From our view, what has happened matters less than what might happen – keep that in mind as you continue. The discrepancy between growth and value has been astonishing enough for us to chime in on how that is impacting your portfolios and our process.

So, what has happened?

The S&P 500 finished its 5th straight positive month. We have seen some of the stocks leveraged towards a reopening economy (restaurants, airlines, hotels, cruise lines, casinos, etc.) perform well as the market has climbed out of the COVID lows…but, that’s not the story.

The story is Big Tech. Consisting of nearly 25% of the index now, Big Tech is the tail that wags the dog. It was not long ago we had ZERO companies with a market cap (overall value) of one trillion (yes, with a T). Now we have four, with one of them being worth more than 2 Trillion! As I type, here are the largest companies in the index:

- AAPL: Market cap 2.25 Trillion

- AMZN: Market cap 1.75 Trillion

- MSFT: Market Cap 1.71 Trillion

- GOOG: Market Cap 1.1 Trillion

2.25 trillion is equivalent to 2,245.9 billion…Yes over 2 thousand billion! Or how about this stat: for the first time ever, US Technology companies are worth more than the entire European stock market. Hopefully, that helps illustrate how amazing the last few months have been for technology stocks.

The good news, our portfolios have exposure to all the mega cap names at roughly market weight. It has been a good thing for returns.

Growth vs Value

Growth stocks have dominated value and it has been driven by the stocks listed above as well as other mega cap names, the list is long.

If you are a die-hard value investor, we are sorry. It has been painful.

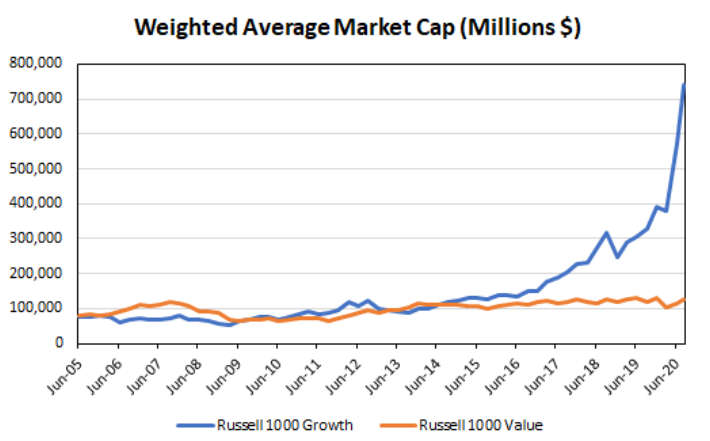

This chart showing the change in weighted average market cap between the Russell 1000 Growth Index (an index of growth stocks) and the Russell 1000 Value Index (an index of value stocks) is in the running for chart of the year. It depicts growth’s dominance as good as any we have seen.

Source: EconomPic

Do not Forget Where Returns Come From

Yield, growth, or valuations changing…

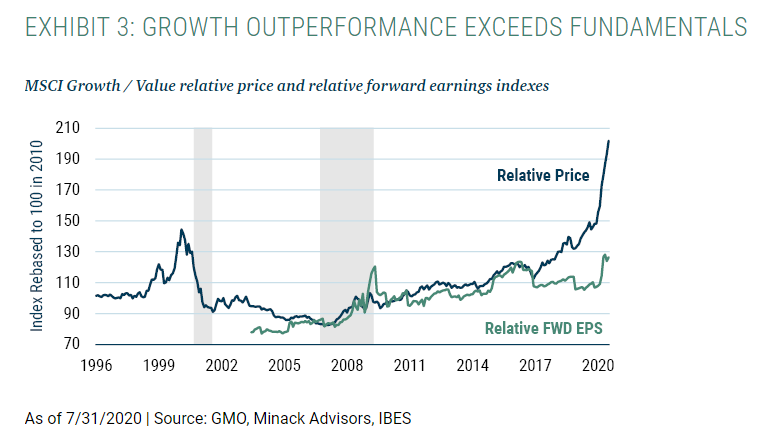

It does not take a market expert to realize that most of the returns of late have come from valuations expanding. Remember, valuations expanding means investors paying higher and higher multiples for stocks. It is not hard to make a case that valuations (a measure of current multiples) are extended, especially for growth stocks. Here is a chart illustrating growth exceeding underlying fundamentals:

Why does this matter

The phenomenal run in growth stocks has reached a point where we are paying close attention. The correlation between growth and value stocks has fallen to near zero. Will this…shoot, can this continue?

We see two potential paths forward:

- Mega cap tech cools off. This benefits nearly all other market segments given the size of tech. According to Tavis McCourt of Raymond James, this is a VERY asymmetric outcome and looking like an index is a bad place to be given the size of technology. This would lead to smaller caps finally outpacing large caps again.

- More of the same

Our job is not to predict the future but to position today based on what is most likely to happen. The windshield, not the rear-view.

We’re just continuing to focus on owning compounders as determined by our yield + growth framework. We have a good combination of high-quality stocks…some value, some growth. We will not deviate from our process and are positioned to benefit if technology continues to dominate.

At the same time, we’ve selectively added exposure to names that could benefit from a transition to value, and continued our practice of resetting hedges to minimize drawdown. It’s a constant balancing act, and we’re comfortable we’re pursuing an appropriate mix to help you keep clients comfortable.

If you have any questions at all around stock selection, please do not hesitate to reach out. As always, thank you for your trust and please keep in mind, simple beats complex.

Disclosures:

Past performance is not indicative of future results. Investing involves risk including the potential loss of principal. This material is not financial advice or an offer to sell any product. The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Aptus Capital Advisors, Inc. reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Forward looking statements cannot be guaranteed. This is not a recommendation to buy or sell a particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment and tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible. One cannot invest directly in an index.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. More information about the advisor, and its investment strategies and objectives, is included in the firm’s Form ADV, which can be obtained, at no charge, by calling (251) 517‐7198. ACA-2009-2.