Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

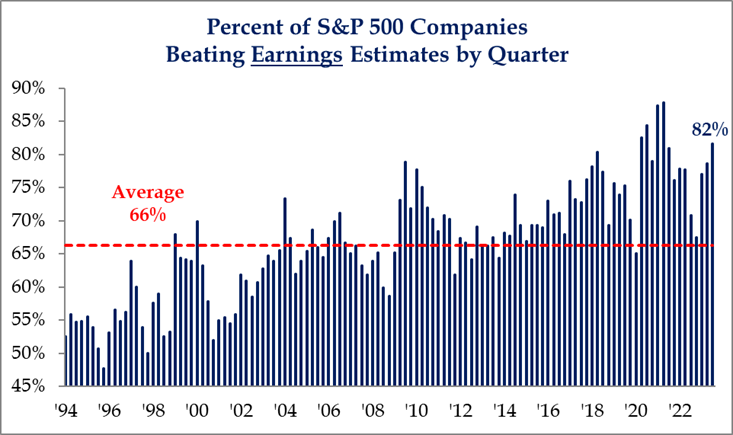

Brad: Q3 earnings results ran ahead of estimates by a wide margin

Source: Strategas as of 11.03.2023

Source: Strategas as of 11.03.2023

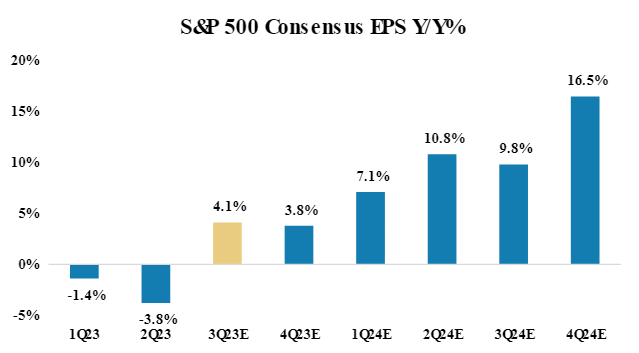

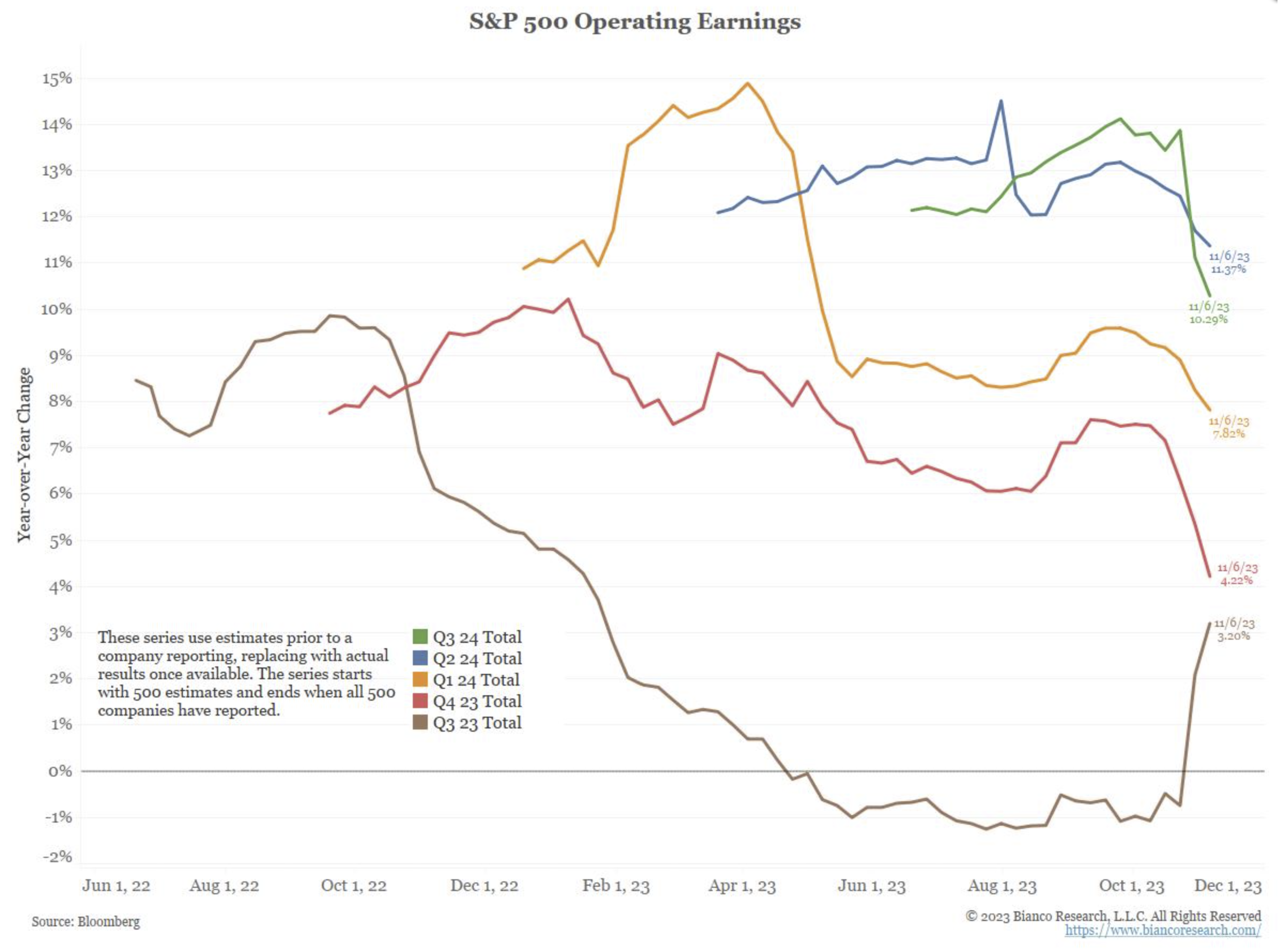

Dave: and while the earnings trough seems to be in the rearview mirror

Source: Morgan Stanley as of 11.06.2023

Dave: it’s not exactly resulting in a bump to Q4 estimates and beyond

Source: Bianco as of 11.07.2023

Source: Bianco as of 11.07.2023

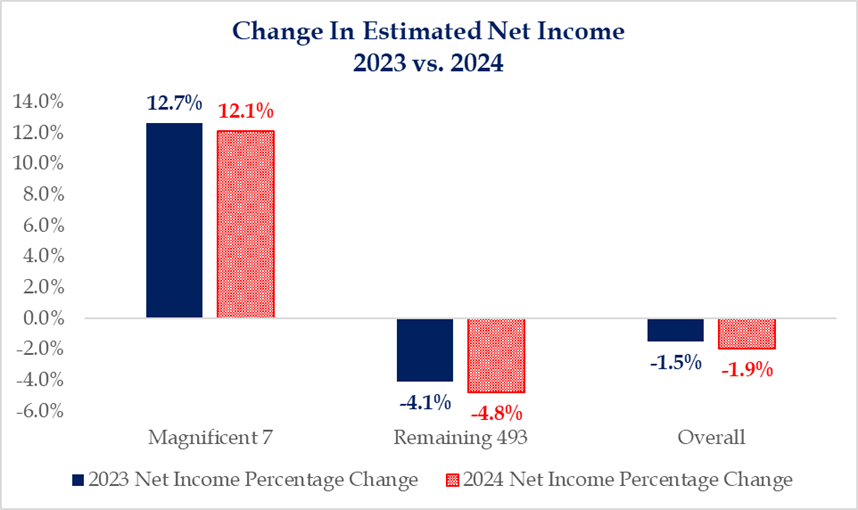

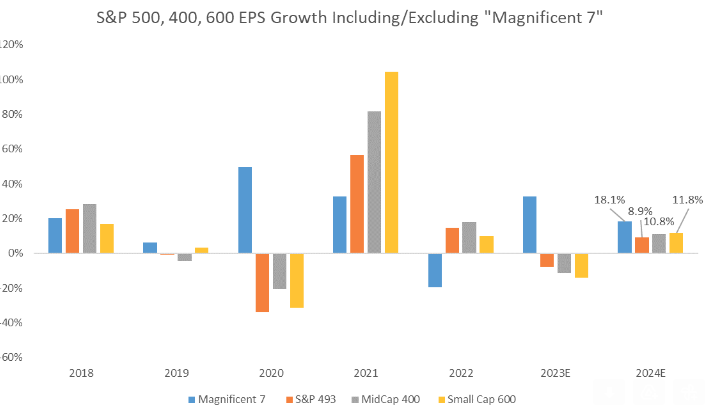

Brad: While the Mag 7 is dominating earnings this year

Source: Strategas as of 11.03.2023

Source: Strategas as of 11.03.2023

Joseph: there’s a story in the past few years about the impact of earnings growth on market leadership

Source: Raymond James as of 11.10.2023

Source: Raymond James as of 11.10.2023

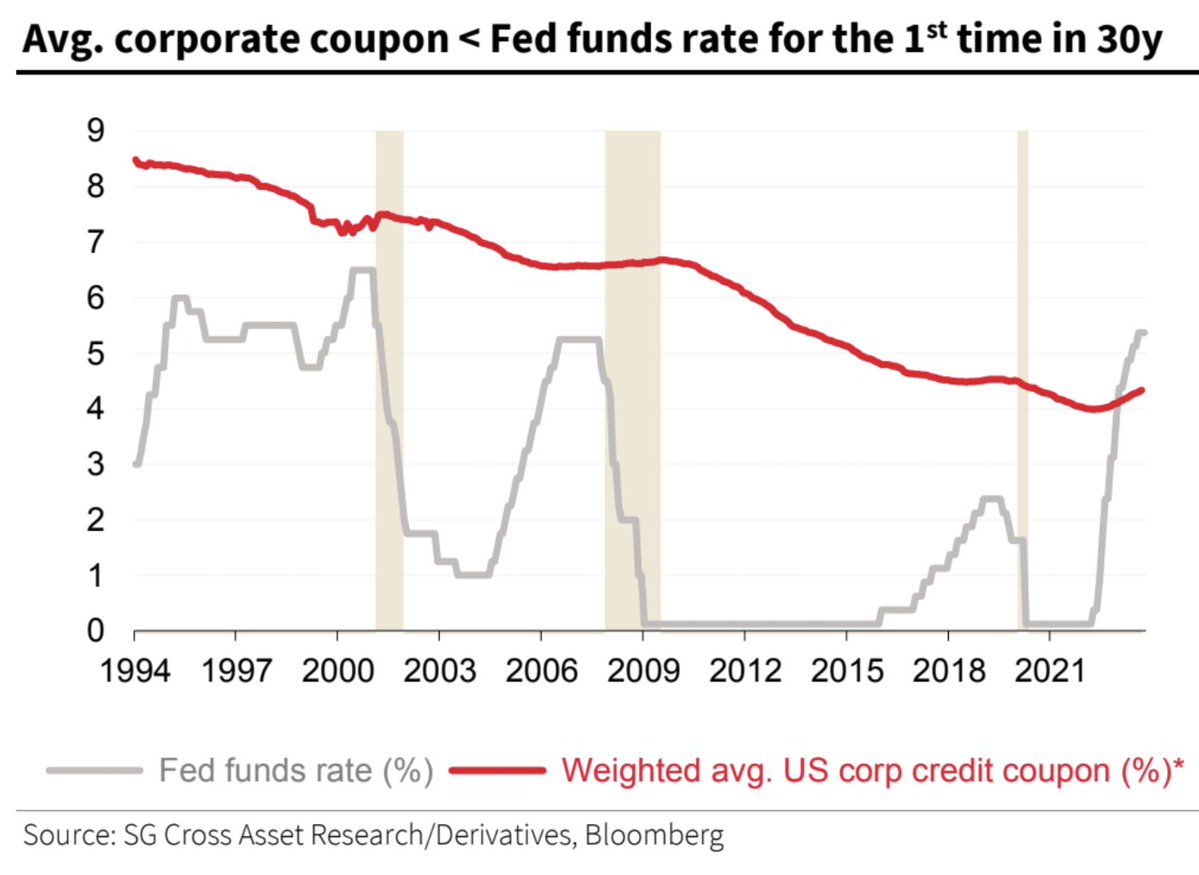

Brett: The Fed Funds rate is above the average corporate bond coupon for the first time in decades

Data as of October 2023

Data as of October 2023

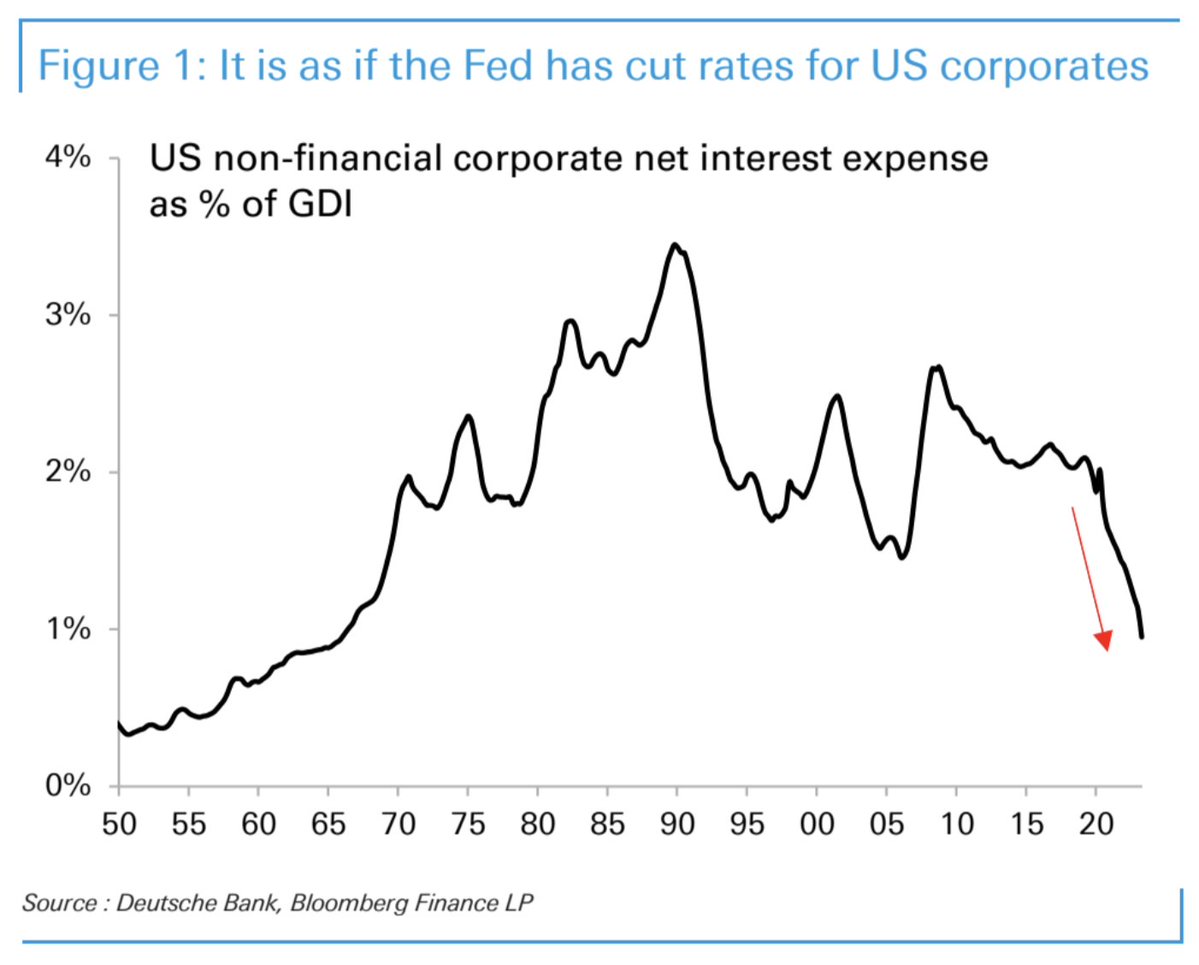

Beckham: as the Fed’s zero-rate policy turned out to be one heckuva tailwind for corporations willing and able to raise debt

Data as of October 2023

Data as of October 2023

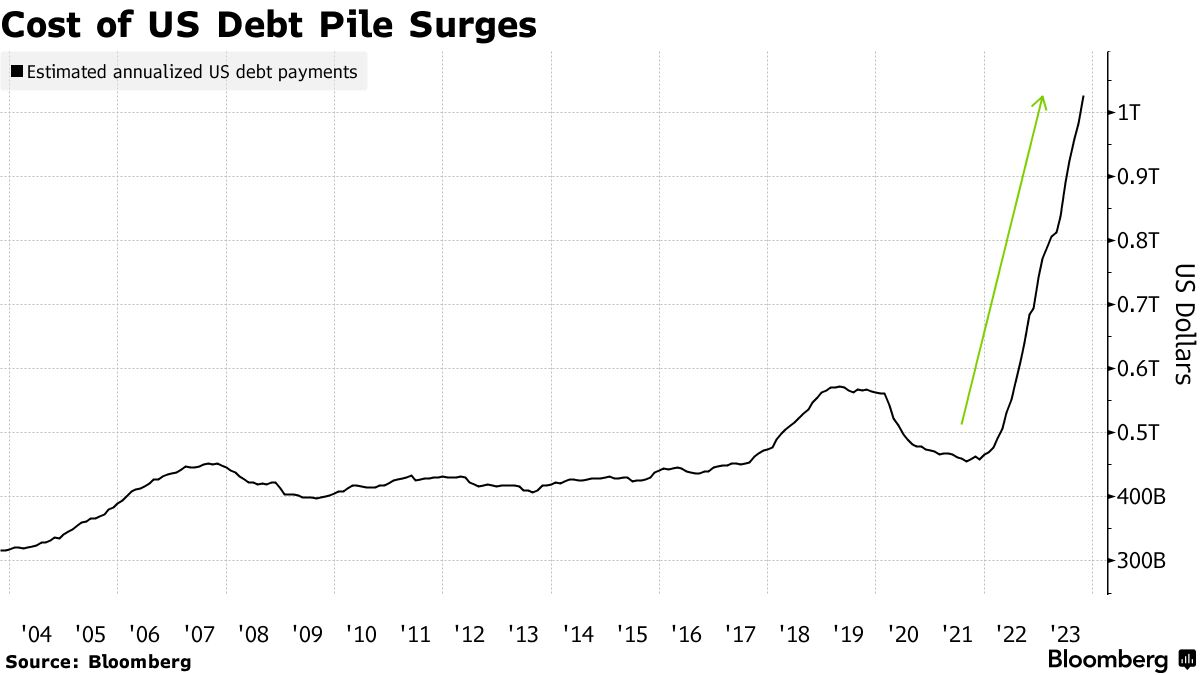

John Luke: The same cannot be said for the US government, as they took on huge debt and relied on short-term maturities

Data as of November 2023

Data as of November 2023

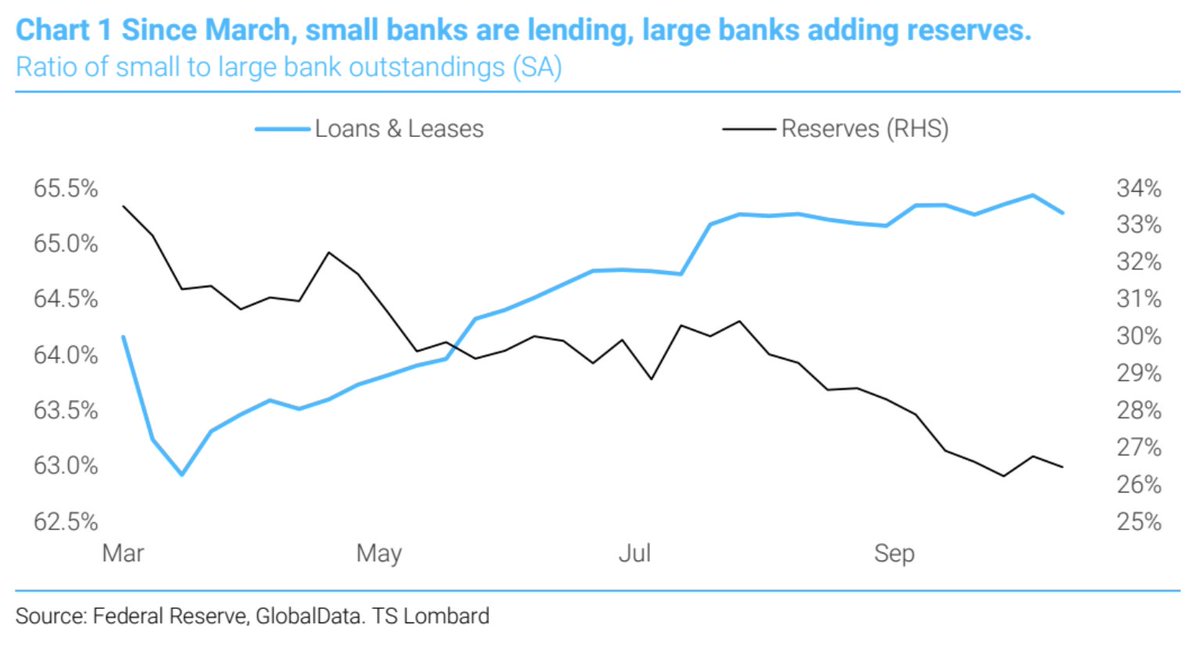

Joseph: Large banks and small banks have taken a much different approach to their business activity since the SVB crisis

Data as of October 2023

Data as of October 2023

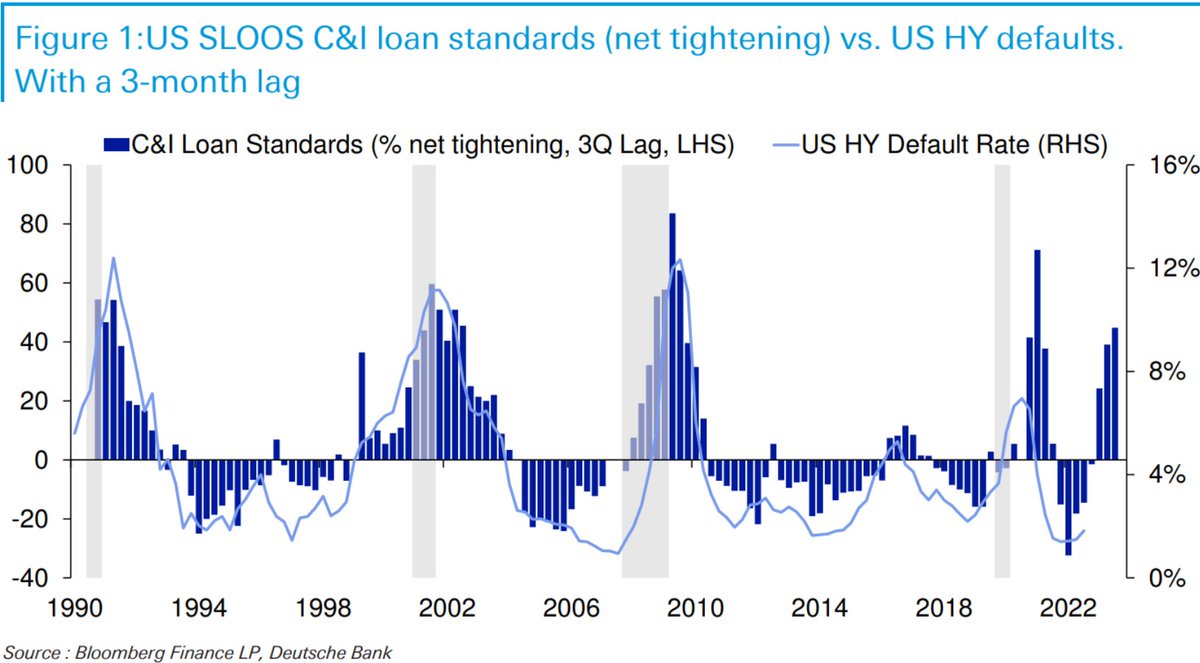

Brett: but the tighter lending standards haven’t flowed through into wider high-yield spreads like they have in the past

Data as of October 2023

Data as of October 2023

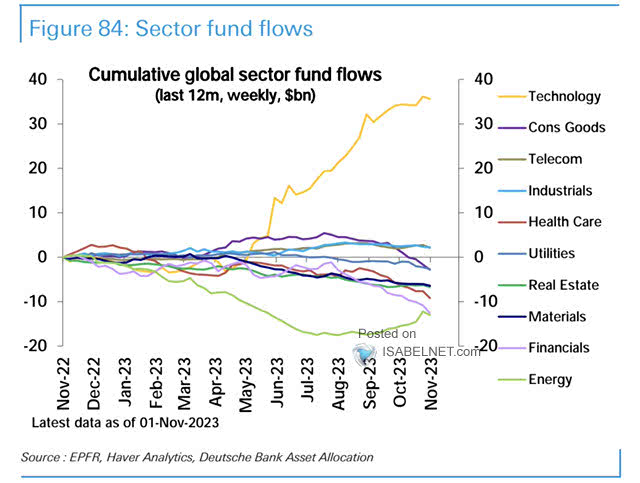

Beckham: Asset flows have sector have been dominated by technology

Data as of 11.08.2023

Data as of 11.08.2023

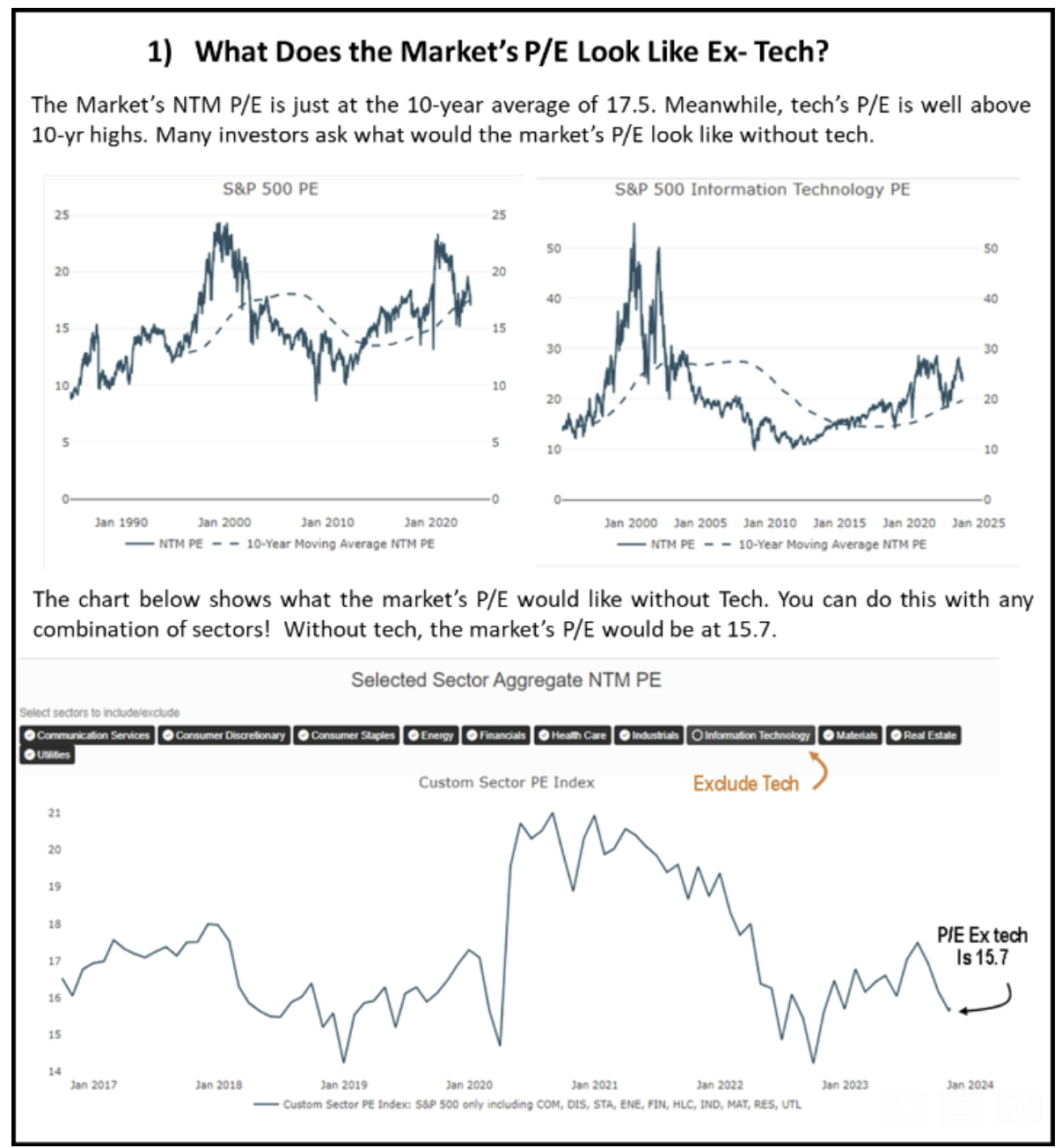

Dave: resulting in a continued valuation split between technology and the rest of the market

Source: Piper Sandler as of October 2023

Source: Piper Sandler as of October 2023

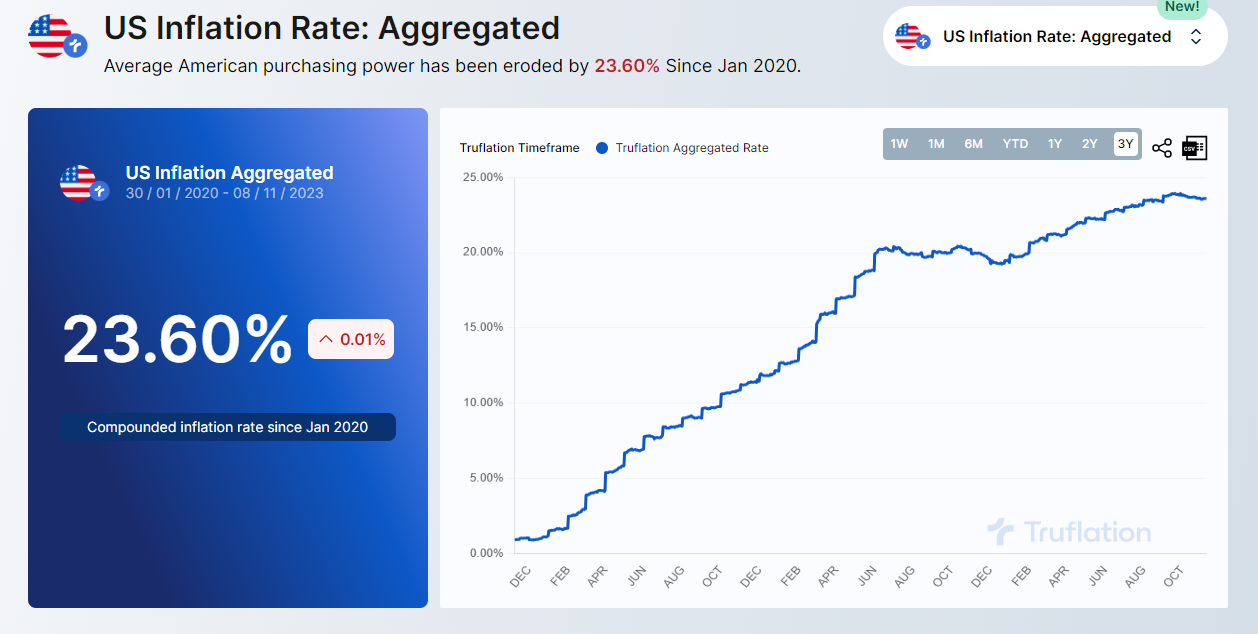

John Luke: The cumulative inflation of the past few years is adding up to real longevity risk for those relying on fixed cash flows

Data as of 11.08.2023

Data as of 11.08.2023

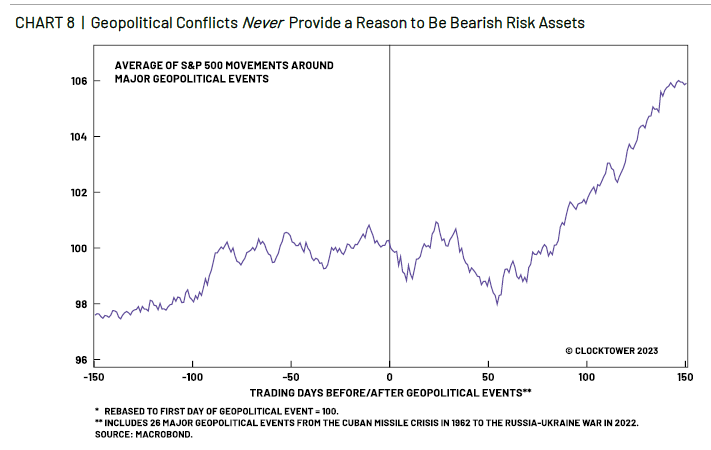

Dave: A reminder that markets have historically made their way through geopolitical events without much impact

Data as of January 2023

Data as of January 2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2311-12.