As we sit in bewilderment at equity performance in 2020, we take a step back to understand what happened. We can largely thank the year’s impressive equity returns to two things… record government assistance (both fiscal and monetary) and the cost of money dropping to zero. Thinking about our current positioning and what could happen in 2021, here are a few things high-level viewpoints with supporting evidence.

#1: Equity Multiples are Expensive… Will they prove to be correctly priced in 2021?

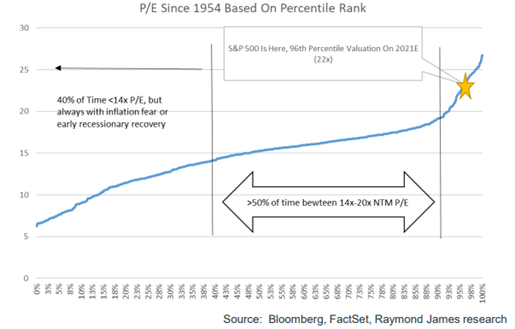

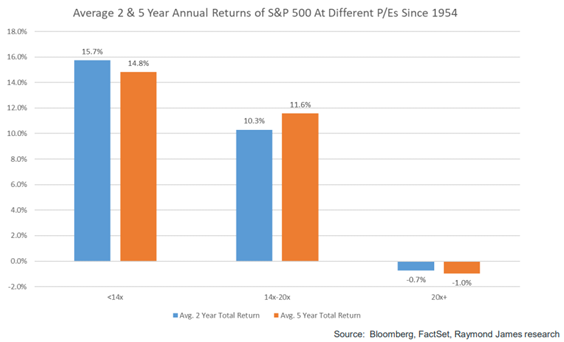

In our analysis, multiple expansion has been the main contributor to 2020 equity returns. To be specific, P/E multiples have expanded to a 96th percentile valuation when based on estimated 2021 earnings. As we move into the new year, we think strong non-inflationary EPS growth in the next few years is needed to justify current valuations. We view this as a race between EPS growth and P/E compression.

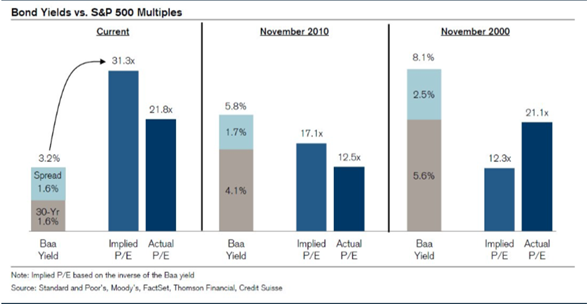

#2: Investors might rethink their asset allocation… specifically Fixed Income

The implied P/E multiples above show just how expensive bonds are as of December 2020. Let’s break down the math… currently a hypothetical long term corporate bond would pay 3.20%… 1.60% risk free rate + 1.60% in spread to compensate for the credit risk. If we buy the bond at $100, we are in essence paying P/E = $100/ $3.2 in earnings to own that cash flow or 31.3x earnings…not exactly cheap! The broadly-known P/E discussed in our first point shows forward S&P multiples. Stocks seem expensive, but bonds look even more expensive…and by design, no growth potential.

In another illustration, lets look at how returns in fixed income historically have been generated vs. how they’ve been generated the last two years, specifically since the Fed stopped hiking rates. This example looks back at where returns were generated from the granddaddy of them all (Pimco Total Return Bond Fund) since inception (5/11/87), vs. the last two years. Historically, less than 1% of the annual return has come from price change. Remember, the main return driver for fixed income is supposed to be income!

![]()

Since the Fed’s last rate hike in 2018, ~40% of the total return of the fund has come from price return. As the income part of the equation gets smaller and smaller we believe it will be impossible for this trend to persist.

![]()

Source: Bloomberg

Remember, we look at every investment through a Yield + Growth framework. When evaluating bonds we take out the growth part of the equation and focus on income +/- multiple expansion (broken down below):

Return Drivers for Bonds: Coupon (interest income) +/- Yield Curve (Chg in Interest Rates/ Roll down the curve potential) +/- change in Credit Spreads

Mathematically, we don’t believe the fixed income returns of the past can continue given current rates.

#3: Increased Volatility Likely a “New Normal”

Source: Bloomberg Intelligence

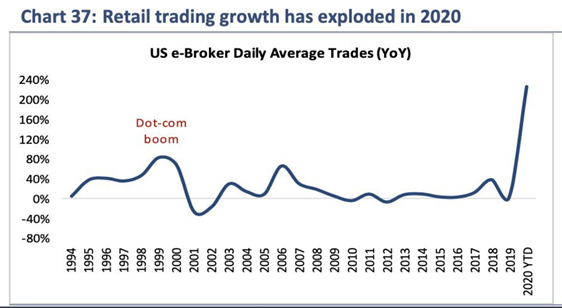

As retail brokers have shifted towards the no-commission model on trades, we have seen a large uptick in retail trades. Since the pandemic specifically, we have seen a huge uptick in retail options trades. Retail trading, which now comprises 20% of U.S. stock orders, has increased by 5 percentage points in the $42 trillion stock market as of December 2020. It smashed through the highs it set during the dot-com boom of the late 1990s.

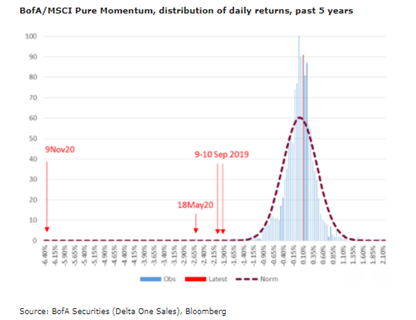

Momentum has led to some spectacular returns. But as we’ve learned in 2020, we can’t time or predict momentum crashes. 9 of the worst 10 days in the past 5+ years as mapped by BofA Securities have occurred in the last 18 months and 7 came in the 2020 after the market lows. Normal distribution (bell curve, maybe isn’t so normal) and the days of fitful rallies seems likely here to stay.

Increases in retail traders/ commission free trades, quant funds, algorithms (arbitraging retail equity options trade flows… Citadel… cough cough), and passive fund trading creates interesting liquidity dynamics that can move markets in wild directions and very quickly. We’ve seen this play out over 2020.

#4: Bonds likely won’t have the same correlation benefits to stocks as they historically have.

Source: Strategas

A continuation of point #2, as we’ve seen more and more return of late within fixed income come from price appreciation, but the historical correlation benefits that bonds have shared with stocks seems in jeopardy. If bonds don’t dampen volatility or provide future return potential… why own them?

#5: What if Inflation ever does appear?

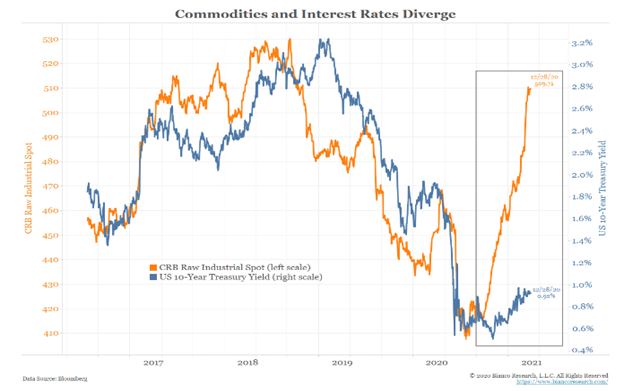

The CRB Raw Industrial is an index made up of largely non-futures traded commodities. Theoretically it should not be subject to the flows of speculative money, making it a cleaner measure of inflation expectations and/or real economic activity than the Bloomberg Commodity Index or the traditional CRB futures Index.

Components include: Hides, tallow, copper scrap, lead scrap, steel scrap, zinc, tin, burlap, cotton, print cloth, wool tops, rosin, and rubber.

As can be seen above, the CRB index is diverging from interest rates. The interpretation is that nominal economic growth is accelerating (Nominal Growth = Real Growth + Inflation). Over the last 25 years, we’ve seen nominal growth led by an increase in real growth but minimal inflation. So, is the latest surge in the industrial complex (measured by CRB) a sign of higher real growth or inflation? Keep in mind we haven’t seen real inflation since the 70s-early 90s…might investors be too sanguine?

Interest rates rising because of real growth is generally positive for risk assets and in our opinion they are neither good nor bad on a standalone basis. The drivers behind rates rising are what matters. If real growth is there, we believe the Fed’s suppression of interest rates is likely be tolerated.

On the other hand, if interest rates are rising because of inflation, we believe risk markets will have a negative response as purchasing power is reduced (negative for risk assets). We believe the Fed’s suppression of rates will not be tolerated by markets and the market would likely reprice interest rates higher (even if the Fed attempts to implement yield curve control or shift asset purchases to longer duration securities).

With the trend of higher production costs globally as supply chains revamp post crisis along with very loose Central Bank policies (and no end in sight), we believe some form of inflation appears like a decent possibility over the next few years. Only time will tell!

Final thoughts…

As displayed above, buying stocks at current multiples hasn’t turned out well. BUT there are many factors present currently that we’ve rarely seen before: record low interest rates (Fed suppressed), record wall of cash on the sidelines, and a Fed willing to do just about anything to support the markets. As we move into a new year that is likely full of surprises, we always remember the wise words of Uncle Warren: “The Future is Never Clear” and “Cool Heads Prevail”.

As we build portfolios and manage money, we believe it’s pivotal to stick with a core process of investing in very high-quality businesses at reasonable valuations but it is also prudent to be dynamic in our philosophy and actions as opportunities come and go. We are excited for 2021 and the value that we believe the Aptus philosophy brings to the table for our investors and as confident as ever in our ability to give our investors what we believe to be a great setup for sufficient long term returns and tolerable volatility.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2012-16.