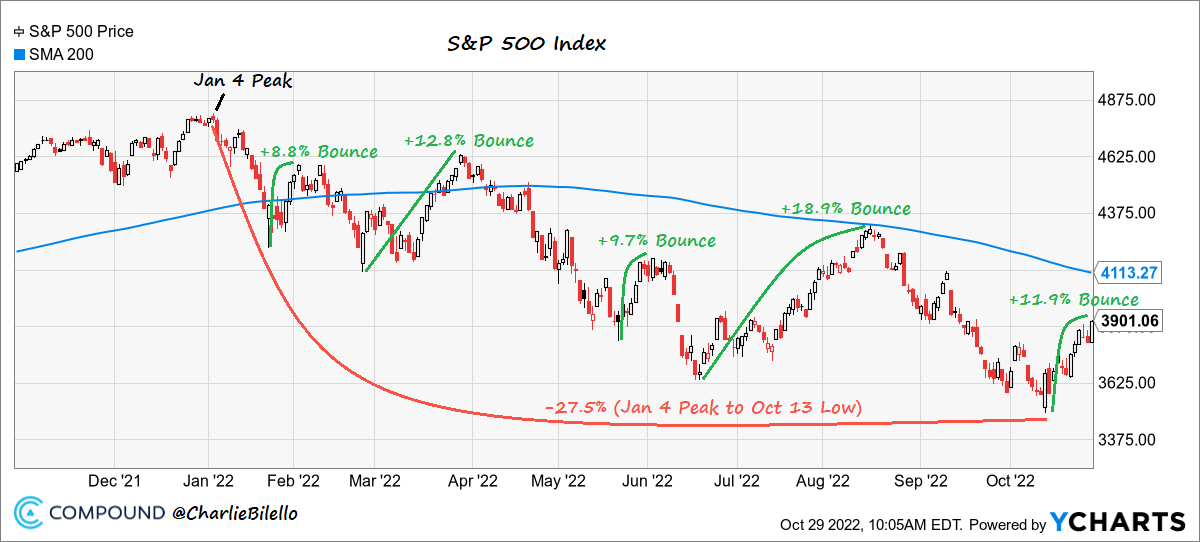

It has also been a choppy year for equities. We are currently in what appears to be another bear market rally. Since the October 13th lows the market is ~+12% higher. This rally makes for the 5th rally >8% since the beginning of the year. Each time prior, we’ve made lower lows…will this time be different?

Source: Charlie Bilello. As of 10/31/22

Source: Charlie Bilello. As of 10/31/22

On to the fun stuff… we’ve got quite a bit to accomplish in this note and the corresponding rebalance you’ll see across your account the next couple weeks. We will start off with the largest change and work our way down.

JUCY!!!

You asked and we delivered … Aptus finally has a TRUE income fund. We are very excited for the combination JUCY brings to our aggregate fixed income portfolio. Given the increase in bond yields, we’re able to start at yield levels we haven’t experienced in some time (or ever within an Aptus ETF vehicle). Higher nominal returns will boost potential portfolio returns looking ahead. As far as JUCY goes, we are excited for the combo of yield from the government bond portfolio (85% of the portfolio) along with the elevated level of volatility within equity markets which will allow for increased income from the options overlay portfolio via ELNs (15% of the portfolio). Interest rates and volatility will impact yields, but as of early November we believe the strategy will provide an overall yield in the 8% range. We believe the combination of the two ETFs (JUCY + DRSK) will continue to be a game changer for our overall allocation while allowing us to stay away from traditional fixed income. The allocation to JUCY will be most heavy in the Preservation and Conservative allocation and decrease as we move up the risk tolerance.

To read more on JUCY, see the JUCY Fact Sheet.

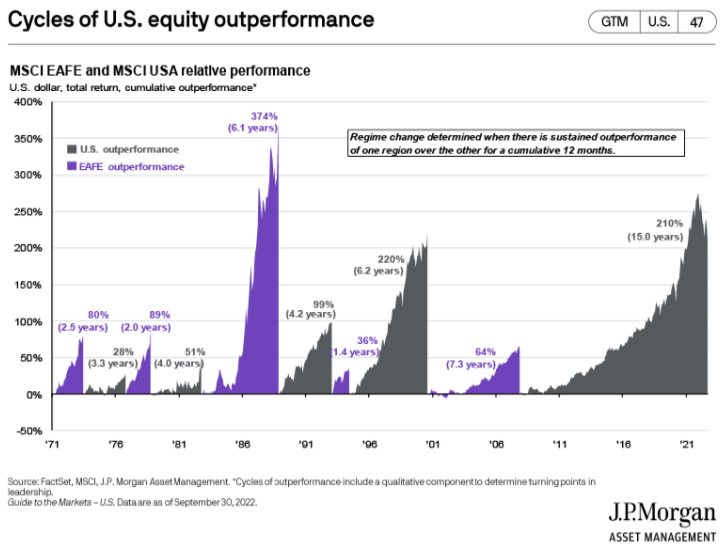

Slight Decrease to International

We all know the picture across the pond and in general outside the US isn’t pretty. Between war, new communist manifesto, record energy prices, and the US dollar wrecking ball, foreign economies are struggling. While the famous Warren Buffett quote about buying when there is blood in the streets could apply here, we’d prefer to take our chances and take chips off the table for now. This might not be the “forever” allocation, as we will be quick to “pivot” if we see a change within Fed policy that weakens the USD or a substantial shift in political winds, specifically within energy policy ex US. This trade is somewhat two pronged: Tax Loss Harvest + we are excited about the reallocation (more to come).

Source: JPM. As of 09/30/22

Source: JPM. As of 09/30/22

In addition to the decrease in international holdings/ tax loss harvest, we will tilt the portfolio holding to a more dividend-oriented holding. More on the logic behind the decision listed below.

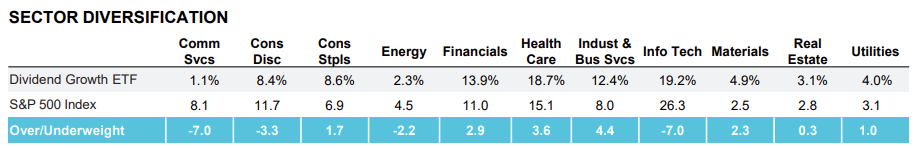

Add a Dividend Growth ETF (TDVG) to Replace Equal Weight S&P 500 (RSP)

We added RSP to the models back in August 2020 as we expected cyclical reopening of the economy following Covid. This turned out to be a longer-term position than we originally intended as the backdrop for the exposure continue to fit our allocations…we’re finally ready to let it go after a strong showing.

Source: Bloomberg. As of 10/31/22

Source: Bloomberg. As of 10/31/22

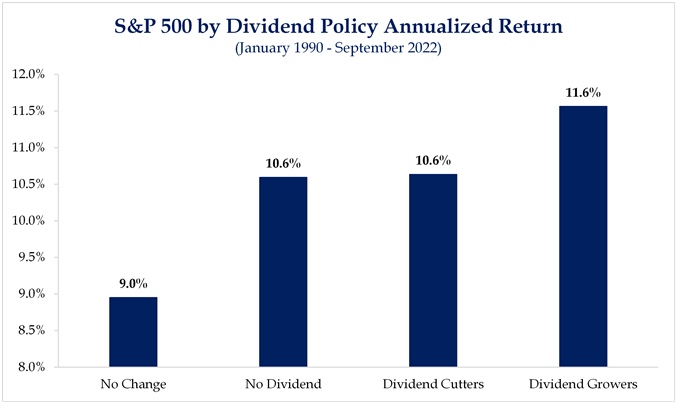

With rising rates likely to continue to tighten financial conditions and slow economic growth, we believe it’s time to move up in quality and incorporate both a selection (quality) + dividend focus on a piece of our large cap equity allocation.

TDVG employ fundamental research and active, bottom-up stock selection to construct a portfolio of high-quality, largely U.S.-based companies (approximately 100-125 issues) that they believe can grow their dividends over time. The investment process focuses on identifying companies trading at attractive valuations with strong competitive advantages and durable business models that will allow for the compounding of earnings and dividends over time, utilizing a tax efficient ETF wrapper.

Source: T Rowe Price. As of 10/31/22

Source: T Rowe Price. As of 10/31/22

Source: Strategas, as of 09/30/22

Source: Strategas, as of 09/30/22

While the expense ratio is slightly higher than RSP (50bps vs 20bps), we believe the minimal uptick in cost is justified given the improvement in exposure and general environment for active management. We think the fund complements our Yield + Growth framework and can add value to the overall allocation.

Did Somebody Say Small Caps??

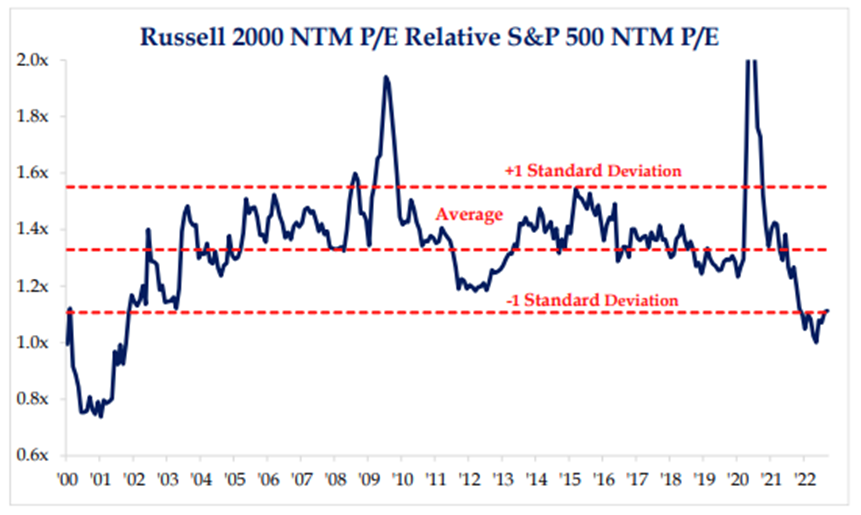

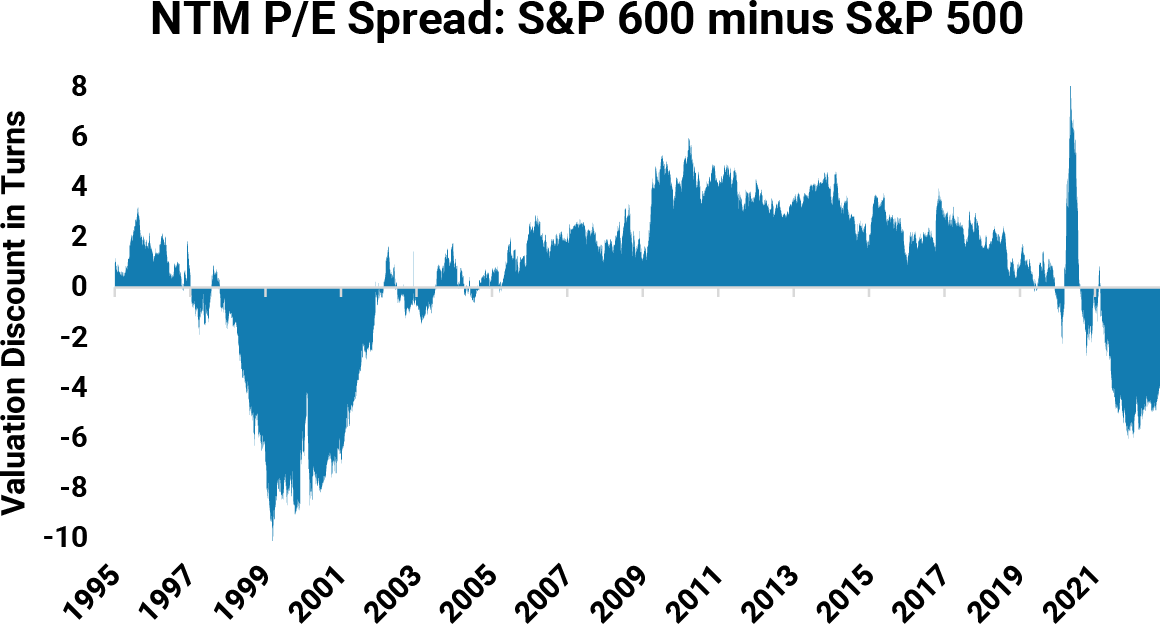

We are slightly bumping our small cap exposure to replace the international/ EM cut. While we cut exposure with lower valuations (ex US are cheap but this is probably valid considering the overhangs we cited above), we are adding exposure with low valuations PLUS quality as a replacement.

Domestic Opportunity: Most Small Caps are U.S. based with highly regionalized revenue streams, which helps to hedge global macro and currency uncertainty.

Historical Outperformance: Small Caps historically start fast after recessions, outperforming their Large-Cap counterparts by 32% in the 3 years following the Great Financial Crisis.

Not Afraid of Rate Hikes: Small Caps in general tend to outperform the market in rising rate environments, beating Large-Caps by an average of 1.2% during rising rate environments between 1978-2021. We haven’t seen that outperformance so far this cycle, which is partly why valuations look so attractive.

On the positive side, small caps have cheap valuations and lower currency risk (owing to more Small Cap business being done exclusively within US Borders).

On the negative side, small caps historically have elevated earnings risk amidst economically challenging periods and high cyclical concentration during a period of slowing growth; though this market cycle has seen resiliency in small cap earnings relative to large cap. We feel our exposure offers enhanced protection to these risks versus cheap beta.

Small cap valuation trades at 11.5x forward P/E and a four-turn discount to large caps. Valuation is without a doubt the most attractive feature of small caps. However attractive this may be currently, that doesn’t necessarily mean that they can’t get “cheaper”, which would mean more pain. We do think valuation will likely fare better on a relative basis to the S&P 500.

Source: Strategas 10/19/22

Source: Strategas 10/19/22

Source: Morgan Stanley, Data as of 10/23/2022

Add a sliver of exposure to an Energy ETF (VDE):

We’re adding old-line energy (read: oil & gas) exposure to the growth and aggressive growth allocations. Due to years of underinvestment both globally and domestically, the world finds itself structurally undersupplied hydrocarbons while the outlook for renewables transition continues to move further into the future than once thought. While prices can be erratic in the near-term, we believe fundamentals for sustained above mid-cycle oil & gas pricing are present, providing strong returns to players across the sector. Moreover, the sentiment around free cash flow management has seen a drastic shift away from growth at all costs to shareholder return via dividends and share buybacks. Limiting the allocation to our most aggressive models is a respectful nod to the volatility inherent of the sector and expected short-term fluctuations. Why VDE? There are not many low-cost, oil & gas-related ETF’s available – VDE gives us this exposure while including many attractively valued small-cap companies excluded from the S&P 500 sector fund, XLE.

Honorable Mentions:

- We cut the 1% Gold exposure from the Preservation Model 🡪 we believe we get enough exposure to metals via INFL as well as the general asset allocation limiting traditional fixed exposure.

- We cut the 1% OBTC from the Aggressive Growth model 🡪 we will rely on the tech companies inside the QQQ exposure in lieu (we like actual earnings)… also a tax loss harvest.

- You’ll notice we added one additional traditional bond holding to the Preserve allocation at 5%. We think short term Treasuries given the bump in yield offer a solid return with very little interest rate risk. We used the lowest cost exposure we could find in VGSH to achieve the exposure.

To Conclude

We are excited at the opportunity to make several structural and tactical changes across the portfolios as we approach year end. With the launch of JUCY, we are thrilled to enhance the yield profile of conservative allocations taking advantage of higher market yields and higher market volatility (which equates to more income from the options overlay). In addition, we see value in the tilt towards higher quality/ dividend paying companies which should outperform in an environment where the “G” (growth rate) is more uncertain 🡪 this pertains to TDVG, OSCV and the international changes (combination of better exposure + tax loss harvesting). Lastly, we are excited to add some direct energy exposure for our more growthy allocations where we see the structural backdrop on energy as providing a strong catalyst to the sector for the foreseeable future.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

When a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 11.2 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 4.6 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

The S&P SmallCap 600® seeks to measure the small-cap segment of the U.S. equity market.

The MSCI USA Index is designed to measure the performance of the large and mid cap segments of the US market. With 627 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in the US.

The MSCI EAFE Index is an equity index which captures large and mid-cap representation across 21 Developed Markets countries around the world, excluding the US and Canada. With 800 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The Russell 2000® Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000® is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2211-2.