Aptus Compounder Update

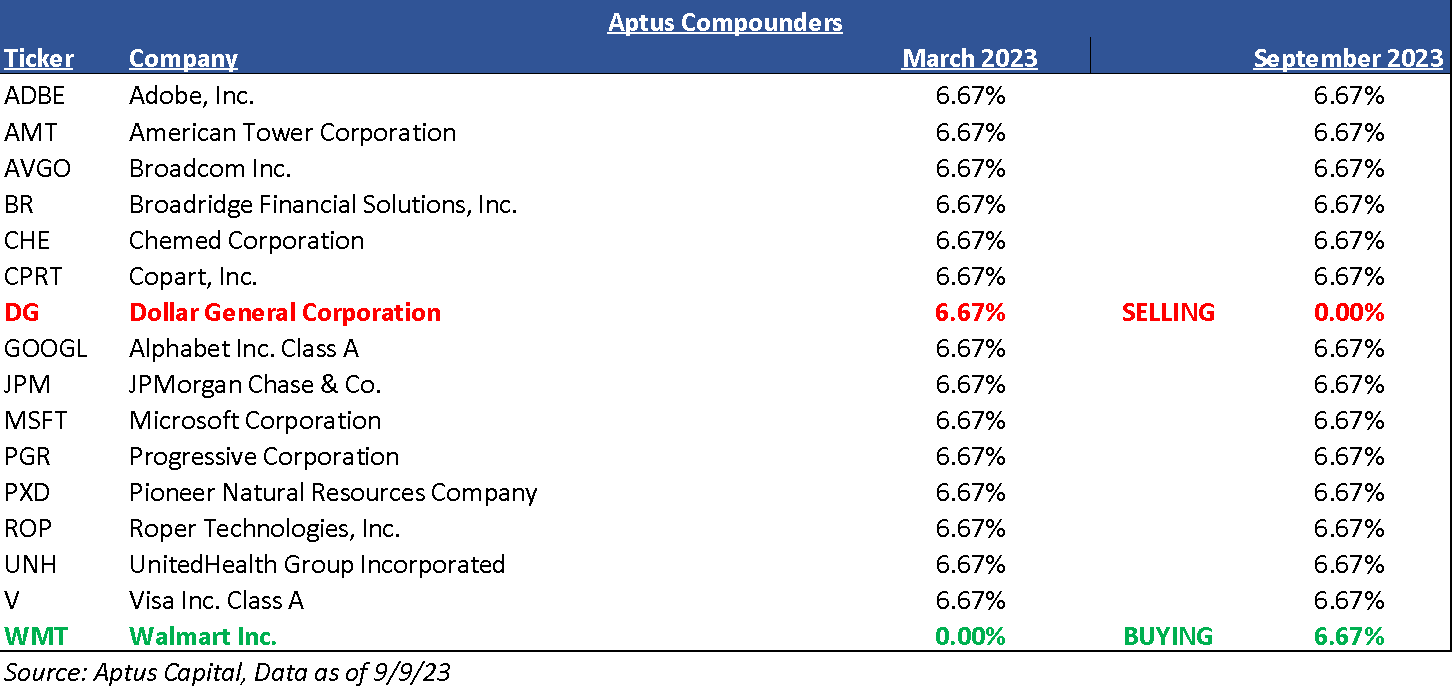

The Aptus Compounder Stock Sleeve is designed to give equity exposure to a group of individual stocks that we think offer attractive prospects through a combination of yield, growth, quality, and reasonable valuations relative to large cap peers.

Sell

We have held Dollar General (DG) for over three years now, as it served a pivotal holding in our portfolio construction process to help buoy performance during bouts of volatility. The stock did just that in 2022. Unfortunately, the majority of the stock’s holding period occurred during a risk-on rally, thus underperforming over the cycle.

The final straw that broke the camel’s back was during its last earnings report, which happened to be its second poor report in a row. DG has dealt with a number of near-term headwinds that have impacted sales and profitability, thus weighing on shares. We have difficulty owning this name in a decelerating comp environment. Not to mention the wage pressures and traffic recovery also present risks to DG.

Where we got this security wrong was at the end of the holding period as we believed that valuation was pricing in a lot of negative expectations. Given slowing traffic and continued investments, the company’s return on invested capital (“ROIC”) started to trend lower, as did the multiple. Unless ROIC significantly improves, we realize that there isn’t much upside to the multiple and we don’t see stability in profitability occurring in the near future. Moreover, after the recent company commentary, we don’t believe that there is much growth to earnings either. Thus, we decided to sell the name.

Purchase

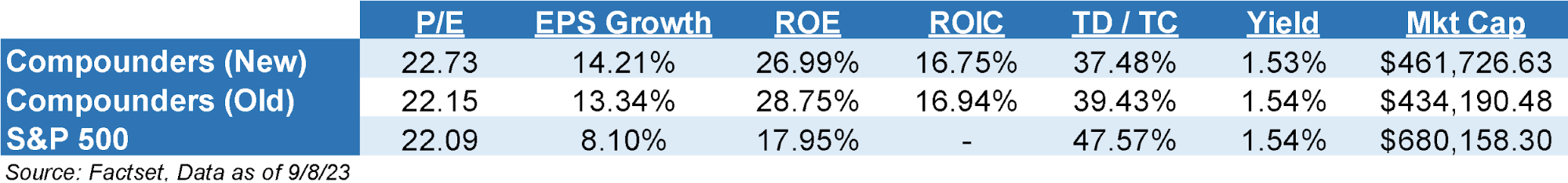

Understanding the importance of portfolio construction and the necessity to protect capital during down markets, especially given the concentrated nature of the strategy, we are purchasing a name that is also a Consumer Staple. We believe that Walmart Inc. (WMT) fits that bill on all of the portfolio construction requirements, alongside our stringent Yield + Growth Framework.

Our view on WMT is subject to a number of macroeconomic and company specific factors that, on the upside, include better-than-expected top-line growth and/or margin expansion in the U.S. stemming from its strategic initiatives; International operating margin and/or ROIC that improves faster than our forecast; and higher-than expected square footage growth in the U.S. and/or abroad. Moreover, a recession could drive an investor flight to safety, positively impacting WMT’s stock performance via absolute and / or relative P/E multiple expansion.

We believe that owning WMT benefits the portfolio holistically, as we have the ability to own more growth per unit (EPS) of valuation (P/E), increasing our Y + G.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

Information presented in this commentary is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Information specific to the underlying securities making up the portfolios can be found in the Funds’ prospectuses. Please carefully read the prospectus before making an investment decision. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy.

The company identified above is an example of a holding and is subject to change without notice. The company has been selected to help illustrate the investment process described herein. A complete list of holdings is available upon request. This information should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the holdings listed have been or will be profitable, or that investment recommendations or decisions we make in the future will be profitable.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy call (251) 517-7198. ACA-2309-15.