With this Aptus Musing focusing on the stock of the month, I thought I’d review the stock that has the least amount of U.S. exposure in our Compounders Portfolio – NVIDIA Corporation (NVDA). See the compliance approved Case Study here.

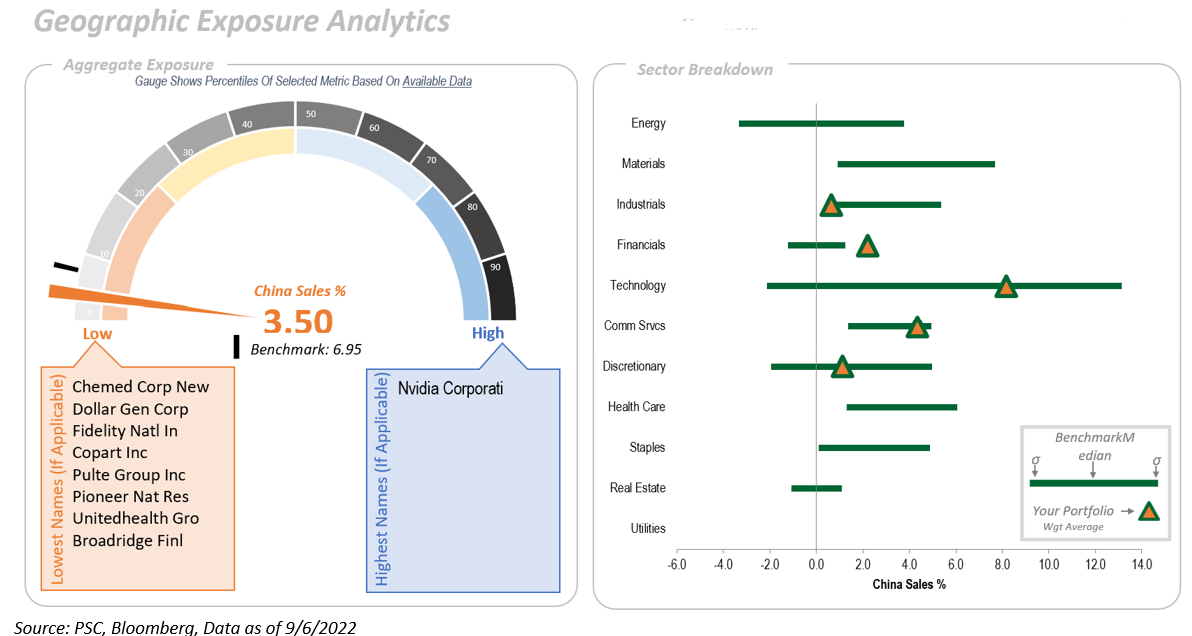

But, before we start our dive on NVDA, let’s revisit the Aptus Compounders overall strategy exposure to China – hint, it’s de minimis. NVDA is the outlier in the portfolio with the company deriving around 25% of its revenues from China, but the rest of the portfolio’s positions are 10% or lower. Holistically, the portfolio has half the exposure to China relative to the S&P 500. Given the macroeconomic worries in China, growth and potential flaws in the real estate market, we’d love to keep this underweight.

NVIDIA Corporation (NVDA)

What Does NVDA Do?

NVDA is a software and fabless company which designs graphics processing units (GPUs), application programming interface (APIs) for data science and high-performance computing as well as system on a chip units (SoCs) for the mobile computing and automotive market. NVIDIA is a global leader in artificial intelligence hardware and software.

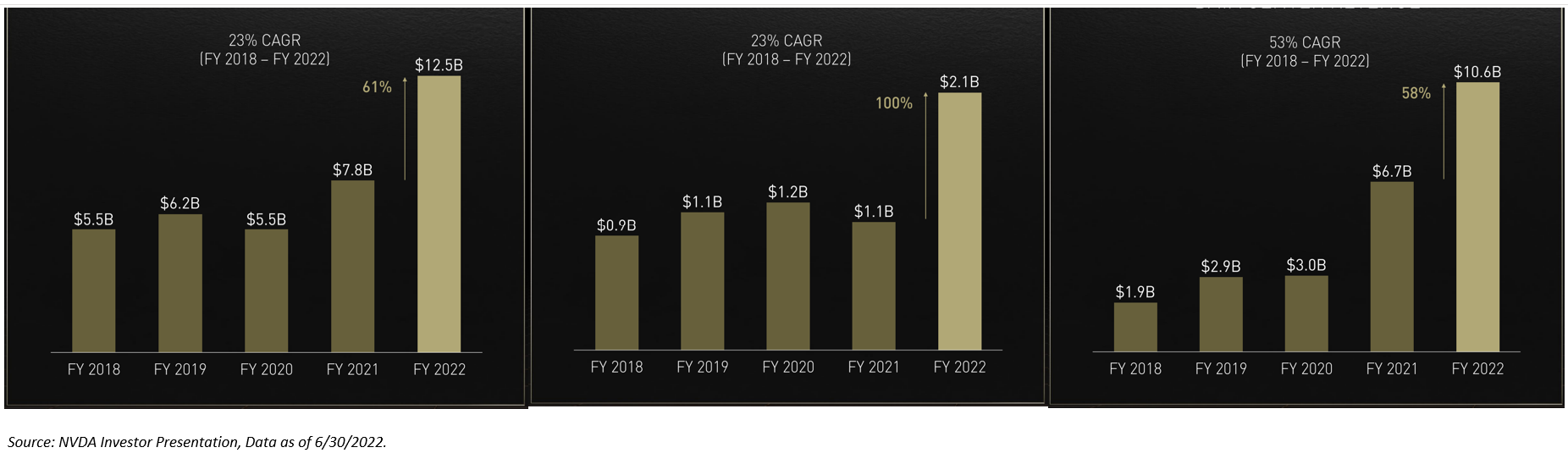

At its core, NVIDIA looks to use its rich history of GPU technology in order to penetrate some of the fastest growing and largest end-markets in the semiconductor industry. Several of these markets have TAMs in the $10s of billions range, and NVIDIA has been able to drive double-digit 3-year revenue CAGRs in most of these markets. The company can drive accelerated innovation by leveraging its GPU architecture and its software across all of its end-markets. By doing this, NVIDIA is able to introduce “industry-first” technologies. Over the next several quarters and years, we expect the company to continue to drive innovation in the gaming, professional visualization, data center, and automotive markets. Finally, we expect the company to continue investing in its technology in order to maintain its market leading position across its verticals.

Tackling the Elephant in the Room – U.S. Tensions with China:

Many of you know that this stock is down 28% since the market’s high on June 16th, 2022, underperforming the S&P 500 by close to 20%. The big question is … why?

What’s Going On?

Last week NVIDIA put out an 8-K highlighting new export license requirements for their A100 and H100 shipments into China, quantifying $400M potential impact in Q3 2022,

and highlighting further risks such as potential delays to H100 development. It appears now that NVIDIA received some further approvals after releasing this 8-K and put out another 8-K last Thursday. Upon the initial announcement, NVIDIA would have been prohibited from shipping product to themselves or their partners in China for the purpose of finalizing development of the forthcoming H100 system – hence yesterday’s release signaled potential for delay. The new permissions now remove this risk and give NVIDIA the ability to ship product for this purpose. The new authorization gives NVIDIA permission to perform exports to support US customers. The China revenue (~$400M/Q at least as of Q3 2022) remains at risk. But we’ve seen most analysts deduct this from their models – showing it could be a permanent demand destruction. We believe NVIDIA’s datacenter opportunity is very large, and not dependent on China (relevant revenues are LDD% of datacenter sales, not trivial but not devastating either). However, the risk of potential restrictions on advanced hardware sales to China, while already on the radar screen, is now going to be an even bigger and more visible controversy. The natural questions will be who could be next, what potential escalations we might see (from either side) going forward, and what China might do in response long term.

What Does This Mean? The geopolitical tensions between the U.S. and China are not going away anytime soon. NVDA generates 25.4% of their revenue from China. We will probably continue to see this exposure get discounted in the company’s valuation, much like we have seen this entire year.

D + G Framework:

0.12% + 12.57% = 12.69%

Yield: 0.12%

NVDA hasn’t increased its dividend the last few years from $0.16/year. The company pays a paltry dividend, but we know that the company continues to invest in growth, hence why its dividend payout ratio is less than 10%.

Growth: 12.57%

Organic Growth + Inorganic Growth + Margin + Share Repurchases = Growth Rate 12.57% + 0.00% + 0.00% + 0.00% = 12.57%

Our estimates are slightly below most analyst’s expectations as we 1) tend to be more conservative than most, and 2) believe that continued inventories will remain elevated in the near future.

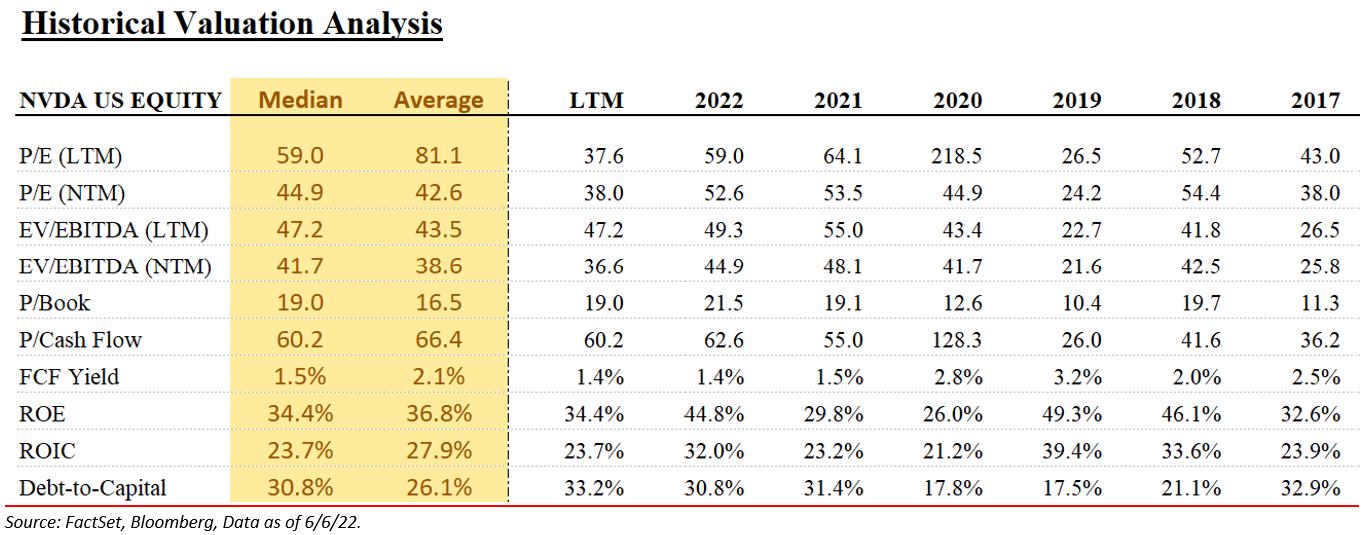

Valuation Analysis:

NVDA is not an easy company to analyze. With its fingers in so many forward-looking technology pots, it’s hard keeping up with developments that represent new potential upsides for the company. However, when you distill it down to its essentials, we view NVIDIA as an enabler of industries and a facilitator of the technologies they use. And, because of its approach to new technologies, we believe it has evolved into a company with a near-perpetual upside. Whether it’s gaming, data centers, autonomous systems, data science, or any one of the numerous industries it engages with, NVIDIA provides the superlatives that its clients need to maintain their own edge – fastest, smallest, most powerful, and so on and so forth. Some investors net out cash when computing the P/E multiples – given the capital on the balance sheet here, you can do that – making NVDA look a bit cheaper.

NVDA has not been immune to the re-rating that the market has gone through this year. Given their market penetration and addressable TAM, we place heavy emphasis on consistent and profitable growth into the future.

Bull Case:

- A Diversified Juggernaut with a Competitive Edge– Given that NVDA has its fingers in so many forward-looking technology pots, we believe it is hard keeping up with developments that represent new potential upsides for the company. However, when you distill it down to its essentials, NVIDIA can be seen as an enabler of industries and a facilitator of the technologies they use. Whether it is gaming, data centers, autonomous systems, data science, or any one of the numerous industries it engages with, we believe NVIDIA provides the superlatives that its clients need to maintain their own edge – fastest, smallest, and most powerful.

- Continued Strong Product Demand – NVDA continues to post double-digit revenue growth, and yet, they still cannot get enough product to satisfy all of the demand.

- Innovation Strength – The ongoing push in enterprise software suites is an opportunity into tens of millions of servers and which should be incremental to valuation when revenue contribution takes off, in our view. Management expects supply constraints to last through most of next year, notably in gaming, which bodes well once inventory eventually rebuilds begin. RTX is still in an early cycle ramp with an estimated adoption rate of only 20%.

Bear Case:

- Highly Competitive Industry– Unlike many of our holdings, NVDA does not compete in a monopolistic or oligopolistic market environment. NVDA operates in highly competitive markets with strong competitors – RMD, INTC, plus numerous others. Luckily, we believe NVIDIA has a leading or strong market share in multiple industry verticals which seems to have come from what we consider an aggressive R&D expenditure and product release cadence.

- Continued U.S. / China Restrictions– Continued tensions between the United States and China could lead to increased regulation, potentially hurting the company’s valuation.

- Semiconductors is a Cyclical Industry– Historically, the industry has experienced drastic fluctuations leading to overcapacity in the market. These downturns can be prolonged and can drastically impact revenue, profitability, cash flows, and stock performance.

Investment Thesis:

We see NVDA as a major beneficiary of the 4th tectonic shift in computing, in which parallel processing captures share in the computing market. We believe that the market underappreciates NVDA’s businesses and its transformation from a traditional PC graphics chip vendor: into a supplier into high-end gaming, enterprise graphics, cloud, accelerate computing and automotive markets. From our perspective, the company has executed consistently, and has a solid balance sheet with what we believe to be a demonstrated commitment to capital returns.

We understand the unwelcoming landscape regarding China and the U.S. restrictions but believe that they are manageable over time.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2209-8.